Existing homeowners across Canada have been the driving force behind the country’s housing market gains, as move-up buyers took advantage of the temporary pause in interest rate hikes by the Bank of Canada (BoC) in the first half of the year.

According to Re/Max Canada’s Move-Up Market Report, surging demand for residential properties in the second quarter of 2023 was fueled by move-up buyers and limited inventory levels.

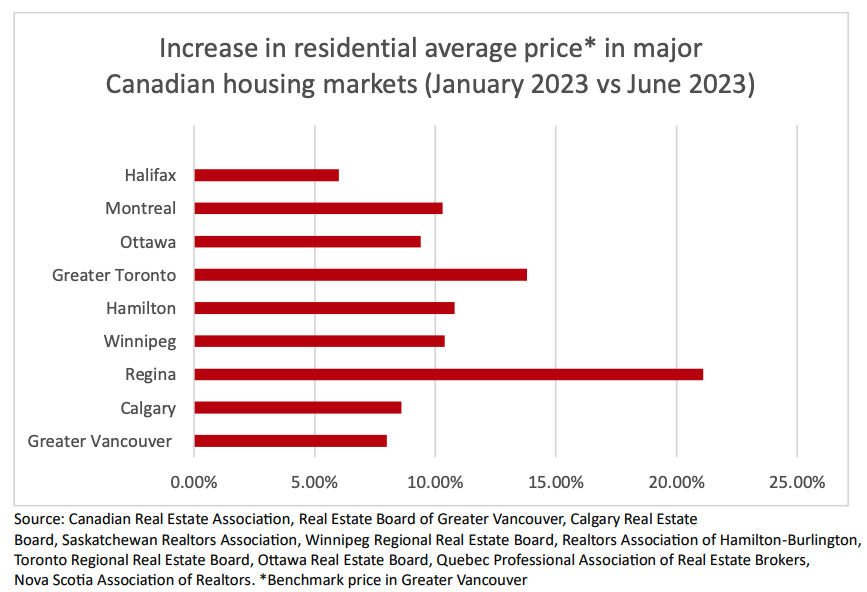

Double-digit price increases in five major markets

The report analyzed nine of Canada’s largest housing markets and found that the BoC’s decision to pause rate hikes sparked a flurry of activity in the mid to upper-price ranges. This surge in demand resulted in double-digit price increases in five major markets, including Regina, Greater Toronto, Hamilton, Winnipeg, and Montreal. Meanwhile, the remaining four markets — Metro Vancouver, Calgary, Ottawa, and Halifax — experienced single-digit price growth as sellers held onto properties that fell short of peak price levels reported a year ago.

The fear of further rate hikes played a significant role in influencing buyer behaviour, with move-up buyers hoping to enter the market before interest rates climb again. According to Re/Max, many sought pre-approvals with guaranteed rate holds to secure favourable financing terms prior to the BoC’s June and July announcements.

Fear of rate hikes prompts urgency among move-up buyers

“When the BoC signalled its intent to hold on further interest rate hikes, the floodgates opened, sending buyers into the market from coast to coast,” says Christopher Alexander, president of Re/Max Canada.

“Inventory challenges re-emerged in most major centres as demand once

again outpaced supply. Quality listings were quickly snapped up, many moving in multiple-offer situations, which served to draw more sellers into the market in April. By May, the market was moving full speed ahead until the BoC announced its decision to raise the overnight rate in June and again in July, taking the wind out of the proverbial sails of most markets, with some exceptions, namely Calgary, Regina and Montreal.”

Equity gains and quality-of-life considerations influence purchasing decisions

Equity gains over the past five years gave existing homeowners the means to upgrade to larger homes or more desirable neighbourhoods, despite the fluctuations in values caused by the pandemic. With trade-up activity traditionally occurring within four to seven years of the initial home purchase, Re/Max examined pricing in June 2018 compared to June 2023 and found that almost every market reported a significant upswing in value over the five-year period, ranging from just over three per cent in Regina to more than 80 per cent in Halifax.

Necessity was the primary factor driving demand throughout the first half of 2023, as buyers looked for homes that could accommodate growing families, provide space for work-from-home arrangements or offer access to better schools.

“Inevitably, periods of contraction and short-term restraint ultimately give rise to increased pent-up demand,” says Elton Ash, Executive Vice president, Re/Max Canada. “You can only hold back the impetus for so long. Real estate, after all, is driven largely by lifecycle events and broader factors such as population growth. While some will adjust their timing, most purchasers will eventually move forward, and we’ve seen that pattern emerge time and time again as move-up buyers nationwide re-ignite demand and competition for a limited number of listings.”

Rate hikes expected to temporarily slow market, but demand likely to rebound

Looking ahead, the July 0.25 basis point rate hike by the BoC is expected to slow homebuyer activity during the summer months in most major housing markets. However, once the central bank signals the end of quantitative tightening and rates start to unwind, Re/Max expects housing demand will likely ramp up once again. Supply constraints are expected to become a significant challenge, leading to renewed upward pressure on pricing in the move-up market and across the board.