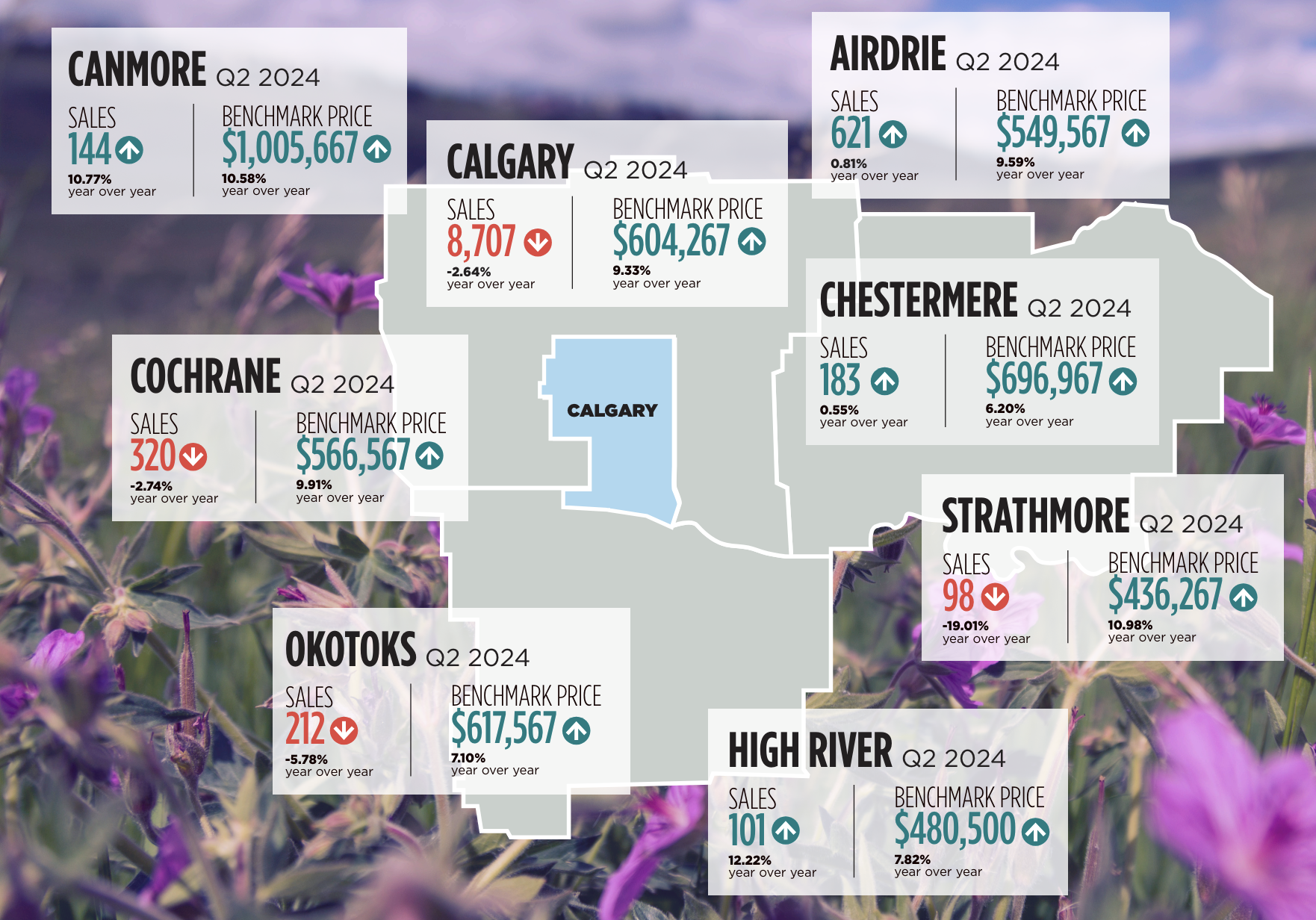

Last week, the Calgary Real Estate Board (CREB) released its Q2 2024 housing market report, which offers an overview of the real estate landscape in Calgary and surrounding areas and showcases trends in sales and pricing.

A seller’s market with sales-to-new listings below 80% for first time since Q1 2023

New listings have risen for the fourth consecutive quarter compared to last year, with many gains in the upper price ranges of each property type — rising prices and high lending rates have encouraged more sellers to list their properties. This increase caused the sales-to-new listings ratio to fall below 80 per cent for the first time since Q1 2023.

However, the market continues to favour sellers with a Q2 sales-to-new-listings ratio of 75 per cent and a months-of-supply of one month.

Slower sales thanks to lower-priced properties, though still above trends

In the second quarter, sales slowed by three per cent compared to the same time last year. This was mainly due to lower-priced properties with the lowest supply levels. Despite this, sales levels were 29 per cent above long-term trends and, after the year’s first half, nearly six per cent higher than last year.

“The unexpected surge in migration over the past two years has contributed to the demand growth and supply challenges experienced in the Calgary market,” says Ann-Marie Lurie, chief economist at CREB.

“While we still have to work through the pent-up demand, slowing migration levels and supply gains in the resale and new home markets should start to support more balanced conditions, taking some of the pressure off home prices.”

Source: CREB

Source: CREB

Home prices have risen by 10 per cent so far this year — with the biggest gain occurring in row properties at 19 per cent and the smallest growth occurring in detached and semi-detached homes at 13 per cent.

What’s next

CREB predicts that increased supply from the new home sector will help support a better-supplied market, including for rentals, and reduce pressure on home prices.

Slowed price growth is expected throughout the year’s second half as supply increases, though this will mostly impact higher-priced properties. The board says more price increases will affect the most affordable property types with persistently tight conditions.

Review the full report here.