This past year delivered a mixed bag for the Greater Toronto Area’s real estate market, with declining prices, mediocre home sales and an increase in average days on market.

According to Wahi’s 2024 Housing Market Snapshot, early hopes for a spring rebound fell flat, and although rate cuts in the latter half of the year sparked some signs of life, they weren’t enough to drive meaningful growth. Buyers, however, benefited from a flood of inventory, keeping the market competitive and prices in check.

Wahi’s post-mortem on the 2024 market includes TRREB data from Jan. 1 to Nov. 30, and compares it to the same time period in 2023.

Prices down, sales flat across the GTA

The median sales price across the GTA dipped to $965,000, marking a 2 per cent year-over-year decline, while the total number of sales remained unchanged at 62,651. Homes took longer to sell, with the average DOM rising to 24 days (an increase of five days compared to 2023).

Among regions:

- Toronto saw a 2 per cent decrease in the median sales price to $888,000, while total sales also declined 2 per cent to 24,017.

- Durham posted a 3 per cent price drop to $860,000, and a 3 per cent jump in sales to 8,8682.

- Halton’s median sale price fell 2 per cent to $1.08-million and a 3 per cent increase in sales to 7,7132.

- Peel’s median sales price dropped 2 per cent to $970,000 while the number of sales fell 2 per cent to 11,363.

- York also saw a price drop, down 3 per cent to just under $1.22-million, coupled with a 1 per cent decline in sale to 11,457.

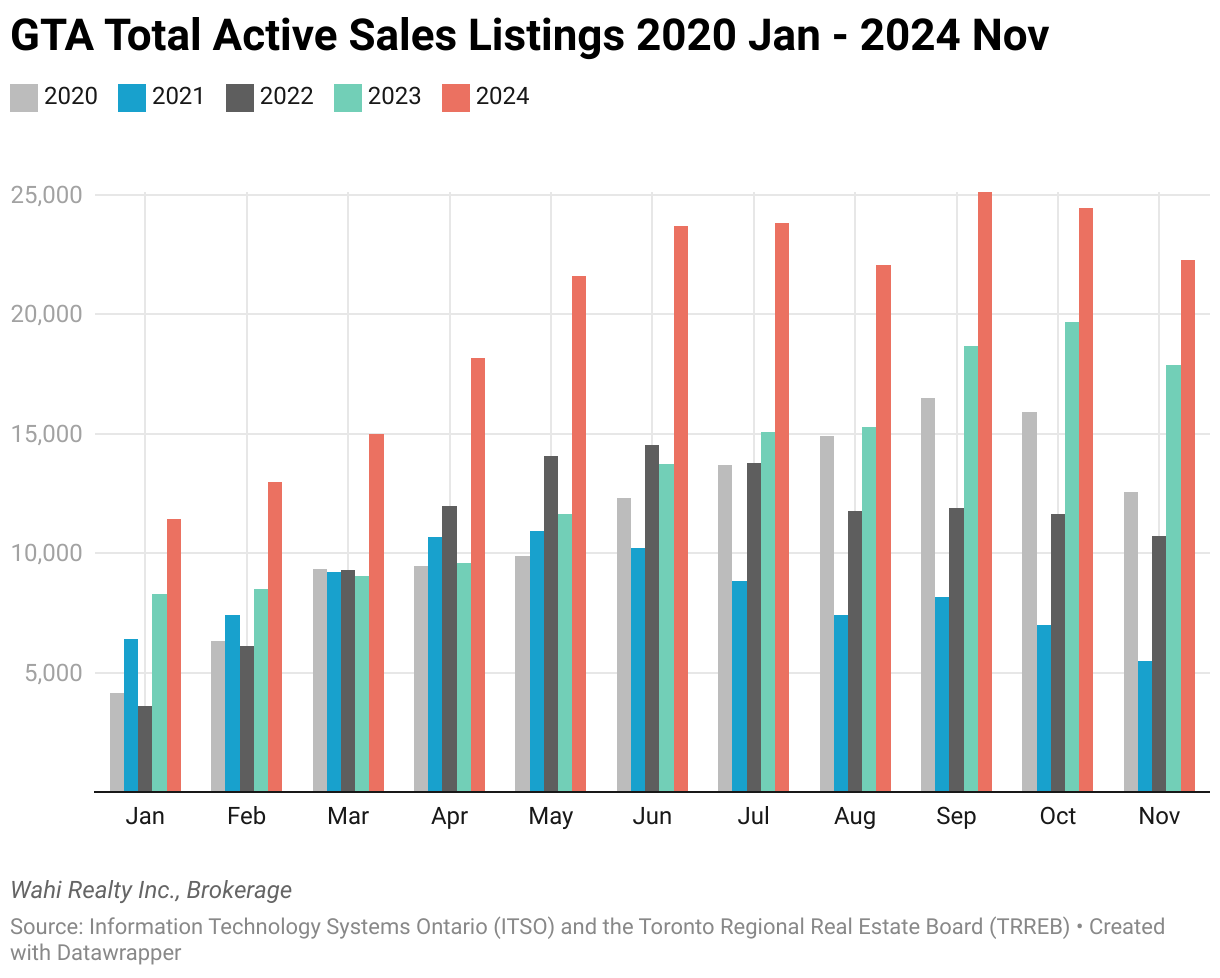

Buyers had an advantage as inventory stayed high; the number of homes actively listed on the market remained above 20,000 from May onwards.

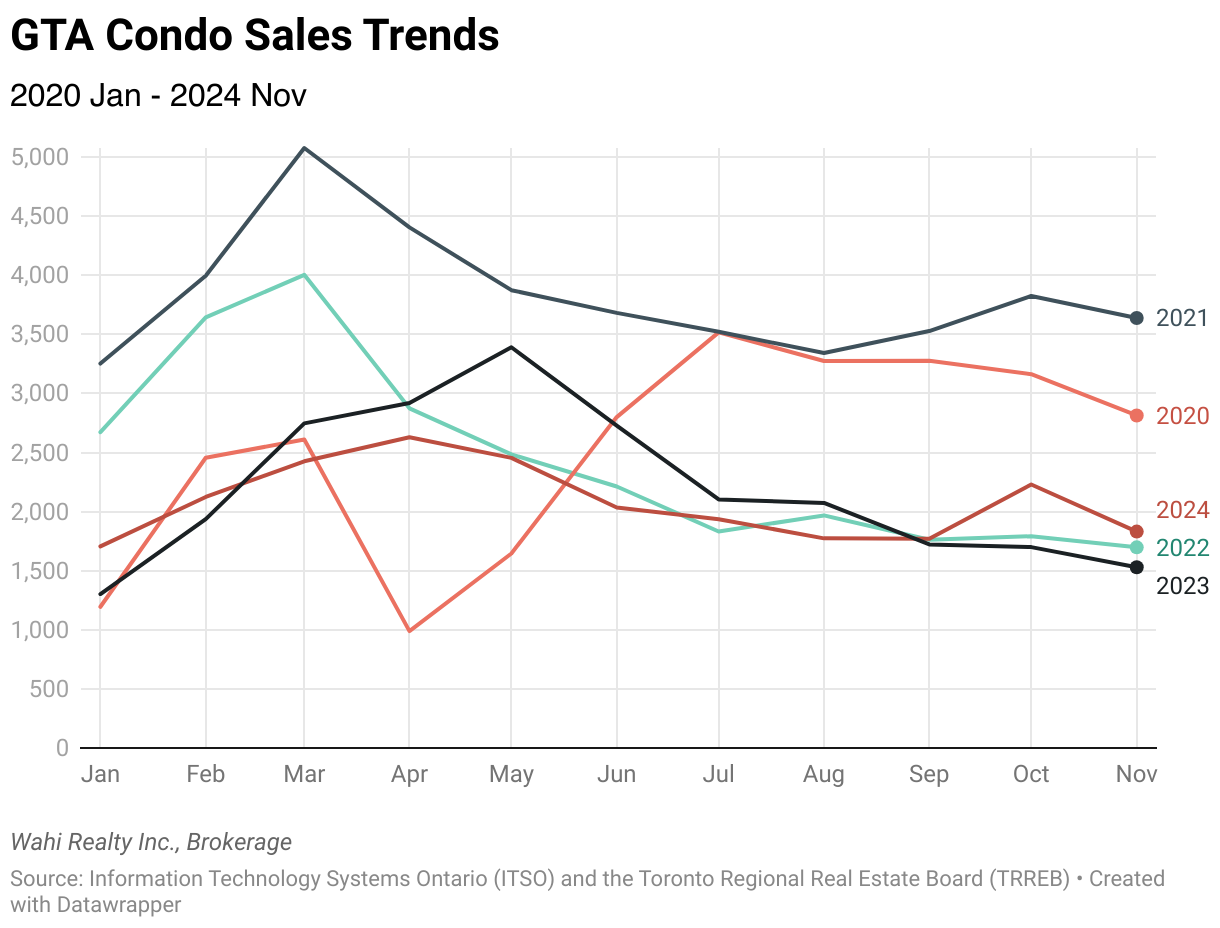

The condo market remains under pressure

The GTA’s condo market underperformed compared to single-family homes, reflecting a 5 per cent decline in sales and a 3 per cent drop in median prices to $655,500. Condos also remained on the market longer, with an average DOM of 30 days (up seven days year-over-year).

High inventory levels in the condo sector, driven by new developments and investors offloading properties, contributed to downward pressure on prices. Wahi’s data shows that condos took nine days longer to sell than single-family homes on average. The company notes that GTA condo sales jumped to the highest level in three years over September, October and November.

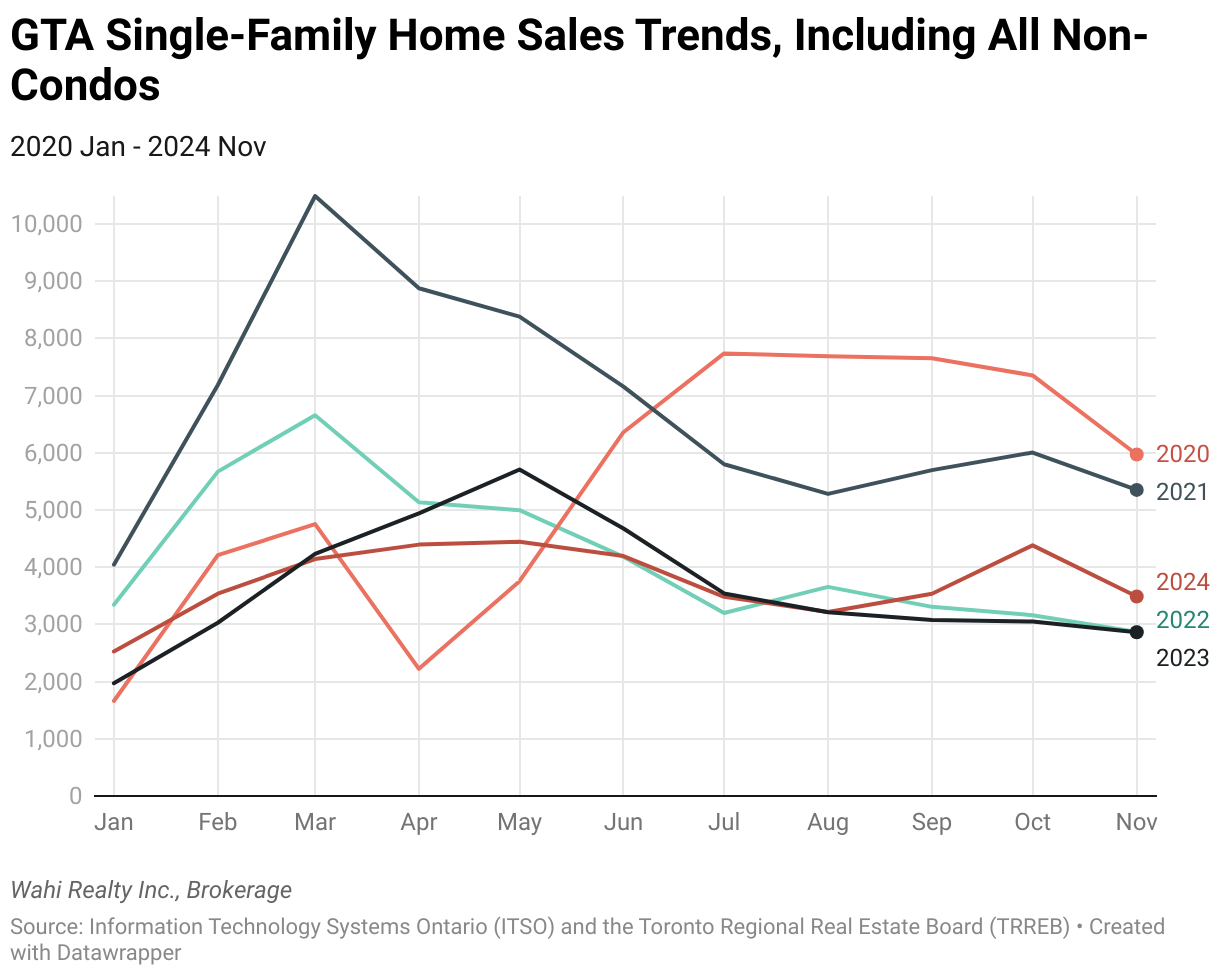

Single-family homes hold steady

Single-family homes displayed relatively more stability in 2024, with a 2 per cent year-over-year decline in median prices to almost $1.9-million, while sales rose 2 per cent to 39,576 units. This segment also saw a sharper recovery in the fall, as sales gained momentum during September, October and November.

Wahi identified the most popular communities based on its website’s search volume as well as neighbourhoods with the most sales.

Most searched neighbourhoods

- Bowmanville (856 homes sold)

- The Danforth (253 homes sold)

- Jane and Finch (155 homes sold)

- Bridle Path (seven homes sold)

- Mount Pleasant, Brampton (481 homes sold)

GTA neighbourhoods with the most sales

- Willowdale (1,134 homes sold)

- Neighbourhood of Newmarket (922 homes sold)

- Bowmanville (856 homes sold)

- Entertainment District (792 homes sold)

- Neighbourhood of Aurora (754 homes sold)

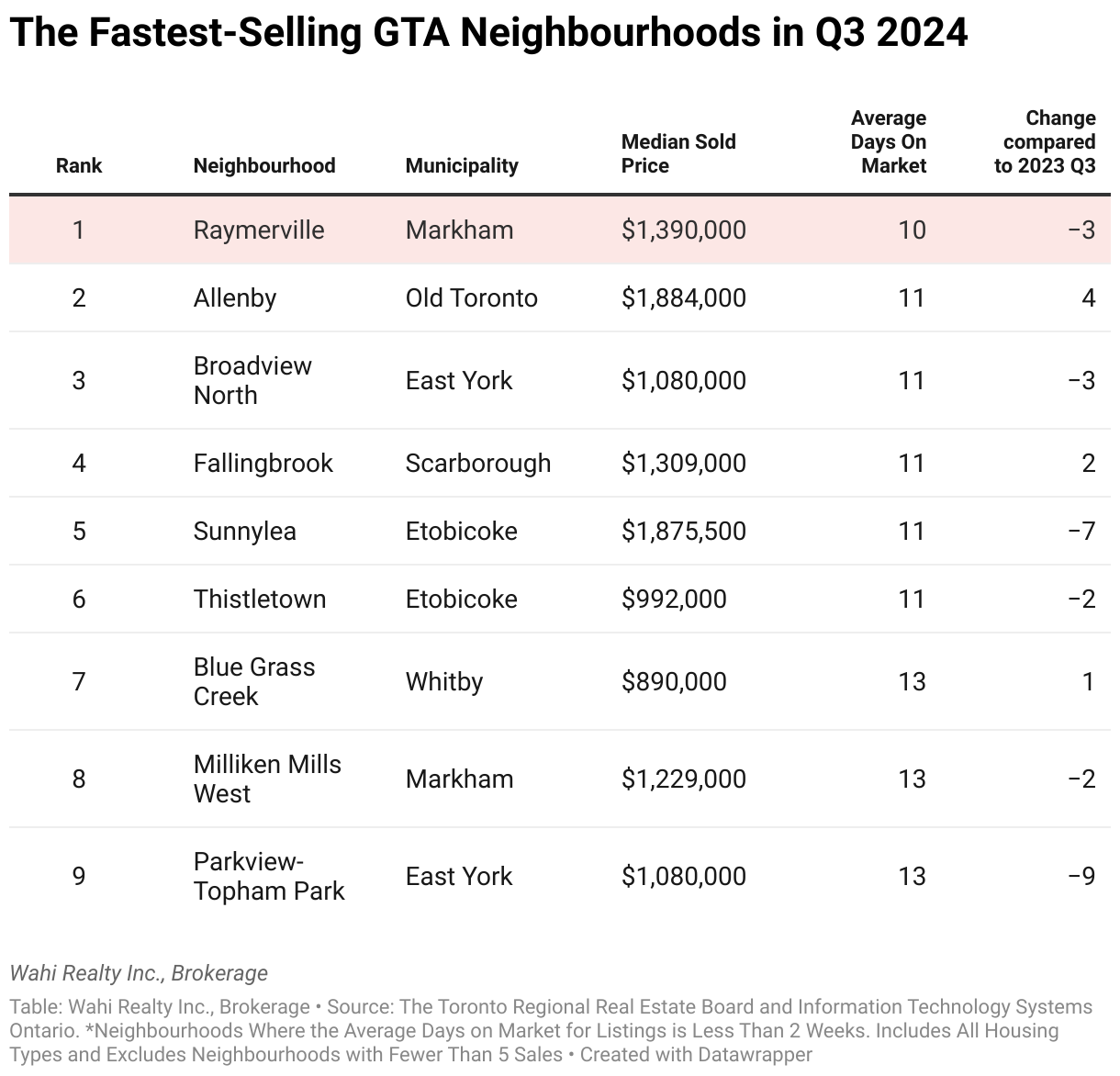

The fastest-selling GTA neighbourhoods

According to Wahi, It took longer for homes to sell in 86 per cent of neighbourhoods across the GTA in the third quarter of the year compared to Q3 2023, but in some areas, the average DOM was 10 days.

Overbidding trends decline

For much of the year, the majority of the GTA’s approximately 400 neighbourhoods have seen prices bid down. As of November, 91 per cent of GTA neighbourhoods were in underbidding territory up from 88 per cent in October.

A buyer’s market in transition

Wahi’s 2024 report paints a picture of a housing market in transition, characterized by more inventory and moderate price declines.

Wahi CEO Benjy Katchen sums up the year, saying in the report, “In 2024, Toronto homebuyers had more choice in the market than they have in years, with listings piling up to the highest level in recent memory.”