The spring market is over.

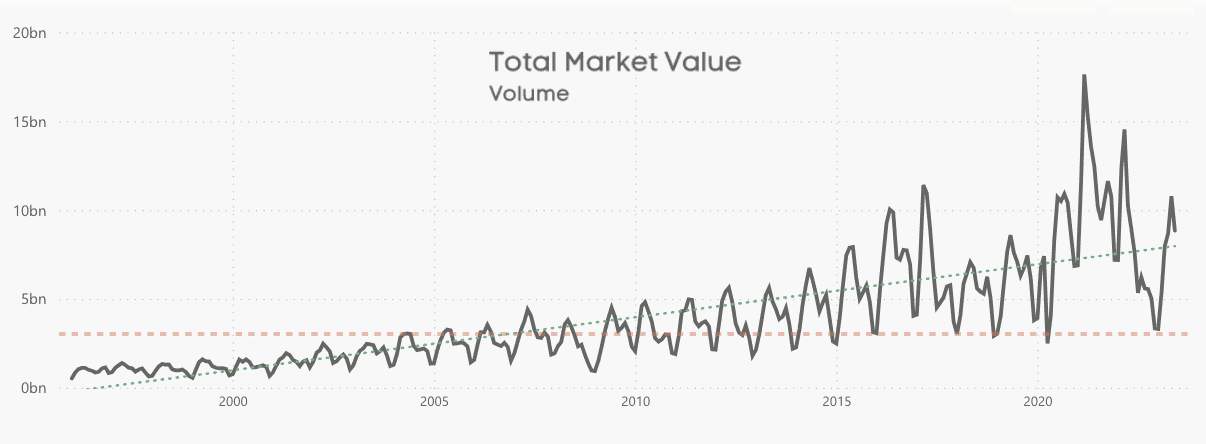

This June, 7,481 homes sold on the Toronto Regional Real Estate Board’s MLS — 16.5 per cent more homes sold than last June.

TRREB’s analysts mention that Toronto’s real estate market posted a relatively strong June market when compared with June 2022. However, June 2022 took place in the middle of one of the largest drops in house prices in Canadian history — so an annualized comparison to that year can be a little problematic.

Generally, total dollar volume of the market has been trending down since last month, which indicates that the spring market is likely behind us.

Source: Daniel Foch

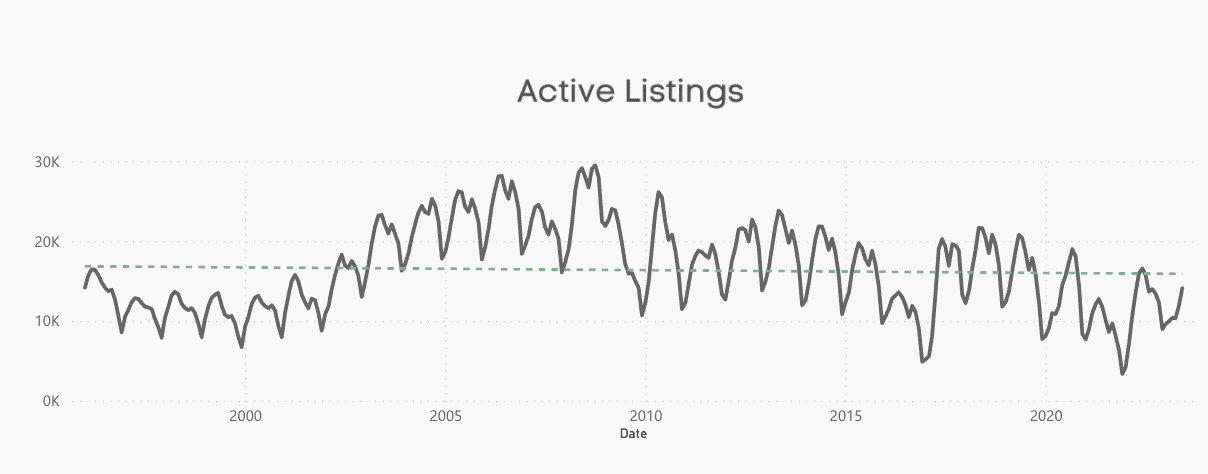

Supply is no longer the story we want it to be

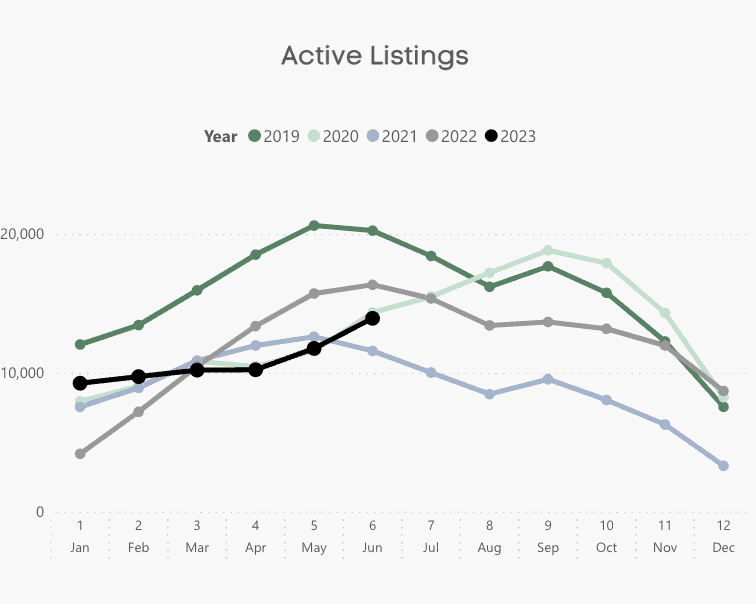

TRREB’s monthly news release indicates that a lack of listings led to tighter market conditions in June, leading the board to urge government to accelerate action on housing supply. On an annualized basis, that statement is correct, but looking at a monthly picture, it becomes evident that supply is actually growing, and it’s breaking the typical seasonal trend by doing so.

Active listings are trending up but still well below the long-term trendline.

Source: Daniel Foch

Usually, active listings roll over and decrease from spring into summer. This year, active listings are continuing to trend up through the end of spring. This will be an important trend to watch heading into the summer market.

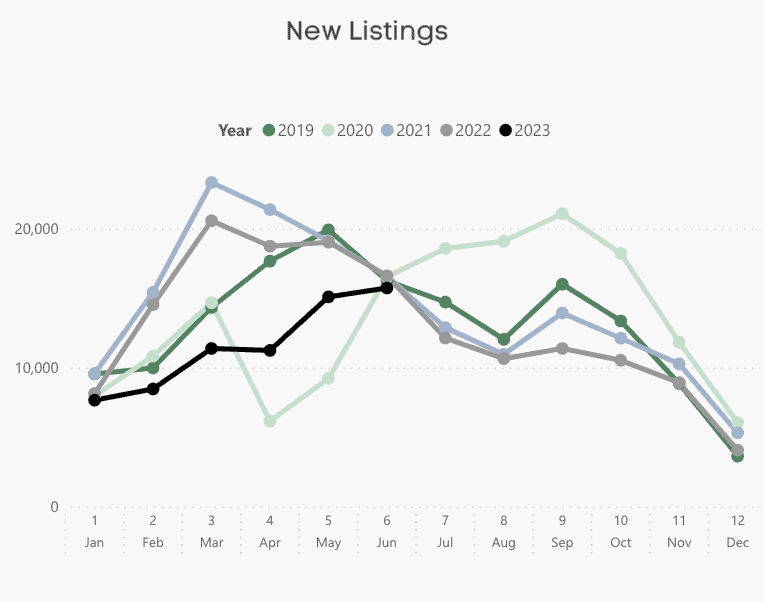

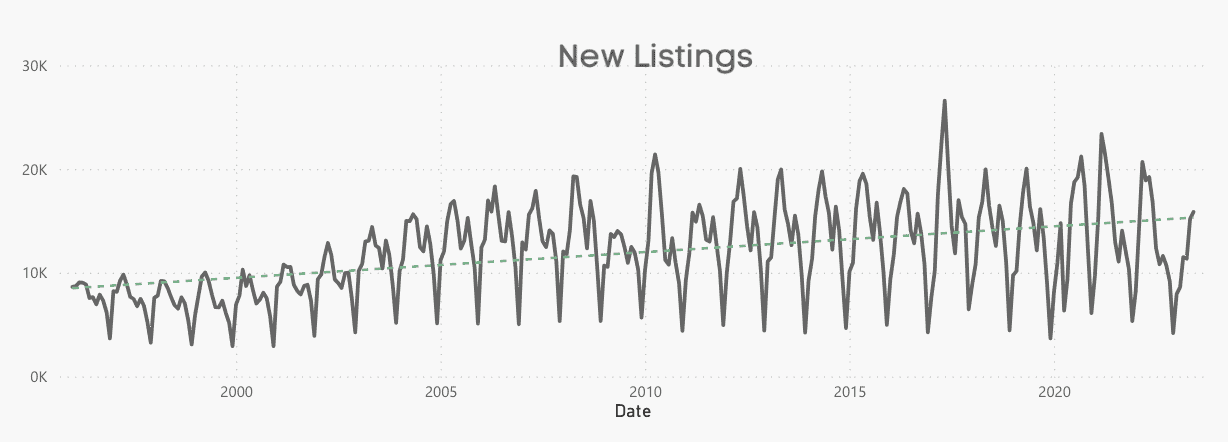

Similarly, the number of new listings would be trending down by now in previous years, but this year, it’s still going up monthly in June.

Source: Daniel Foch

Source: Daniel Foch

When examining the long-term context, the monthly jump in new listings has put new supply a little bit above the long-term trendline.

Source: Daniel Foch

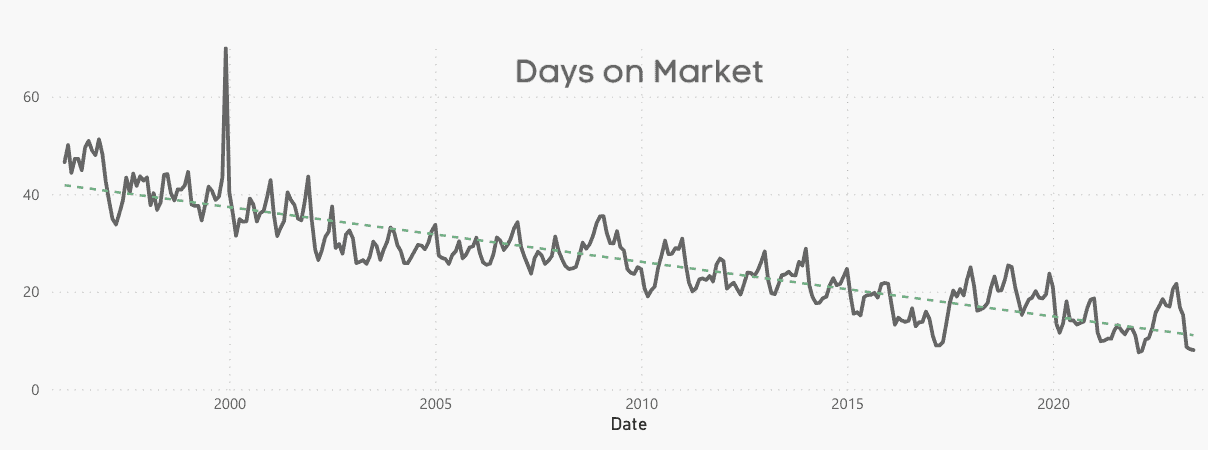

Fast and furious

With this being said, absorption was still strong in June, with days on market continuing its downtrend. This means that properties are selling faster than they did last month and almost as fast as the record set last year. If this trend holds, there is little risk of inventory piling up too quickly to push the market into buyer’s market territory, but it’s worth keeping an eye on these data points.

Source: Daniel Foch

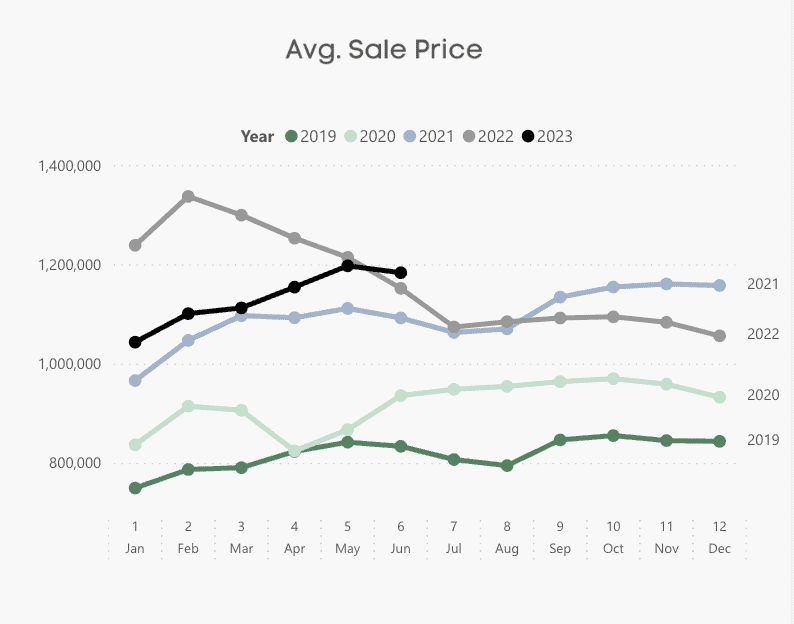

Price plateau

Every year in Toronto real estate, average and median sale prices rise from January until the peak of the spring market due to seasonality. When the spring market is over, these price metrics typically fall until August and then jump up in September. This rollover took place in May this year, signalling that pricing supports the end of the spring market, just as volume does.

Source: Daniel Foch

Similarly, the sale-to-list price ratio for TRREB has also tapped out its seasonal cycle, plateauing around 105% and likely headed down into the slower summer. This means that although demand is strong, the expectations of buyers and sellers are beginning to diverge.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.