Toronto’s real estate market is starting to feel unfamiliar. After a long stretch of rapid price growth and relentless competition, the landscape is shifting. Buyers, once forced into rushed decisions, are now taking their time.

Sellers, who could once count on quick sales and soaring offers, are facing a market where patience and pricing strategy matter more than ever.

With sales down, inventory rising and interest rates keeping affordability in check, economic uncertainty is adding another layer of complexity. The recent U.S. tariffs on Canadian imports are fueling concerns about job security and consumer confidence, potentially dampening demand further.

As trade tensions and their broader economic impact unfold, the question isn’t just whether the market is cooling—it’s whether this shift is here to stay.

With the recent implementation of U.S. tariffs on Canadian imports, the economic outlook has become increasingly uncertain. This uncertainty is having a significant impact on the Toronto real estate market, as buyers and sellers alike are adopting a wait-and-see approach.

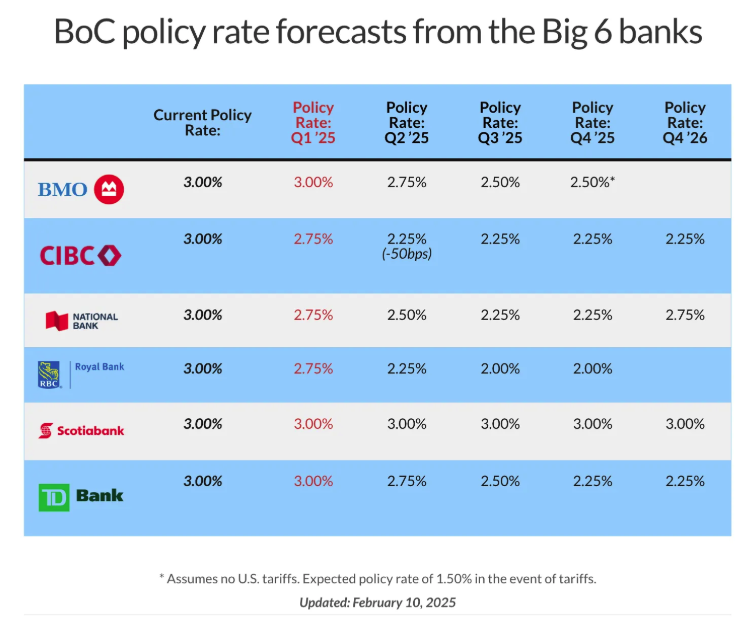

One potential outcome of the tariffs is that they could drive interest rates down. Canadian Banks are speculating that the Bank of Canada will be forced to drop interest rates harder and faster than previously anticipated in order to stimulate the economy and offset the negative impact of the tariffs. This could make borrowing more affordable for potential homebuyers, which should in turn lead to increased demand for housing. The problem is that people aren’t in a hurry to buy when the economy and their unemployment are uncertain—and this is why the Bank of Canada ends up cutting rates.

The ultimate impact of the tariffs on interest rates and the Toronto real estate market is difficult to predict. However, it is clear that the tariffs are adding an additional layer of uncertainty to the market, and this uncertainty is likely to weigh on both buyers and sellers in the coming months.

Sales plummet, but price declines remain gradual—for now

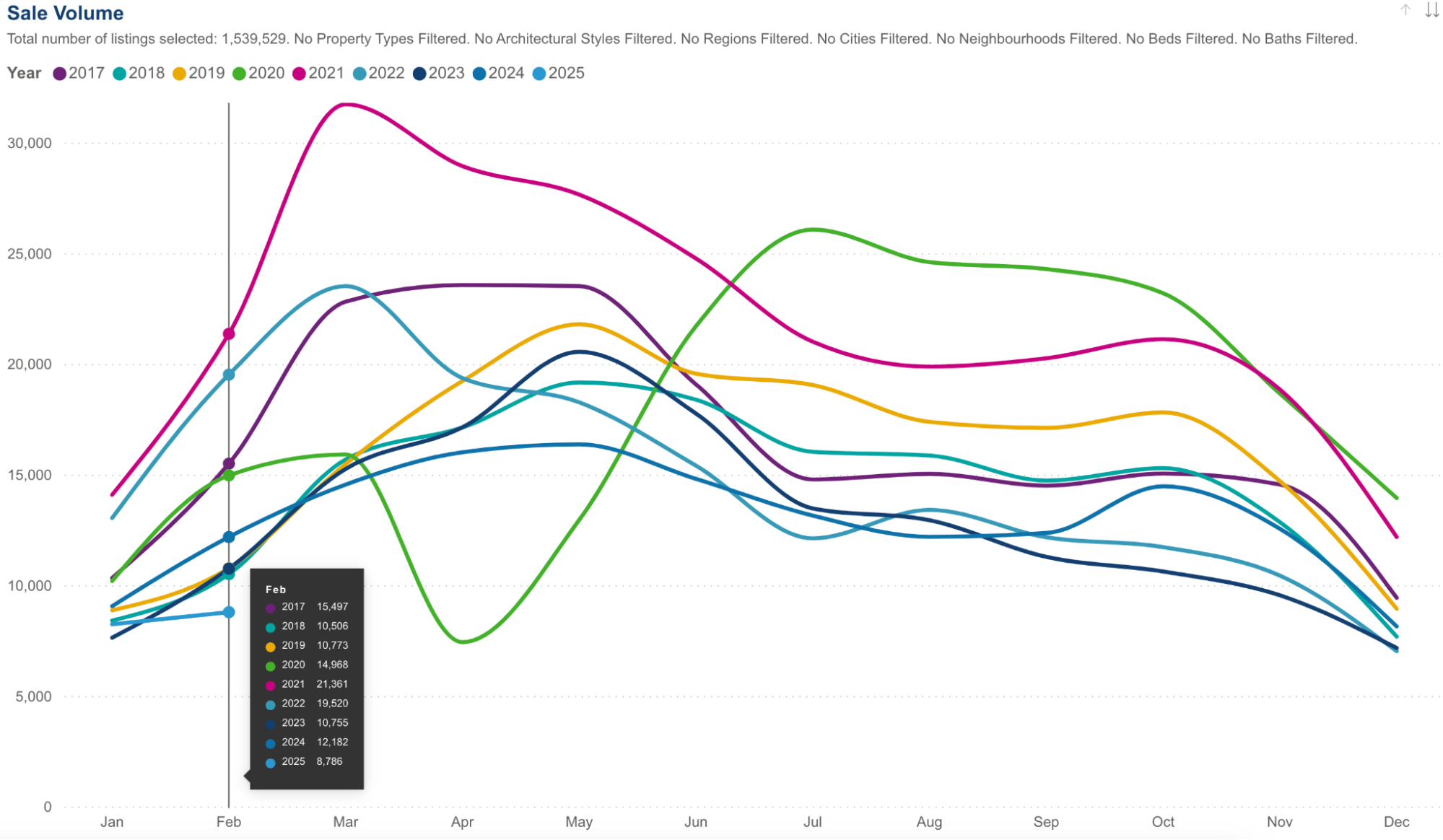

After strong year-over-year sales growth in late 2024, the GTA housing market has seen a sharp downturn in early 2025, with February marking the steepest decline yet. The chart below illustrates this.

We’ve experienced the slowest start to the year for sales in recent memory. Traditionally, the first few months of the year are a busy time for the real estate market, but this year’s market has been uncharacteristically sluggish.

Source: thehabistat.com

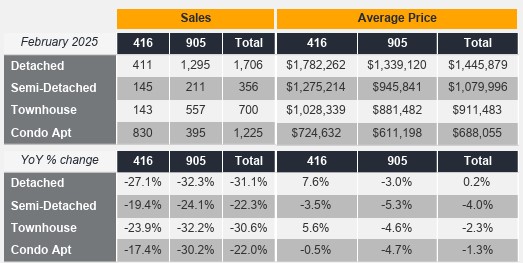

TRREB data for February also reveals a widespread drop in sales across all major housing types, with every segment experiencing double-digit declines compared to last year. However, while prices have softened across most categories, declines have remained moderate, and some segments have held steadier than others despite slowing transactions:

- Detached homes: Sales fell 31.1 per cent, with 1,706 transactions. Prices, however, held steady, rising 0.2 per cent to $1,445,879.

- Semi-detached homes: Sales declined 22.3 per cent, with 356 sales recorded. Prices decreased 4.0 per cent, settling at $1,079,996.

- Townhouses: Sales dropped 30.6 per cent to 700 transactions, while prices softened by 2.3 per cent to $911,483.

- Condo apartments: Experienced a 22.0 per cent decline in sales (1,225 transactions), while the average price dipped 1.3 per cent to $688,055.

.

Source: TRREB

One key reason prices have seen only modest declines despite declining sales may be seller resistance. Many homeowners remain reluctant to lower their asking prices, particularly after years of sustained price growth.

At the same time, market conditions are increasingly favouring buyers, with homes taking longer to sell. This shift is reflected in the rise in average listing days on market (LDOM) to 28 days (up 12 per cent year-over-year) and average property days on market (PDOM) to 43 days (up 16.2% year-over-year).

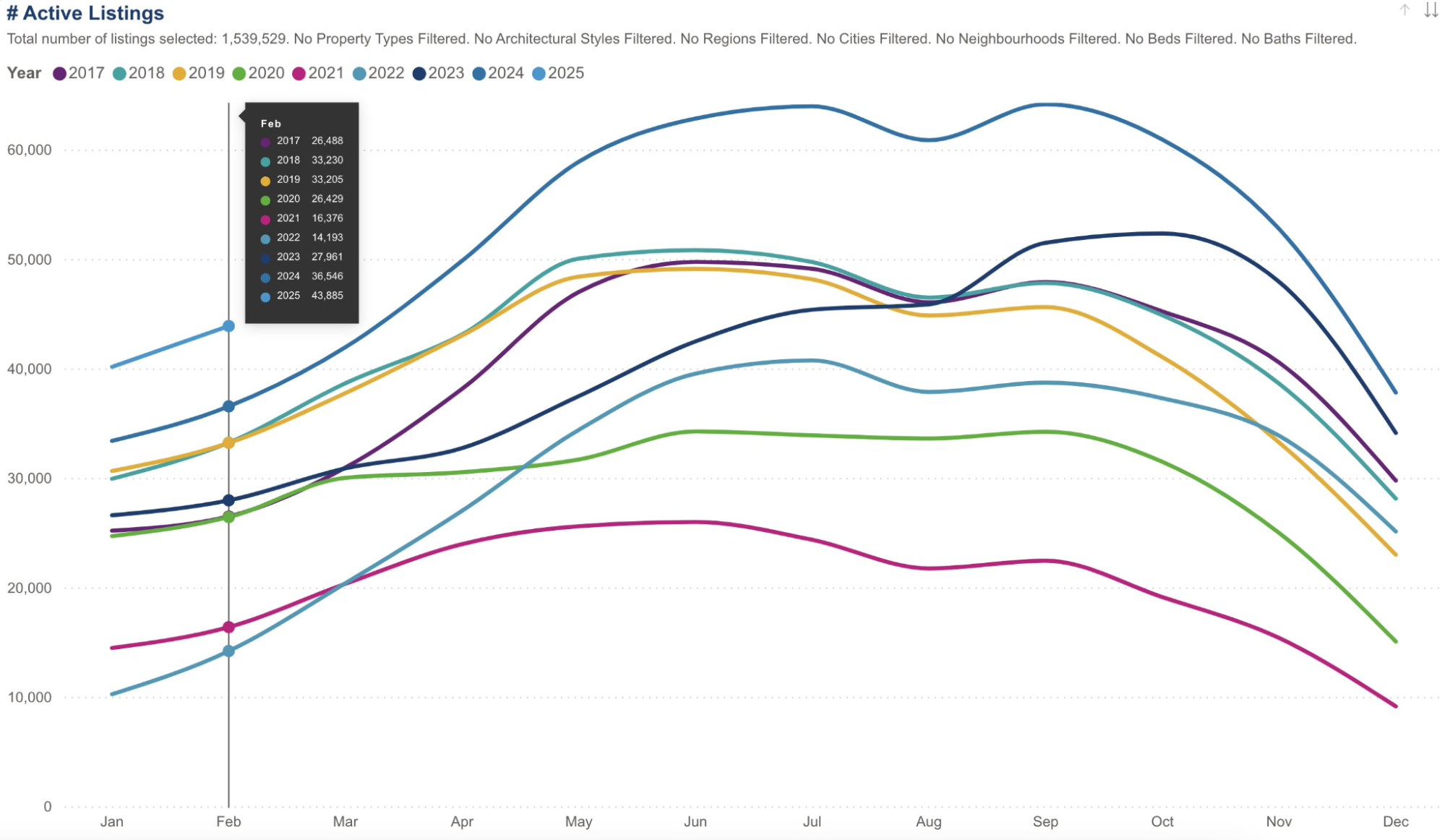

The rise in available inventory also remains a recurring trend in February, continuing the pattern observed in January. Active listings have surged by 76 per cent year-over-year, while new listings have increased by 5.4 per cent, expanding buyer options significantly.

Source: TRREB

A market favouring buyers—but many are still holding back

For those looking to buy, conditions haven’t been this favourable in years. With inventory rising and demand slowing, buyers now have more choices, more negotiating power, and less urgency to act quickly. The once cutthroat market has shifted, giving buyers more control:

- Fewer bidding wars: Competition has eased, allowing buyers to make more calculated decisions.

- More negotiating power: Sellers, facing longer listing times, may be more open to price adjustments and conditions.

- Better timing for decision-making: With homes sitting on the market longer, buyers have more time to evaluate options.

Despite these advantages, many buyers remain hesitant, held back by high mortgage rates and broader economic uncertainty.

In terms of listings, 2025 has seen a remarkable surge in activity within the Toronto market. The number of active listings has skyrocketed, reaching levels unseen in recent memory. This significant increase suggests a potential shift in the market dynamics, prompting questions about whether this is a temporary surge or indicative of a new normal for the Toronto real estate landscape.

High mortgage rates are still a barrier

While buyers can now negotiate more aggressively, borrowing remains expensive, limiting affordability. TRREB President Elechia Barry-Sproule noted that despite many households are eager to buy, “current mortgage rates make it difficult for the average household to comfortably afford monthly payments.”

Lower borrowing costs—if and when they arrive—could be the key to reviving demand.

Economic uncertainty Is holding back confidence

Beyond mortgage rates, some buyers are waiting for greater economic stability before making a move.

- High Unemployment in Toronto: The city’s 8.4 per cent unemployment rate is raising concerns about job security and home affordability.

- Impact of U.S. Tariffs on Canada: The recent implementation of U.S. tariffs on Canadian imports is expected to intensify economic instability.

TRREB Chief Market Analyst Jason Mercer explains, “On top of lingering affordability concerns, homebuyers have arguably become less confident in the economy. Uncertainty about our trade relationship with the United States has likely prompted some households to take a wait-and-see attitude towards buying a home.

Mercer suggests that if economic uncertainty clears up in the coming months, buyer confidence could return, leading to stronger market activity later in the year.

Until then, the market remains in a delicate balance, offering opportunities for those who can navigate the challenges.

What’s next? Will the market pick up or cool further?

The big unknown is whether sales will rebound later in 2025 or continue to slow. Several factors will influence the market’s direction in the coming months:

What could keep the market sluggish?

- Rates stay high for longer: If interest rates don’t come down, affordability issues will persist.

- Sellers refuse to adjust pricing: If homeowners continue holding out for higher prices, fewer transactions will occur.

- Ongoing economic uncertainty: The recent implementation of U.S. tariffs on Canadian imports is expected to heighten economic instability. With trade uncertainties weighing on market sentiment, potential buyers may delay purchasing decisions, fearing job market disruptions and increased costs in key sectors. This hesitation could further dampen real estate activity, prolonging the slowdown in sales and price growth.

With the spring market approaching, these factors will be closely watched to see whether Toronto’s real estate market remains soft or begins to rebound.

What this means for buyers, sellers and investors

For buyers

If a buyer has the financial flexibility to buy now, this could be one of the best opportunities in recent years to secure a home without intense competition. With more homes available, negotiation is back on the table.

However, economic uncertainty, including the impact of U.S. tariffs on Canadian industries, could affect job stability, so buyers should factor in broader economic conditions alongside mortgage rates.

For sellers

This is no longer a market where overpriced listings sell in days. If a homeowner is serious about selling, it’s important to price competitively and be prepared for longer listing times.

Homes are still selling, but only when realistic expectations are set. Trade tensions and economic uncertainty could further weaken demand, meaning sellers should be prepared for a slower market and more cautious buyers.

For investors

Although the GTA rental market has shown signs of softening, real estate still holds potential as a long-term investment. However, U.S. tariffs and broader trade uncertainty may impact economic growth, employment, and consumer spending, potentially affecting rental demand and price growth.

With borrowing costs still high, cash flow analysis is more critical than ever. Investors who can minimize reliance on financing may find strategic opportunities, particularly as market conditions shift in favour of well-capitalized buyers. Should this downturn result in economic uncertainty and falling prices, there may be bargains to be found for well-capitalized investors with dry powder heading into 2025 and 2026.

A market in transition

Toronto’s real estate market is in transition. Sales have slowed, inventory is rising, and homes are sitting longer.

Whether this slowdown is temporary or the start of a prolonged cooling period remains to be seen. Much will depend on how economic conditions, interest rates, and trade tensions shape buyer confidence in the months ahead.

For now, buyers have a rare window of opportunity—with less competition and more negotiating power—but whether they act remains uncertain amid shifting conditions.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

Some good points, but interest rates are not as crucial as the cost of delivery of homes, new and used. My first house was financed at 7.5%. My 2nd house, 4 years later, was financed at 7.25% (private). The cost of the homes against my income was at a sufficient ratio. What good are rates that drop to 3% if that drop motivates sellers to raise prices in response to a sudden increase in demand? What Canada needs, and will never consider, is that buyers need to be offered alternative methods of home-ownership. There are not more condos (and their associated-inflating fees, a symptom of the increasing cost of delivery of components: maintenance, etc.), and of tiny homes, something rejected by most owners. Seniors wishing to sell their larger homes in order to have some living funds, as pensions are strained, have little choice when moving. If there were options available for shared-lot ownership (not land leases), those options would open up more inventory for home buyers that wish to buy the homes the seniors are selling, freeing up inventory and lowering prices in general. Younger buyers will also be able to consider shared-lot ownership. What Canada and Canadian policy makers need is imagination and the sudden realization that continuing to do what has been dinem, and does not work, still won’t work.

Sorry about the spelling errors.

Thoughtful presentation.

NB Spring Market 2025 is Prorogued.

StatsFolk: – when is the last time the Average Price Broke Down below the Ave Price for the two previous years?

-How long until it retraced the breaking-thru intersection?

-How long before it set a New High?

-What were interest rates doing?

– Does this info suggest anything helpful or hopeful or otherwise?

– Or is it mis-leading?