There are not enough houses for sale. While this may sound like an oversimplification, inventory scarcity continues to be the major theme in Toronto real estate. Since April of last year, sales are down just 5.2 per cent, while new listings and active listings are down 38.3 per cent and 20.8 per cent, respectively.

Quite simply, supply is not meeting demand.

This lack of supply has created more extreme competition and price increases than we’d typically see in a spring market on the Toronto Regional Real Estate Board (TRREB).

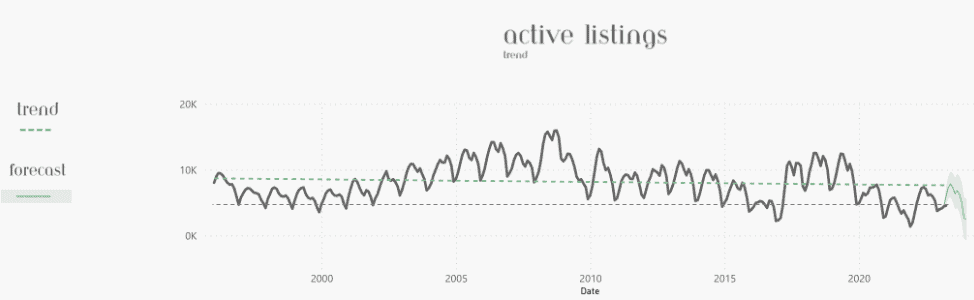

To really contextualize this—it’s helpful to look at supply since the beginning of the data available in TRREB’s Marketwatch reports.

Source: Daniel Foch, TRREB Marketwatch

Looking at the active listings graphic above, the black dotted line follows this month’s listing volume from the TRREB Marketwatch Report. We’ve only ever seen two spring markets with active listings this low in the Marketwatch data set—in 2016 and 2021. Professionals can draw their own conclusions about the strength of those markets—and we’re seeing similar themes happen here. It is worth noting the increase in supply that happens after those tight markets cause prices to accelerate, especially in 2017.

Supply is really the big question mark in this equation, and as a result, the outcome of the market will be decided by existing owners’ resilience against recession in the coming year.

Prices are growing

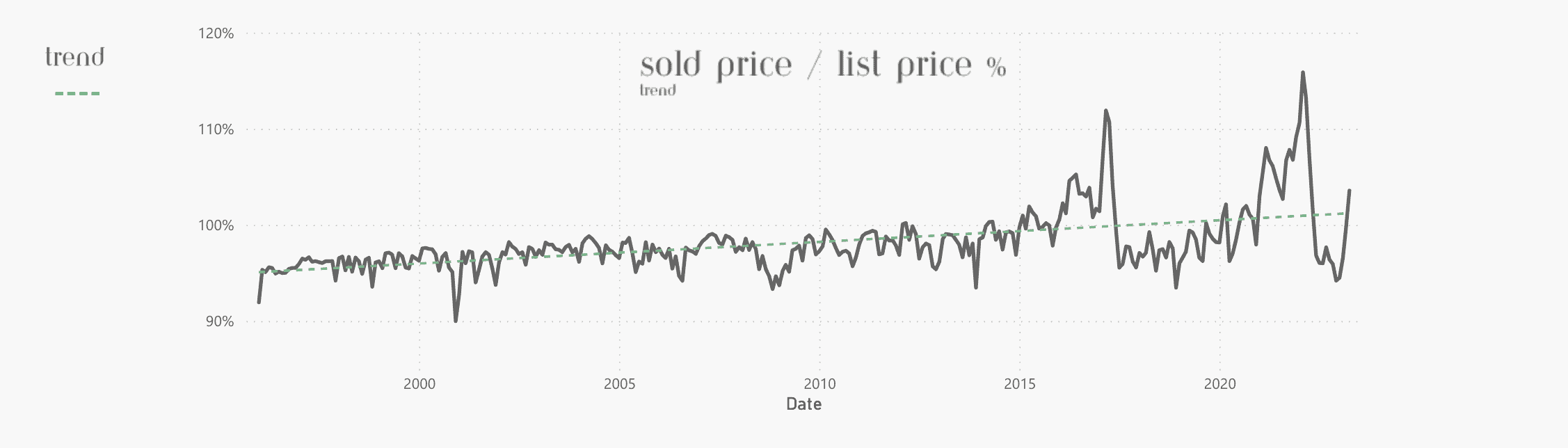

Source: Daniel Foch, TRREB Marketwatch

The sale-to-list price ratio, calculated by dividing the sale price by the listing price, is trending upward after a long lull and is now over 100 per cent in the vast majority (73 per cent) of regions on the Toronto Regional Real Estate Board. This means that most areas are in a state of excess demand, and homes are selling over asking as a result.

Economics defines excess demand as a situation in which the market demand for a product is greater than its market supply, thus causing its market price to rise. This state of excess demand has cemented the price floor in Toronto’s real estate market so far in 2023, but it’s difficult to distinguish if we will see sustained excess demand throughout this year.

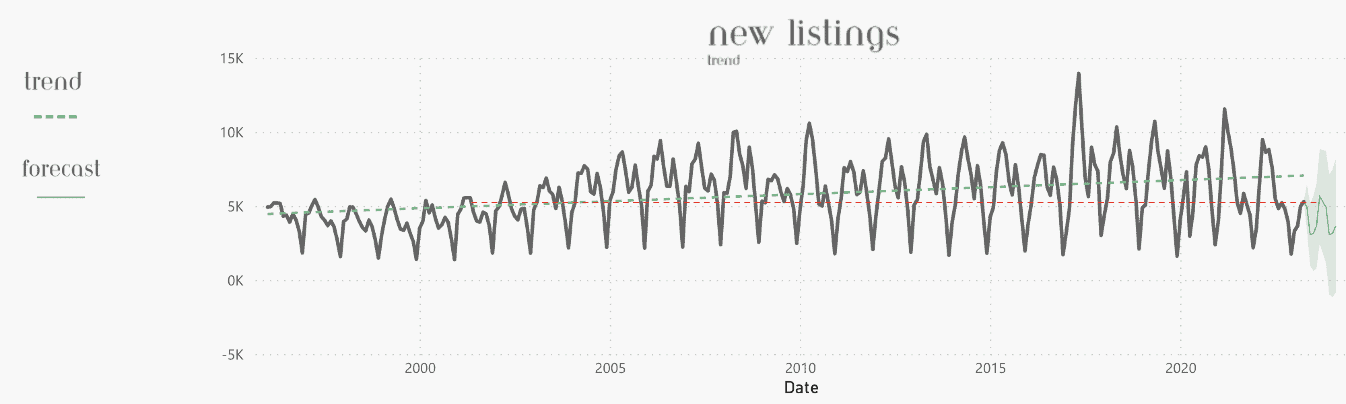

We haven’t seen a spring market with this few new listings since 2001.

Source: Daniel Foch, TRREB Marketwatch

Heating up means speeding up

Absorption rates indicate how long it takes to sell homes in a given market. Over the last few months, the market has been uncharacteristically slow. I felt that the market was vulnerable to supply—that any amount of spring-market supply could pull the market out of excess demand toward an equilibrium.

With absorption speeding up, now I’m no longer so confident that a normal supply increase can totally break the market’s strength—we’d need to see a more extreme supply scenario happen in May to reach an equilibrium. Looking at the peaks on both new listings and active listings trends above, it is clear that the market typically sees the most supply in May each year.

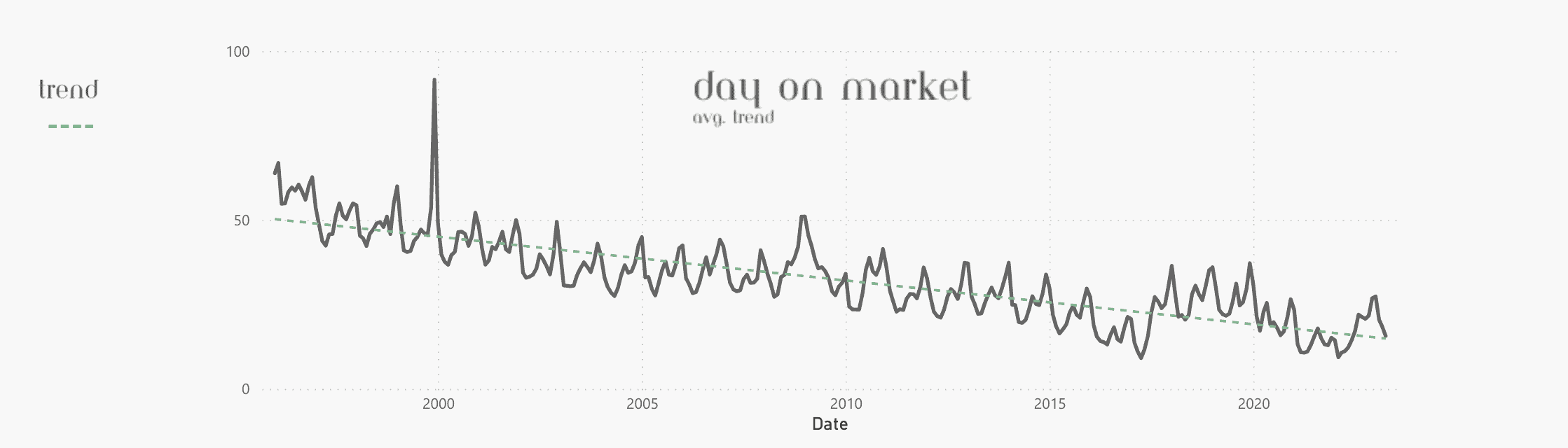

I think seasonal cyclicality and macroeconomic factors, especially recession and unemployment, will determine the trajectory of prices for the rest of the year. Days on market are significantly worse than last year, up 54.5 to 71.4 per cent, depending on the metric.

It sounds really bad when compared to the hot market we saw in Q1 2022, but when compared to the jump up in the last few months, days on market are now trending down again in a meaningful way and have reached their long-term trendline again.

Source: Daniel Foch, TRREB Marketwatch

Let’s talk about price

The average price of a home in the Greater Toronto Area was $1.15 million in April 2023. While down 7.8 per cent year-over-year, GTA house prices are on the uptrend from the beginning of this year. The average sale price continued its growth in April but at a slower pace than last month.

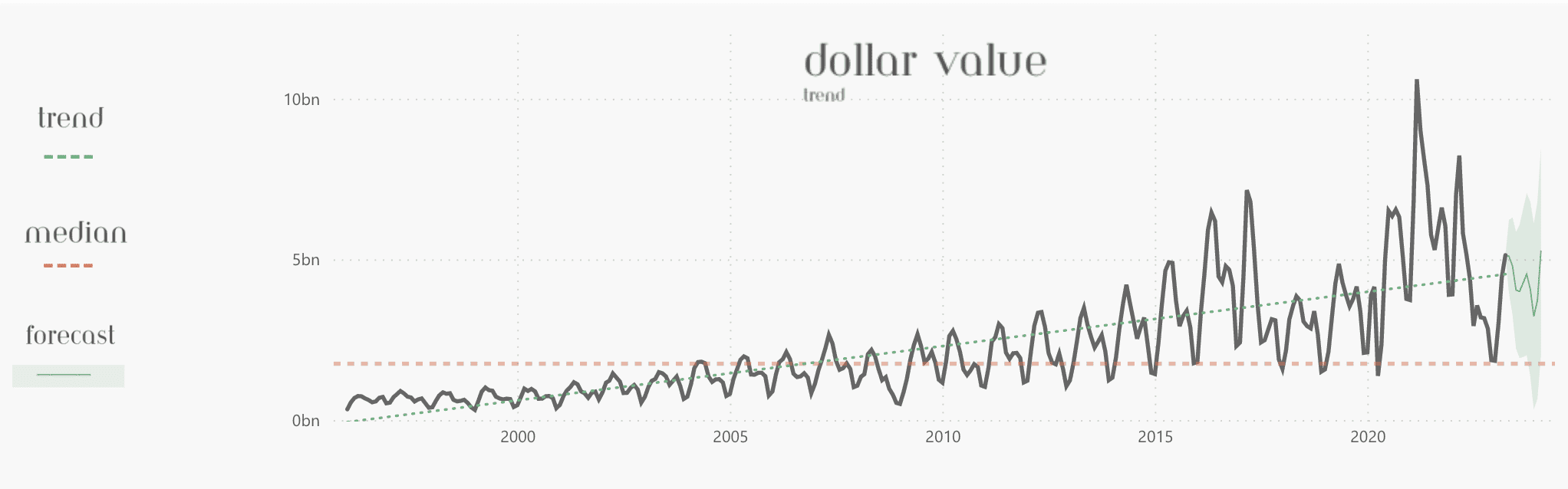

The slowing of price growth indicates that the market is likely behaving seasonally, and we will see price growth stall and even reverse heading into the summer market. To better understand this seasonality, it’s easiest to look at the total dollar volume of the market, which is just getting above its long-term trendline into spring market territory.

Source: Daniel Foch, TRREB Marketwatch

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.