For realtors in British Columbia, it’s important to keep track of property assessments. You can expect your clients will ask about assessed values, regardless of whether you think they accurately depict real estate prices.

BC Assessment releases updated assessments annually based on real estate trends as of July 1. This year, homeowners saw a jump in the assessed values of their homes.

According to the crown corporation, overall assessments for the Lower Mainland region have increased from about $1.75 trillion in 2022 to over $1.94 trillion this year.

There are several reasons why realtors should care about assessed values.

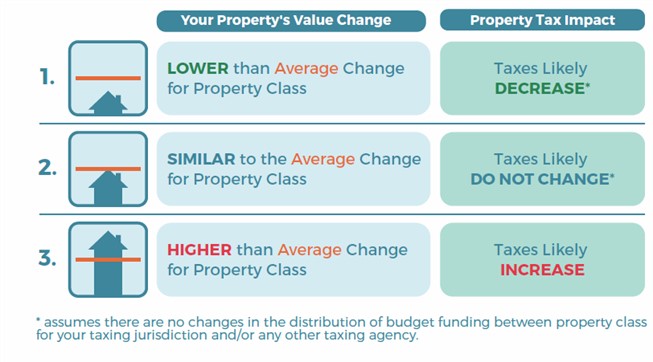

Assessed values can impact the amount of property taxes a homeowner pays, which can be important for real estate professionals to understand when pricing and marketing a property.

Source: BC Assessment

Assessed values may also be used as a starting point for negotiations on the sale price of a property, so understanding the perceived value of a property can be helpful for realtors in pricing and marketing a property effectively.

It can also affect its attractiveness to potential buyers, so real estate agents should be aware of assessed values to understand the demand for a property.

Additionally, keeping track of numbers in an area can give Vancouver realtors a sense of the overall health of the local real estate market and how it may change over time.

Property assessment trends

Assessment notices were mailed out on Jan. 3, and property owners can expect to see a five to 15 per cent increase in their home values. However, it’s important to note that some areas saw greater gains than others.

White Rock and Abbotsford had the highest increases in condo property prices, with a staggering 21 per cent increase.

The City of Vancouver saw a modest increase of only six per cent. That being said, compared to the losses many saw from investing in stocks and crypto, plus six per cent is great.

What areas saw the greatest increase in condo prices?

At the top of the list for the high-performing areas were condos in White Rock and Abbotsford, which both saw a staggering increase of 21 per cent.

To put that in perspective, if you bought a condo in Whiterock in 2021 for $800,000, a 21 per cent increase of $800,000 equals a capital gain of $168,000 on paper. This means that the assessed value after the increase would be $968,000.

Other high-performing areas included Surrey and Maple Ridge.

Areas that offer more affordability did better on average than already expensive areas.

There is also likely more land to develop in places like Maple Ridge and Abbotsford versus the City of Vancouver.

Of course, as prices rapidly increase at over 20 per cent in the Fraser Valley, real estate will quickly become unaffordable, leading to a slowdown in the increase of property prices.

How keeping track of assessed values can help realtors

Understanding the assessed values of properties in an area can give realtors a sense of the overall health of the local real estate market.

Assessed values reflect the government’s estimate of the market value of a property as of a specific date, so tracking changes in assessed values over time can help identify trends and shifts in the market.

For example, if values in a certain area are consistently increasing, it may indicate a strong and growing market. On the other hand, if assessed values are stagnant or decreasing, it could signify a weaker demand.

In addition to tracking changes, assessed values can also be used as a benchmark to compare the asking price of a property to the estimated value.

If the asking price is significantly higher than the assessed value, it may be less appealing to potential buyers, while a lower asking price may be more attractive.

By understanding assessed values and how they relate to the local real estate market, real estate professionals can make informed decisions when pricing and marketing properties.

Alistair Vigier is the CEO of Clearway Law, a company that connects people that need a real estate lawyer or Realtor with one for free.