Economic uncertainty and rising interest rates have sidelined many potential homebuyers and sellers. Prices are down, sales have slowed, and inventory remains low.

The good news? Canada’s housing market may have already been through the worst of it, according to a new report from TD addressing issues impacting the economic and financial outlook.

TD Economics is forecasting the average home price will drop by just over 20 per cent on a peak-to-trough basis. If the forecast is accurate, prices may be nearing the bottom. In October, the average national selling price of a home was down 21 per cent to $644,643, well below the February peak of $816,348, according to data from CREA.

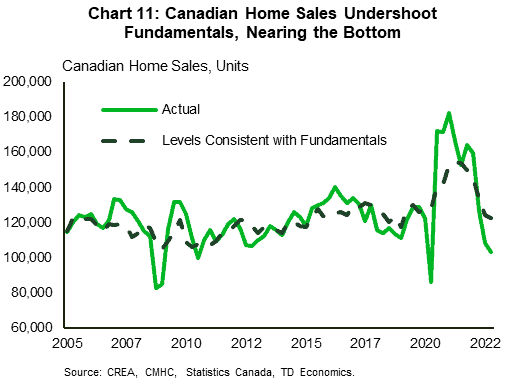

TD economists are predicting home sales should bottom at levels around 40 per cent lower than at the beginning of 2022. “With home sales already down about 30 per cent, the largest part of the sales adjustment has likely occurred,” the report states.

The company forecasts resale supply to remain sluggish over the next few quarters as many remain hesitant to list their homes amid a weak backdrop. “After which, an orderly increase in supply is expected to take place, as markets find a bottom next year, and demand and prices begin to recover.”

Mortgage rates are expected to head higher still, and TD says that will keep a weight on the markets. Economists expect another 50-basis point rate hike in December, followed by 25-basis point increments in early 2023 as needed. “The increase in carrying costs may force some overstretched owners to list their homes. We are cautiously watching how this dynamic unfolds and recognize that it represents a downside risk to the price forecasts.” Economists lay out a scenario where two per cent of homeowners with mortgages are forced into listing their homes, in which case “Canadian average home prices could be four per cent lower by the end of 2024 than our current baseline.”

Housing supply will continue to be a significant issue across Canada. With the government’s immigration target of nearly 1.5 million newcomers over the next three years, supply will continue to face tremendous pressure to keep up. If the government meets its targets, TD Economics says the demand for rental units will stay strong and eventually shift towards increased demand for ownership.

I would suggest the drop in “average” home price is likely the result of more lower priced homes selling. In our area we certainly have not seen anything remotely close to a 20% drop across the board. Realistically more like 5-7%.

if housew drop and.you.owe.more then what you borrowed .i woupd loose my house.thats crazy.we need imagration to stop .take care of our homeless.

Who do you think builds new homes? It’s not the homeless.

Now let’s talk about the thousands of new condo units that will fail to close due to mortgage qualification and low demand issues.

How will they affect the market and the average price?

So TD is telling us that even though the entire world is trying to grapple with high inflation numbers, the world banks have ratcheted up interest rates, a large numbers of new house buyers are walking from their purchases, and a plethora of other weights on the worlds economies we are probably close to the bottom? Very unlikely TD economists. What I see with this press release is another company with a lot of other peoples money trying to keep their investors for heading for the gates.

Funny how realtors hate to admit 21% drop and monthly stats omit the poor buyers at the height who bought blindly and are now underwater.

Also funny they now say “ you can put in an offer and even get protection with Finance and Inspection conditions”. Wow back to looking out for buyers best interests. Just laughable.

Anonymous – You are bitter that you don’t own a home, blame it on realtors and are completely clueless.

Whatever the huff Homes are still needed so get on that Canada

They are overpriced and leaving many people without homes out of the market nice go Feds and banks l hope you all end up in the brink with your greed oh let’s not forget the real estate market the true greed mongers🤷♂️🤷♂️

Half the time the Central Bankers don’t really know how to tackle the inflation, slow down of economy will lead to more serious joblessness issues, giving antibiotics when not needed.

I have been a realtor for over 35 years and I never sold one condo conversion because I called other realtors in a different city to see what went down after the boom . 80% of the realtors out there have screwed there clients just to pay for there BMW or what ever ! I see it ever day and it makes me sick to my stomach to know that the client has to pay for it with a major loss .

99% of my business is repeat and that’s because I will not sell anything that I would not buy myself . I have lost clients because of it but at least I know I have a heart and it can’t come back to me ! Good luck greedily realtors !!!