Since March of last year, the Bank of Canada has raised interest rates an unprecedented nine times. Not only that, but the rates themselves have swung from historic lows to a 20-year high. Resulting monthly expenses have been just too steep for many mortgage holders.

To get a read on Canadians’ sentiments overall, Royal LePage commissioned a survey. It found that “74% of mortgagees with lending agreements set to renew within the next 18 months report feeling concerned about higher interest rates”.

As a result, many Canadians are looking to cut costs, including by considering a change to their mortgage product or a longer amortization period.

Hopefully, they feel at least some relief after yesterday’s announcement of the Bank of Canada holding its overnight rate target at 5 per cent.

Key highlights

The study found that over 30 per cent of all Canadian mortgage holders – or 3.4 million people – have lending agreements that will renew by March 2025. Over half of this group will renew in the next year.

Nearly 75 per cent of Canadian mortgagees are on a fixed rate, while 20 percent are on a variable.

High impact on variable/hybrid mortgage holders

Of the latter group (or hybrid mortgage holders) that are worried about their renewal, 40 per cent say they plan on switching to a fixed-rate mortgage.

“Many Canadians today are facing a mortgage renewal at a significantly higher rate than they’re used to, and this will continue to be the case in the coming years as more loans mature,” says Karen Yolevski, chief operating officer of Royal LePage Real Estate Services Ltd.

“Canadians generally tend to err on the side of caution when it comes to their finances, and we believe this has served them well. Our financial institutions are well positioned to support consumers through one of the largest and most important purchases of their life.”

Vast majority at the trigger rate

64 per cent of variable or hybrid mortgage holders feel their mortgage payment has reached its trigger rate, thanks to higher interest, and therefore raised their monthly cost.

“Some Canadians with variable-rate mortgages have seen their monthly payments double or even triple over the last year and a half, due to the Bank of Canada’s aggressive interest rate hike campaign aimed at tamping down high inflation. Those locked into a fixed-rate mortgage, which most are, have been protected from those increases, at least for a short time,” says Yolevski.

“While the central bank’s key lending rate is expected to come down in the medium term, the likelihood that we will return to rock-bottom rates of less than one per cent is very low. Upon renewal, fixed-rate mortgage holders will be faced with a new reality – higher monthly payments.”

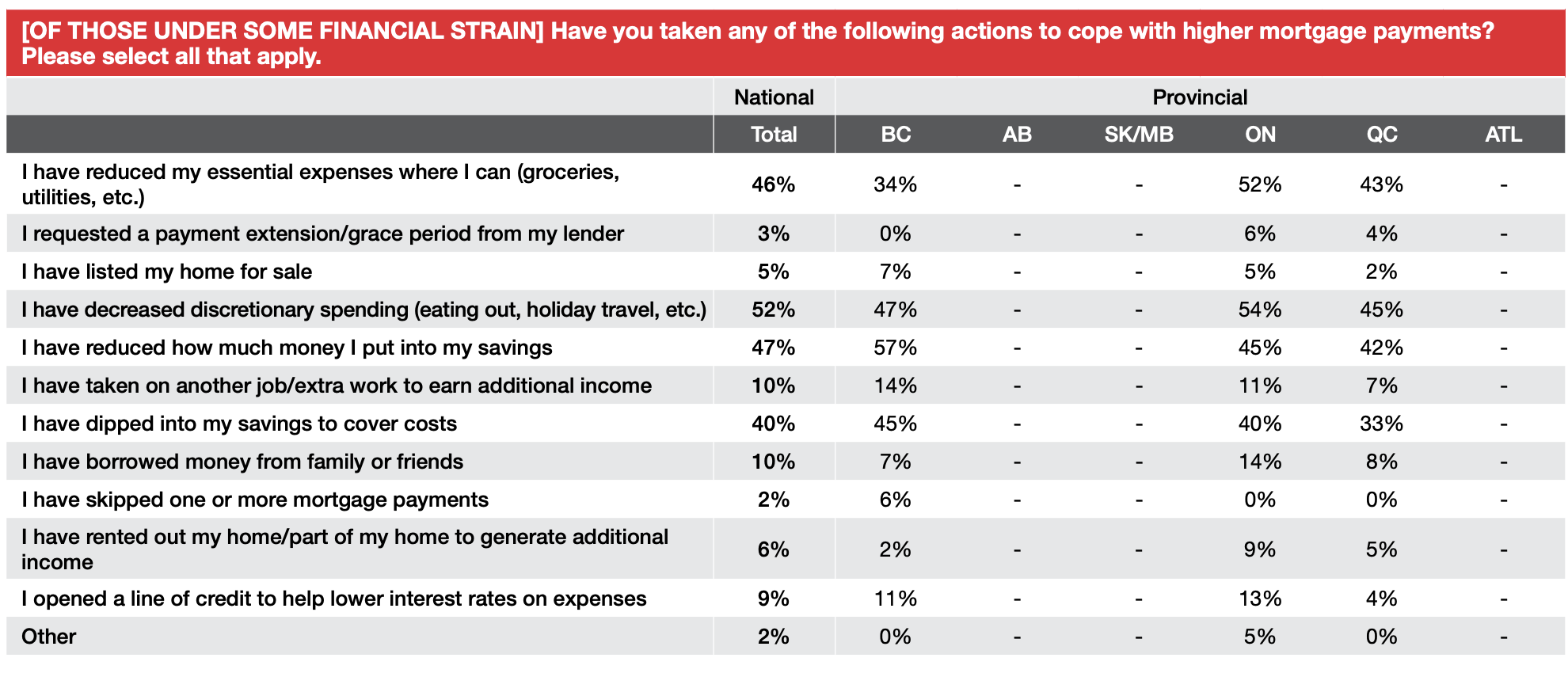

When asked if their household has felt financial strain due to raised interest rates and were then prompted to lower spending and use savings, 86 per cent of variable or hybrid mortgage holders concurred.

Read RoyalLepage’s survey, including regional summaries, here.