January is typically a slow month for transactions, but the Greater Toronto Area’s real estate market appears to be off to an exceptionally slow start this year, with most metrics significantly trailing January 2022.

Industry anecdotes point to a lot of buyers waiting on the sidelines, and waiting seems to be exactly what buyers did last month.

Only $3.22 billion worth of real estate was transacted through the Toronto Regional Real Estate Board’s (TRREB) MLS in January of 2023 – less than 50 per cent of the $7 billion of real estate sold in the same month last year.

As many have noted, the first quarter of 2022 was a market in a state of near mania, and so the annual comparison will produce extreme results, as illustrated in the year-over-year summary in TRREB’s Market Watch for January 2023.

Sales are down 44.6 per cent from 5,594 to 3,100 in 2023, representing a steep drop from a strong start to last year.

Number of new listings relatively unchanged

However, January 2023 has been uncharacteristically weak – the slowest January in the last five years.

In fact, transaction volume was so low that the closest comparable month was April 2020 – the month of the first lockdown, which saw 2,975 sales.

The number of new listings was relatively unchanged – down just 3.7 per cent from the same month last year. The past few months of perception seemed to indicate that low sales volume is a consequence of low inventory – an assumption that appears to be disproven by the price and number of sales compared to last year.

Balanced territory

In 2022, the January sales-to-new-listings ratio was 70 per cent, indicating a strong seller’s market. In 2023, that ratio was just 47.6 per cent, indicating that the market has cooled into balanced territory.

This reduced absorption brought a 124.6 per cent increase in active listings – from 4,140 in 2022 to 9,299 in 2023. Listings, on average, are taking more than twice as long to sell, with the average listing spending 29 days on the market, up from 13 last year.

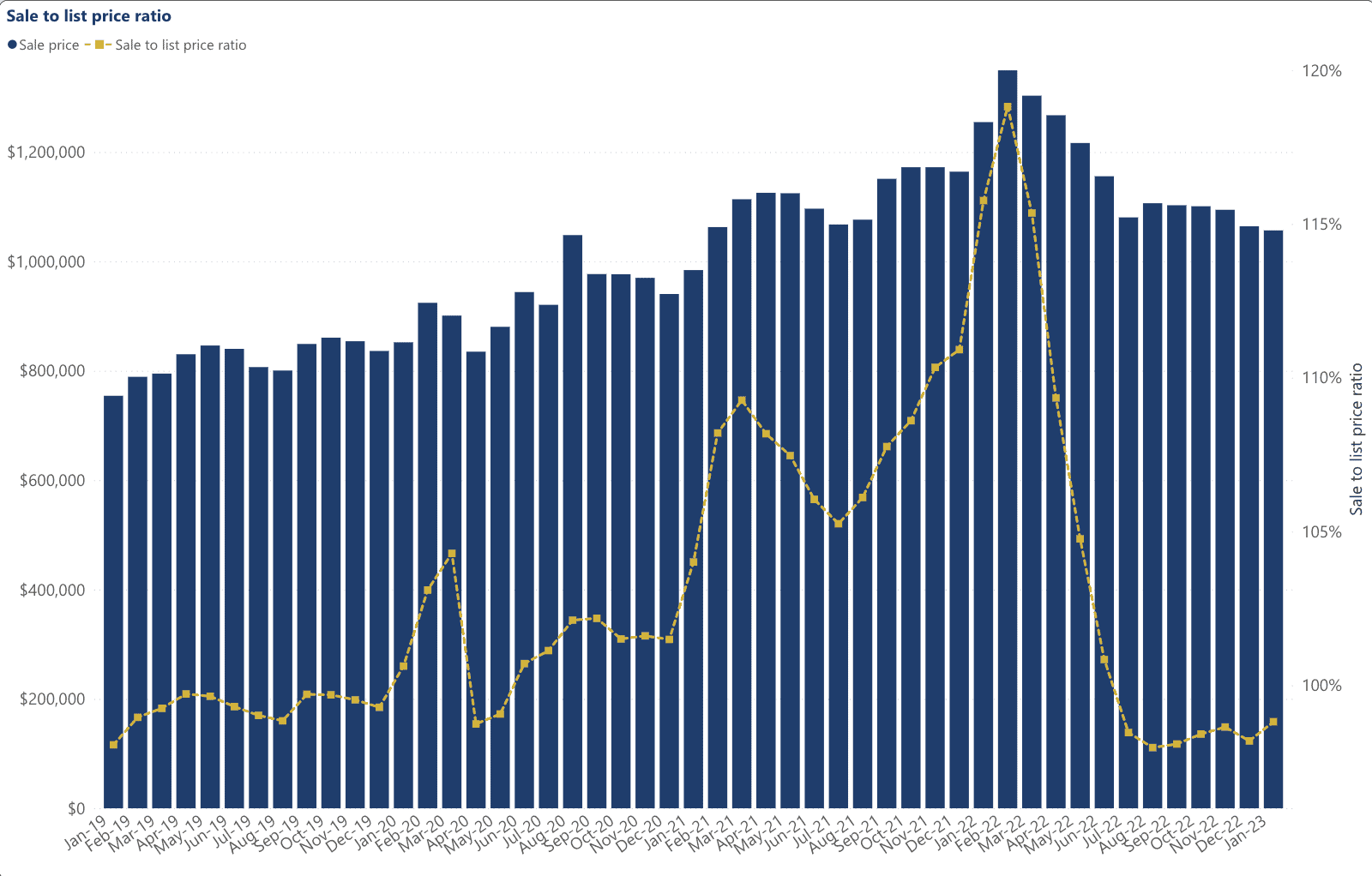

Sale-to-list price ratio

With prices down just over 16 per cent since last year, perhaps the most alarming trend in TRREB’s report is that the sale-to-list price ratio has dropped from over 115 per cent in January 2022 to below 100 per cent in January 2023.

This type of pricing dynamic, combined with a balanced-market sales-to-new-listings ratio, has created the ability for the slow downward price discovery we’ve seen over the past few months as the lagging impact of interest rates takes hold.

Source: Daniel Foch

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

What about allowing for the (approx) 20-35% of New Listings that are Terminated/Re-Listed immediately w same Broker, Owner & property?

This ignore ‘metric’ is compiled in TRREB’s RE-List Comparison Report (not out yet today) but sadly TRREB has chosen to not place references to this chart (which is formatted much like the PDOM/LDOM graphic) on the Front Page of Market Watch or even on the Stratus Landing page.

Indeed an overcounting of New Listings by 20-35% skews the 1-month and 1-year comparisons — AND wholly changes the SNLR (which we then pass onto CREA and sometimes they pass it on to the Bank of Canada see Chart 17 in the just-released January 2023 Monetary Policy Report) .

Terminate & Re-List is an embedded LBO/Seller marketing strategy.

It’s not a transitory market condition.

The number of Terminate/Re-Lists and the number of NET-New Listings should be part of the Full Disclosure of market info in just the same way as PDOM/LDOM (because they are both caused by the same LBO/Seller strategy.

Truly

rce

Absolutely. This metric is significant in, in all likelihood, every REALTOR Association in Ontario.

Definitely agree, especially in January when considering how many expiry dates are December 31st. We do need a way to control for re-listing in the inventory data points.

Great to have this pointed out. MLS Days on Market (DOM) the public sees is a scam. Could be for sale for 90 days but “Price Adjustment” starts the clock again!! Creates false interest. Show the public Actual Days on Market. Some listing agents cancel and relaunch to have better sold in record days data. Cat is out of the bag.

I agree entirely, but this would be reflected in last January’s SNLR re-listing data as well so there’s nothing wrong with an annual comparison. But comparing January SLNR to other months would definitely present some improper conclusions.

Excellent point.

We all know that with relists properly noted would make Jan 2024 much worse.

Absolutely. This metric is significant in, in all likelihood, every REALTOR Association in Ontario.

I hate to send obvious but I don’t think any of us didn’t see this coming from miles (or months) away.

Double negative, I like it

Very pleased to see this author correctly state that it isn’t a shortage of inventory. It hasn’t been for well over a year.

The Sales to New ListIngs ratio is actually only a useful metric in a declining market to measure the increase in rate by which sellers are exiting the market. Of utmost importance is available inventory – specifically the carry over unsold portion. Unfortunately, as with everything in this industry, someone years ago thought SNLR seemed a notable ratio and it’s parroted and abused ever since.

Also abused all through 2019, 2020 and 2021 was the story that there was no inventory as though the endless price increases had no effect on affordability because consumers were chewing up the available properties.

There are two critical stats that actually reflect the true state of the market, the months of inventory (MOI) and true absorption rate – the sales made from actual available inventory which includes the inactivated listings adjusted for relistings. TRREB started providing the relist numbers in May 2022 and put out a semi-annual graph as to its percentage over several years.

Even since May, 2022, with the ability to calculate the true absorption rate, I’ve yet to see anyone report it except to continue to do so as sales to new listings, likely because the industry as a whole has no clue how to calculate it.

Jan 2023’s relist number is 20% rounded, of the month’s new listings and for Jan to April, 2022, per the graph, I estimate the monthly average to be 15% of new listings. The actual absorption rate and MOI for Jan/23 is 16.5% and 3 months, which means sales, relative to available listings are continuing to lose ground as are prices especially considering month end listings are very similar to the first 6 months of 2021 but MOI is 3 times as much.

From Jan to April 2022 the estimated absorption rate after removing 15% of new listings from the available inventory and MOI were:

J 32.2%&.7/ F 49.5% &.8/ M 36.5% &.9/ A 24.1%&1.6

From May to Dec 2022 the actual monthly absorption rates and MOI were:

M 20.3% &2.1/ J 17.9% &2.5,/J 15.0& 3.1/ A 18.7% &2.4/ S 18.0% &2.7/ O 18.1% &2.6/ N 18.1% &2.6/ D 16.2% &2.8

From Jan to Dec 2021 the estimated absorption rates and MOI were:

J 35.2% &1.1,/ F 47.5% &.8,/ M 47.1% /&.7/ A 39.7% & 9,/ M 35.7% &1.0/ J 34.6% & 1.0/ J 35.2% & 1.0/ A 38.6% &1.0,/ S 39.1% &1.0/ O 43.3% & .8,/ N 47.5% & .5/ D 48.3 / .5

I’m encouraged that over the last 6 months or so TRREB’s MW reports are more matter of fact and to the point.

I appreciate the thorough insights – thank you for adding depth here. Feel free to email me or DM on Twitter if you would like me to include some of your commentary in subsequent articles!