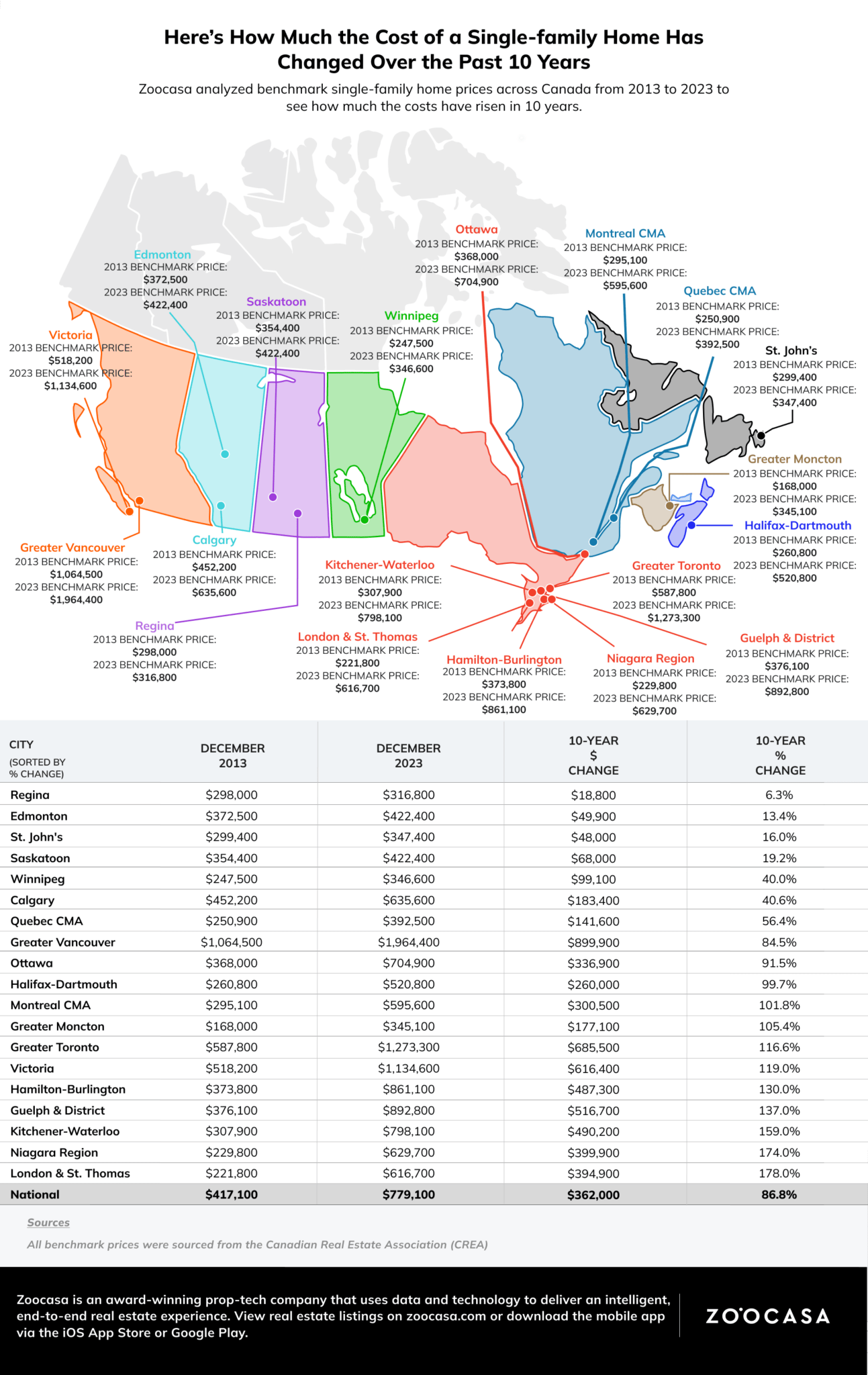

Canada’s real estate market has seen much change over the last 10 years, thanks to interest rate changes, economic fluctuations, immigration increases, the impact of a global pandemic and more.

The one thing that’s been constant though is the persistent rise of home prices: the benchmark single-family price in most of Canada has doubled from 2013 to 2023, representing an 86.8 per cent increase.

Zoocasa analyzed single-family home prices in 19 Canadian cities during this period, revealing substantial price increases, with Southern Ontario cities experiencing the most significant growth.

Southern Ontario: Single-family home prices more than doubled

London & St. Thomas topped the list for price growth, with a 178 per cent increase in benchmark single-family home prices from 2013 ($221,800) to 2023 ($616,700).

Niagara Region and Kitchener-Waterloo also experienced substantial price increases (174 per cent and 159 per cent, respectively), in part reflecting the trend of priced-out GTA buyers moving to more affordable markets.

Guelph & District saw the largest price increase (of $516,700) in Ontario outside of Greater Toronto (which went up by $685,500).

At the same time, GTA single-family home prices exceeded $1,000,000 for the first time (the current benchmark is $1,273,300).

The Prairies see most stable home prices

Conversely, cities in the Prairies, such as Regina with a modest increase of $18,800, exhibited the most stable price growth over the decade.

St. John’s and Edmonton were in similar situations, with respective 10-year price jumps of $48,000 and $49,900.

Despite having the highest benchmark price ($1,964,400), Greater Vancouver experienced an 84.5 per cent increase in single-family home prices over 10 years.

Substantial mortgage payment increases

The report also notes that five-year mortgage rates have mostly risen in the past decade. This, along with the higher home prices has led to increased monthly mortgage payments, with homeowners in many Southern Ontario cities facing substantially higher bills in 2023 compared to 2013.

For instance, a typical London homeowner would have seen their monthly mortgage payment increase from about $999 in 2013 to about $3,407 in 2023, reflecting the substantial rise in benchmark prices and interest rates.

Read the full report here.