Prime Minister Justin Trudeau called a federal election for Monday, September 20, in the middle of various COVID-19 lockdowns to force millions of Canadians to go out to the polls to vote, or perhaps in anticipation that many citizens wouldn’t go out to vote.

Historically, and before the current provincial Ford administration in Ontario, the Progressive Conservative party always appeared to be the most understanding or perhaps at least considerate of residential landlord issues. In my opinion, over the past four years or so all three main parties have essentially become “shades of the NDP.” All the parties have been making outlandish promises about arresting the housing crisis, specifically obtainability and affordability for both purchase and rental properties.

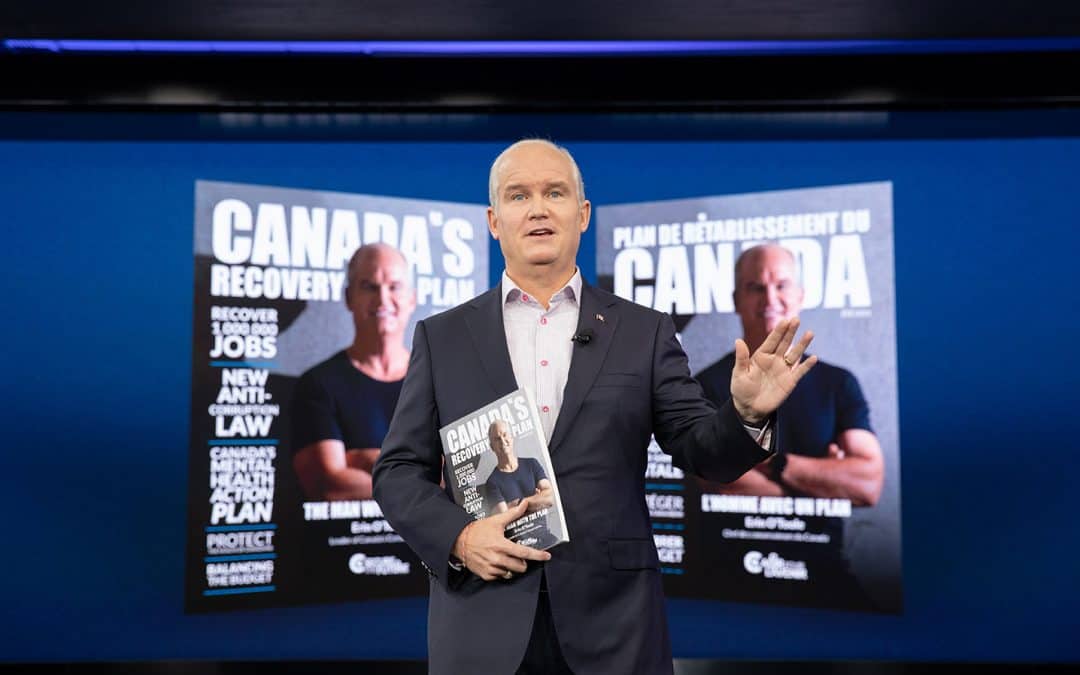

The Conservative Party’s Recovery Plan includes the party’s platform on housing affordability actions if they are elected, on pages 55 to 56. Here are my comments about their plan:

- While the capital gains deferral is mildly interesting, it’s still only a deferral. It remains to be paid and therefore is not much of an incentive. The time period to re-invest is missing too. If it’s only one or two years, then it’s relatively meaningless since it can take years to approve a new development, and years to find a financially viable purpose-built property for sale. Most sellers have no compelling reason to sell and there are many disincentives to selling, so current seller price expectations routinely far exceed most properties’ ability to be financed. Arguably, 85 per cent of residential rental properties are financed.

- Converting federal administration (office) properties to housing may seem like a good idea but many developers will tell you they tried that and ran into all kinds of real-life issues, especially related to natural light, environmental contamination tolerance levels, windowless floor plate size, mould, hidden deterioration and myriad other issues. Most of these converter-developers concluded that it’s much easier to tear down and re-build an office building rather than convert to residential.

- It may be politically advantageous to separate out a special initiative for Indigenous housing needs but there are a great many non-Indigenous Canadians who are suffering from the multi-year consequences of a debilitating pandemic that have left them in desperate financial straits and possibly without a place to live too.

- Incentives for land trusts to donate land seems nice but most of such lands are typically unserviced (no electricity, water, garbage removal and/or roads). It’s not land availability that’s needed. According to a government website, 87 per cent of Ontario is Crown land. What’s needed are serviced lands and reducing multi-year municipal zoning processes. Bylaw departments everywhere are militantly oblivious to the housing crisis, discouraging rentals at every turn “because that’s their job.” Anything done at the federal level ultimately needs provincial and municipal housing agencies to be on the same trajectory to resolving the housing crisis.

The Conservatives’ Recovery Plan appears to blame “corrupt” activities (which they don’t define) for driving up real estate prices. Forgive me, but that is utter nonsense. Establishing a beneficial ownership registry for residential property smacks of big brother and shades of the previously failed Rent Control Bureau. I recall that CMHC reported that foreign investors make up less than 0.5 per cent of Canada’s residential housing investments although I did find a statistic that non-residents owned 3.1 per cent of Toronto’s condos in 2020. Notwithstanding that, housing speculation – if that is what the Conservatives are calling “corrupt” practices – can ONLY exist when there’s high demand and low supply. Property “flipping,” assignments without ever owning the property and other price-increasing phenomena are symptoms of high demand and low supply. These practices would stop dead if supply increased such that buyers had other options than buying a quickly renovated or flipped home or the purchase of a multi-year delayed condo construction.

I like the idea of encouraging foreign investment in purpose-built rental housing but “… affordable to Canadians …” is a meaningless motherhood statement. It could also possibly be injurious to Canada’s long-term economy. Every foreign investor will calculate how much it costs to build and maintain a purpose-built property and then look at what profit they make. I believe invariably, it will be unattractive for all but large condo projects (and maybe not even then).

No one is building “missing middle” properties in particular today because they are deemed unprofitable. I don’t believe that’s true but rather that missing middle rental properties aren’t “highest and best use” for most serviced land and don’t offer the same economies of scale and return on investment as larger rental properties do. This is where government needs to create compelling incentives, but then property taxes would be much lower per square foot than a “condo-scraper” so it’s a vicious circle.

It’s socially unconscionable in my view to prevent immigrants from buying a home for a period of time by stating on the one had that housing is a human right and then denying that same right to newcomers who want to make a new life for themselves and contribute to this great country.

Reinstating the Conservatives’ “Housing First” initiative calls for creating more addiction centres. Once again, this is a response to symptoms, not cause(s). Fighting addiction must begin with regulating pharmaceutical companies and their distribution networks against distributing powerful and addictive opioids prescribed initially to combat chronic pain but which become incredibly addictive over a very short period of time – especially fentanyl. Legalizing drugs to me is a far better approach than “combating” drug abuse. It may or may not lessen the addiction but it would almost certainly lessen the criminal element and perhaps create a self-sustaining addiction-control business or industry. Was nothing learned from America’s Prohibition era?

The Canadian insurance industry ripped off Canadian consumers across the country in 2020, reporting one of its most successful and profitable years in recent history – in the middle of a global pandemic. The Competition Bureau said it couldn’t investigate unless it had a whistle blower so such profiteering abuse must be resolved by politicians. Indirectly related, I spoke to the Insurance Bureau of Canada and asked if they knew of any company that offered multi-year insurance plans. Not a single one. How about creating a multi-year insurance scheme for rental properties that gives some predictability for such costs?

Regarding mortgages, the best way by far to provide more affordable mortgages is to increase the amortization period. Even five more years (30-year) can have a dramatic effect on lowering monthly payments. The upside is that monthly and weekly mortgage payments are much more affordable. The downside is that it takes longer to build up equity, which could impact the country’s GDP-to-debt and lead to a slowing down of the economy (recession). Nevertheless, slow-building home equity is still much better than no-equity renting.

No mainstream Canadian banks to my knowledge offer greater than 25-year amortization and several don’t do more than 15 or 20 years. Banks generally don’t like longer amortization periods but CMHC insurance would make that push-back moot and it would drive consumers back into CMHC-insured mortgages after CMHC derailed itself and lost its significant market position last year. Banks strongly discourage their borrowers from obtaining CMHC insurance because the bank wants to keep the premium upside for themselves and the paperwork and qualification process with CMHC is incredibly onerous and unappealing.

Unlike most Realtors, lenders and real estate boards, I believe the stress test provides more positive benefits than negative. The problem is that those home buyers who don’t qualify because their ability to service their debt is too risky and are prevented from buying a home therefore typically remain in their rental unit. This results in a cascading “damming” effect that ultimately results in (a) more affluent people staying in their rental units longer and using rent control as a savings plan to buy a home and (b) locking out all the low-end renters and vulnerable groups who otherwise might have been able to move into the low-end of the rental market.

Providing incentives to build more purpose-built housing and second suites would break this log-jam such that a stress test might not be necessary at all. However, provincial residential housing legislation in B.C. and Ontario in particular, and to a lesser extent in Quebec, are brutal and would need to be addressed in some way for federal incentives to build rental properties to take root in these provinces.

Summary

In my opinion, the Conservative Party’s solutions in their Recovery Plan for resolving housing availability and affordability are ineffectual and demonstrate an ongoing failure to understand the root causes of the housing crisis.

I haven’t reviewed the Liberal and NDP parties’ plans but I’m fairly certain that the net result would be for a call by these other parties to massively increase government debt. This would ultimately weaken or undermine the perceived value of our currency, which would lead to a crippling recession in combination with already rapidly increasing inflation. If you think affordability is challenging today, especially for seniors and low-income earners, hyper-inflation combined with a recession would wipe out the savings of many Canadians.

I recently came to realize that most government initiatives seem to me to be about throwing available budgeted money at a problem (such as “build more houses”) rather than creating long-term self-sustaining vehicles and mechanisms that survive changes in government such as changing passive income corporate tax for rental property owners to active income or reducing amortization rates on residential rental housing capital costs.

A call for government to spend more money on constructing affordable social housing is, and always has been, fatally flawed. Rents are held artificially low and there’s no money saved for the inevitable capital costs, which is addressed by the reserve fund in condo corporations. Most social housing projects degrade over time to the point where they must be removed from the social housing inventory stock (such as Toronto’s 1,100 recently lost affordable units).

The question is then, which party should I vote for? The answer would have to lie with looking at each party’s plans of action for other top-of-mind non-housing issues and how you feel about their approach to resolving those issues. However, none of the parties to me have any idea about how to address the housing crisis.

Chris Seepe spent 35+ years in I.T. before entering commercial real estate a decade ago. He’s a published writer and author of two books on “landlording,” course instructor, president of the Landlords Association of Durham, and a commercial real estate broker of record at Aztech Realty in Toronto, specializing in income-generating and multi-residential investment properties. Call (416) 525-1558, or send him an email.