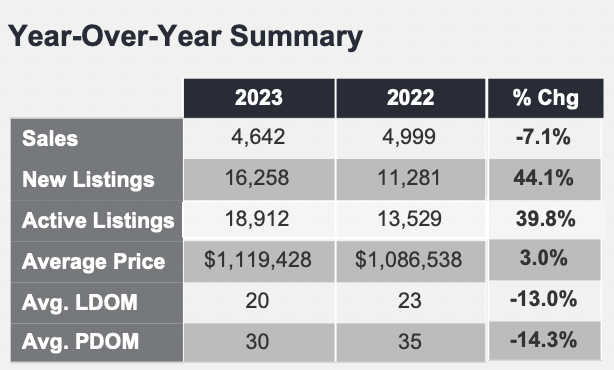

Source: TRREB

About last year

To see year-over-year home sales fall lower in the Toronto Regional Real Estate Board’s September Market Watch tells me that we are in for a particularly rough fall market, even though the average house price is up 3.0 per cent in the same time. The part that particularly stands out to me is the speed at which properties are transacting by comparison to last year. Both measures of DOM (days on market) have improved in the range of 13 to 15 per cent. This means that properties are selling faster than they were in September of last year, which could be a sign of one of two things:

- Buyers are more motivated, decisive or urgent, or;

- Sellers are more motivated and accepting of offers.

Given that the average sale-to-list price ratio is hovering around 100 per cent — it could be a coin flip either way. Increased borrowing costs could further squander buying power and sustain financial stress on households, causing more supply. We’ve already seen a 44.1 per cent increase in new listings and a 39.8 per cent increase in active listings; supply is definitely going to be the most important theme moving forward. As mentioned in previous monthly posts, this current supply trend expedites the market’s transition into a buyer’s market.

In fairness to my criticisms of the market compared against anomalous months to create — it is worth noting that September 2022 was one of the most undersupplied markets we’ve seen in Toronto’s history. So, while it would be easy for me to catastrophize and say that a 44.1 per cent increase in new listings is meaningful or that a 39.8 per cent increase in active listings is scary, these numbers are not so scary when understanding that September 2022 was an anomaly that fell in the middle of the biggest drop in housing prices in Canadian history.

With that being said — September 2023 is not, by any means, what I would call a “good” month for Toronto’s real estate market. When compared to long-term trendlines, we’re about 5 to 10 per cent above where we should be for new listings and about 18 to 22 per cent above the long-term average. While it’s easy to look at the monthly context and think that the market is strong or the yearly context and think the market is weak, the long-term context is really the best comparison.

For further reading on why it’s careful to use the right comparison, check out “How to Lie with Statistics,” a book written by Darrell Huff in 1954; presenting an introduction to statistics for the general reader, and can be read in about an hour.

The price floor

What fascinated me the most about TRREB’s September report was that entry-level ground-based product seems to be much stronger than the broad market for detached and condos. Most notably, non-detached and non-condo product is outperforming the market:

- Detached homes are selling at 100 per cent of asking price, on average;

- Semi-detached homes are selling at 104 per cent of asking price, on average;

- Townhouses are selling at 103 per cent of asking price; on average;

- However, condos seem to be having a rougher go — selling at 99 per cent of asking price on average.

This continued strength in lower-end houses (not condos) could help cement the price floor and create long-term sustainability in prices and slow price growth. If we continue seeing investors and first-time buyers absorb the less-expensive product in the market at this pace, I feel that could dampen the impact of price declines a bit.

Condominiums seem to be the x-factor here; if equity continues getting destroyed in that product, it could limit the ability for those buyers to step up from condo to townhouse or semi-detached. You could use the same logic to assume that buyer stepping up from townhouses and semis into detached could use their newfound equity to gradually support the detached market. This is a fascinating phenomenon to watch, where townhouses, the product in the middle of the market between detached and condominiums, is playing an ever-important role as a data point in determining the outcome of Toronto’s real estate market moving forward.

Recession?

While we start hearing the word “recession” thrown around a lot more in the coming month, consider that the real estate profession has been in recession for over a year now. Real estate professionals have seen drastically reduced income for the past 12 to 16 months as a result of the biggest drop in home sales volume and house prices we’ve ever seen on the back of a massive influx of new registrants. As a result, we’re seeing a real estate market that would give out an average of 1.52 transactions per realtor on an annualized basis.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

Don’t forget the Terminate Re-List Duplications.

In September 2023 27.5% (4476) of Market Watch’s 16, 258 properties published as NEW LISTINGS were in fact “Do-Overs/ Duplicates”.

That is, the same property, same owner & same LBO terminated an existing valid MLS Listing and Re-Listed that same property within the time-currency of the existing Listing, to ‘clear the history & run it afresh through the Prospect Matches and Daily Hotsheets’.

This may be good for these ‘partners’ as a merchandising gambit — but it’s NOT good for our New Listings Statistics!

In addition, this double-counting contributes a big portion to the # of days difference between PDOM & LDOM – to NOT attribute that difference at least partially to the Re-List Factor is almost as bad as not considering the Re-List Duplicates as skew to the SNLR that many Real Estate commentators and media pundits use to gauge the pace of the market.

NB The Re-List Report/ Re-List Share Comparison (seek it out in “Market Stats” Spotlight circle tab near-top of Stratus Home page, under Re-List Report — it’s been there since May 2022)