The Canadian Real Estate Association (CREA) released its quarterly forecast on October 15 and, as it turns out, it’s a mixed bag. There’s cautious optimism as national home sales are expected to see a modest recovery, and interest rates are forecasted to drop further.

However, don’t pop the champagne just yet.

The market’s recovering, but not at a sprinting pace to the finish line

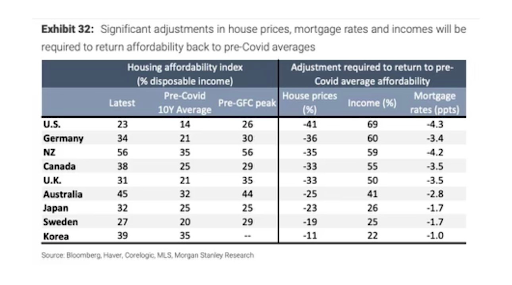

The reality of affordability challenges continues to loom over the Canadian housing market, despite interest rate optimism felt by the real estate industry. According to Bloomberg, Canadian interest rates would need to fall 350 bps to restore pre-covid affordability:

Source: Bloomberg

Source: Bloomberg

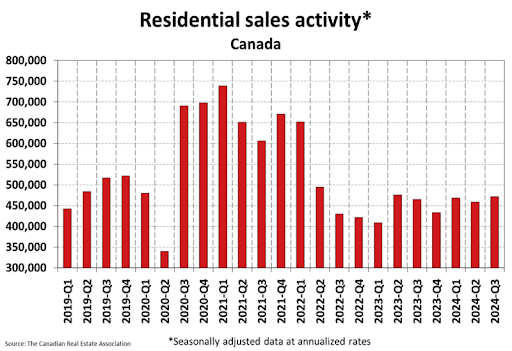

CREA’s forecast highlights a steady uptick in home sales — largely thanks to recent interest rate cuts by the Bank of Canada. A 5.2 per cent bump in sales for 2024 is being touted as a sign of recovery.

Although this is what we’ve all been waiting for, some regions are still dragging their feet. And price increases, while present, are lukewarm at best. In other words, the market’s recovering, but it’s not exactly sprinting to the finish line.

The (not so) immediate impact of interest rate cuts

Three interest rate cuts in 2024, and what do we have to show for it? Well, according to CREA’s report, national home sales recorded over Canadian MLS systems inched up 1.9 per cent in September compared to August. It’s the highest level since July 2023.

With each rate cut, sales have bumped up slightly, but the market is not all sunshine yet as consumer sentiment has remained low.

CREA’s senior economist, Shaun Cathcart, is already warning that buyers might hit the pause button, waiting for the next round of rate cuts next year — the market could stall again before the rebound we’re all supposed to get excited about in 2025. This is one of the primary reasons that interest rate cuts take such a long time to move through the market. If buyers see more rate cuts ahead, they may wait for lower rates, especially if they don’t see prices rebounding anytime soon.

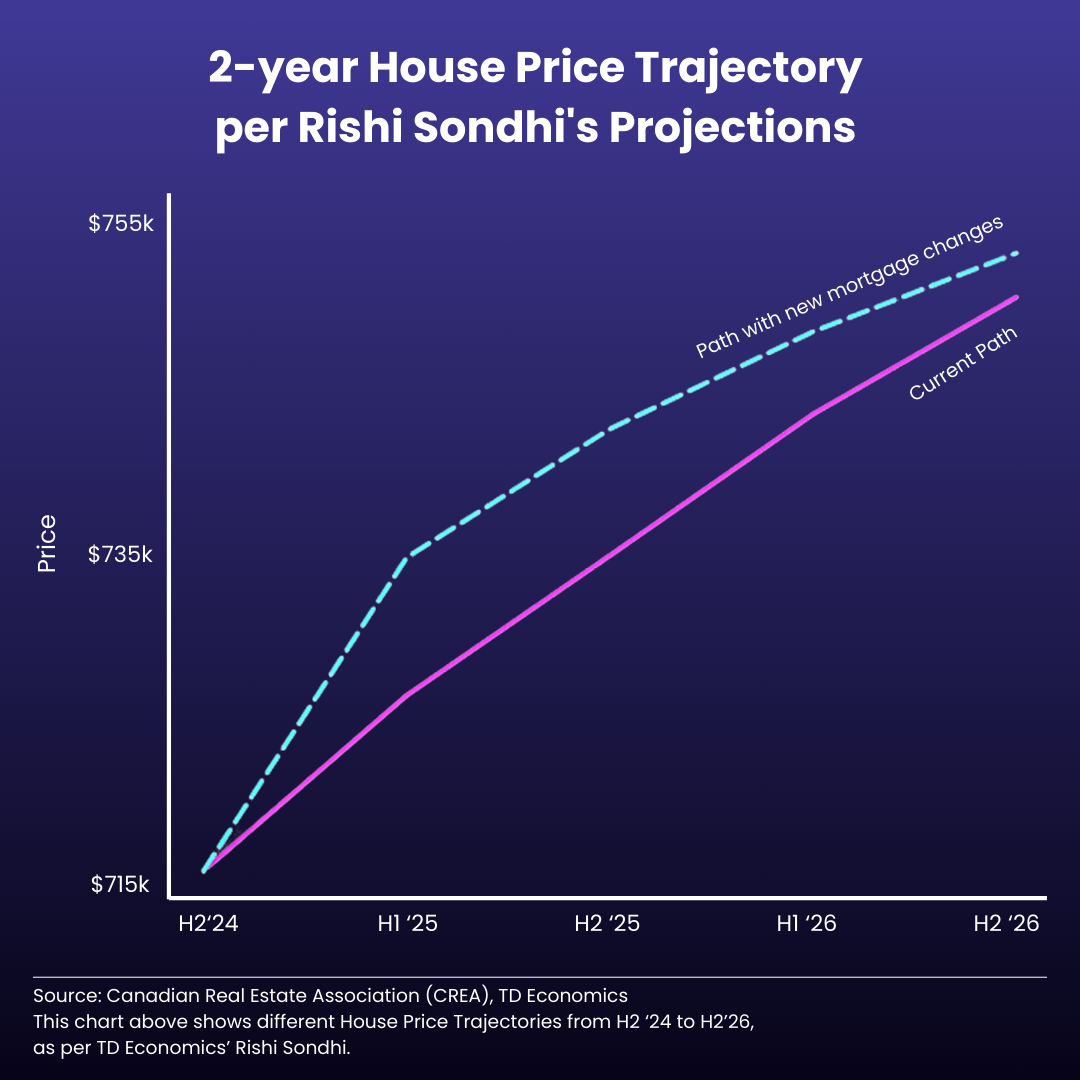

Experts seem to think they could be wrong, though. TD Bank recently projected that recent CMHC insurance changes will front-load any house price increases into the first half of 2025, leading to slower growth at the end of next year:

6.9 per cent increase in September home sales but prices still down year-over-year

September saw a 6.9 per cent increase in home sales compared to the same time last year. This sounds great, but the reality is that the market is stabilizing after the roller coaster ride of relatively higher interest rates and the economic turmoil we’ve seen in the last couple of years.

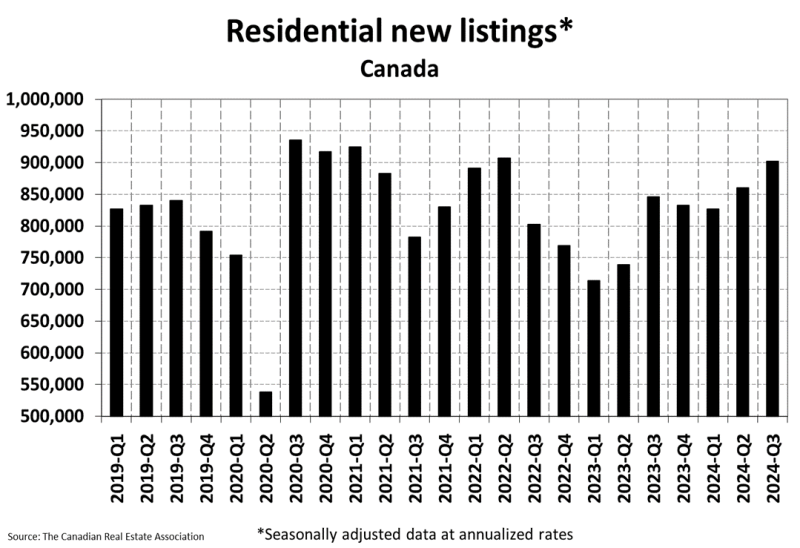

Interestingly, the number of newly listed properties shot up 4.9 per cent, suggesting that sellers are feeling brave enough to test the waters. This is a welcome change compared to the “wait and see” approach we’d seen from sellers earlier in the year when they seemed to hope rate cuts would help them achieve a better price or faster sale. With prices down 3.3 per cent year-over-year, it appears interest rates are not supporting price growth the way they’d hoped.

CREA is quick to point out that month-to-month, things are trending upwards. In short, we’re on the mend, but it’s hardly over yet.

Housing prices rising slow and steady

According to CREA’s forecast, the national average home price saw a year-over-year increase of 0.9 per cent, bringing the average to $683,200. Looking ahead, prices are projected to rise another 4.4 per cent in 2025, crossing the $700,000 mark ($713,375 to be precise), which suggests solid market fundamentals. As mentioned before, this growth could be aided by recent changes to Canadian mortgage rules, increasing the CMHC limit to $1.5 million.

For now, prices are mostly flat with only minor month-over-month fluctuations. This could be considered good news for those considering selling their home in the near future, where the absence of volatility makes the market much safer to buy and sell simultaneously. This is a welcome change from the high-stress buyer’s markets we’ve seen across Canada over the last few years.

More listings, more options — but not necessarily more sales

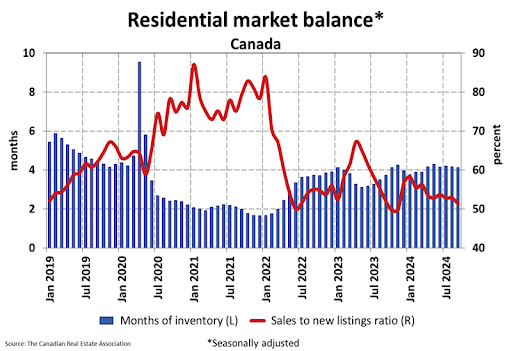

September had a significant rise in new listings — up 4.9 per cent from August. On the surface, this sounds like a great thing for buyers who’ve been struggling to find a decent property. But the surge in listings hasn’t exactly translated into a flood of sales. In fact, sales are climbing at a slower rate than new listings, and this could tip the balance toward buyers — eventually.

The increase in supply should give buyers more leverage, but for now, the market is still holding steady in what CREA calls “balanced” territory. In other words, neither buyers or sellers are fully in control, but this could change if listings keep rising and sales don’t pick up pace.

Months of inventory has stabilized just above four months, though the sales-to-new listings ratio continues to slow down, meaning buyers aren’t absorbing new listings as quickly as they were.

185,000+ properties listed in September, below historical average — power could soon shift to buyers

As of September, there were 185,427 properties listed for sale on MLS systems nationwide, up 16.8 per cent from the previous year. Keep in mind that we’re still below the historical average of around 200,000 listings.

The national sales-to-new-listings ratio dropped to 51.3 per cent in September from 52.8 per cent in August. While this is consistent with a balanced market, it’s worth noting that if listings keep rising and sales don’t, the power could soon shift to buyers.

Will the real estate market rebound in 2025? It’s never as smooth as it sounds

According to CREA, home sales are forecast to climb by 6.6 per cent in 2025, with 499,800 units expected to change hands. This optimism hinges on expectations of even more interest rate cuts and a friendlier economic environment.

The narrative here is clear — 2025 is the year when everything is supposed to come together. Demand will surge, inventory will remain low and prices will rise steadily. But as always, there are still plenty of variables at play, and it’s never as smooth as it sounds.

CREA’s latest forecast paints a cautiously optimistic picture for the Canadian housing market. While 2024 is showing some incremental improvements, real action is expected in 2025 when interest rates drop further.

Until then, we can expect more of the same: a slow, steady recovery that’s more about survival than celebration. Buyers and sellers alike should keep their expectations in check as we move through the final months of 2024.

Daniel Foch and Nick Hill are co-hosts of The Canadian Real Estate Investor Podcast. Daniel Foch, a real estate broker and analyst, is frequently featured in major media and has advised on over $1BN in real estate transactions, focusing on affordable housing. Nick Hill, a real estate investor and mortgage agent, has a background in business, commercial real estate and startups, working with investors and developers across Canada.