Don’t miss out—join us online for REM’s monthly market breakdown on April 22 at 2 PM Eastern. REM, columnist Daniel Foch will analyze CREA’s latest stats, market slowdowns, and what shifting buyer sentiment means for Realtors ahead of the federal election. It’s free, no strings attached—register here.

If there’s one lesson March 2025 teaches us about the Greater Toronto Area real estate market, it’s this: gravity isn’t always a bad thing. After years of frenzied growth, soaring prices, and buyer competition that defied fundamentals, the market has begun a pretty serious descent in response to two key uncertainties in Canada’s market:

- Donald Trump’s tariffs; and

- The Canadian election taking place on April 28th.

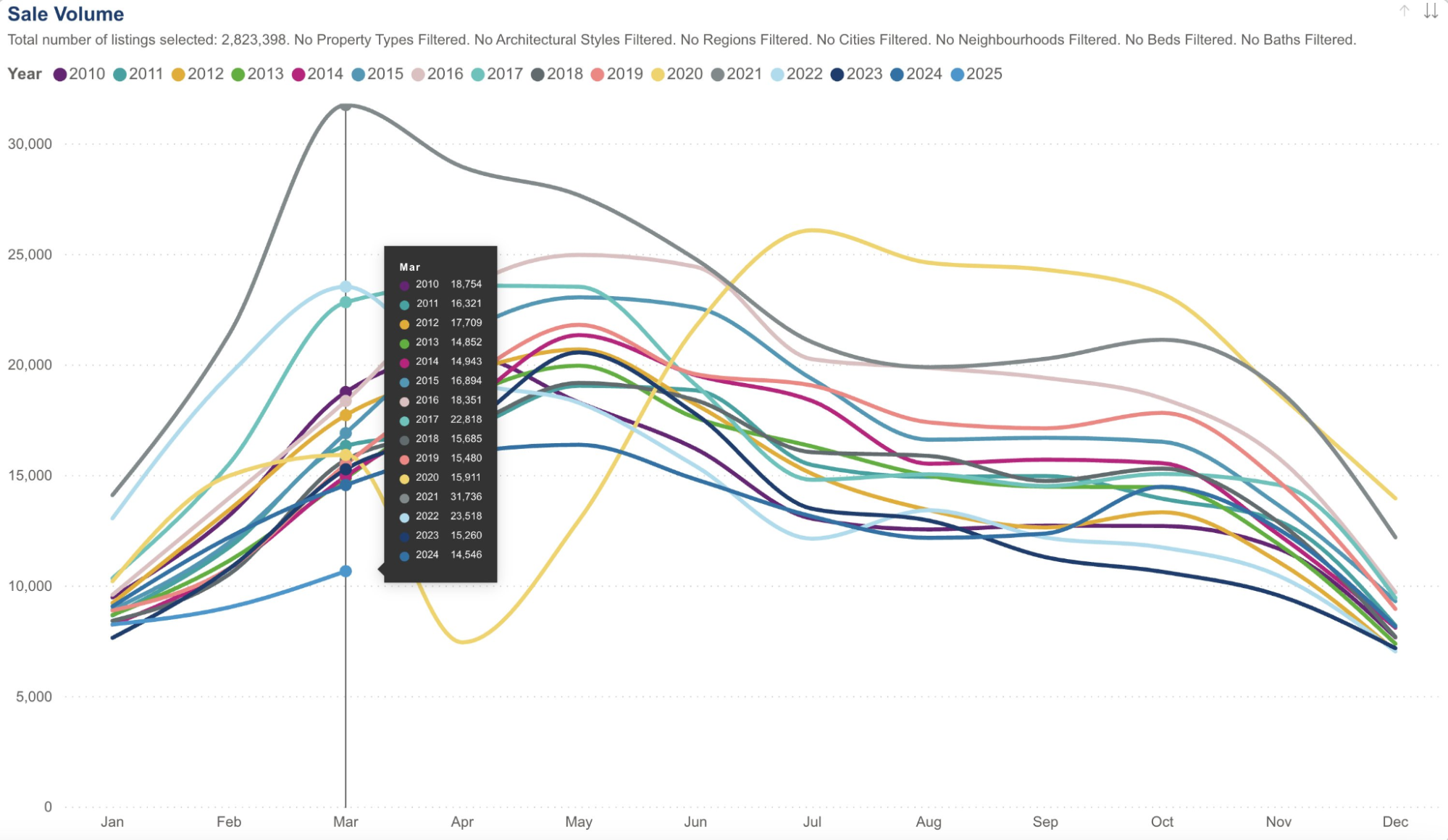

But here’s the thing; a little bit of “pause and reflect” might be exactly what the market needs. February hinted at the shift, with declining sales, easing prices, and growing hesitation among buyers. March has only made that reality more pronounced. This is, in fact, the slowest spring market we’ve seen since the 1990s.

Source: TRREB, The Habistat

This isn’t a collapse, but a necessary recalibration—a sentimental pause that reflects caution, but not yet crisis.

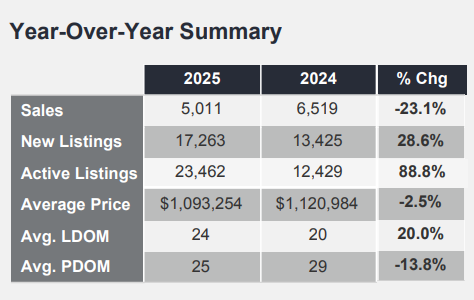

According to the latest figures from the Toronto Regional Real Estate Board (TRREB), sales were down significantly year-over-year, falling by 23.1 per cent. That may sound ominous, but the deeper story is far less dramatic.

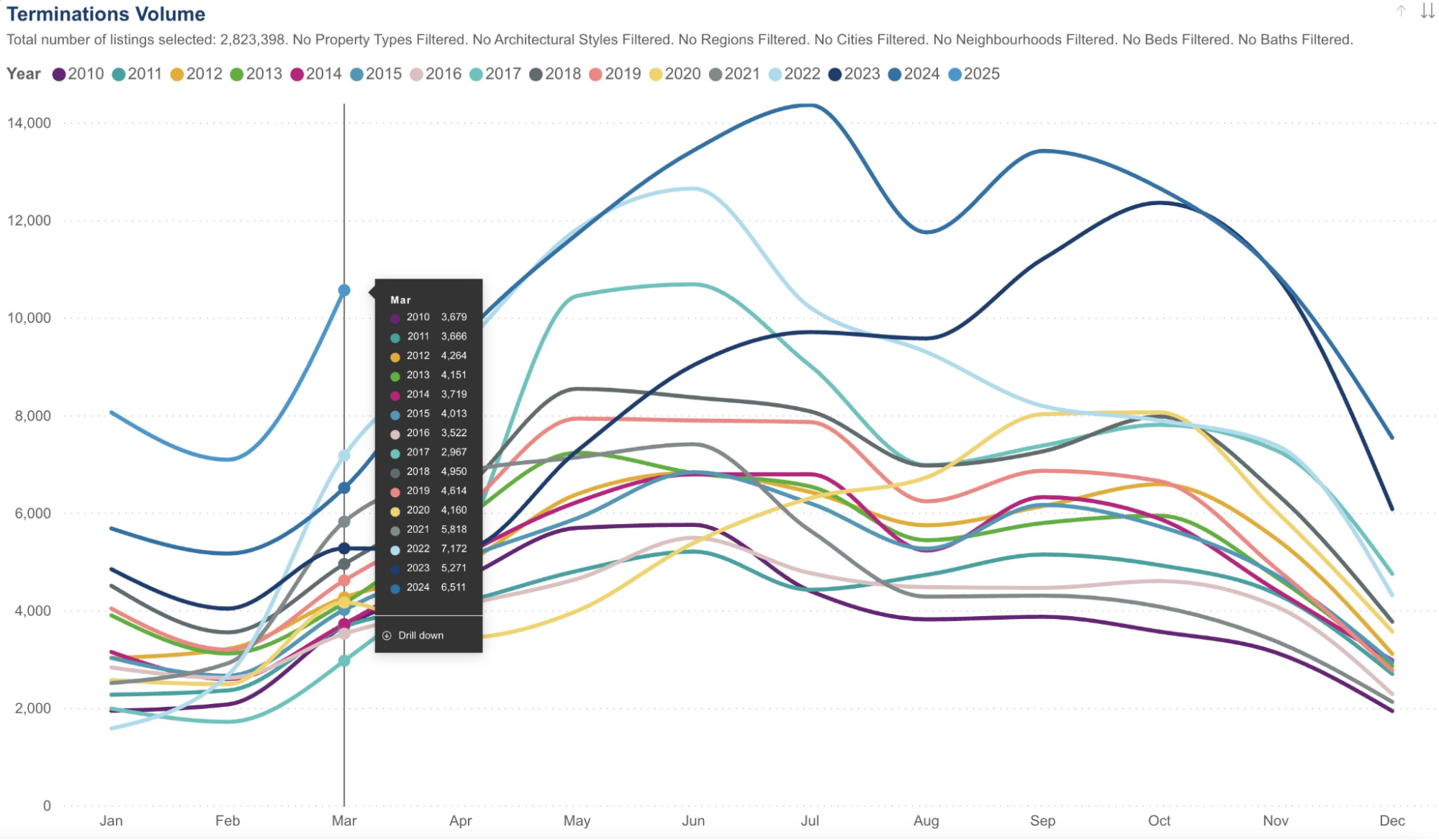

In fact, it’s rooted in something remarkably rational: buyers are pausing, not disappearing. And they’re doing so in response to the two aforementioned forces that define our current economic landscape. Just as we saw the market hit “pause” in November during the US election, buyers are patiently waiting to see what type of economy they’ll own property in. Sellers are equally confused, terminating listings at the highest rate we’ve ever seen.

Source: TRREB, The Habistat

Affordability is making a modest comeback

For the first time in several years, affordability is not only improving—it’s becoming a theme. The average sale price across the GTA clocked in at $1,093,254 in March, down 2.5 per cent from the same period last year. The MLS Home Price Index Composite benchmark fell 3.8 per cent year-over-year, a signal that price softening is no longer confined to specific neighbourhoods or housing types—it’s systemic.

TRREB President Elechia Barry-Sproule captured the mood succinctly in TRREB’s monthly market report: homeownership is gradually becoming more attainable. With more inventory on the market, less upward price pressure and expectations of interest rate relief in the months ahead, buyers are regaining something they haven’t had in years—negotiating power. And that shift, while subtle, could have profound consequences for how this market behaves going forward.

The psychological stalemate

If March feels muted, it’s because the market is holding its breath. Policy ambiguity—whether around tariffs, employment or housing—is giving households pause. When consumer confidence falters, so does the willingness to commit to long-term debt.

But this psychological limbo isn’t permanent. The fundamentals—population growth, immigration and housing demand—haven’t changed. What has changed is the emotional tenor of the market. Gone is the “fear of missing out” that defined the pandemic-era run-up. In its place is a kind of measured hesitancy. Buyers want to see where interest rates land, how the federal platforms shake out and whether job security can be taken for granted again. Until then, many are content to wait.

Supply is rising, and that’s a good thing

While buyer activity has cooled, supply is gaining ground. New listings surged 28.6 per cent year-over-year to 17,263, and active listings rose to 23,462—a whopping 88.8 per cent increase in supply compared to last year. This shift is a healthy development in a market that could be creating a pent-up demand scenario while buyers wait on the sidelines. Should buyers decide to return to the market after the election, they’ll have a lot of options to choose from.

A functioning market isn’t one where homes vanish in two days with twenty bids—it’s one where buyers have choices, sellers must justify their pricing, and balance begins to return. In fact, March’s sales-to-new listings ratio landed at just 36.6 per cent—firmly in buyer’s market territory—highlighting how today’s conditions are giving buyers more room to move, even if many are choosing to wait.

With this added inventory has come a natural rebalancing. Homes are taking longer to sell—the average days on market (LDOM) rose from 20 to 24—and pricing is far more elastic. Sellers who cling to 2021 pricing expectations are being met with silence. Those who understand the moment and list accordingly are still moving product. In this new landscape, presentation, precision, and patience matter.

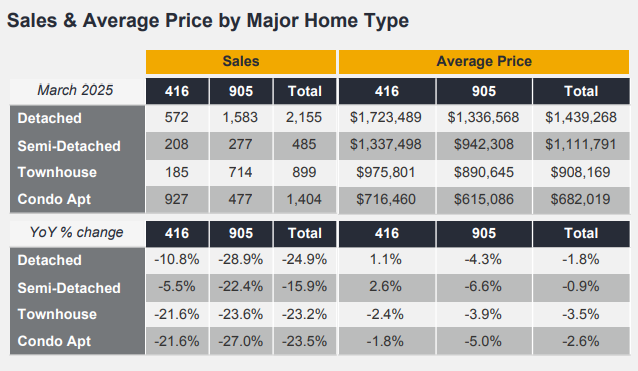

How different housing types are absorbing the slowdown

The price movements, though broadly downward, reveal subtle shifts in how different buyer groups are responding to current conditions. Detached homes continue to dominate in both price and prestige, averaging $1.44-million. Semi-detached properties settled at $1.11-million, townhomes at $908,000, and condos at a more accessible $682,000 (all figures rounded). But it’s in the sales activity—not pricing—where a more revealing story unfolds. Detached homes saw a 24.9 per cent drop in sales year-over-year. Condos followed closely, falling 23.5 per cent. Townhouses and semis experienced similar declines.

What this suggests is that the pullback is not being driven by any one segment, but rather by a shared sense of hesitation across the board—a kind of cross-demographic caution. But notably, the sharp drop in detached activity may reflect the pause of move-up buyers, many of whom already hold significant equity but are waiting for clearer economic signals before trading up. Meanwhile, condo activity cooling implies first-time buyers are still constrained by financing costs. In both cases, the slowdown speaks more to sentiment than structural weakness.

What’s next: All eyes on the Bank of Canada—and Parliament Hill

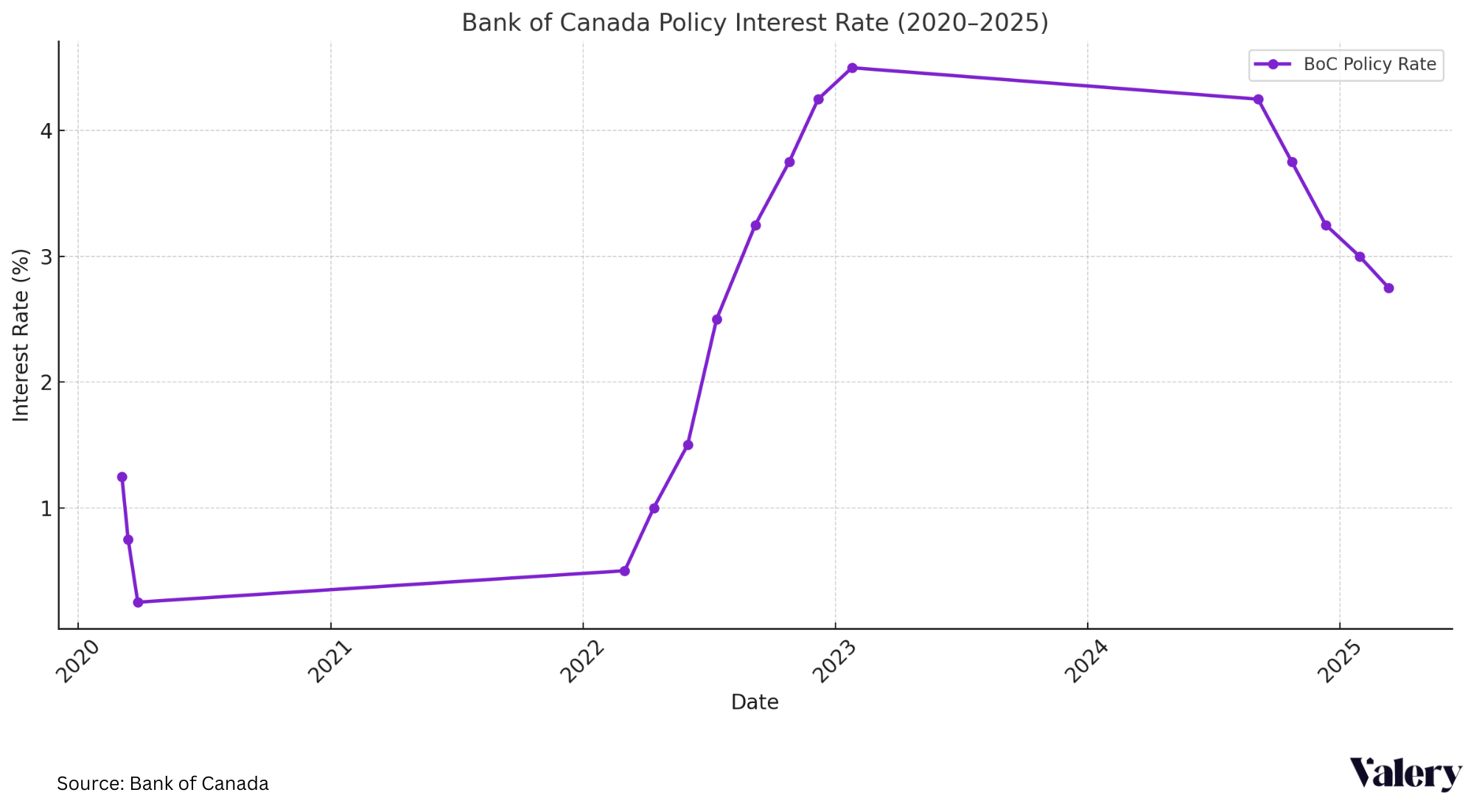

Interest rates remain the most critical variable shaping the market’s immediate trajectory. In March, the Bank of Canada reduced its target overnight rate to 2.75 per cent. While this reduction does not return us to the ultra-accommodative policies of the early 2020s, it represents a meaningful adjustment aimed at stimulating economic activity amid ongoing trade uncertainties (see chart below).

The other wildcard is political. As the federal election approaches, housing has re-emerged as a top-tier issue across party platforms. Voters are demanding bold action on supply, affordability, and taxation. And while the policy specifics remain fluid, the message from the public is clear: housing is no longer a personal challenge—it’s a national one.

This is the market we asked for

The GTA real estate market is no longer in overdrive—and that, frankly, is a relief. In February, TRREB flagged signs of moderation: slower sales, stable-to-declining prices, and growing inventory levels. March has simply confirmed that the shift is real.

After a decade of volatility, the current conditions—stable prices, increased supply, and longer selling windows—feel less like a downturn and more like a long-overdue correction. Buyers are cautious but curious. Sellers are realistic or becoming so. And the industry is learning how to operate without the crutch of cheap money.

This isn’t the market of the past five years. It’s the market we’ve needed. Balanced. Deliberate. Sober. And very possibly, the foundation for a more sustainable chapter in GTA housing.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

r.e. Chat talked about this on Feb the 20-25th.

I’m glad to see you got your TRREB episode out so quickly

The Spring Market was/is Prorogued!

The ban on foreign buyers is not helping.

Great article and perspective.

Cyclical economic rebalancing for a variety of reasons……

Comedy at its best. “Finding it Footing” Yes when it hits rock bottom it will find footing. Nothing here to support any of the predictions. No facts. But the facts are. Immigration has had a change in policy, unemployment is on the rise in Canada, the teriff battle is just beginning, affordability with the average price rang of One Million dollars cannot be considered affordable. Property owners unable to sell because they are underwater and cannot sell below a certain price. These properties will sit on the market until they go power of sale. Banks have already stated that an independent contractors or business owners will have a much harder time qualifying for financing. Building is very expensive now and with teriffs it will just get worse. Headlines such as “Canadians will have to brace for the worst” and “There will be no quick recovery ” do not indicate any improvement in the real estate market. One point I will agree on is in a market that sales and values are dropping those that want to sell and have enough equity in their homes to sell today, should sell. Price for this market and you will sell. In a rising market it is easy in a falling market it is better to take what you can get today as it may only be lower next month. The Canadian election has very little to do with the current real estate market. It is either going to be a Conservative or Liberal Government. So not much will change. Different stripes but the same animal.