This morning, the Bank of Canada (BoC) surprised the market by announcing a 50 basis point (bps) cut in its benchmark interest rate, bringing it down from 4.25 per cent to 3.75 per cent. As homeowners and potential buyers digest this news, the primary question on many minds is how this will impact mortgages, real estate, inflation and the broader economy.

Here’s a breakdown of what the rate cut could mean, with a focus on the housing market, mortgage renewals and the wider financial landscape.

Why a rate cut might not be all good news

At first glance, the BoC’s 50 bps rate cut might seem like positive news for borrowers. Lower interest rates generally translate to cheaper borrowing costs, which could help prospective homeowners and businesses. However, such a rate cut may not be a sign of economic health.

Often, when central banks cut rates significantly, it’s because they anticipate economic challenges ahead. In this case, the rate cut could signal concerns about a looming slowdown or potential recession in Canada. A recession could lead to deflationary risks for some parts of Canada’s economy, and when consumers feel prices are falling, they stop spending and wait for better prices. This fear is especially real outside of the housing market.

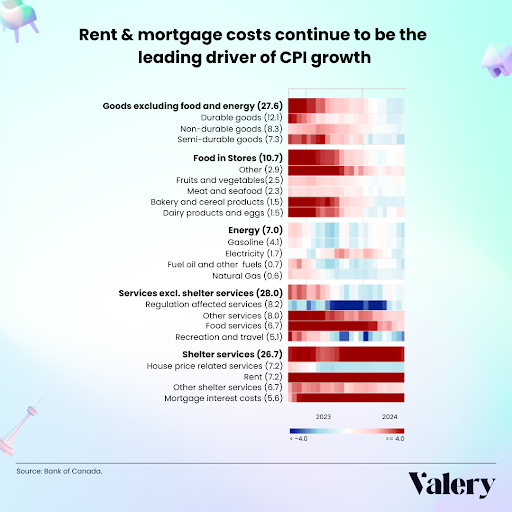

Within the housing market, we see that shelter inflation is a primary contributor to inflation in Canada, according to the BoC’s recent Monetary Policy Report, released with today’s interest rate cut. This inflationary pressure from rent and mortgage interest costs can be observed below in the CPI component breakdown. Especially worth noting is that “House price related services” have been ice-cold for the better part of two years now. Realtor commissions remain at historic lows, and the BoC could be gaining confidence that the market will not overheat in response to rate cuts.

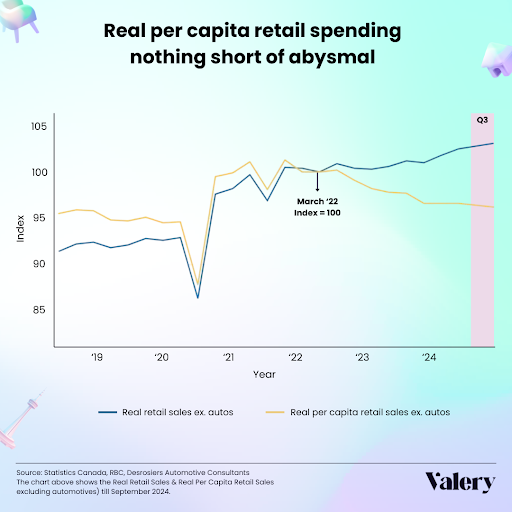

Though the lower rate will reduce the cost of borrowing, it also suggests that the BoC is attempting to stimulate a flagging economy. While homeowners may see some relief in their monthly payments, this could be overshadowed by rising unemployment or weaker economic activity if a downturn materializes. RBC noted this reality very directly in a recent brief that characterized retail spending as “abysmal”:

Effect on inflation due to mortgage renewals

While the BoC has cut its interest rate, inflation continues to be a concern, partly due to mortgage renewals at higher rates. Tiff Macklem, the BoC’s governor, mentioned they’re equally concerned about the risk of deflation and inflation. If we don’t see further reduction, mortgage rates could keep upward pressure on inflation into 2025 and 2026.

From mid-2020 to early 2022, Canadian mortgage rates were exceptionally low, prompting a surge in both new mortgages and refinances. As a result, a large proportion of these mortgages — about 60 per cent — are set to renew in 2025 and 2026. With today’s overnight rate now standing at 3.75 per cent, homeowners renewing their mortgages will face significantly higher payments than they did during the era of 0.25 per cent overnight rates.

This situation has indirect implications for inflation. Higher monthly mortgage payments reduce disposable income for other goods and services, potentially slowing consumer spending and easing some inflationary pressure. However, the “base effect” comes into play, as the shift from historically low interest rates to the current elevated levels still poses a financial strain for many households. Even with the recent cut, the elevated rates for renewed mortgages will continue contributing to inflationary pressure in the Canadian economy — particularly through rising housing costs.

Bond yields control fixed-rate mortgages, not the BoC

A common misconception is that the BoC directly controls all mortgage rates. While it does influence variable mortgage rates, the majority of Canadians who opt for fixed-rate mortgages are affected more by bond yields than by the BoC’s overnight rate. Fixed-rate mortgages are very popular and closely tied to the performance of government bonds, especially the five-year one, which has been on a declining trend since April 2024.

As it stands, the bond market seems to be pricing in fewer cuts in the future, though there’s likely a bit of myopia toward the market as a result of the United States election. The market likely doesn’t anticipate any significant actions from the Federal Reserve prior to the election, as it could become too politicized. (In fact, it already seems to be.)

This means that we’ll likely need to wait until the U.S. election is over for a real idea of what will happen with bond yields and interest rates in 2025. To get an understanding of this, it’s very important to think about how the BoC monitors Federal Reserve activity.

The importance of U.S. Federal Reserve decisions

In light of the BoC’s 50 bps cut, the interplay between Canadian and U.S. monetary policy becomes even more significant. The U.S. Federal Reserve plays a crucial role in shaping the broader North American economic landscape. Since the Canadian and U.S. economies are closely linked, the BoC must carefully consider Federal Reserve actions to avoid a widening policy gap. If the BoC continues cutting rates aggressively while the Federal Reserve holds rates steady or raises them, it risks devaluing the Canadian dollar against the U.S. dollar, because the Canadian currency would have a lower “return” — as measured by its interest rate.

Since we purchase most of our imports in USD, a weaker CAD makes imports from the U.S. more expensive, which could drive up inflation in Canada — a risk that the BoC is keen to avoid. This is why, despite today’s cut, the BoC will remain cautious and closely watch the Federal Reserve’s decisions moving forward. The bank’s goal is to maintain a balance, ensuring that the Canadian economy stays competitive without letting inflation rise uncontrollably due to a depreciating currency.

One key byproduct in this regard is that the BoC observed exports becoming an increasing contributor to Canadian GDP. A weaker GDP could support that notion, but we don’t have a significant export-based economy to capitalize on that reality as we have in past recessions, where Canada was a larger exporter.

A recession could help reduce inflation

Though it may seem counterintuitive, a mild recession could keep inflation at more manageable levels. Economic slowdowns typically reduce demand for goods and services, which can ease price pressures. According to economists like CIBC’s Benjamin Tal, recessions are often an inevitable part of the economic cycle and can play a role in controlling inflation. This is why Tal often states that when given the choice between inflation and a recession, the BoC will choose a recession every time.

The BoC may be willing to allow a controlled recession if it helps bring inflation closer to its target range. While Macklem did mention in his press release question period that he felt he could stick the landing, time will tell if it’s possible. A recession would result in short-term economic hardship but has historically proven as necessary to restore balance in the economy and ensure long-term stability. This is especially true in economic setups where a risk of rising inflation might be present — and Macklem made it clear that he’s just as worried about a return of inflation as he is about deflation/recession.

How mortgage holders and market activity will be affected

For those with variable-rate mortgages, the 50 bps rate cut will bring some immediate relief. Variable-rate mortgage holders have seen their payments increase significantly over the past year due to previous rate hikes. With the overnight rate down 50 bps, these borrowers can expect their monthly payments to decrease slightly, offering some breathing room in their budgets. Static-payment variable rate holders will see more principal paid each month.

In this regard, the BoC can really only play to the supply side of the market by easing pressure on existing mortgage holders, reducing the likelihood that they sell their property. Because variable rates are priced higher than fixed rates in today’s market, a reduction in variable rates doesn’t “add” any buying power to the market. If buyers needed a lower rate to get more buying power, they’d have used the fixed rate. Therefore, the bond market is more in control of the demand curve in Canada through fixed-rate mortgage pricing.

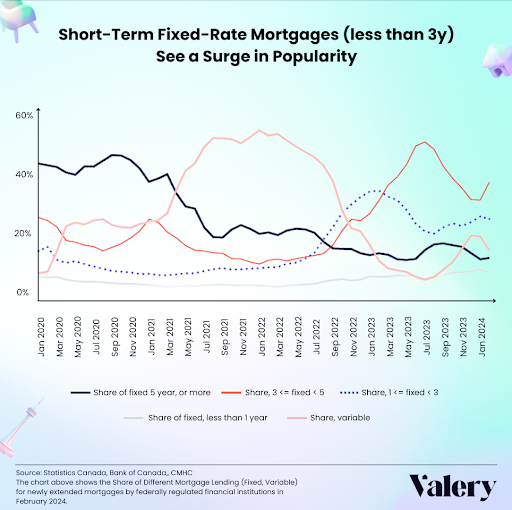

Lower interest rates typically boost housing market activity by making borrowing cheaper. However, with housing prices already elevated in many parts of Canada, today’s rate cut may not be enough to spur significant increases in homeownership, especially with the stress test still in place and most buyers opting for two-, three- or five-year fixed-rate mortgages.

Additionally, the overall economic uncertainty caused by the rate cut may cause potential buyers to remain cautious. While borrowing costs will drop, concerns about a slowing economy or job losses could temper enthusiasm for new home purchases in the short term. Many market participants seem to be adopting a “wait and see” approach, to wait even if rates continue falling, and to better understand if there are risks under the surface.

The BoC’s decision to cut interest rates by 50 bps, bringing the overnight rate to 3.75 per cent, offers both opportunities and challenges for Canadians. While variable-rate mortgage holders will see some immediate relief, those buying with fixed-rate mortgages might not benefit as much, this early.

The broader economic implications, including potential recession risks and inflation concerns, mean that this rate cut is not all good news. Realtors, homeowners and prospective buyers should carefully consider the broader economic context as they plan their financial futures.

Daniel Foch and Nick Hill are co-hosts of The Canadian Real Estate Investor Podcast. Daniel Foch, a real estate broker and analyst, is frequently featured in major media and has advised on over $1BN in real estate transactions, focusing on affordable housing. Nick Hill, a real estate investor and mortgage agent, has a background in business, commercial real estate and startups, working with investors and developers across Canada.