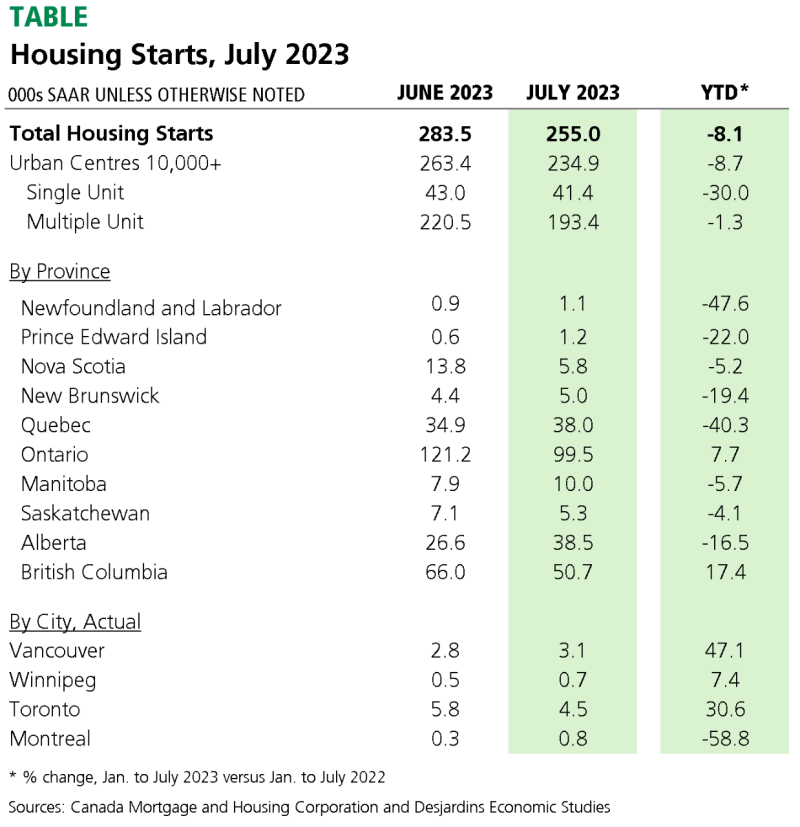

In July 2023, Canadian housing starts experienced a noticeable setback, dropping to 255,000 on a seasonally adjusted annual rate (SAAR). This decline coincides with the first decrease in home sales in six months.

Traditionally, Desormeaux notes that trends in home purchases and new construction have moved in tandem. However, recent data presents a more intricate narrative. On the one hand, the dip in July’s housing starts reflects an ongoing trend of gradual easing in total housing construction. On the other hand, the aggregate new construction figures remain elevated, even when compared to historical levels.

The economist writes, “Going forward, we do expect a more significant slowdown, consistent with construction industry labour shortages, high borrowing and material costs, weak homebuilder sentiment and expectations of softening economic activity.”

Bank of Canada’s perspective

The recent softening of GDP, employment, trade, and core inflation likely won’t go unnoticed by the Bank of Canada, Desormeaux explains. The combined impact of these cooling indicators suggests that the central bank’s efforts to moderate economic growth and curb inflationary pressures through higher interest rates are bearing fruit.

As a result, Desjardins predicts that the central bank will maintain its policy rate at 5.0 per cent during its September meeting.

Regional trends: Affordability challenges persist

A closer look at housing trends across regions and unit types highlights the ongoing challenge of housing affordability. Despite a resilient housing construction sector in Ontario and British Columbia, driven by robust multi-unit projects, this surge in activity does not necessarily translate to increased affordability in these high-priced provinces. Desormeaux’s research underscores a growing trend — investment properties that are more expensive on a per-square-foot basis.

The “missing middle,” referring to more moderately priced housing options, continues to be underrepresented in new construction projects.

Additionally, other regions of the country are grappling with dwindling housing starts, a sign of potential supply constraints on the horizon. In Quebec and oil-producing provinces — “so far relatively unscathed by the latest interest rate hikes” — inventories are notably lower than levels recorded in the pre-pandemic years, a development that could lead to further affordability challenges in these areas.