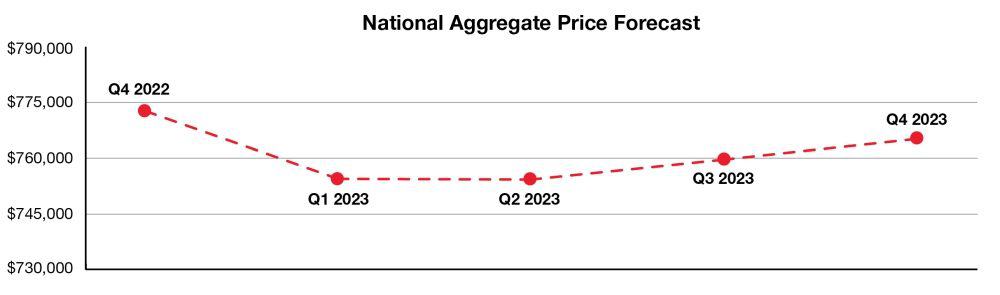

According to Royal LePage, Canada’s national aggregate home price will end 2023 one per cent below the fourth quarter (Q4) of 2022.

Based on the data shared in the Royal LePage Market Survey Forecast, double-digit year-over-year declines are expected in the first quarter of 2023, with modest quarterly price growth in the year’s second half.

On a quarter-over-quarter basis, Royal LePage expects prices to flatten in the second quarter and begin modest improvement in the second half of the year, ending 2023 on an upward trajectory.

Condos expected to outperform homes in most major markets

Condominium prices are expected to outperform single-family homes in all major markets except for Edmonton and Winnipeg.

The greater regions of Toronto and Montreal are forecast to see an aggregate price decline of two per cent year-over-year in Q4 next year, while the aggregate home price in Greater Vancouver is projected to dip one per cent year-over-year.

Phil Soper, President and CEO of Royal LePage, said, “the frenzied housing market overshot, and the inevitable downward slide or market correction began, intensified by rapidly rising borrowing rates…While the volume of homes trading hands has dropped steeply, home prices have held on, with relatively modest declines.”

Soper also points out that there are a number of factors supporting home prices in the current environment, such as the long-term housing supply shortage in Canada and pent-up demand from buyers who have the ability to transact but have chosen not to in these turbulent times.

Progressively less price declines

“Comparing prices to the previous year, the first quarter of 2023 should show the deepest decline in home values,” said Soper. “At that time, we will be comparing 2022’s final weeks of pandemic housing market excess – when home prices reached historically high levels – to a much quieter market, where values have had a full year to moderate.”

Soper expects year-over-year comparisons to show progressively less price decline as the year progresses, with small week-to-week improvements in the third and fourth quarters, allowing Canadian home values to end 2023 essentially flat to where we are today.

While home prices have come down from the record highs recorded in the first half of this year, they remain well above pre-pandemic levels.

Royal LePage’s projected aggregate price of a home in Canada in Q4 of 2023 is expected to sit 15 per cent above Q4 of 2020 and 18.4 per cent above Q4 of 2019.

Source: Royal LePage

Market summaries

Greater Toronto Area

According to Royal LePage, the aggregate price of a home in the Greater Toronto Area is expected to decrease two per cent year-over-year to $1,056,734 in the fourth quarter of 2023.

During the same period, the median price of a single-family detached property is expected to decline 2.5 per cent to $1,329,413, while the median price of a condominium is forecast to increase modestly by one per cent to $701,243.

Royal LePage predicts that activity levels in the GTA will pick up again by the middle of 2023, provided that interest rates stabilize and consumer confidence is restored.

Greater Montreal Area

In the Greater Montreal Area, the aggregate price of a home is expected to decrease two per cent year-over-year to $532,238 in Q4 of 2023, according to Royal LePage.

During the same period, the median price of a single-family detached property is expected to decrease 2.5 per cent to $588,315, while the median price of a condominium is forecast to dip 1.5 per cent to $421,383.

Royal LePage predicts that prices will continue to decrease slightly in the first half of the year before rebounding modestly over the following six months once interest rates have stabilized. The company expects that many buyers who have adopted a wait-and-see attitude will return to the market at that point.

Royal LePage also notes that the Greater Montreal Area is likely to attract buyers from other Canadian provinces due to its relative affordability. However, the market has already begun feeling the effects of the two-year ban on foreign buyers, which is set to come into effect on January 1st.

Greater Vancouver

In Greater Vancouver, the aggregate price of a home is expected to decrease one per cent year-over-year to $1,216,611 in Q4 of 2023.

The median price of a single-family detached property is expected to decline two per cent to $1,644,538, while the median price of a condominium is forecast to increase one per cent to $747,299.

Despite a decrease in demand in the second half of 2022, a lack of available inventory has kept prices from declining further. If activity picks up in the new year as expected, Royal LePage expects tight competition will challenge buyers.

Ottawa

In Ottawa, the aggregate price of a home in Ottawa is expected to increase two per cent year-over-year in Q4 of 2023 to reach $739,602.

The forecast also predicts that the median price of a single-family detached property will rise one per cent to $850,117, while the median price of a condominium will increase two per cent to $378,114.

The forecast expects condominiums to see greater price appreciation than other property types due to higher borrowing costs limiting buyers’ purchasing power.

However, interest rates are expected to continue to significantly impact home prices in 2023, with the potential for a resurgence of buyer demand if interest rates stabilize or decline. The forecast also predicts that sales will increase gradually due to depleted inventory levels.

Calgary

The aggregate home price in Calgary in Q4of 2023 is expected to increase 1.5 per cent year-over-year to $612,451.

The median price of a single-family detached property is predicted to rise one per cent to $701,142, while the median price of a condominium is expected to increase 2.5 per cent to $239,543.

The forecast expects moderate price growth in the entry-level market, particularly in the condo segment, which has recorded double-digit sales growth this year.

The market will also see demand from out-of-province buyers, particularly first-time buyers from Ontario and out-of-province investors, according to Royal LePage. The lack of available inventory will continue to put upward pressure on prices, particularly at the lower end of the market.

Edmonton

Royal LePage forecasts the aggregate price of a home in Edmonton in Q4 of 2023 to increase one per cent year-over-year to $442,683.

The median price of a single-family detached property is expected to rise two per cent to $491,436, while the median price of a condominium is forecast to decrease 1.5 per cent to $198,281.

Similar to Calgary, demand from Ontario and British Columbia buyers is expected to keep the market healthy and balanced.

Strong interprovincial demand is expected to continue at the start of the new year, with a return to normal seasonal trends expected next year.

Halifax

In Halifax, the aggregate price of a home in Q4 of 2023 is forecast to increase 0.5 per cent year-over-year to $479,285.

During the same period, the median price of a single-family detached property is expected to rise 0.5 per cent to $544,610, while the median price of a condominium is forecast to increase 1.5 per cent to $407,015.

Royal LePage anticipates that demand for housing will pick up again in the spring after sales volumes reached a two-decade low in 2022.

Inventory remains low in the region, and without a significant increase in supply, the expected increase in demand will put upward pressure on prices.

The Halifax housing market is expected to return to more normal seasonal trends in 2023, with the population continuing to grow and attract buyers from within Canada and abroad.

Winnipeg

In Winnipeg, the aggregate price of a home in Winnipeg is expected to decrease in Q4 of 2023 by one per cent year-over-year to $368,181.

The median price of a single-family detached property is expected to rise by one per cent to $410,565, while the median price of a condo is expected to decrease by three per cent to $243,082.

Housing supply levels in the region are expected to remain low but may improve in the new year as ongoing supply chain challenges are addressed and housing starts pick up.

Demand for single-family homes is expected to drive the most activity in the market. Still, with inventory levels below the five-year average, condo prices are not likely to decline significantly.

Overall, the market is expected to move towards a more balanced state, provided interest rates stabilize.

Regina

In Regina, Royal LePage expects the aggregate price of a home to decrease by 1.5 per cent year-over-year to $361,495 in Q4 of 2023.

The median price of a single-family detached property is expected to decline by two per cent to $389,648, while the median price of a condo is forecast to increase by one per cent to $221,796.

The forecast suggests that any price appreciation in the region will be in the condominium segment and the lower end of the market, as some buyers have been priced out of single-family due to higher mortgage rates.

There has been an increase in foreclosures in Regina this year, and the trend is expected to continue in the next year as overleveraged homeowners see their low fixed-rate mortgages come up for renewal.

Editor’s note: The headline for this article has been updated to clarify the expected Q1 decline is a year-over-year prediction.

stick a link to the R/L report for us all, in the text will ya?