CREA released their December statistics along with their hallmark annual optimism heading into January. The big question on everyone’s mind is whether or not that optimism is warranted moving into 2025’s real estate market.

CREA also seems to feel that we can see a resurrection of volume (the number of homes sold in 2025) without prices rising to the point of unaffordability.

I think they might be right. At this point, people are buying homes again because they can afford to. As long as that doesn’t change, 2025 should be a good year for Realtors, even if it’s not a good year for the homeowners hoping their house prices go up.

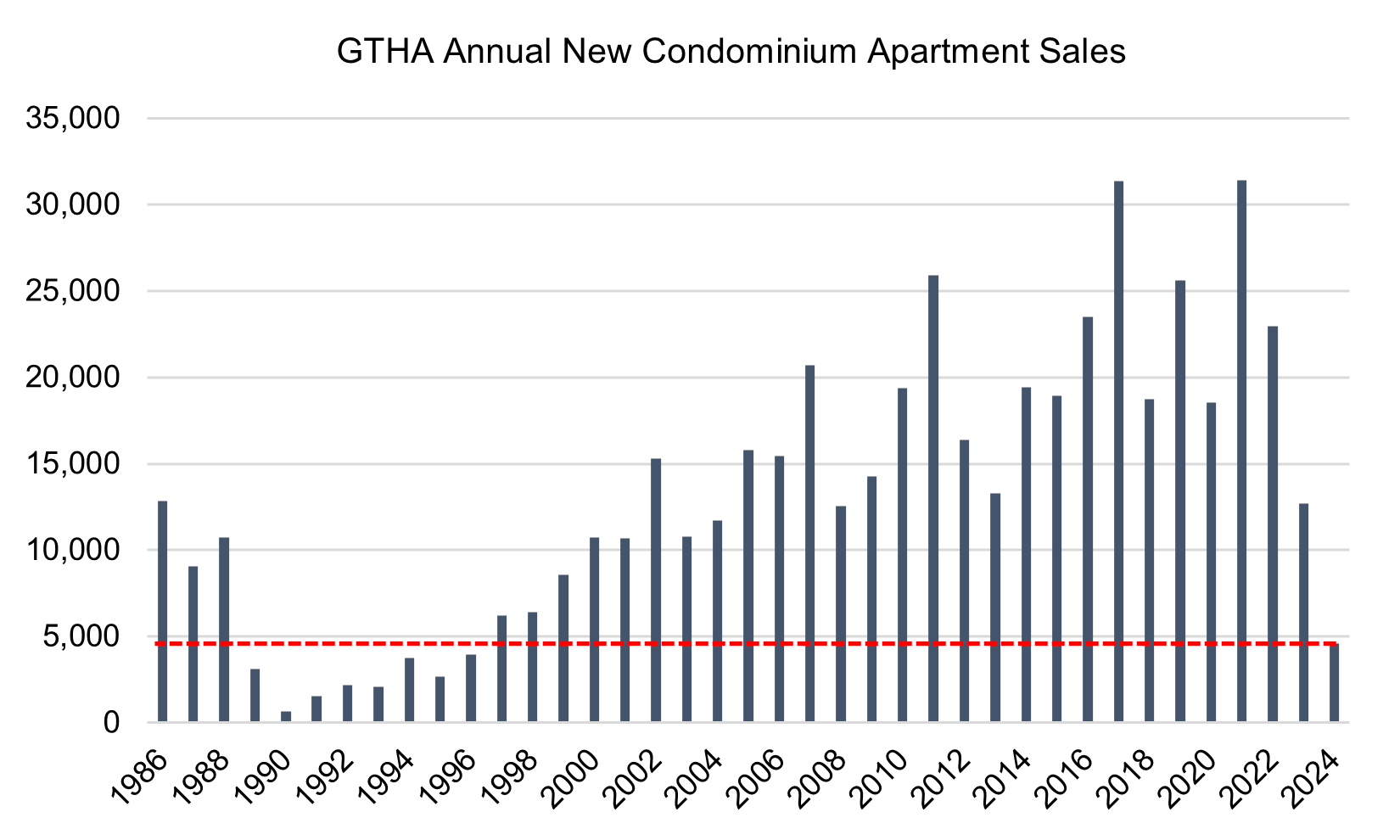

We should certainly hope to see some life in the resale market, given that new condo sales in 2024 were the lowest they’ve been since 1996, according to a recent report from Urbanation.

Source: Urbanation

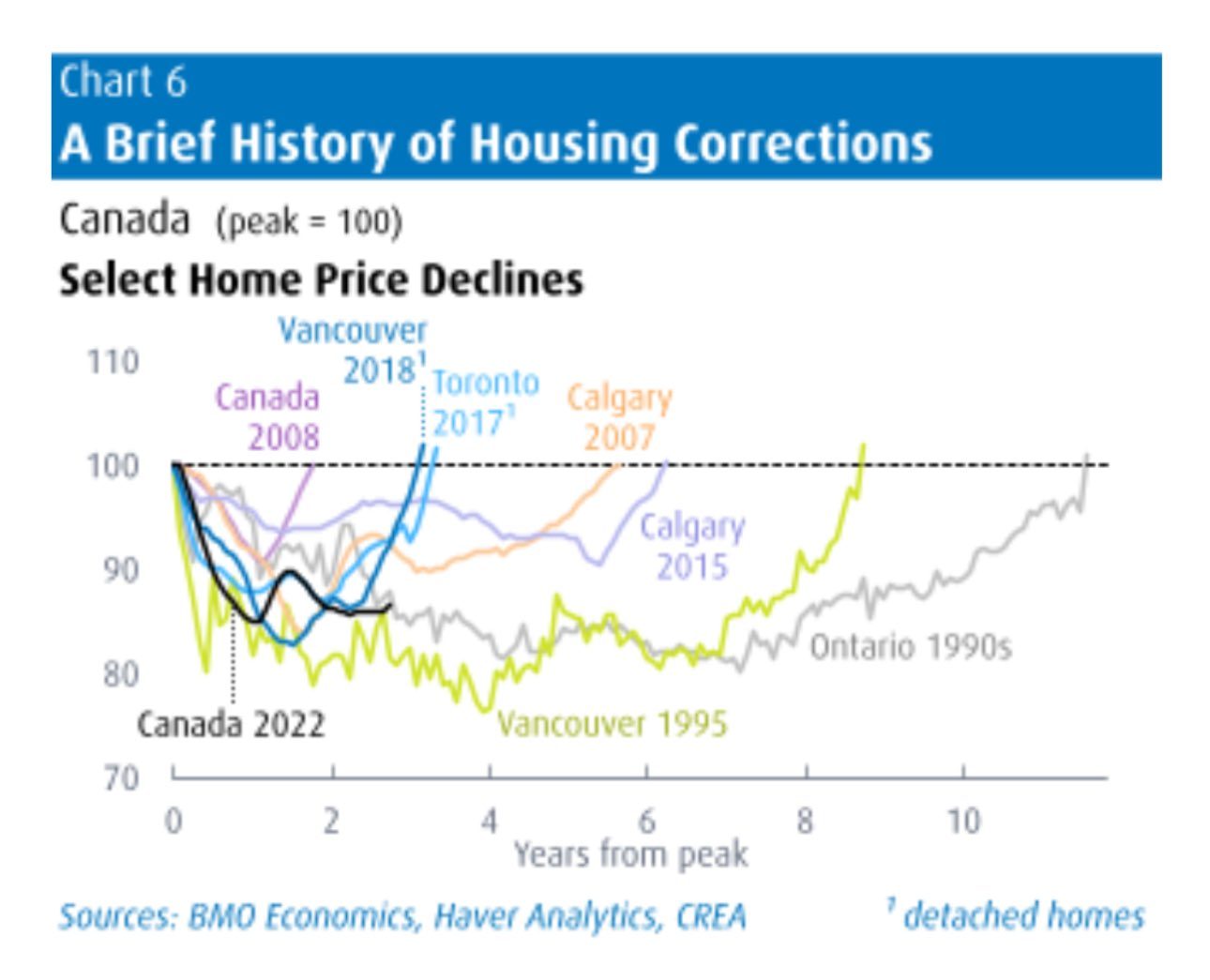

Should this housing correction continue along its path, it looks like we’re in about the third or fourth inning here, and it’ll be a while until we see house prices trend upwards again in a meaningful way. BMO recently visualized this in the excellent chart below.

As we close the books on 2024, it’s worth reflecting on the Canadian housing market’s performance, particularly during its quieter December period. After a remarkable fall rebound, the market saw sales activity dip 5.8 per cent in December compared to November.

At first glance, this might seem like a retreat, but dig deeper, and the picture tells a different story—a market poised for a potentially significant shift this coming spring.

Much like a second-period intermission, December’s slowdown feels more like a pause than an end. Despite the dip, sales were still 13 per cent above where they stood in May 2024, just before the Bank of Canada made its first interest rate cut in June.

In fact, the fourth quarter was among the strongest in the past 20 years (excluding the pandemic), showing the resilience of the Canadian housing market even amid affordability challenges and economic uncertainty.

A supply story, not a demand story

The narrative driving December’s cooling wasn’t a lack of buyers—it was a scarcity of homes for sale. Nationally, new listings fell 1.7 per cent month-over-month, marking the third consecutive decline after a September surge.

The result? A market where potential buyers found themselves facing limited options, even as affordability began to improve. Faced with this challenge, many buyers may have pushed their purchase to Spring 2025, which fuelled CREA’s belief in a “pent-up demand” scenario in the year’s first quarter.

The bigger question on my mind is whether or not we could see a “pent-up supply” scenario as well, given the market is facing a few key factors:

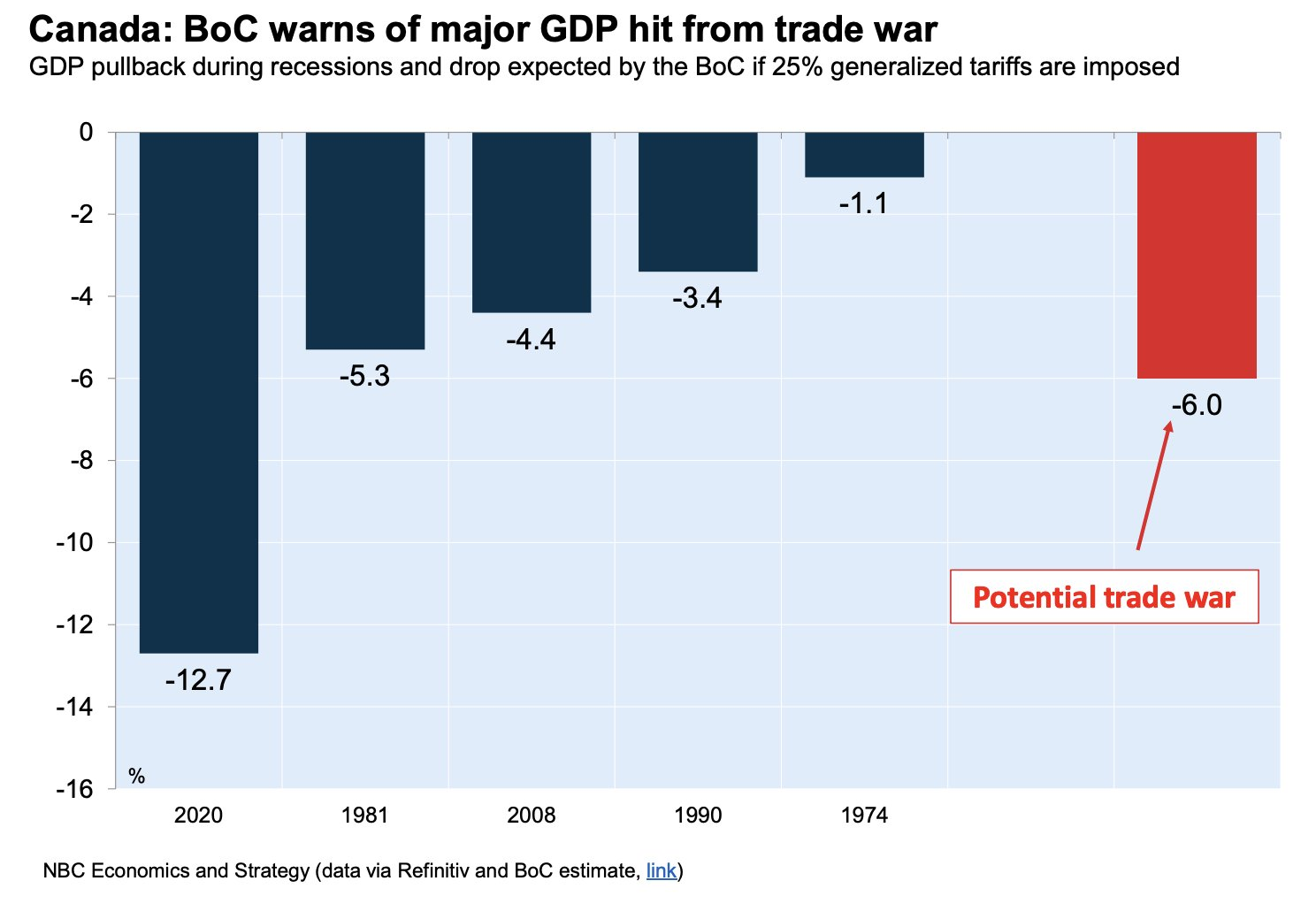

- The impact of a trade war (Bank of Canada is predicting as much as a -6 per cent impact)

- Rising unemployment (albeit surprisingly strong in December)

- A change in government that promises less government jobs and spending

- Increasing purpose-built rental supply competing with investors

- Historically high jump in supply from completions in 2024 and 2025

- A record number of mortgages renewing at higher interest rates

- To me, the pent-up supply argument could be stronger than the one for pent-up demand.

Absorption is normal, not “strong”

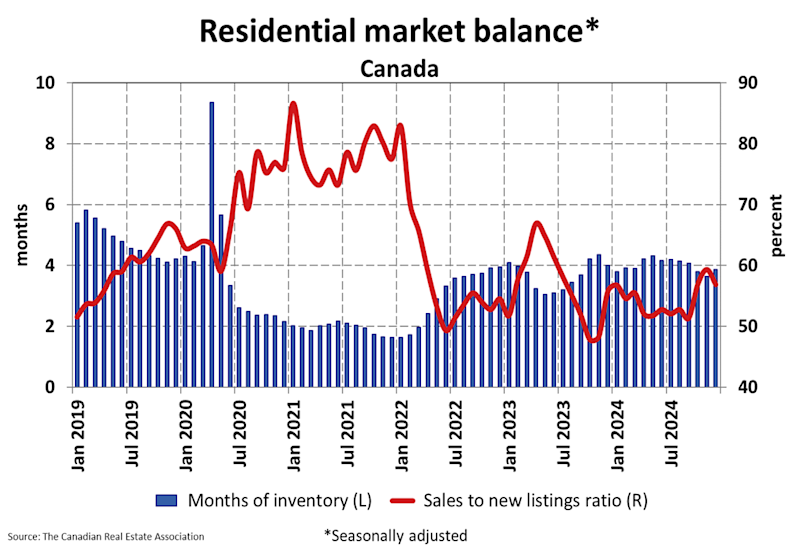

The national sales-to-new listings ratio, a key indicator of market balance, eased back to 56.9 per cent in December from a 17-month high of 59.3 per cent in November. For context, this figure hovers near the long-term average of 55 per cent, reinforcing the idea that we’re still in a relatively balanced market. Yet, with inventory levels well below historical norms—128,000 properties listed nationally, compared to a long-term average of 150,000—buyers remain at a slight disadvantage.

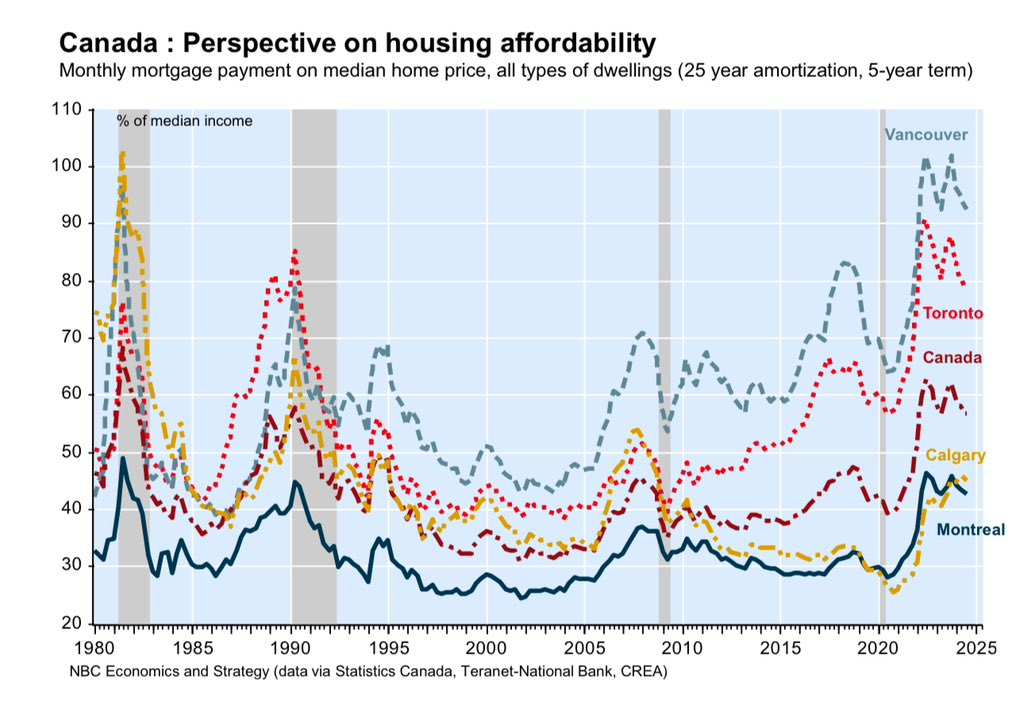

Affordability: A fragile silver lining

One of the more optimistic takeaways from CREA’s December data is the indication of modest improvements in housing affordability. Mortgage payments as a percentage of income (MPPI) have begun to decline, supported in part by the Bank of Canada’s interest rate cuts earlier in the year. This relief has allowed more buyers to consider entering the market, particularly in regions where prices have stabilized.

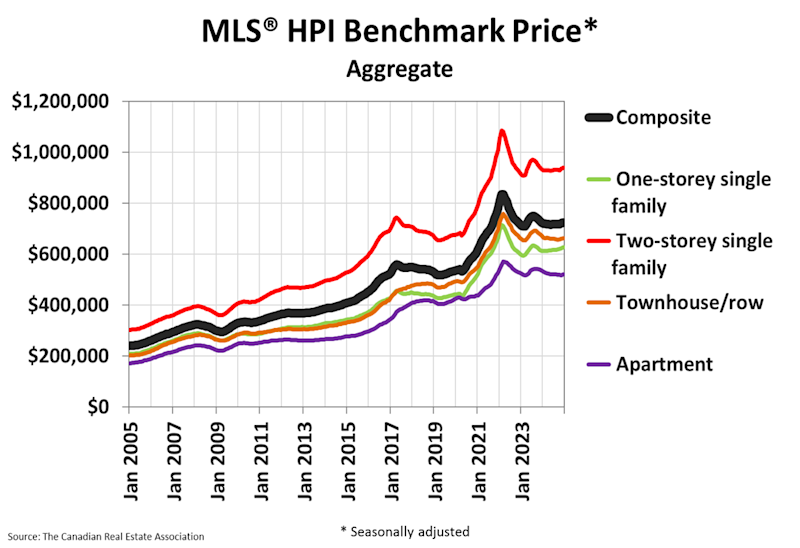

However, this silver lining comes with caveats. The national average sale price rose 2.5 per cent year-over-year to $676,640, and the MLS HPI edged up 0.3 per cent month-over-month. While these price increases are smaller than those seen in previous years, they could still erode the modest affordability gains if household incomes do not keep pace. In short, any improvement in affordability remains precarious.

Adding to the uncertainty are broader economic pressures. Rising unemployment and potential government hiring cuts loom as risks that could dampen affordability this year. These factors may offset the positive effects of declining mortgage payment costs, particularly if interest rate cuts slow or stall.

The forecast remains uncertain: will sustained rate reductions and stable home prices bolster affordability, or will economic pressures push it further out of reach for many Canadians? For now, the improvements in affordability offer a glimmer of hope, but the coming months will reveal whether that hope is sustainable or fleeting.

The role of inventory in 2024’s narrative

A closer look at inventory trends highlights why 2024’s market defied expectations in certain months while tapering off in December. After peaking in September, new listings steadily declined over the fall, creating a bottleneck that frustrated buyers eager to capitalize on improved affordability. By December, there were just 3.9 months of inventory on the market—a slight increase from November’s 3.6 months but still well below the long-term average of five months.

This constrained inventory helped keep prices relatively stable, even as sales activity slowed. Sellers, wary of accepting lower offers, chose to hold firm or delay listing altogether, contributing to a stalemate in the market. This dynamic was particularly evident in urban centers like Metro Vancouver, where the market displayed modest stability with a 0.7 per cent month-over-month price increase and steady demand. The limited flexibility in prices on both sides reflects the cautious behaviour of buyers and sellers alike, highlighting the ongoing challenges of navigating a market shaped by tight inventory.

Spring 2025: The perfect storm for a demand surge?

Looking ahead, spring 2025 could mark a turning point. As snow melts and sellers bring new properties to market, demand is expected to unleash in a big way. Historical patterns suggest that real estate springs to life earlier than anticipated, and this year should be no different.

CREA anticipates a notable uptick in activity for 2025, with an estimated 532,704 residential properties expected to change hands through Canadian MLS—a substantial 8.6 per cent jump over 2024. Shaun Cathcart, CREA’s senior economist, predicts that the anticipated bottoming out of interest rates will encourage more sellers to list their homes, further fueling the surge in activity.

The market conditions brewing this spring could create opportunities not seen in years, particularly if affordability continues to improve.

How interest rates shape the 2025 outlook

Interest rates remain the wild card. The Bank of Canada’s decision to cut rates in June 2024 provided a much-needed boost to affordability, but further reductions will be critical to sustaining momentum. Lower interest rates could not only draw more buyers into the market but also encourage sellers to list properties that were previously held back due to unfavourable market conditions.

However, the timing and scale of rate adjustments will play a pivotal role. A delay in cuts could dampen the anticipated spring surge, while aggressive reductions could reignite fears of another housing bubble. Policymakers will need to strike a delicate balance to support market stability without overcorrecting.

The long road to balanced housing

Despite the promise of greener pastures, structural challenges in the Canadian housing market remain unresolved. Inventory levels are still below historical averages, and the gap between buyer expectations and seller realities shows no signs of closing quickly.

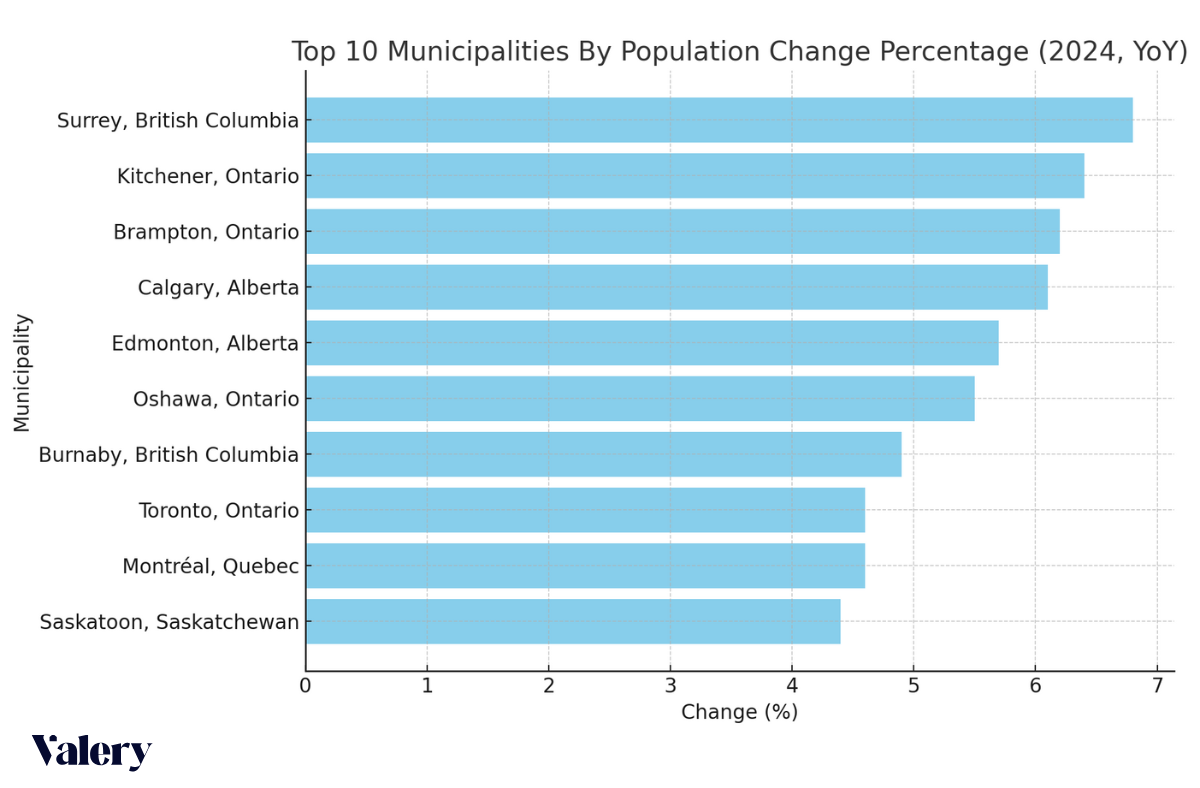

Adding to these challenges, recent announcements regarding reductions in immigration targets could have a significant impact on housing demand. Canada has relied heavily on immigration to drive population growth, which in turn fuels housing market activity. With immigration levels curtailed, the anticipated surge in demand may soften, potentially easing pressure on housing supply but also creating uncertainty for developers and long-term market stability. Lower immigration could temper price growth in some regions, but it also risks stalling construction projects and reducing economic momentum tied to new arrivals.

The chart below highlights the municipalities with the highest population changes in 2024 compared to 2023, a trend heavily influenced by the surge in international students. This demographic has significantly contributed to local rental and housing demand. Such growth may not be as pronounced in the coming years.

Source: valery.ca

What December tells us

While December 2024 wasn’t the blockbuster end to the year some might have hoped for, it offers valuable insights into the market’s current state and future trajectory. Inventory levels remain tight but are improving, prices are stabilizing, and the balance between buyers and sellers is holding steady.

The question lingers: will the spring market deliver the long-awaited relief buyers crave, or will it usher in another cycle of rising prices? One thing is clear—2024 stands as a transitional year—neither a full recovery nor a complete correction. It offered glimpses of stability but left plenty of unanswered questions for 2025.

The calm before the storm? Perhaps. But in Canadian real estate, the only constant is change.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.