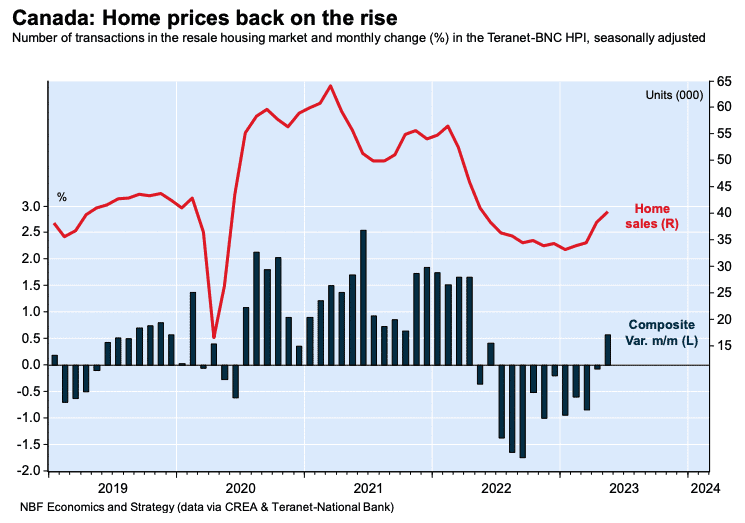

The Canadian housing market is showing more signs of recovery this spring as the Teranet-National Bank Composite House Price Index (HPI) recorded a monthly increase of 0.6 per cent in May. This marks the first upturn in home prices in 11 months after a prolonged period of decline.

Before seasonal adjustments, the HPI rose by 1.6 per cent from April to May, the third consecutive monthly increase.

The data from the Teranet report reveals a positive trend in the market, with several cities experiencing notable gains in property prices.

Monthly increases in major cities and regional markets

In May, eight of the 11 major Canadian Metropolitan Areas (CMAs) covered by the index saw an increase in house prices. Toronto led the way with a significant 1.6 per cent rise, followed closely by Winnipeg with a 1.5 per cent increase. Victoria, Edmonton, Quebec City, Montreal, Hamilton, and Calgary also posted positive gains ranging from 0.1 per cent to 1.3 per cent.

Three CMAs experienced a decline in prices during the same period, namely Halifax (-2.6 per cent), Vancouver (-1.2 per cent), and Ottawa-Gatineau (-0.3 per cent).

The report also highlighted the performance of regional markets not included in the composite index. Among the twenty CMAs for which data is available, 10 recorded growth in May. Sudbury, Guelph, and Kingston stood out with significant monthly increases of 4.9 per cent, 4.7 per cent, and 4.6 oper cent, respectively. Conversely, Brantford and Sherbrooke experienced notable decreases of -8.1 per cent and -4.5 per cent.

Year-over-year analysis shows signs of recovery

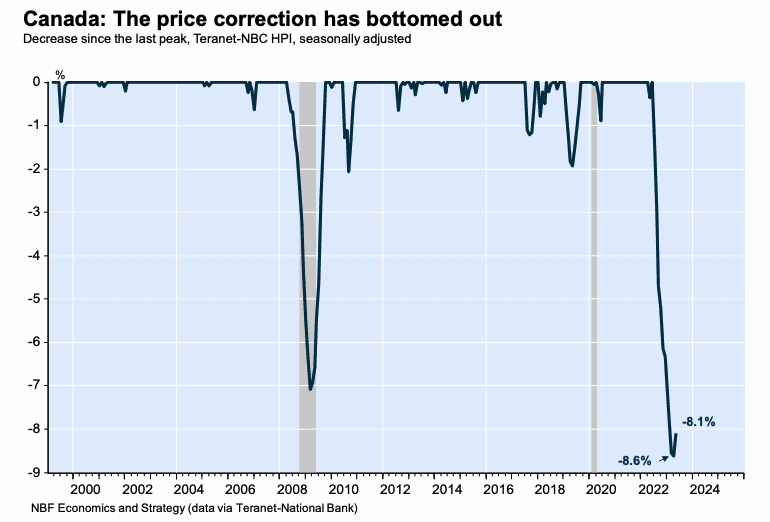

Although the report recorded a year-over-year decline of 7.6 per cent from May 2022 to May 2023, this represents a smaller contraction compared to the previous month’s record drop.

Calgary emerged as the top performer among the eleven cities in the composite index, exhibiting an impressive 8.3 per cent increase in property prices. Edmonton and Quebec City also showed positive growth, with gains of 4.9 per cent and 3.1 per cent, respectively.

On the other hand, some cities faced significant challenges, with Hamilton experiencing the sharpest decline at -16.8 per cent year-over-year. Toronto and Ottawa-Gatineau also saw notable drops of -10.3 per cent and -9.5 per cent. Among the other twenty CMAs not included in the composite index, four registered annual gains, led by Saint John (7.2 per cent) and Trois-Rivieres (3.9 per cent), while Brantford, Peterborough, Oshawa, and Abbotsford-Mission faced the steepest declines.

“This turnaround in property prices is due, in particular, to the rebound in the resale market over the past four months.”

– Darren King, National Bank Financial

According to Darren King, senior wealth advisor and portfolio manager at National Bank Financial, the increase in home prices is a result of the rebound in the resale market over the past four months.

“This recovery is taking place against a backdrop of record demographic growth, which is accentuating the shortage of housing supply on the market,” King observes.

However, he notes that with domestic housing starts at their lowest level in three years, it is unlikely that the shortage will be resolved in the near future.

King also noted that the recent resumption of the monetary tightening cycle by the Bank of Canada and the anticipated economic slowdown could potentially moderate price growth later this year.

Just the echo. Boom, Bust, Echo. This is not over by a long shot. Look at the market today. There are listings that have not had a showing in days, weeks or months. As we head into the summer months the experts will just say “seasonally adjusted” to account for the slow down. Yes some price ranges are experiencing activity. People , after all, do need a place to live.