It seems that the interest rate reality is finally catching up to the Canadian housing market, with very few positive data points to report when it comes to home sales in October 2023, as the Canadian Real Estate Association reports.

Sales up from 2022, down from September

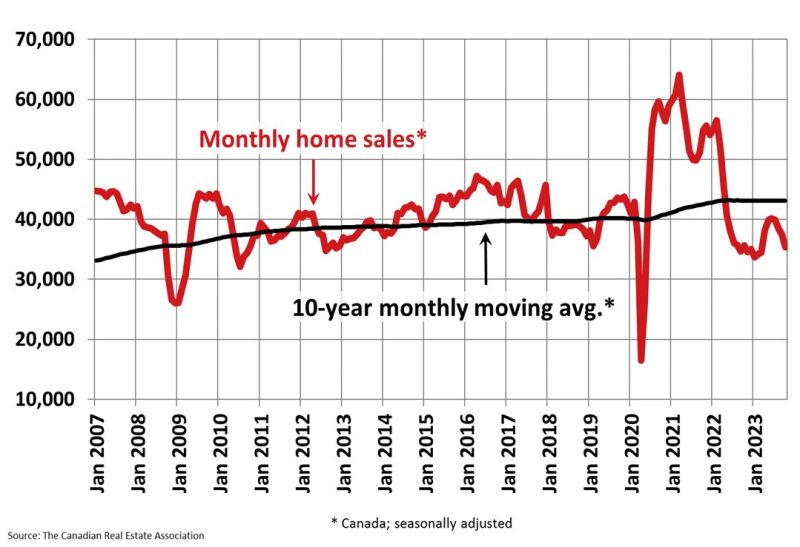

Canadian home sales continued their steep decline, after a glimmer of hope as sales trended back up toward the 10-year moving average earlier this year.

Although up slightly (0.9 per cent) since last year, the number of homes sold in October fell 5.6 per cent below September sales:

Prices following suit

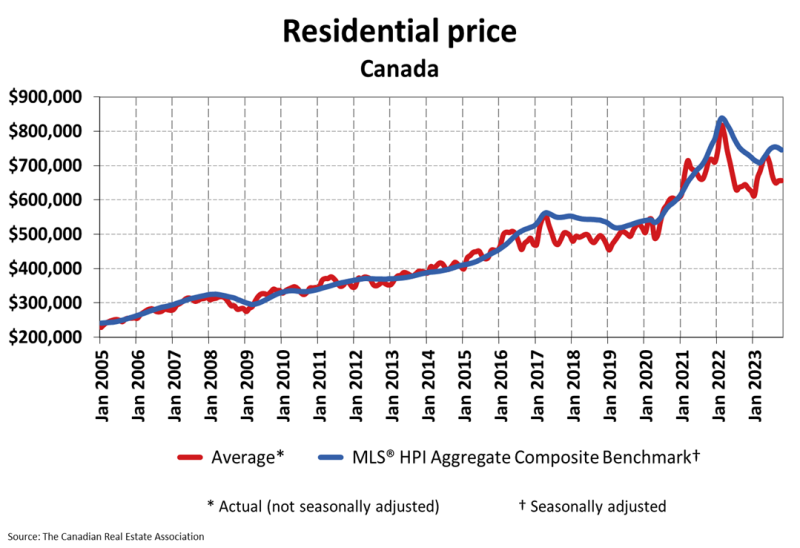

Much like sales volume, prices are in decline in the short-term (monthly) context, but up in the longer-term (yearly) context.

The House Price Index went down about 0.8 per cent, continuing the downward trend from the months prior, but up about 1.1 per cent since October 2022, showing that the market has not reached the severe lows we saw during last year’s selloff.

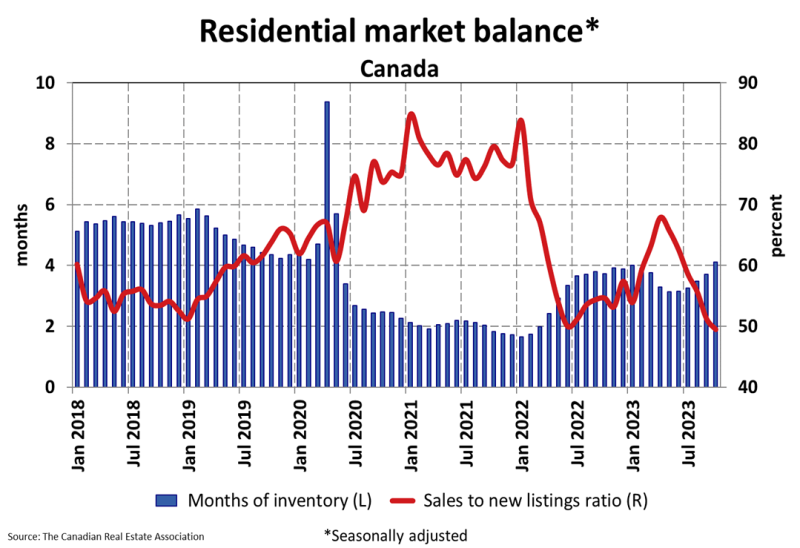

Still heading toward buyers’ market

Canada’s real estate market continued heading towards buyers’ market territory in October, with the sales-to-new listings ratio reaching a 10-year low at 49.5 per cent. Furthermore, there were 4.1 months of inventory nationally, up from the low of 3.1 months in May:

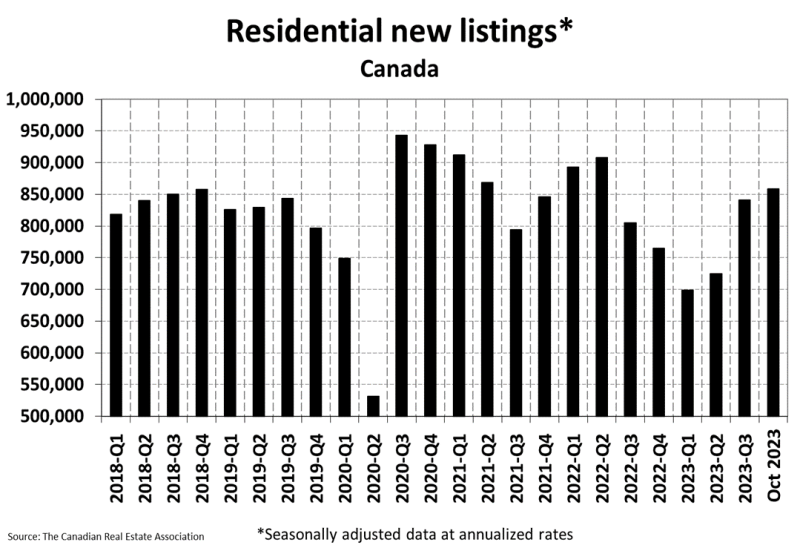

Financial stress on Canadians

New listings continued to outpace weakening sales. This is a likely indication that some financial stress has begun to impact households in Canada, and selling is the best option to relieve that stress.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

I am a realtor for over 50 years as my father before me. I have watched all the previous governments try to put in restrictions on whom can own real estate. I have worked in both commercial real estate as well as property management for residential apartment buildings.

The biggest problem I think we face is speculators (so called investors) buying up prebuilt condos in major cities.

These should only be sold to end users, this would keep prices in line with where they should be and if investors want properties they can buy qualified apartment buildings or hotels, but hands off our residential real estate.

Tax these “investors ” 50% on any gain, this will stop them and help are residential new homes available. If they build new rental apartments give them incentives to build.

I am friends with Andy Brethour and our real estate families go way back and I am here if you would like any of my imput.

Regards,

Rick

Home address: 19 Mckean Blvd. Nottawa Ontario L0M 1P0

I agree Rick. These “investors” are also buying up townhouse and single family units.

Strain now, pain the reality. Mortgage debt is only part of the equation. Financing for cars, TV’s, renovations, pools and hot tubs. Todays consumer buys now and pays later. This is just the tip of the ice berg. Banks began layoffs last year and that continues. As the Liberals strangle Canada with high carbon taxes( a big part of inflation) and higher than needed internet rates the worst is yet to come. Consumers will Buck it up through the Holiday Season then the walls will come tumbling down in 2024.

Canadians like most of the Western World, spent money like the was no tomorrow, including our governments.

Everyone was warned that “closing time” would happen with artificially low interest rates, and instead of packing up, settling the bill – kept buying rounds.

There is a PRICE for not facing the future…..

Time to cut spending, learn new ways to make money, and pay the bill.

Hopefully, everyone will learn and grow.