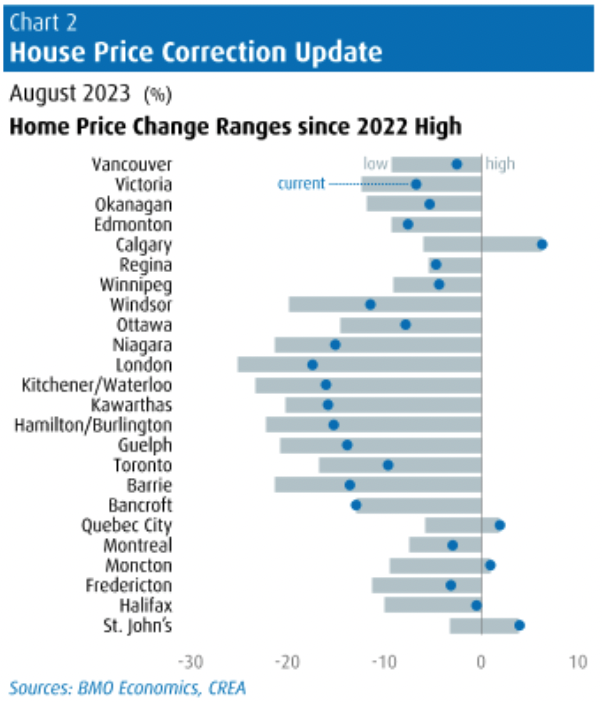

Have Canadian housing markets been through the worst of it, or is there still further to fall? Well, it depends on where you’re looking.

Regional variations have become increasingly apparent nationwide, as noted in a Sept. 29 report from Robert Kavcic, senior economist with the Bank of Montreal.

Calgary burns bright

Calgary stands out as the strongest market in Canada, with a sales-to-new listings ratio running at a “hot” 82.4 per cent. Prices in Calgary have rebounded by more than 6.0 per cent above the 2022 pre-correction high. A few Atlantic Canada markets are also seeing levels above pandemic highs.

On the other hand, Southwestern Ontario continues to grapple with the deepest correction, with some cities still down more than 15 per cent. Toronto has made up some ground recently but is still down about 10 per cent from last February.

What sets these regions apart? It comes down to a combination of relative affordability and net provincial migration inflows. People are flocking to areas where they can live affordably, as Kavcic’s report suggests.

Challenges ahead

There are several factors that might pose challenges to the housing market through 2024. These include softer job-market conditions, increased listing availability, and, most notably, rising mortgage rates.

Households will continue to face waves of mortgage resets through 2026. The report suggests that 2024 could see payment increases in the range of 25 per cent to 40 per cent if current interest rates hold, with even larger increases expected in 2025 and 2026, though as Kavcic writes, “we assume rates will back off by then.”

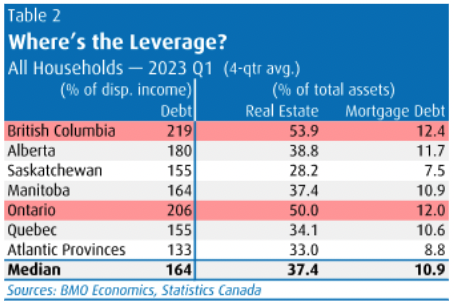

British Columbia and Ontario emerge as the provinces most exposed to any further real estate downturn and potential economic weakness driven by the mortgage market.

Both provinces have above-average household leverage and exposure to real estate, with Ontario having been unquestionably the “frothiest” market during the boom. British Columbia stands out with Canada’s highest household debt-to-disposable income ratio, 219 per cent, while Ontario is second at 206 per cent. This is compared to the 164 per cent median.

In these provinces, as Kavcic explains, real estate and mortgage debt make up a disproportionately large share of total household assets compared to other regions.

Quebec and Atlantic Canada carry relatively low exposure to these measures, partly due to demographic factors, as these populations tend to be older. Alberta, while having above-median readings for household leverage, appears to carry less risk, largely due to market conditions in the province.

Read the full report from BMO Economics.