In 2022, most felt the squeeze brought on by rising inflation and the ever-increasing cost of living.

Rising housing expenses are putting pressure on the household budgets of both owners and renters, though one group may be feeling it more than the other.

According to new research from Point2, the average Canadian homeowner is spending 24 per cent more than renters on monthly shelter costs.

There are benefits to owning, just as there are benefits to renting. Owning a home is often seen as a long-term investment, whereas renting has traditionally been a more affordable option that comes with less responsibility.

While both renters and owners are often on the hook for covering the cost of at least some utilities, Point2 notes the latest census data shows the key difference is that renters have monthly rent payments. In contrast, homeowners are responsible for property taxes, condominium fees and mortgage (where applicable).

The company is analyzing Canada’s 50 largest cities to determine how housing costs affect the owners and renters living there.

Renters spend $289 less than owners

The number of owners (9.96 million) is almost double that of renters (4.95 million), making up more than 66 per cent of Canada’s residents.

However, the latest census shows the country’s homeownership rate is declining.

Recent data showed the number of Canadians renting their homes is at an all-time high— proof that homeownership is becoming increasingly out of reach.

Historically high prices and market volatility steer more and more Canadians away from owning their own homes, but monthly housing costs are also a contributing factor to renting gaining ground, according to Point2.

On average, renters spend $289 less than owners on shelter expenses.

As per the most recent census, the average shelter costs of a homeowner increased by 14 per cent nationwide compared to five years prior, reaching $1,498. Although renter households experienced a larger bump of 20.66 per cent, their average shelter costs reached $1,209.

Point2 considered 30 per cent of a household’s income as a benchmark to gauge whether the amount spent on monthly housing expenses is feasible.

The company’s research shows 79 per cent of all Canadian dwellings spend less than 30 per cent of income on shelter-related costs. That’s more than 11.6 million households compared to 3.07 million that spend 30 per cent or more of their monthly income.

Most expensive vs. most affordable

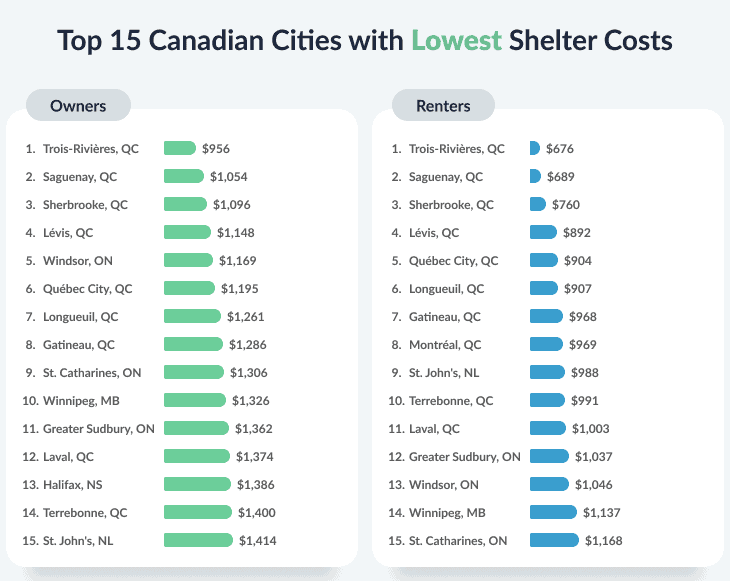

In the battle of shelter costs, Quebec cities are in the more reasonable corner, says Point2 researchers.

With the 2021 census ranking B.C. and Ontario as the most expensive provinces, it’s not surprising that the largest cities in those provinces are on the less affordable end of the spectrum.

All of the Quebec cities Point2 analyzed showcase lower shelter costs for renters than the $1,209 national average.

With the exception of Montreal, the situation is similar when it comes to homeowner shelter costs too. Notably, as much as 89 per cent of all households in Levis, as well as 88 per cent in Saguenay, spend less than 30 per cent of their income on housing.

Trois-Rivieres is the only city where both renters’ and owners’ housing costs are lower than $1,000 per month.

Source: Point2

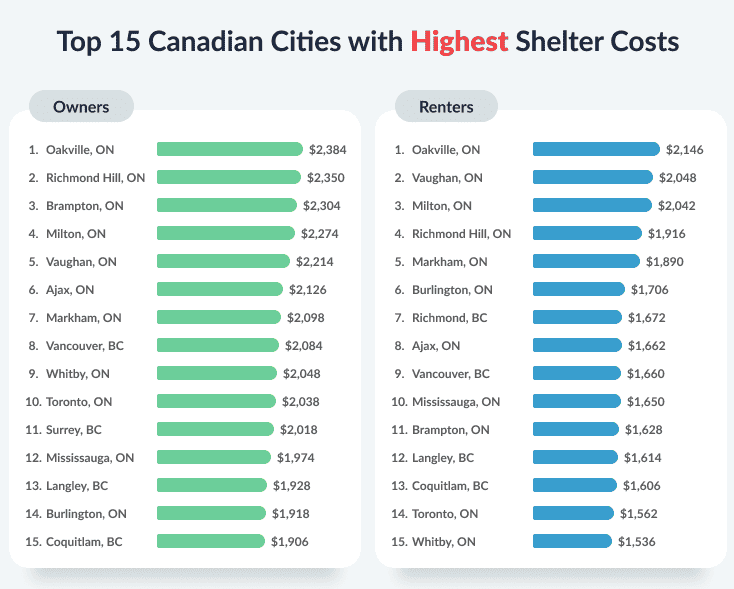

Ontario and British Columbia

Ontario and British Columbia city-dwellers face some of the most expensive housing costs in the country, dominating the top 15 highest shelter costs, according to Point2’s data.

The company singles out Oakville, Ont. as the most expensive city in terms of shelter costs. Homeowners are paying an average of $2,384 versus renters, who are paying $2,146.

Ontario cities like Richmond Hill, Milton, and Vaughan are also among the top five most expensive for renters and owners.

Renting in Toronto averages $1,562 per month, and owning reaches $2,038; residents in cities like Markham, Brampton, and Ajax pay even more for shelter costs, as per the most recent census data.

Despite dealing with such high monthly costs, homeowners make up the majority in all of these cities, ranging from 78 per cent in Oakville to 86 per cent in Vaughan.

There are Ontario pockets where both renters and owners deal with more reasonable shelter costs, such as Windsor, St. Catharines and Greater Sudbury.

Whether you rent or own in British Columbia cities, your monthly housing expenses exceed the national averages for both owners and renters, explains Point2.

B.C. owner housing costs range between $1,614 in Kelowna to $2,084 in Vancouver, while renter costs go from $1,324 in Abbotsford to $1,672 in Richmond.

Source: Point2

Almost the same shelter costs

According to the data, housing costs are not remarkably different between homeowners and renters in some of Canada’s most populous cities.

For example, homeownership in Kelowna, B.C., comes with a $78 (or five per cent) bump in housing costs compared to renting.

Similarly, in Kingston, Ont., it means $120 (nine per cent) more, while in Richmond, B.C., it involves $122 (seven per cent) more going to monthly shelter costs.

Highest differences between renter and owner shelter costs

In some cities, census data show it costs significantly less to be a renter.

Homeowners in Brampton, Ont. spend $676 more than renters on housing costs, while those in Surrey, BC., deal with a $584 difference.

Point 2 notes that coincidentally, owners in Surrey and Brampton also experienced the sharpest five-year uptick in housing costs since the previous Census of 2016 — 25.5 per cent and 23 per cent, respectively.

In terms of percentage, Montreal homeowners draw the shorter end of the stick by paying 58 per cent more (or $563) than renters spend on shelter costs. Interestingly, renters make up 64 per cent of Montréal residents, as opposed to 36 per cent who are owners.

Source: Point2

Read the full report from Point2 here.

Hey REM,

Do you have a source for the data from Point2 that you could share? Your hyper link in the article on Point2 just brings you to a search on your REM site (old articles). I’m interested in seeing their data / report and understanding how recent these numbers are based on. I tried Google, but didn’t find it on the open web.

Thanks!

Hey Annalee,

I can’t include links in this reply, though we’ve added a direct link to Point2’s data analysis at the bottom of this article.

Does this study take into account what kind of unit the people are renting? In Brampton, for example, the reason why the discrepancy is high between owners and renters is because of the vast number of basements being rented out.

What this analysis misses is the equity built through home ownership

Tell that to someone who bought in Feb or March 2022 !