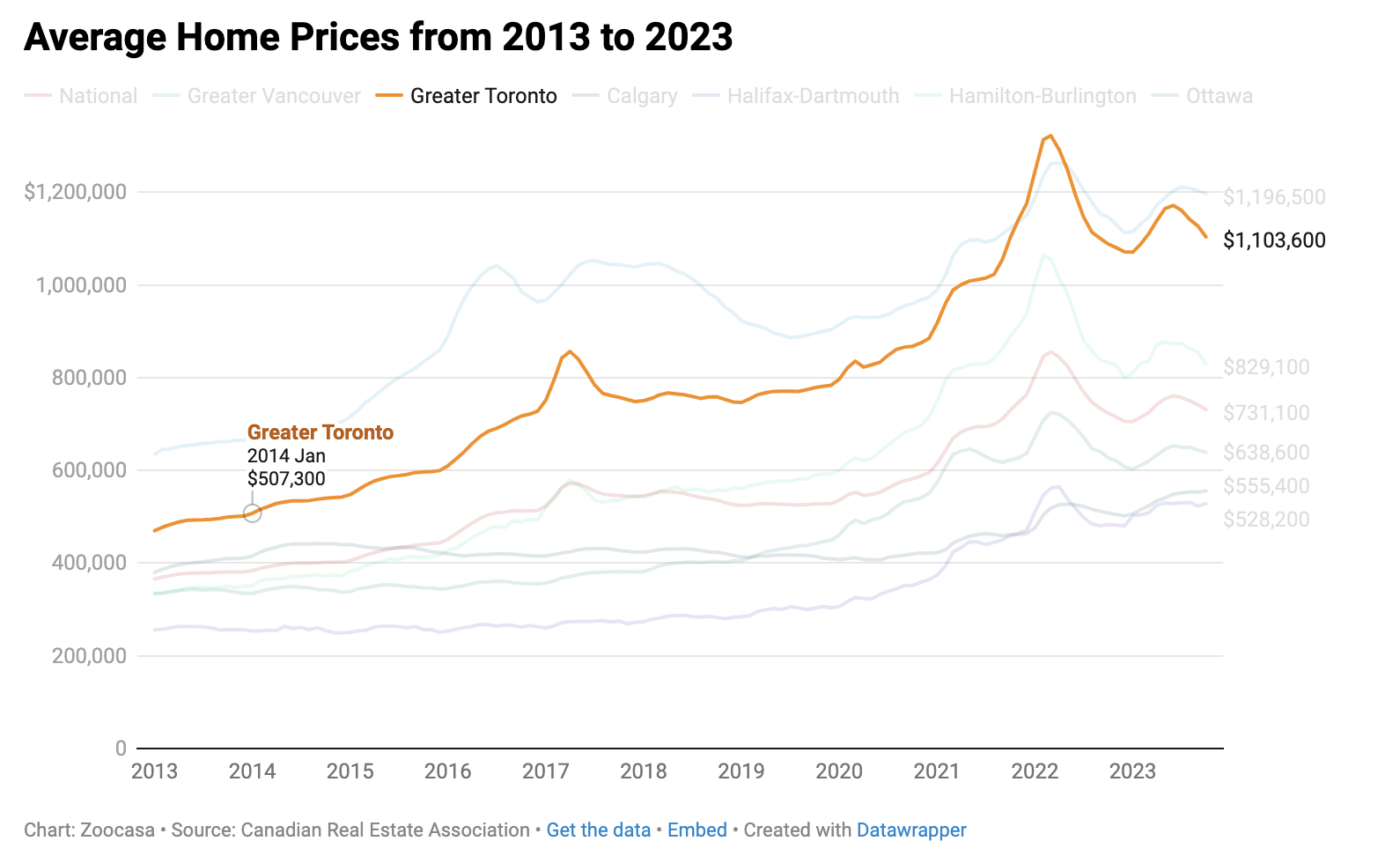

Buyer uncertainty and less affordability were two main themes of this year’s housing market, much in part due to the Bank of Canada’s interest rate hikes. Inventory increased to more usual levels across the country but, at the same time, sales slowed down.

But, with inflation going down, economists predict there won’t be further interest rate hikes and that rates will actually come down into next year. Zoocasa reports on what this could mean for the housing market.

Prices will continue to go down

This past fall, many prospective buyers held off, as the 3.4 per cent month-over-month sales national drop in October shows. The national average home price during that time decreased for the fourth consecutive month to $731,100.

Lauren Haw, Zoocasa’s broker of record & industry relations officer, explains, “There’s a current chasm between the bid/ask for many property types. Sellers are still priced quite high relative to what non-urgent and hesitant buyers are willing to spend, meaning sellers in 2024 will have to come down to the buyers’ preferred pricing in order to sell.”

Buyers downsizing or moving up, or otherwise not in any rush, will likely delay their purchase and hang onto their homes longer. While this will keep prices down somewhat, particularly in entry-level recreational properties and cottages, Haw notes, “There will still be continued pressure for family homes in prime locations which will keep prices buoyant for great detached homes in great school districts.”

Haw predicts, “Non-essential properties that are disposable in nature, especially those that were over-sold and speculated upon during the pandemic, will see the biggest price drops.”

The impact of high interest rates is far from over

As for the numerous interest rate increases, it can take a few months to over a year for their effects to be seen across markets. Zoocasa’s CEO, Carrie Lysenko, explains, “The Bank of Canada’s 10 rate hikes since March 2022 seem to be achieving its goal of bringing inflation down, however, the full impact has yet to be felt.”

This means that even if rates stay flat as predicted, the previous rate hikes’ impact will still rise. “Every month that passes, more current homeowners will see their mortgages up for renewal at these higher rates, likely leading to more forced selling,” Lysenko says.

For example, the report notes that the average 2020 Toronto homebuyer had a monthly mortgage payment of $3,737, based on 1.64 per cent, one of the best rates in September 2020. If that same homebuyer is up for renewal now, their monthly mortgage payments will jump to $4,499, based on the 5.24 per cent September 2023 rate.

Everything can change by spring

Currently, home prices are trending downward. This is typical for winter, with price growth usually picking up before the start of the spring market. Last year, the national average home price peaked at $855,800 in March and was at its lowest at $705,600 in December — but Haw does not think we’ve reached the bottom just yet.

“Once that bottom is hit and prices start to go back up, it will be a rapid ascent to the top as the latent demand for housing in urban cores race to get back in before prices peak again,” Haw explains. Investors will likely re-enter the market, as well.

Read the full report here.