The latest report from RBC Economics explores CREA’s data from July, revealing that the once-intense demand-supply imbalance is rapidly rebalancing. Authors Robert Hogue and Rachel Battaglia also note the influence of an exceptionally hot summer, coupled with large-scale forest fires impacting various regions, could also have played a role in this transformation.

Market correction and cooling effect

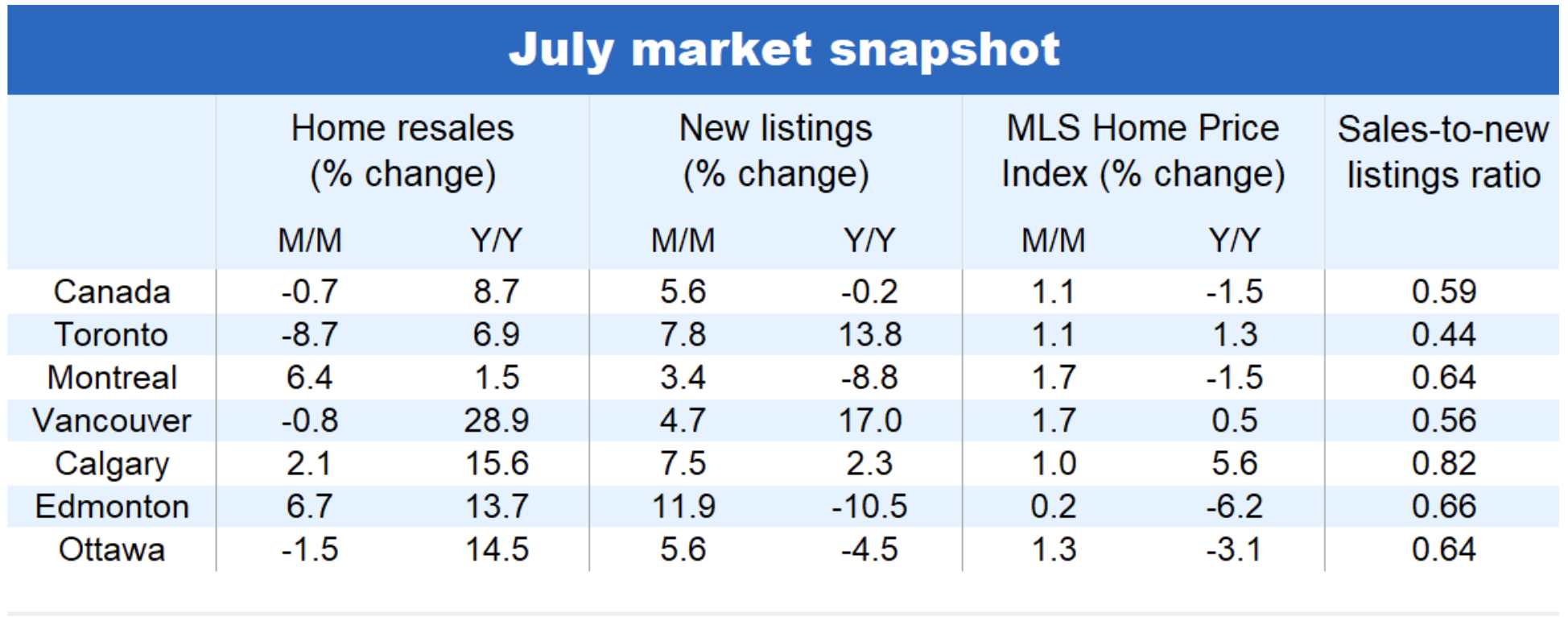

The Bank of Canada’s successive rate increases have cast a shadow on the housing market’s post-pandemic resurgence, contributing to a dampening of activity this summer. In the midst of back-to-back rate hikes, the housing market witnessed a modest decline in home resales in July, marking the first contraction (-0.7 per cent month-over-month) in six months, a departure from the growth observed earlier this year.

Uptick in new listings

Despite the slowdown in home resales, the Canadian housing market saw a substantial boost in new listings, with a notable 5.6 per cent month-over-month increase. This uptick in new listings represents a shift, “fully reversing declines earlier this year.” In fact, since April, new listings have soared by an impressive 24 per cent.

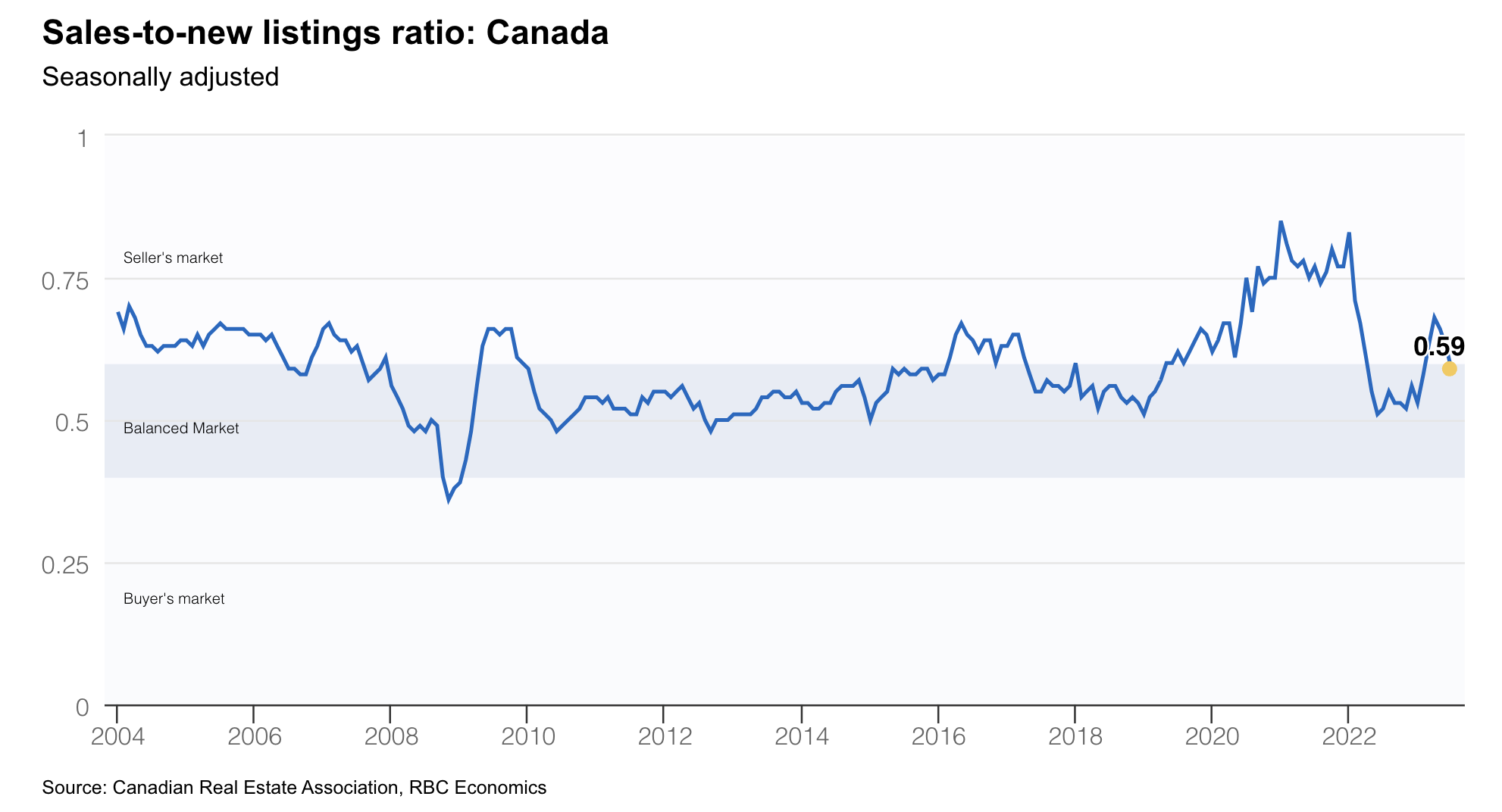

“Market developments over the last two months have brought overall demand-supply conditions in Canada back into balance after tightening surprisingly fast this spring,” the economists explain.

Regional sales patterns reflect market correction

A closer look at regional sales patterns provides insight into the evolving market. The report highlights that British Columbia and certain parts of Ontario experienced a slowing of sales momentum. The Fraser Valley, for instance, witnessed a significant 11.1 per cent month-over-month decline in sales. Toronto (-8.7 per cent), and Kitchener-Waterloo (-5.9 per cent) also reported sizable drops and, to a lesser extent, Hamilton (-3.7 per cent) and Vancouver (-0.8 per cent). However, more affordable markets in Ontario’s western regions, as well as Quebec, the Prairie provinces and parts of Atlantic Canada, continued to display signs of rebounding activity.

Supply surge and price appreciation

Sellers across the country have responded to changing market dynamics by putting more homes up for sale, leading to an increase in new listings. Edmonton, Hamilton, Kitchener-Watrloo, London and Saugenuay all saw a double-digit increase in new listings month-over-month. While this surge is notable, economists explain, “These increases are from exceptionally low levels at the start of this year. They merely reset the bar closer to normal in most instances.”

Despite the increase in supply, home prices continue to appreciate at a rate. The MLS Home Price Index (HPI) reveals that property values saw a 1.1 per cent month-over-month increase in July, albeit a noticeable decrease from the 1.9 per cent average rate observed over the previous three months.

“The spring tightening in demand-supply conditions is unwinding rapidly in B.C. and Ontario. Softer sales and increasing new listings returned most markets in these provinces to balance, with Toronto the closest it’s been to a buyer’s market since January.

RBC economists add, “Interestingly, price gains were comparatively subdued last month in the Prairies. Edmonton’s MLS HPI was up just 0.2 per cent month-over-month, Calgary 1.0 per cent, Regina 0.8 per cent and Saskatoon 0.4 per cent. This may reflect the fact property values in these markets did not decline as much—or at all in Calgary’s case—during the recent correction.”

Economic uncertainty muddies the path forward

Looking ahead, the Canadian housing market continues to face a somewhat uncertain trajectory. The combination of higher interest rates and potential economic challenges has the potential to curb buyer enthusiasm and even prompt some current homeowners to sell.

Hogue and Battaglia write, “A recession would further generate headwinds as rising job losses and economic uncertainty undermine market participants’ confidence.

“We see this summer’s cooling as evidence the surprisingly strong rebound in the spring wasn’t sustainable. Our view had been—and remains—the recovery will be slow until interest rates are cut. What the spring rebound did, though, is bring forward the bottom of the price cycle that we earlier anticipated around the fall.”