We saw lower inflation numbers last month, which could lead to a better situation for home buyers – despite widespread concern over another interest rate hike today from the Bank of Canada.

As of now, the overnight lending rate is at 5 per cent, a high of many years, and the five-year- fixed rate is at 5.49 per cent, a 15-year high.

But, there may be light at the end of the tunnel. Statistics Canada data shows a 0.2 per cent drop to 3.8 per cent inflation in September, which indicates that the effect from past rate increases is happening.

Many buyers will lose interest in real estate with another rate hike

A Zoocasa survey reports on home owner and buyer sentiments, in which the vast majority – 79.1 per cent – indicated if mortgage rates keep rising, their interest in real estate would be negatively impacted.

It’s worse for first-time buyers, over 86 per cent of whom felt this way due to economic uncertainty.

Prospective buyers need more than a pause in interest rate hikes

Most survey respondents felt neutral about whether their interest in real estate was positively impacted by the Bank of Canada’s September announcement to pause interest rates, after three consecutive increases earlier in the year.

Nearly a quarter of respondents felt the pause had a positive effect on their level of interest, while just over 16 per cent strongly disagreed with this statement.

Home prices and government responses: Major reasons for disinterest

Housing demand, prices and affordability are often linked, and respondents feel similarly about how the government is addressing affordability – the majority strongly disagreed it has done enough.

Buyer interest is also being impacted by low housing supply nationwide, which is keeping prices high. Nearly 40 per cent of respondents strongly disagreed with the idea that the Canadian government is doing its fair share to address the housing shortage issue. Only 5.4 per cent strongly agreed, while under 26 per cent were neutral.

The thing is, federal government efforts will only be needed more as housing demand grows as the plan for 485,000+ newcomers in each of the next two years becomes reality.

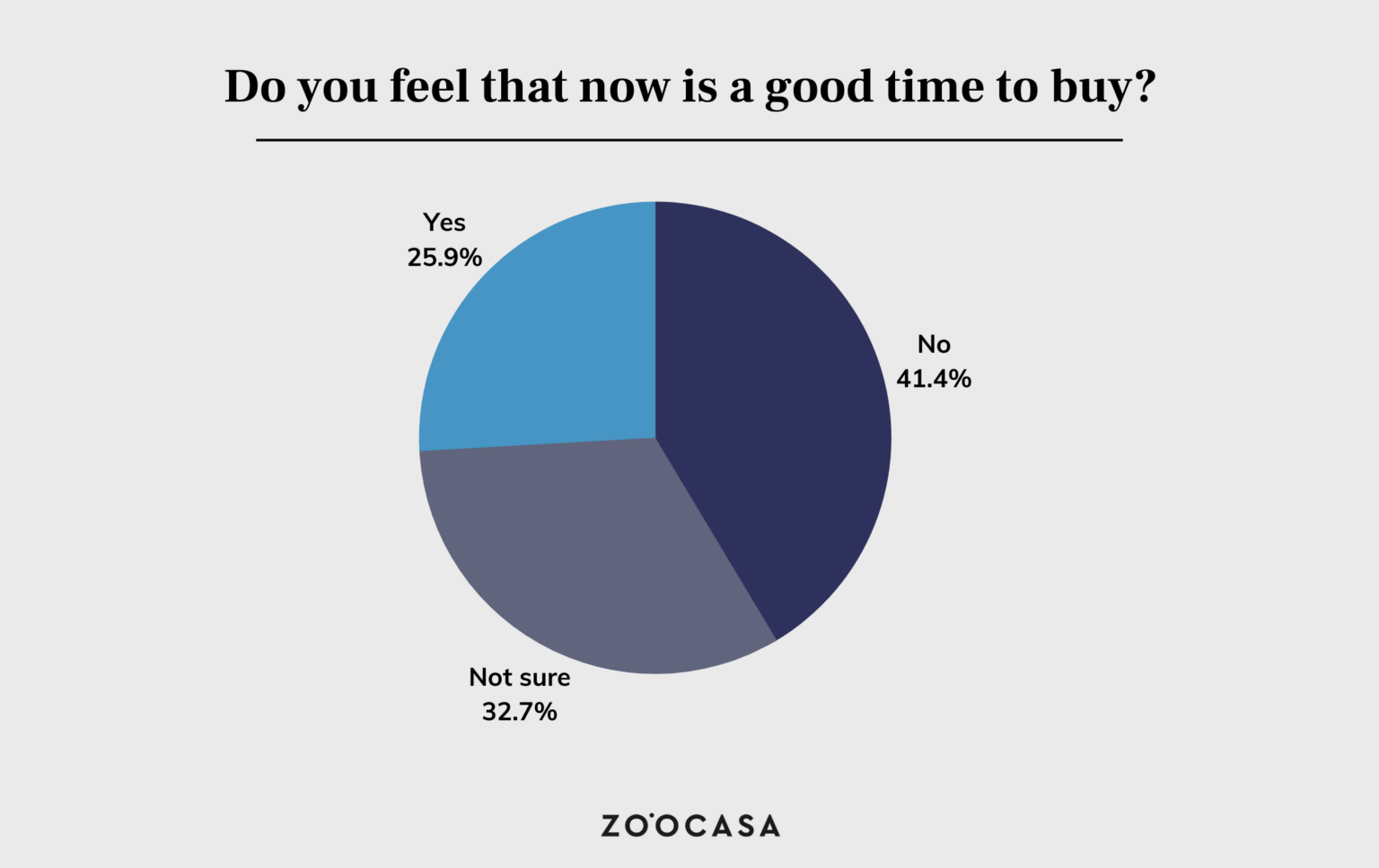

Also, home prices, which have skyrocketed over the past five years in all major Canadian markets (despite the country’s national benchmark price lowering over the last three months), are a likely reason most respondents (over 40 per cent) feel like now’s not the time to buy a home.

Source: Zoocasa

All hope not lost

These things aside, there are still motivated buyers to work with. Over half of respondents said they’ll be looking to purchase a home soon, including over 7 per cent planning to buy in 4-6 months and another 5.4 per cent over the next 1-3 months.

How does raising interest rates lower costs? Such an enigma.

All it does is increase the costs to manufacture and thereby shrinks the profit margin and the costs to consumer to purchase an item.

That’s how.

That doesn’t sound good for a capital based economy.

Look at housing.

The added interest costs to build

have maybe tripled. The buying power of a consumers have shrunk.

Buyers who paid big $$’s when buying and borrowed when rates were low are now faced with double mortgage pymnts and all their equity evaporated.

Now the banks maybe forced to foreclose as they take take a loss and can sue the borrower for the deficiency.

The poor borrower has lost his job because his companies operating line has doubled in costs along with material and service costs.

Wow so how does all this help?

Have grocery prices dropped? Has gas gone down? Has a loaf of bread gone down?

Do you ever get the feeling the Gov’t has no clue as to what they’re doing? They just love to induce financial pain to us.

So the governor of the bank of Canada had something to do.

Really what else does he do?

Their way of measuring inflation is flawed. Does not account for increased operating costs and scarcity of resources.

Nor decreased purchasing power of consumer.

I remember back in 1981 when rates hit over 20 % for maybe a few hours that one day but the damage it caused was colossal

In the end the Gov’t said “we really didn’t know what else to do”

Nothing has changed.

Supply and demand – supposedly higher interest lowers amount that can be borrowed in effect requiring house prices to drop in order to sell

Dear Jeff: It seems that you have no clue about what you are saying (like the Bank of Canada). Prices were increased even with less numbers of sales. Prices won’t go down.

Simply the market will be even slower than now. Sellers won’t be able to sell and buyers won’t be able to buy. Thanks to the government this is a classic “lose-lose” situation.

This is a proof that the people from Bank of Canada are worse than the COVID, not only because of the effect in the market but also because the masks are useless and there is no vaccine against them.

Jorge – Thankyou but It’s classical economics – doesn’t have to down immediately

agreed. Some people don’t understand the basic concept of “Economics 101”

Thankyou Sabine