Canada’s real estate market continued to cool in July, despite the summer heat. Months of inventory rose for the first time after falling for seven consecutive months since January. Sales-to-new listings ratio continued its steep downtrend for the fourth consecutive month, according to CREA’s data. The national association uses these two metrics to determine market balance in Canada:

On a national level 🇨🇦 real estate market cooled down a little in July but remained a Seller’s Market. pic.twitter.com/xk1454TVg4

— Alex (xelan) (@xelan_gta) August 16, 2023

MOI: Months of inventory

Months of inventory is a supply metric –— it measures the supply, or inventory, of homes against their ability to sell. It tells us whether or not the real estate market has a shortage or a surplus of listings. In economic terms, that decides if the market is in a state of excess demand or excess supply from an inventory perspective.

Excess demand exists when the quantity demanded is greater than the quantity supplied at the given price. This is also called a shortage, or in real estate, a seller’s market. Excess supply exists when the quantity demanded is less than the quantity supplied at the given price. This is also called a surplus, or in real estate, a buyer’s market.

To calculate the months of inventory for a real estate market:

- Find the total number of active listings on the market last month.

- Find the total number of sold transactions for last month.

- Divide the number of active listings by the number of sales to determine the number of months of inventory remaining.

The number at which a market becomes a “buyer” versus a “seller” market is widely debated and seems to vary on a market-by-market basis. Most data suggests that with less than 4.0 months of inventory, sellers have gained pricing power. If the metric is above 6.0, buyers have gained negotiation power. Currently, Canada has 3.2 months of inventory, up from 3.1 in May and June. That is a growth of about 3.2 per cent, which was outpaced by a 5.6 per cent growth in the number of newly listed properties. This tells us that although listings are rising sharply in a typically slow-supply month, demand is struggling to keep up.

SLNR: Sales-to-new listings ratio

As a result of listings outpacing sales growth, the sales-to-new listings ratio continued its downtrend after peaking just below 70 per cent in the second quarter of this year. It is worth following that red line back to the pandemic era, where you can see sales to new ratio stayed above 70 per cent until the market peaked and crashed in the first quarter of 2022, experiencing a record-setting price drop thereafter.

A market typically balances with a sales-to-new listings ratio of about 50 per cent. Anything above that typically favours sellers, and anything below that is a market that typically favours buyers.

Should this trend continue, I expect the national market to shift from a seller’s market to a buyer’s market by the end of 2023.

Home sales

The number of homes sold trended down since last month, but the story seems to vary across the country. The data is evidently skewed by the Greater Toronto Area (GTA), as CREA admits in their July report:

“While sales were up in July in more than half of all local markets, a decline in the GTA tipped the national figure slightly negative. Sales were also down in the Fraser Valley, which, together with the GTA, offset gains in Montreal, Edmonton and Calgary.”

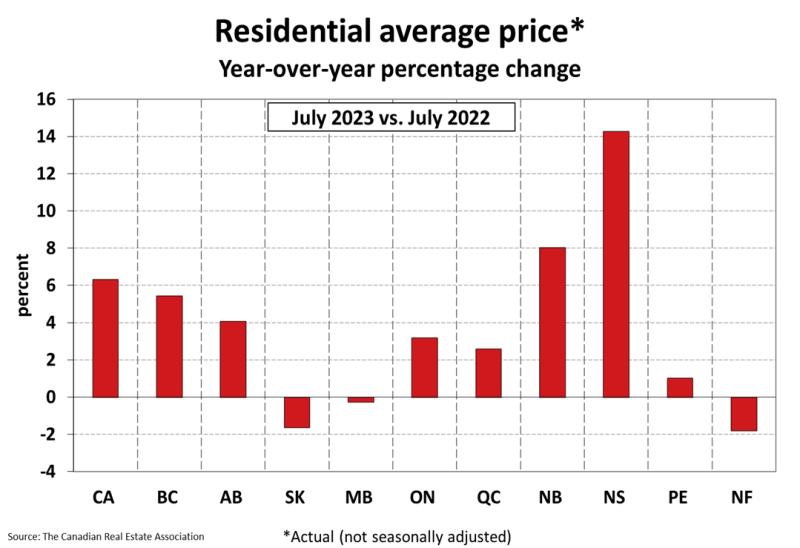

Ontario saw the largest drop, at -5.5 per cent, followed by British Columbia, at -2.6 per cent. Interprovincial migration trends and flight to affordability provided continued strength to Alberta, which saw a 4.0 per cent growth in the number of homes sold compared to last month.

Graphically, it does seem like the rebound we saw in home sales earlier this year has run out of steam for the summer, and we’ll have to wait until we see fall-market data to determine if sales will make their way back to the 10-year average, especially given continued dislocations happening in the Toronto market.

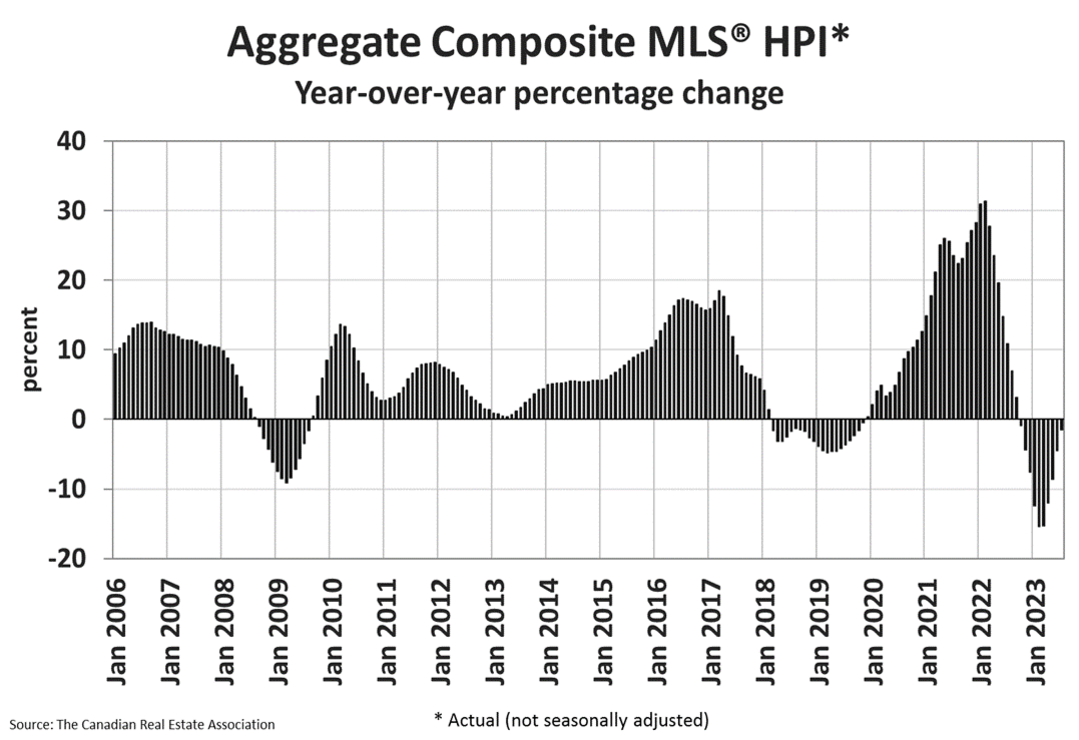

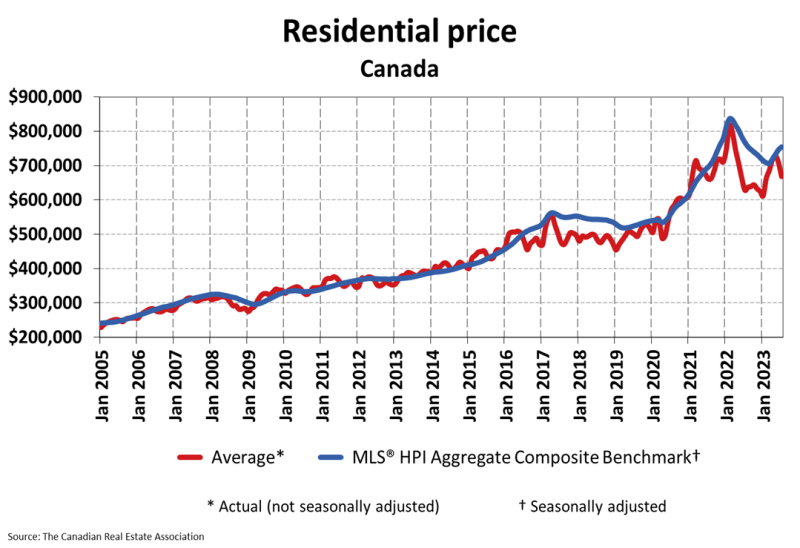

Price

House prices have seemed to have returned to their long-term growth trajectory, departing from the volatility we’ve seen over the last few years. The House Price Index (HPI) grew 1.1 per cent since last month, with the index now down just 1.5 per cent since this month last year. As a result, it’s likely we’ll start seeing positive year-over-year growth in house prices in Canada again, even if the market is really moving sideways. This is due to the base-year effect and comparing against particularly low prices toward the end of 2022, when the market was in turmoil.

With all this being said, it is worth noting that the average house price continues to trend down, and so I try to take the HPI with a grain of salt. Typically when you see divergences between the index and average house price like the one we’re seeing right now, we’ll see the index correct in line with average data in short order, with a bit of a lag. Right now, the index is climbing while average prices have commenced a steep drop. Time will tell which metric is more reliable for pricing guidance in Canada.

It is also worth noting that CREA has acknowledged several times that the average price is very easily skewed by Toronto data — which is very likely in this case. This would explain their tendency to favour the index during volatile markets like the one we’re seeing today.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

What about the impact on SNLR of double counting (Re-List Share Comparison) of 20-30% of NEW Listings?