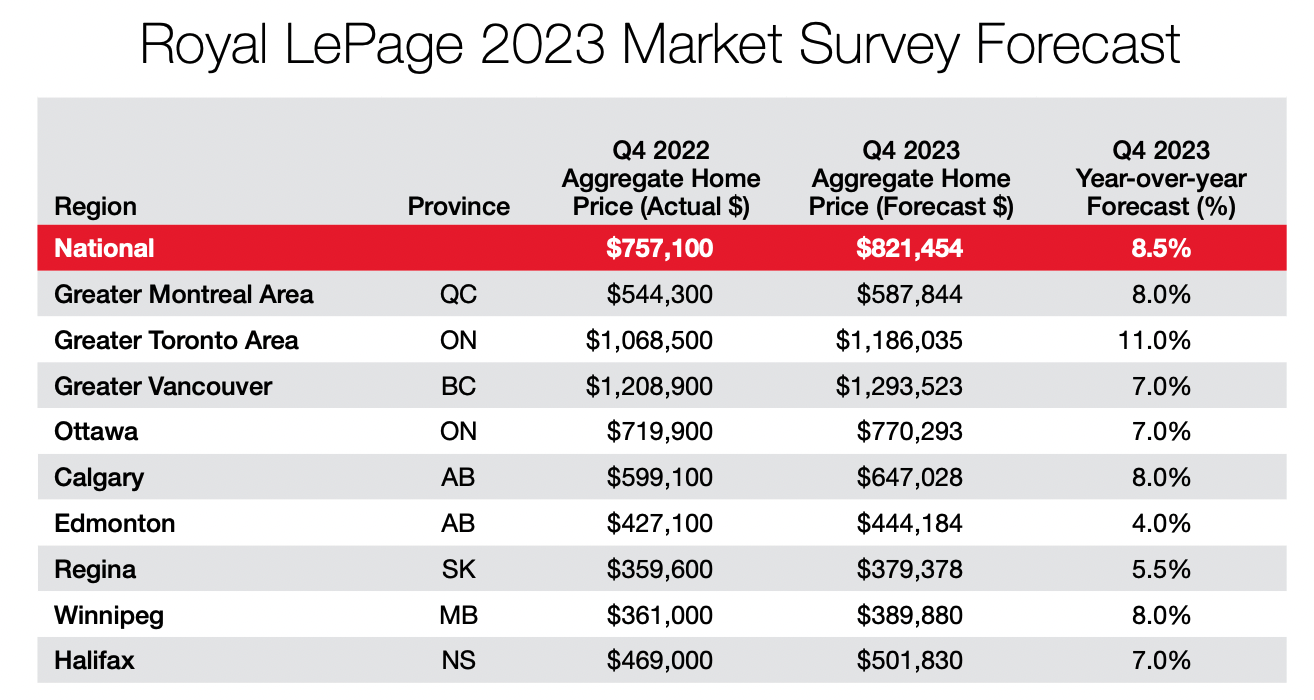

In a report released Thursday, the company shared its prediction of an 8.5 per cent increase in the aggregate price of homes during the fourth quarter of 2023, compared to the same period last year. That’s nearly double the 4.5 per cent increase predicted in the spring.

The report highlights that homebuyers remain determined, while sellers exhibit hesitancy in response to additional interest rate hikes by the Bank of Canada.

“The Bank of Canada remains determined to bring inflation down to its target of less than three per cent. This has proven to be especially challenging at a time when the job market is so strong, and Canadians continue to spend, partly due to a build-up of savings during the pandemic,” says Phil Soper, president and CEO of Royal LePage.

“The Canadian real estate market has been in a steady state of recovery since the start of the year. While these additional interest rate hikes, and those potentially to come, will likely put a damper on activity and sales volumes, demand for housing remains very strong.”

Although there may be a slight drop in activity, Royal LePage expects the rate of appreciation to moderate in the second half of 2023, leading to a stabilization or marginal increase in home prices on a quarter-over-quarter basis. However, the chronic shortage of housing supply continues to put upward pressure on prices.

“We are close to that pivotal point where people who purchased at the peak would break even if they sold today.”

– Phil Soper, CEO & president, Royal LePage

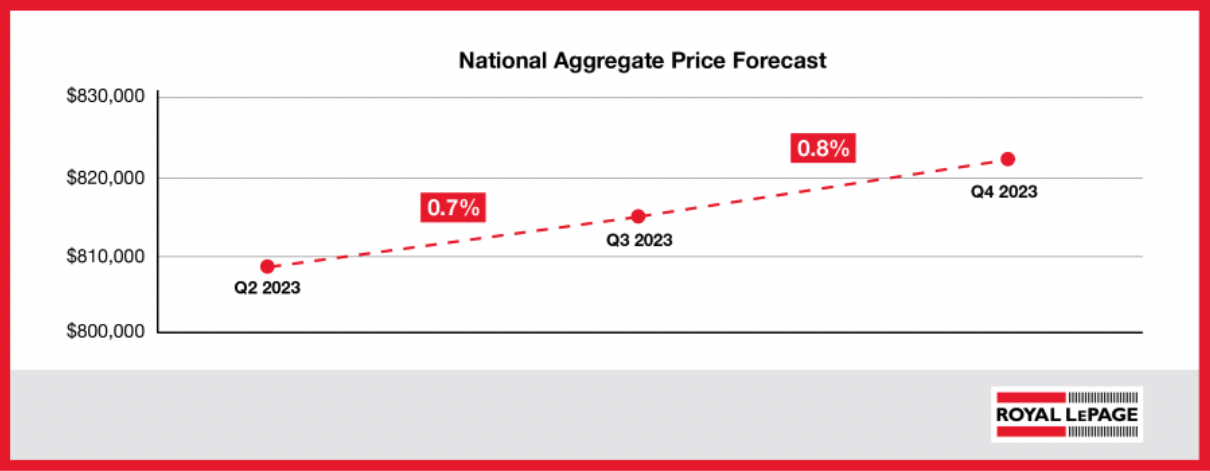

The second quarter of 2023 showed promising signs for the Canadian real estate market. While the national aggregate home price remained almost flat year-over-year, with a modest decrease of 0.7 per cent to $809,200, there was a significant quarter-over-quarter increase of 4.0 per cent. This marks the second consecutive quarter of positive growth following a period of declining prices due to the central bank’s aggressive interest rate hike campaign initiated in March 2022. The aggregate price of a home in Canada sits just 5.6 per cent below the peak reached in the first quarter of last year.

“We are close to that pivotal point where people who purchased at the peak would break even if they sold today,” Soper notes.

Buyer determination and adjustments

Following Wednesday’s quarter-point increase, the overnight lending rate now sits at 5.0 per cent.

“Despite the central bank’s decision to start raising interest rates again, many buyers are still in the game. Demand remains strong, particularly among those who have secured a rate hold,” said Soper. “Buyers who are determined to make a purchase this year have accepted the reality of higher initial carrying costs, rationally surmising that rates are at or near peak and will become more affordable before long.”

However, buyers may need to adjust their expectations, consider alternative housing types or neighbourhoods, or opt for smaller and more affordable properties.

Seller hesitancy and inventory shortage

On the other hand, Soper adds that potential sellers who do not have an urgent need to move have paused their plans, exacerbating the ongoing shortage of housing supply. The worry of not finding a suitable move-up home in the tight market contributes to their hesitation. Additionally, sellers who secured fixed-rate mortgages at historically low rates are reluctant to reenter the market with substantially higher borrowing costs. The combination of fewer sellers and increased buyer demand continues to contribute to the chronic inventory shortage, further driving up home prices.

Regional variations in recovery

The recovery of the Canadian real estate market has unfolded differently across various regions. Approximately one third of regions in the report posted year-over-year aggregate price gains in the second quarter, and only four regions reported quarterly declines.

The Greater Toronto Area and Greater Vancouver, Canada’s largest and most expensive real estate markets, are still below their previous price peaks. However, the aggregate price of homes in these regions has shown slight increases, indicating a gradual recovery.

The correction period in the Greater Montreal Area was shorter, and home prices currently sit just 2.4 per cent below the peak. Regional variations in the recovery timeline highlight the complexity of the Canadian real estate market.

Impact on rental markets

The increased cost of borrowing has had a significant impact on rental markets nationwide. The report notes that landlords, facing higher carrying costs, have passed on these expenses to tenants through rent increases. Additionally, individuals who were unable to qualify for lending or were priced out of the resale market are turning to rentals, adding further pressure to the already limited supply of available rental units. According to Statistics Canada’s latest Consumer Price Index, rent in May was up 5.7 per cent over the same period last year.

Read the full report from Royal LePage, including regional summaries.