Canada’s once unstoppable population growth is finally tapping the brakes, and the ripple effects are beginning to surface—most notably in the country’s rental markets.

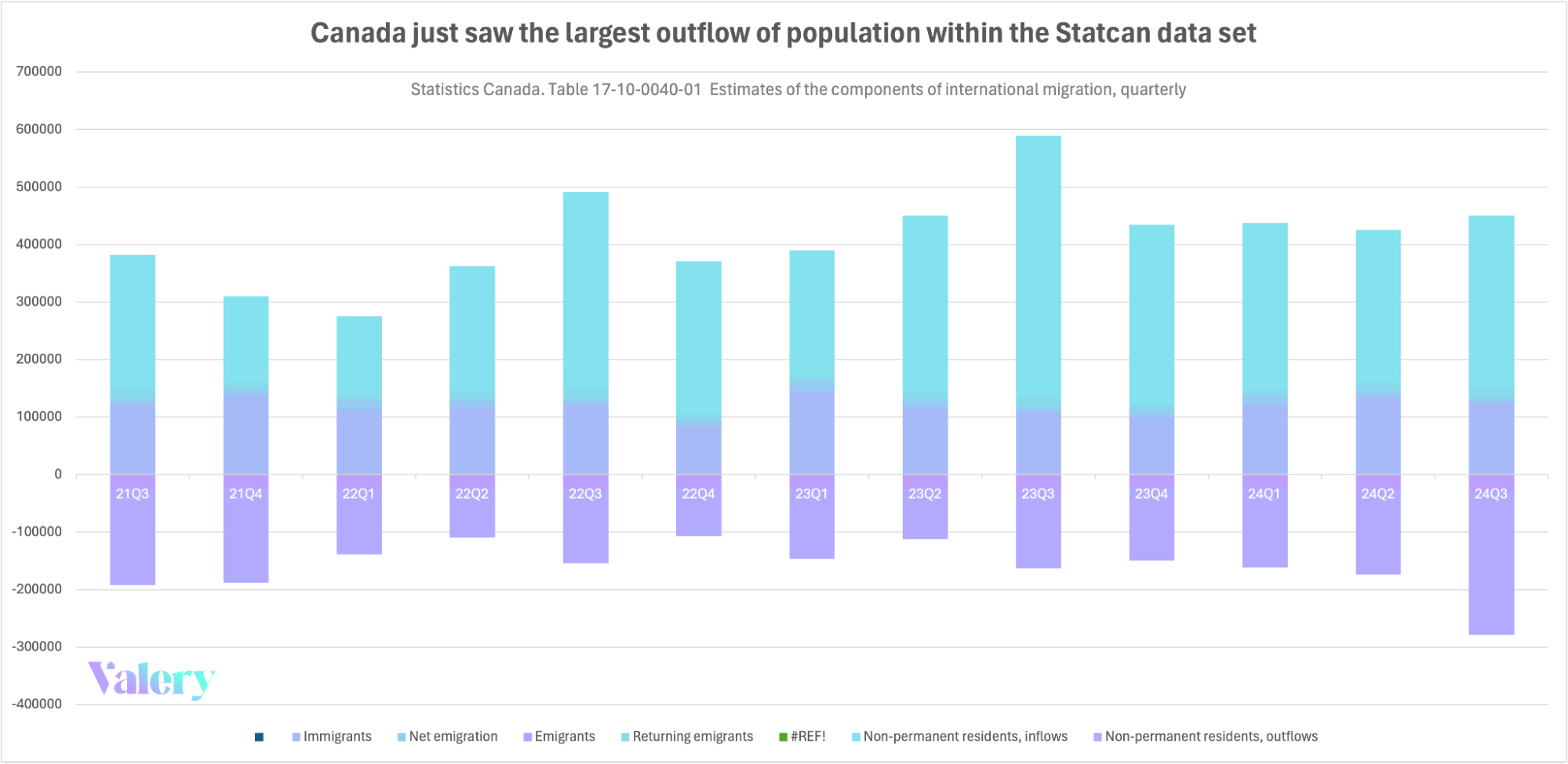

In a significant shift that could reshape the dynamics of Canada’s real estate landscape, the country has recorded the highest exodus of non-permanent residents (NPRs) since the Canada Mortgage and Housing Corporation (CMHC) began tracking this data in 2021. This exodus coincides with a marked softening of rental rates across various Canadian markets, hinting at a direct relationship between the two trends.

While the federal government recently committed to reducing population growth, available data suggests this decline may have already been underway before any official announcements. A recent report published on Valery.ca outlined how population growth could be predicted by rental inflation months in advance.

Canada’s once unstoppable population growth is finally tapping the brakes, and the ripple effects are beginning to surface—most notably in the country’s rental markets. This plan includes the first-ever comprehensive strategy to manage not only permanent residents but also temporary ones.

Immigration targets in focus

As part of the new framework, the government aims to gradually reduce permanent resident targets from 500,000 in 2024 to 395,000 in 2025. The numbers will further decline to 380,000 in 2026 and 365,000 in 2027. This deliberate scaling back is expected to curb the intense demand for housing, especially rental units, which has surged in recent years due to high levels of immigration.

Temporary residents, including international students, foreign workers, and other NPR are also significant contributors to housing demand. While precise targets for temporary residents have not been disclosed, the government’s inclusion of this group in its planning signals a more controlled approach to overall population growth. Temporary residents often cluster in urban centres like Toronto, Vancouver, and Montréal, where they compete with locals for limited rental housing. Consequently, their departure is having a profound cooling effect on these overheated rental markets.

The link between population and rent inflation

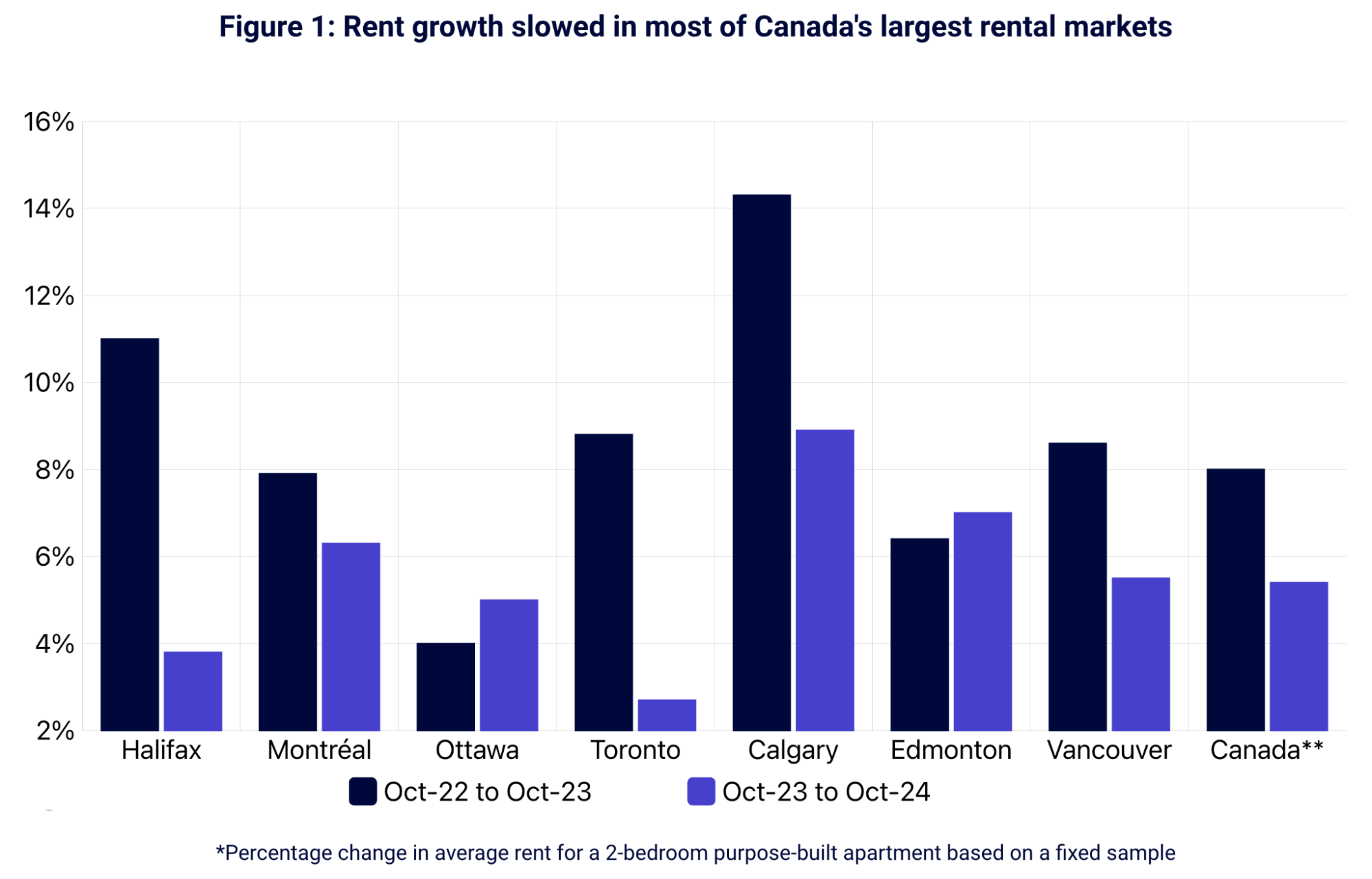

The Bank of Canada has long highlighted the relationship between population growth and rent inflation. A booming population naturally amplifies housing demand, leading to rising rents, particularly in urban centres. However, recent data paints a different picture. As we enter 2025, several sources, including The Habistat and Rentals.ca, report a noticeable deceleration in rent inflation.

According to these reports, rental inflation is beginning to stabilize due to two key factors: slower population growth and increased rental supply. This shift marks a notable departure from previous years when double-digit rent hikes were common in major cities. CMHC’s Q4 report highlights this trend, with Toronto experiencing the lowest rent growth among major regions in 2024, at 2.7 per cent, down significantly from 8.8 per cent in 2023.

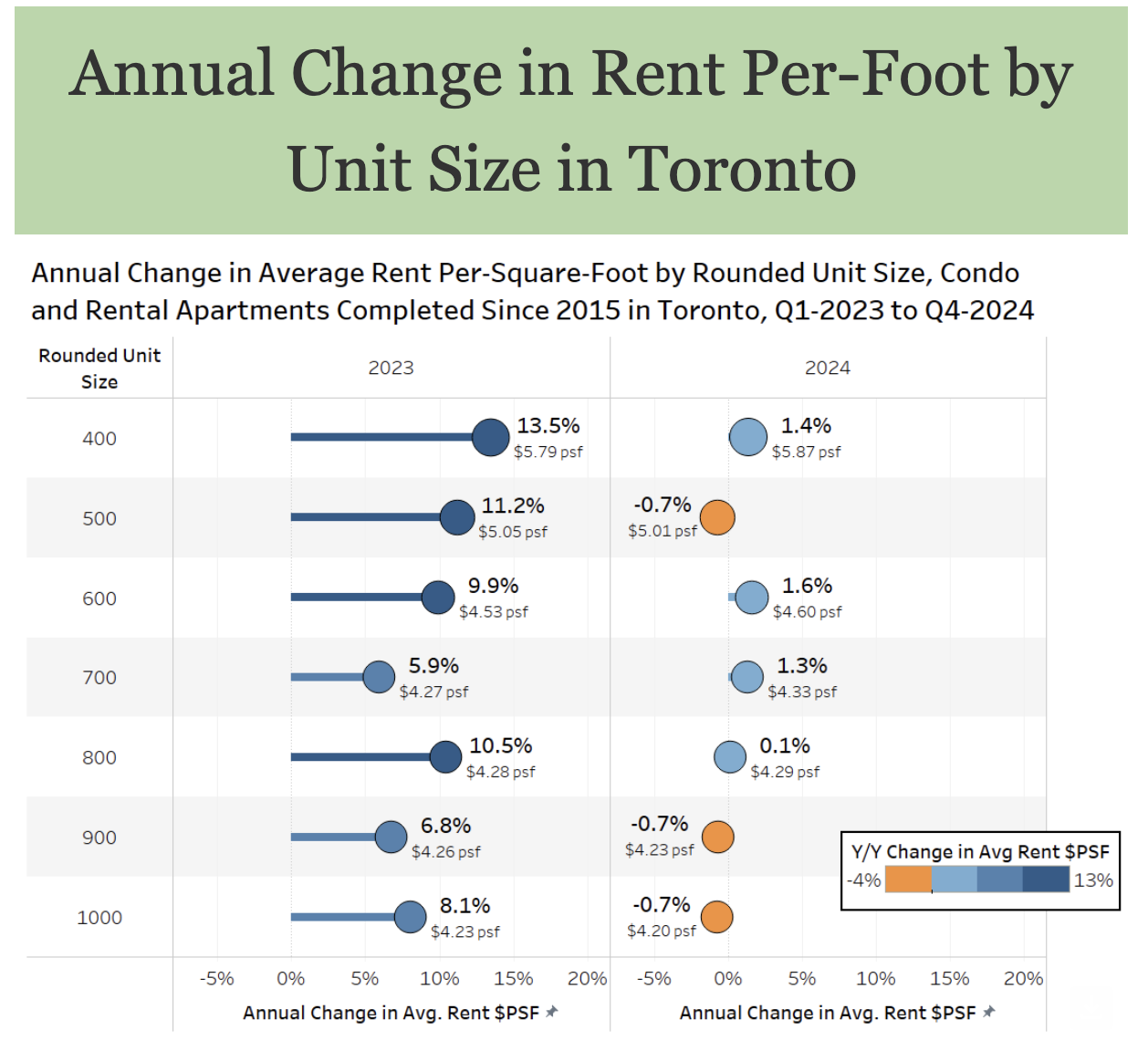

Interestingly, not all experts agree on the extent of this trend. Ben Myers of Bullpen Research, for example, has observed differing patterns in specific unit sizes, given the majority of new condominium supply is smaller. The prevalence of smaller units skews the average and median data down, but illustrates that units on a per-square-foot basis are not falling as sharply as the headline data might suggest:

Source: Ben Myers, Bullpen Research

NPR departures and cooling rental markets

Once hailed as the eternal bull case for Canadian real estate, population growth seems to be grinding to a halt. In a surprising policy flip mentioned above, the liberal government took a populist approach after years of defending its position that its population growth strategy was sustainable.

One of the most striking elements of this narrative is the synchronicity between the departure of NPRs and the cooling of Canada’s rental markets. NPRs, who typically contribute significantly to demand for rental housing, are leaving in record numbers, reducing upward pressure on rents. This shift has provided much-needed relief for tenants, but it also raises critical questions about the future of Canada’s housing market.

For example, a significant drop in NPR numbers could lead to prolonged stagnation in rental demand, especially in urban centres that have historically relied on this demographic to absorb new rental supply. Compounding this, some of these markets are experiencing record supply. This could also challenge landlords who are already grappling with high borrowing costs and reduced cash flow, forcing some to sell or convert their properties to owner-occupied units.

What lies ahead for Canada’s housing market

As Canada navigates a new era of housing and immigration policy, finding a balance between managing population growth and sustaining economic vitality will be critical. The ongoing decline in this demographic could have ripple effects beyond the housing market, potentially slowing growth in key sectors like retail, hospitality, and education. Canada’s GDP grew substantially from record population growth in the last few years while sacrificing per capita GDP. Now, we can see the opposite impact occurring as population growth slows in the absence of economic growth—GDP could fall, putting Canada clearly in a recession in 2025.

At the same time, this transition offers an opportunity to reassess Canada’s housing priorities. By incentivizing the development of affordable housing, supporting renters, and expanding homeownership opportunities, policymakers can address the challenges posed by a slower-growing population. Proactive adjustments to housing policy, paired with a measured approach to immigration, could mitigate affordability issues while fostering sustainable development. The unfortunate part about all of this is that it sounds great in theory, but the reality is that it’s a painful process to get to.

Much like a construction project, you have to demolish a derelict building before you can create a new one on a new foundation. The demolition process is necessary, but not pretty.

That’s the phase of the process we’re in now. We’re not rebuilding yet. We’re just realizing that what we built before wasn’t working – and we’re doing something about it. The decisions made today will shape the future of Canada’s real estate market for years to come.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.