The Canadian real estate market stands as a cornerstone of the nation’s economy, reflecting not only economic conditions but also societal shifts and demographic patterns.

Currently, the state of our market displays a surprising resilience against various challenges, including a looming recession, record interest rate hikes and economic stagnation reminiscent of Japan’s “lost decade.”

Unforeseen strength against recessionary pressures

Despite looming recessionary pressures, the country’s real estate market has defied expectations, showcasing stability heading into the spring market.

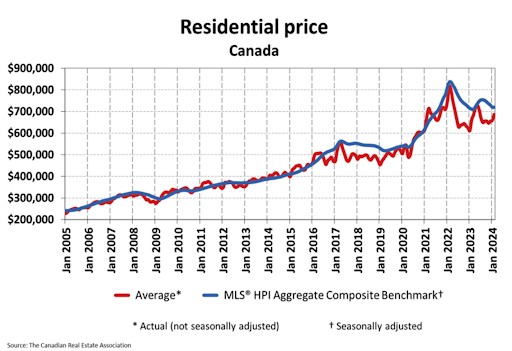

House prices in Canada were unchanged since last month, but are still down 2.3 per cent from three months ago, and down 4.6 per cent from six months ago. When looking at a more long-term context, the house price index (HPI) tells us that prices are up 1.2 per cent since the same month last year, and up 13.1 per cent since three years ago.

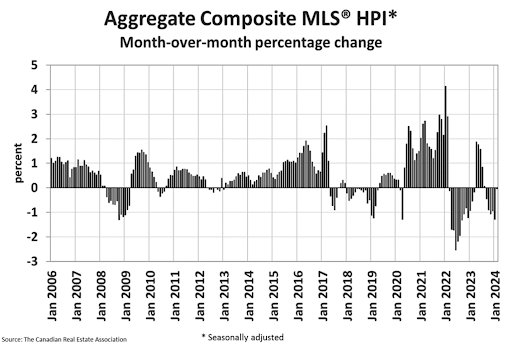

When it comes to house prices in the shorter term, it’s understandable why consumers experience confusion around the market. Average price is trending up on a month-over-month basis, yet the MLS HPI benchmark is trending down:

On top of that, 30 markets saw a decrease in HPI value in Canada, while 24 markets saw a monthly increase in HPI and two markets remained unchanged.

So, more than half of markets fell in value, despite CREA’s headline stating, “Canadian home prices see sudden end to declines in advance of spring market.” While the declines may have stopped, it’s not all sunshine here.

Usually, the market would be growing steadily in the spring, with prices growing from January to May in a typical year.

Largest monthly home price changes

Below are the biggest monthly increases in house prices, measured by the HPI:

- Simcoe & District +4.3 per cent

- Quebec CMA +3.8 per cent

- Regina +2.6 per cent

- Saskatoon +2.5 per cent

- Winnipeg +1.5 per cent

Five Ontario real estate markets saw the biggest drop in house prices, measured by the HPI:

- Woodstock-Ingersoll -3.5 per cent

- Windsor-Essex -2.3 per cent

- Niagara Region -1.7 per cent

- North Bay -1.7 per cent

- Cambridge -1.7 per cent

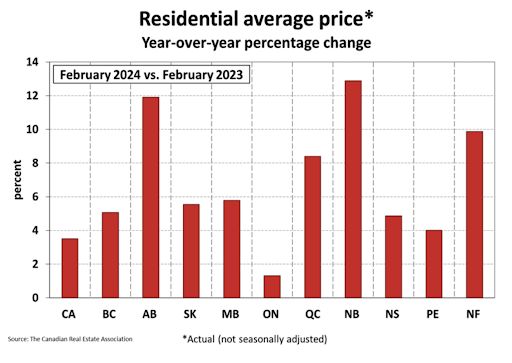

On a provincial basis, the biggest annual increases in average price can be seen in Alberta, New Brunswick and Newfoundland and Labrador. Not coincidentally, these markets have also been some of the biggest recipients of Ontario residents fleeing the province for more affordable markets.

Record population growth has played a pivotal role in bolstering housing demand, underpinning market activity even amid economic headwinds. The growth and interprovincial migration patterns have contributed to sustained housing demand, countering downward pressures that typically accompany recessions.

Record interest rate hikes and market response

The Bank of Canada’s unprecedented series of interest rate hikes has posed a significant challenge to the real estate market, traditionally sensitive to fluctuations in borrowing costs. However, the market’s resilience has been notable, especially in entry-level product and affordable markets outside of Ontario and British Columbia.

While the rate hikes have tempered demand to some extent, particularly in overheated markets, the overall impact has been mitigated by other factors, including demographic trends and supply constraints.

Economic stagnation and its impact on housing

Canada’s GDP per capita stagnation, reminiscent of Japan’s “lost decade,” presents a sobering backdrop for the real estate market. Despite nominal economic growth, when adjusted for population, GDP per capita has declined to 2016 levels — raising concerns about long-term economic prospects and affordability challenges.

While this stagnation may ordinarily dampen housing market sentiment, other factors such as population growth and low unemployment rates have offset some of the negative effects.

The current state of the country’s real estate market calls for cautious optimism tempered by awareness of underlying challenges.

While the market has demonstrated resilience against recessionary pressures, record interest rate hikes and economic stagnation, vulnerabilities remain. Affordability concerns persist, particularly in major urban centres, and there is a need for policymakers and industry stakeholders to address these issues proactively.

Our market’s resilience against a backdrop of economic uncertainty is both surprising and noteworthy. Factors such as record population growth, adaptability to interest rate hikes and demographic shifts have contributed to this unexpected strength.

However, challenges remain, including affordability constraints and the specter of economic stagnation. As we navigate these uncertain waters, careful monitoring of market indicators and strategic policy interventions will be essential to ensure the long-term health and sustainability of Canada’s real estate sector.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

Negative growth is a new trend in recent years. Let’s wait till April 1 to see where we are. Carbon tax hike will not add confidence to the buyers.

3.3 cents a litre won’t have an impact

Interest rates in Canada will likely follow the lead of US rate movements as dictated by the US Federal Reserve. Considering the massive $$ deficit driven investment in US infrastructure due to the Inflation Reduction Act and resulting stubbornly high inflation rates being experienced, the BOC may NOT reduce interest rates on the schedule assumed by the markets for fear of a weaker Canadian $ and the increased inflationary consequences such a move would cause to our CPI.

The winds of wage and price increase pressures blowing across western developed economies are still blowing quite briskly and lowering rates too far too fast will only fan increases in inflation.

The inflation dragon has yet to be slayed, and irrational expectations of major rate decreases happening anytime soon are only continuing to fuel the very inflation we’re looking to reduce.