During Q4 of 2023, the aggregate Canadian home price increased 4.3 per cent year-over-year to $789,500, Royal LePage reports in its House Price Survey. Quarter-over-quarter, the national aggregate home price decreased by 1.7 per cent, which illustrates that higher borrowing costs still impact market activity.

“I believe the narrative suggesting that the housing market will rebound only when the Bank of Canada lowers rates misses the mark,” Phil Soper, president and CEO of Royal LePage, notes. “The recovery will begin when consumers have confidence the home they buy today will not be worth less tomorrow. We see that tipping point occurring in the first quarter, before the highly anticipated easing of the Bank of Canada’s key lending rate.”

Price changes by housing type

The national median price of a single-family detached home went up by 4.4 per cent year-over-year, to $816,100, while the median price of a condominium increased by 4.0 per cent year-over-year to $583,900. Quarter-over-quarter, the median price of a single-family detached home went down by 2.1 per cent, while the median price of a condominium declined by just 0.6 per cent.

“Canadian consumers are moving through a period of transition and as a result, so are the dynamics of our national housing market,” Soper adds. “Buyer sentiment can have as great an impact on market trends as inventory or interest rates. Early market recovery will be sparked by signs of home price stability, and we are very close to that now.”

How current aggregate price stacks up to prior quarters

The aggregate price of a home in Canada is 7.9 per cent below the peak, which was hit in 2022’s first quarter.

But, the national aggregate home price sits well above pre-pandemic levels: 2023’s fourth quarter aggregate price was 18.7 per cent higher than the same period in 2020, and 22.2 per cent higher than the same period in 2019.

“People are working, with unemployment particularly low among the key 25 to 55-year-old demographic. Discretionary spending is down and savings levels are materially higher than normal. Nearly two years after the Bank of Canada began raising rates, mortgage delinquency remains at historic lows. We believe many who need housing have the capacity to enter the market, they simply lack the confidence to transact,” Soper explains.

Calgary stood out from the pack

While prices decreased slightly throughout Canada over the last half of 2023, Calgary went against the grain with an upward price trajectory. Calgary is the only major region reported with a quarter-over-quarter aggregate price gain (of 1.5 per cent), and the city had the highest year-over-year price jump (of 10.7 per cent).

Sales and inventory

According to the Canadian Real Estate Association (CREA), months of inventory have increased compared to extreme lows during the pandemic. But, it still remains below typical historical levels.

In Q4 of 2023, there was slightly over four months of inventory available nationwide, compared to under two months at the end of 2021. It contrasts even more with the five and six months of supply in 2018 and 2019’s first half.

“Over the last year and a half, we’ve seen a drop in sales activity in most of Canada’s major real estate markets, while inventory levels have gradually increased. Yet, we know the number of homes available remains well below what we need today and will continue to need in the future. The fundamental shortage of housing supply in this country will inevitably put upward pressure on home prices when temporarily sidelined buyers return to the market in the months ahead,” Soper says.

Changing borrowing costs and mortgage renewals

In December, the Bank of Canada again held its key lending rate at 5.0 per cent, indicating the campaign of rising interest rates has likely ceased. The central bank is even expected to slightly cut rates later this year, and some major financial institutions are currently offering fixed-rate mortgage discounts.

“The Bank of Canada governing council will soon face the difficult task of trying to balance the lowering of interest rates without simultaneously stimulating spending, which would cause inflation to rise again,” Soper notes.

The Consumer Price Index rose 3.1 per cent year-over-year in November, which was the same jump as the month prior. Without the costs of mortgage interest in the index’s formula, this means inflation is at 2.2 per cent, which is near the Bank of Canada’s rate target.

Soper weighs in: “In Canada, we purchase homes with short-term mortgages of five years or less, in contrast to the situation in the U.S. where much longer 30-year terms are the norm. In a typical year, 25 per cent of our mortgages turn over.

Consequently, during the period from 2023 to 2025, most homeowners in Canada will have transitioned to higher mid-single-digit borrowing. We will be required to adapt quickly, positioning our industry on a path to recovery more quickly than in the U.S. where the prospect of losing a below-market rate will act as a deterrent to moving.”

Almost half of outstanding Canadian mortgages, about 2.2 million households, are up for renewal this and next year (as the Canada Mortgage and Housing Corporation reports), and most will be at a much higher rate.

“Similar to what we witnessed last spring when the Bank of Canada paused rates for the first time in a year, causing sales activity and prices to increase almost immediately, the first sign of rate cuts – even if only by 25 basis points – could create a flurry of activity in the real estate market, releasing pent-up demand. Those who have been holding off listing their homes will follow close behind,” he predicts.

2024 forecast

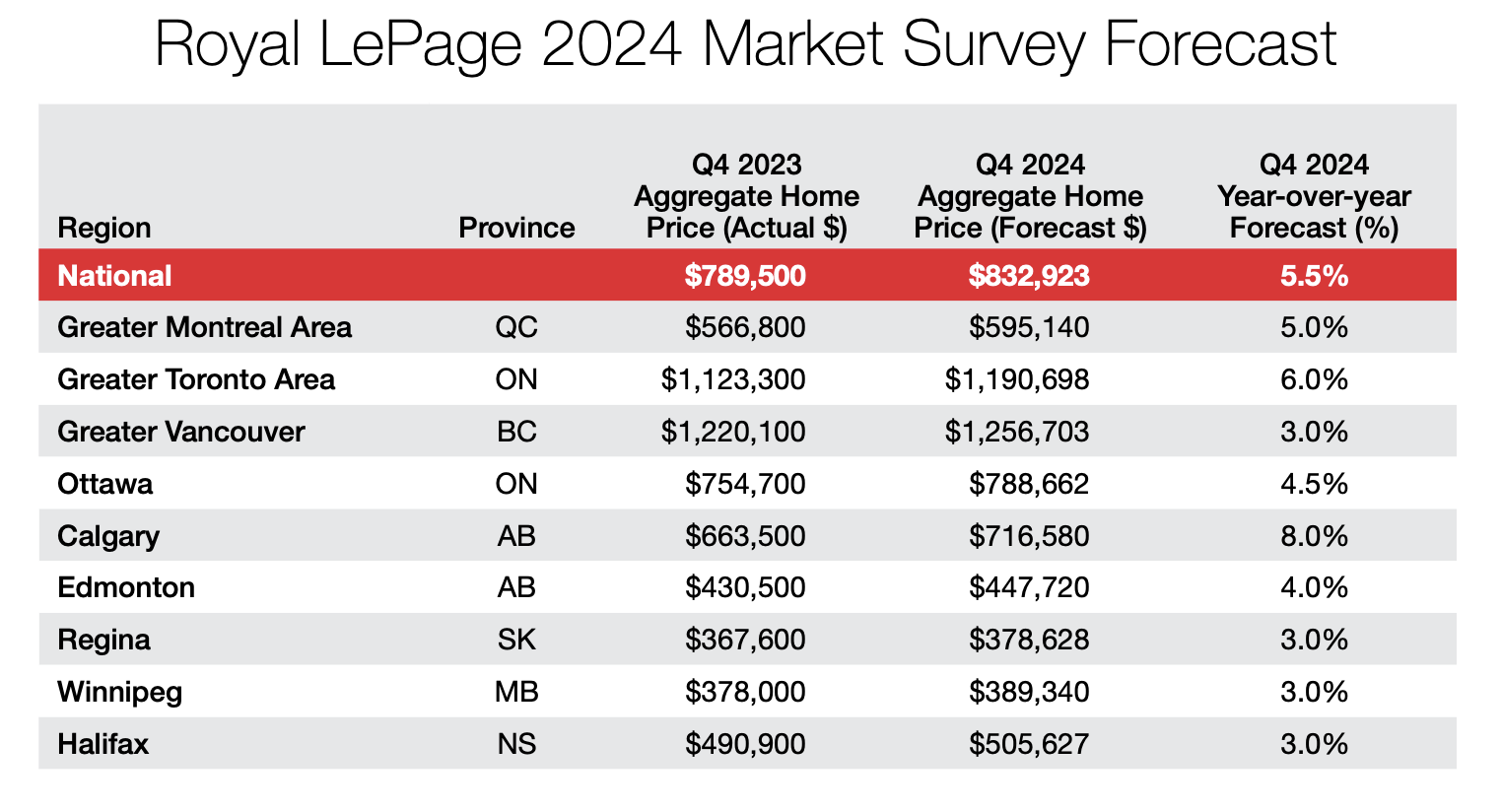

Royal LePage’s 2024 Market Survey Forecast, issued last month, projects the aggregate Canadian home price will rise by 5.5 per cent in the final quarter of this year, compared to the same time during 2023.

The company forecasts home prices will rise modestly over the first half of the year, with larger increases during the last half thanks to more activity post-interest rate cuts. (This is assuming there will be no further interest rate hikes and that the key lending rate will remain at 5.0 per cent throughout early 2024.)

Review the full survey, including regional summaries, here.

I agree w Mr Soper, but I wish he had re-phrased it as:

““I believe commentators are missing the mark when they reinforce the narrative that the housing market will rebound ONLY when the Bank of Canada lowers rates””

The Market’s 5 segments all are sitting on the sidelines awaiting the BEST time to buy-at-advantage or sell-at-advantage.

In fact they are sitting ANTICIPATING when and how they can ‘pounce’ just before the trend they are awiting becomes widely apparent.

It’s human nature. Self-interest.

And Self-Interest Prevails

Sadly this opportunistic pouncing-by-pouncers was proved wrong in Jan 15, 2022, Feb 2022 & March 2022 in anticipation of a return-to-boom Spring Market after 3 pauses by the B of Cda.

The only question that remains is whether THAT lesson stuck.

Look up Don’t Fight the Fed – a Stock Market expression.

The Five categories:

-First Time Buyers

-Last Time Sellers

-Sell to Buy Consumers

-Investor-owners who are Underwater’

-Investor-owners who are In The Money

I agree w Mr Soper, but I wish he had re-phrased it as:

““I believe commentators are missing the mark when they reinforce the narrative that the housing market will rebound ONLY when the Bank of Canada lowers rates””

The Market’s 5 segments all are sitting on the sidelines awaiting the BEST time to buy-at-advantage or sell-at-advantage.

In fact they are sitting ANTICIPATING when and how they can ‘pounce’ just before the trend they are awiting becomes widely apparent.

It’s human nature. Self-interest.

And Self-Interest Prevails

Sadly this opportunistic pouncing-by-pouncers was proved wrong in Jan 15, 2022, Feb 2022 & March 2022 in anticipation of a return-to-boom Spring Market after 3 pauses by the B of Cda.

The only question that remains is whether THAT lesson stuck.

Look up Don’t Fight the Fed – a Stock Market expression.

The Five categories:

-First Time Buyers

-Last Time Sellers

-Sell to Buy Consumers

-Investor-owners who are Underwater

-Investor-owners who are In The Money

Not sure of the math here. But proves you can do anything using averages. On the front lines I do not see price increases only properties sitting on the market for longer periods of time or not selling at all. and when they sell they are selling below the asking prices. Properties will sell when values drop to levels that buyers can afford regardless of interest rates. Sellers in distress will have to lower asking prices to facilitate sales. I see this early this year. Sellers listing a prices well below the averages of the last two years to sell the property. This establishes the values. I have yet to read a market prediction by a real estate company that predicts values to drop. It always values are going up. With inflation increasing over December I do not see any rate cuts in the near future. It may be more likely we continue on in this recession. Another fact the Feds keep fudging. The fact that Canada has been in a recession since the spring of 2023.

Averaging should be abandoned. It never shows true picture.