Quebec realtors should see a return to a normal market next year with stable prices, sales close to historical norms and no big surprises, forecasts the Quebec Professional Association of Real Estate Brokers (QPAREB).

More stable activity will give buyers and sellers a bit more time to prepare their transactions and negotiate well. “That’s always favourable for a realtor,” says Stéphanie Lapierre, QPAREB’s chief economist. “We’re no longer in a race, even if there’s still a bit of overasking.”

Slight transaction drop expected next year

Lapierre was speaking on the heels of the association’s December 14 release of its 2023 year-in-review and 2024 outlook for Quebec’s residential real estate market.

The association forecasts a slight 2 per cent drop in provincewide transactions next year to 74,719, from an estimated 76,036 in 2023. “But that’s very close to the historical average in Quebec of 78,000 transactions” for the last 20 years and “still a good year for the Quebec real estate market,” Lapierre says.

In contrast, there were more than 112,000 transactions in 2020, the first year of the pandemic. Sales dropped 20 per cent in 2022, however, as interest rates began to rise.

“As interest rates will remain high at the beginning of 2024, we think sales will remain weak at the start of the year, but activity will pick up during the year (as inventory remains low),” she adds.

A slight increase in the unemployment rate next year from 4.3 per cent to 5.3 per cent and a slowdown in the economy won’t help matters.

More buyer negotiating power — but not for long

Along with weak sales, the association forecasts an increase in new listings as 2024 begins, which will allow the market to benefit from more balanced conditions, as buyers will be able to negotiate better terms.

However, the situation will be short lived, as the first announcements of Bank of Canada interest rate cuts later in the year will lead to a market upturn. Immigration will also spark demand.

The association forecasts a drop of 75 basis points by the central bank in 2024 but “some economists are going further,” Lapierre says.

QPAREB says there should be no significant variation in median prices for single-family homes in the province during 2024.

Price increases to come in Montreal and Quebec City

In Montreal, however, median prices for single-family homes should increase 2 per cent to $549,400 next year and condos should increase 1 per cent to $395,600.

The metropolitan Montreal area is expected to see 36,285 transactions this year, 15 per cent less than in 2022. The transaction number should drop to 35,230 in 2024, a 3 per cent decline over 2023.

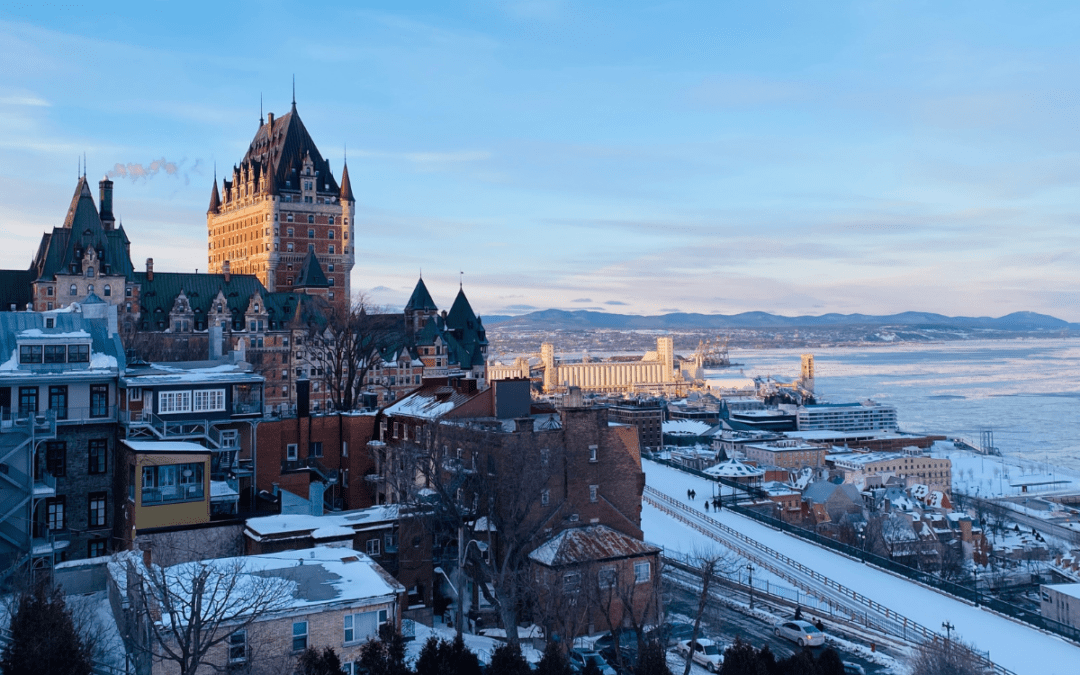

Quebec City will go against the flow and outperform the province, Lapierre says, with a 5 per cent increase in single-family home prices (to a median of $368,000) due to a lack of availability, while condominiums will see a modest 1 per cent growth in prices, to a median of $244,900.

In 2023, regions with median prices lower than the provincial mean saw prices reach new peaks, while regions with higher prices saw slight declines.

Overbidding common in the capital

The share of overasking in the province was in sharp decline from January to November of this year, falling to 11 per cent for single-family homes, a 22 per cent drop from last year, QPAREB reports.

The provincial capital remains one of the few areas of the province where it’s common for houses to sell above asking prices, with one out of every four transactions last month seeing overbidding, Lapierre notes. “That’s because demand for single-family homes is strong but availability in Quebec City is low.”

“It’s much more common for houses to sell for over asking price in regions of the province where prices are more affordable than in Montreal,” she adds.

However, given a lack of listings, houses in Montreal that are of good quality, not in need of renovations and well-priced can be subject to overbidding, she says.

QPAREB also notes there has been a return to a healthier negotiation process in Quebec. For example, in October of this year, 70 per cent of houses sold in the province went for asking price, 23 per cent for under-asking and 7 per cent for over-asking.

Lapierre points out that, overall, Quebec’s residential real estate market is well-positioned for more balanced conditions in 2024, given the resilience of the province and low household debt.

Danny Kucharsky is a contributing writer for REM.