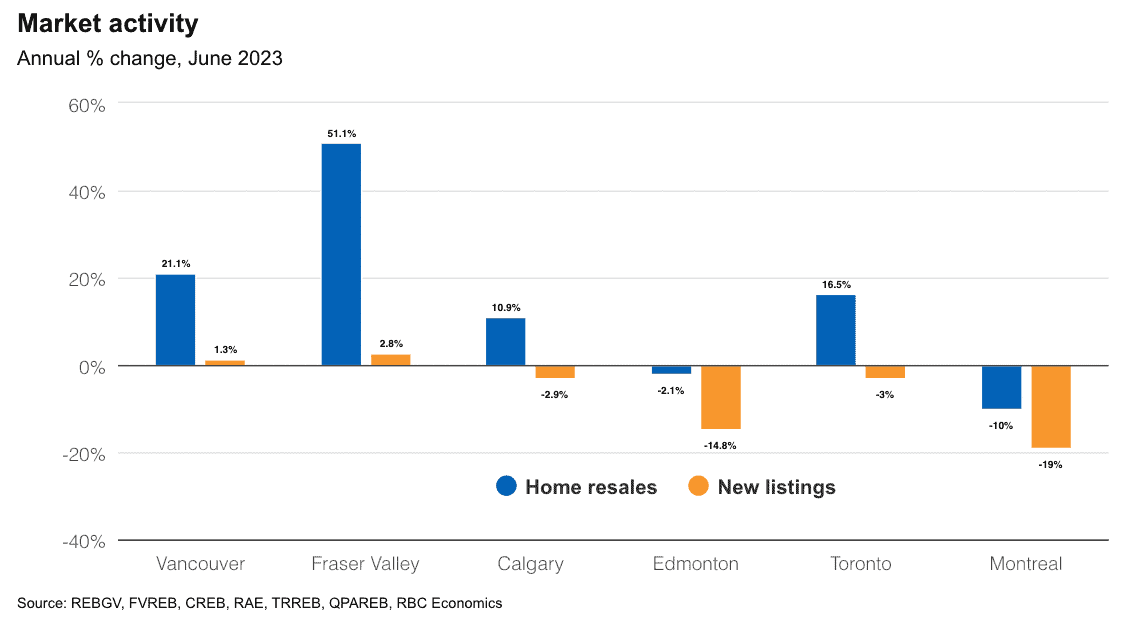

RBC Economists Robert Hogue and Rachel Battaglia looked at the country’s largest markets. They found that buyers retreated in cities such as Toronto, Hamilton, Ottawa and Vancouver. While they remained seemingly undeterred in the Fraser Valley, Calgary, Edmonton and Montreal, according to early reports from real estate boards.

The contrasting responses may be attributed to strong price gains observed in the spring, particularly in Toronto, Vancouver, and other parts of Ontario and British Columbia, which the economists believe might have “spooked” some buyers.

Increase in supply across markets

The good news, however, is that the supply of homes for sale continues to rise across major markets. RBC Economics’ estimations indicate that more homes became available for sale in every major market last month, following substantial increases in May.

Despite the growing supply, upward price pressure has yet to be significantly eased. If sustained, experts expect the pace of property appreciation to slow in the coming months.

“We’ve been surprised by the speed with which some markets (e.g., Toronto and Vancouver)rebounded this spring,” stated Hogue. “Our view had been—and in fact remains—that the initial stage of the recovery would be gradual in the face of massive ongoing affordability challenges. Buyers retreating in key markets in June could be a sign that the future trajectory will be more measured.”

Here’s a closer look at RBC Economics’ analysis of the state of housing markets in key Canadian cities:

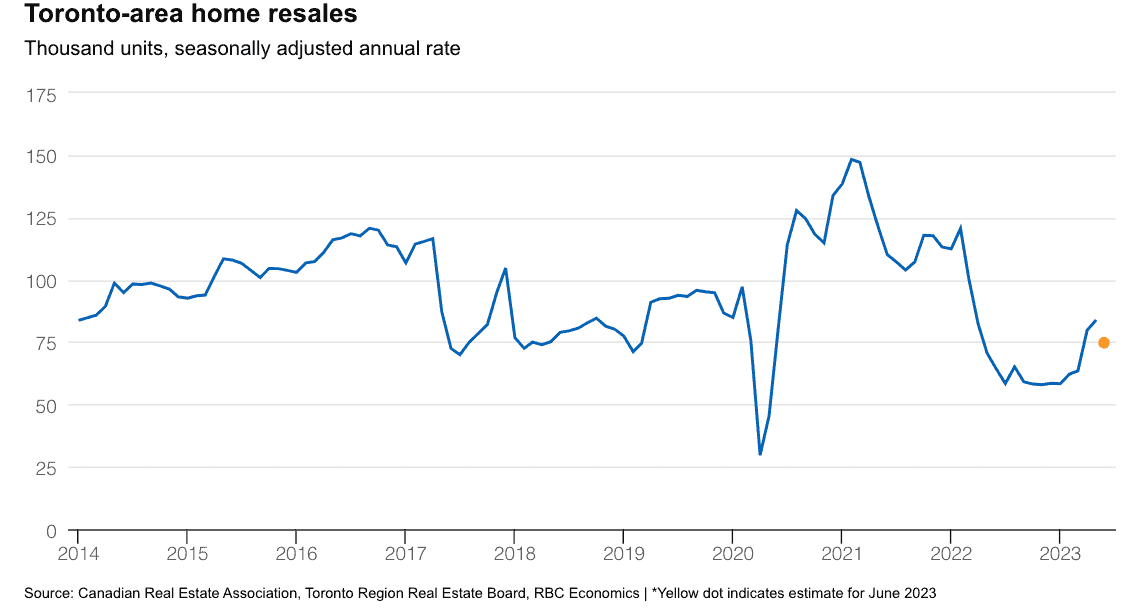

Toronto re-sales fall in June

The Great Toronto Area witnessed a loss of momentum last month. Home resales, which soared 32 per cent in April and May, fell by 6.9 per cent month-over-month in June. This retreat in buyer activity occurred despite an increase in properties available for sale, marking a departure from the previous two months when upticks in new listings significantly stimulated market activity.

The rebalancing of demand-supply conditions resulted in a slower pace of appreciation, but home prices in the area continue to rise. The MLS HPI composite benchmark price climbed by 2.5 per cent compared to May to $1.16 million in June.

“Since reaching a cyclical bottom in February, the benchmark price is up an astounding 8.9 per cent or nearly $96,000—reversing almost half of the decline in the previous year,” Hogue writes. “But more balanced conditions point to a slower pace of appreciation in the months ahead.”

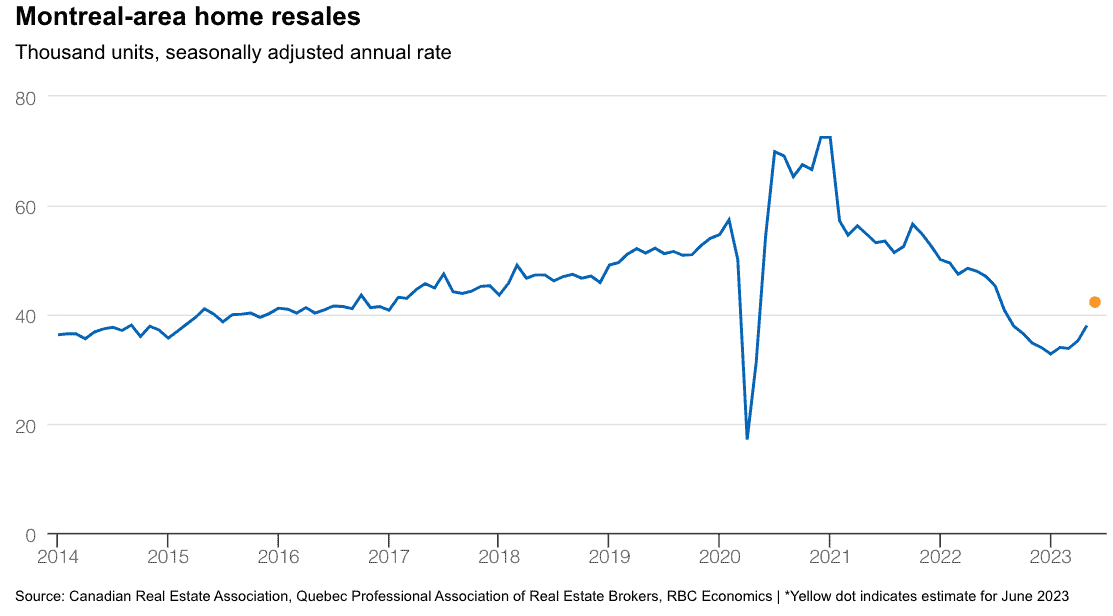

Montreal sees accelerating resales

The Montreal area continues to see upward momentum, with home resales estimated to have climbed by approximately 11 per cent month-over-month in June. This growth in demand follows increases of 3.9 per cent in April and 8.1 per cent in May. A growth in supply, including a 12% increase in new listings (seasonally adjusted) last month, has facilitated these advances.

As both demand and supply recover, price pressure remains relatively muted. The median value for a single-detached home remained unchanged between May and June, with a slight decrease observed for condo apartments. RBC economists predict a gradual appreciation in the period ahead, although the Montreal market remains soft, with resales roughly 15 per cent below pre-pandemic levels.

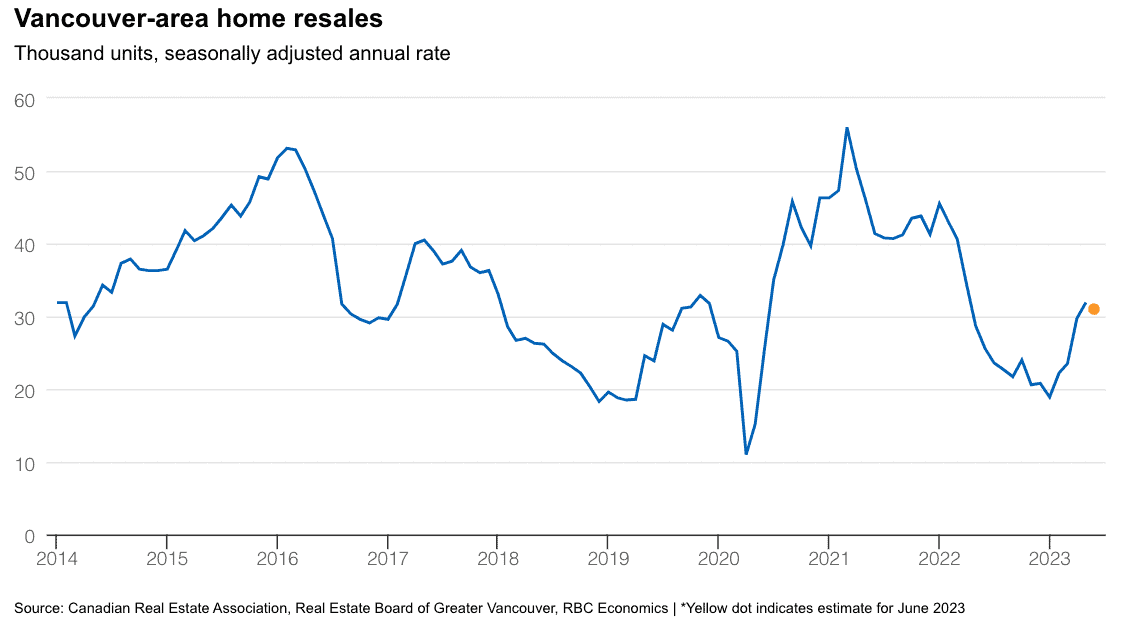

Supply increases in Vancouver

June saw an influx of sellers moving supply in better alignment with demand in the Vancouver area. New listings rose for the third consecutive month, increasing by more than 15 per cent month-over-month, based on RBC’s calculations. However, purchase transactions remained relatively stable compared to May. This pause in activity may indicate that the latest interest rate hike and the spring’s price upturn are starting to deter buyers. Despite this, property values continued to appreciate, with the MLS HPI for Vancouver rising by 1.3 per cent from May, adding to the cumulative 3.1 per cent increase in the previous two months.

Economists anticipate buyers will increasingly push back on further price appreciation in the coming months.

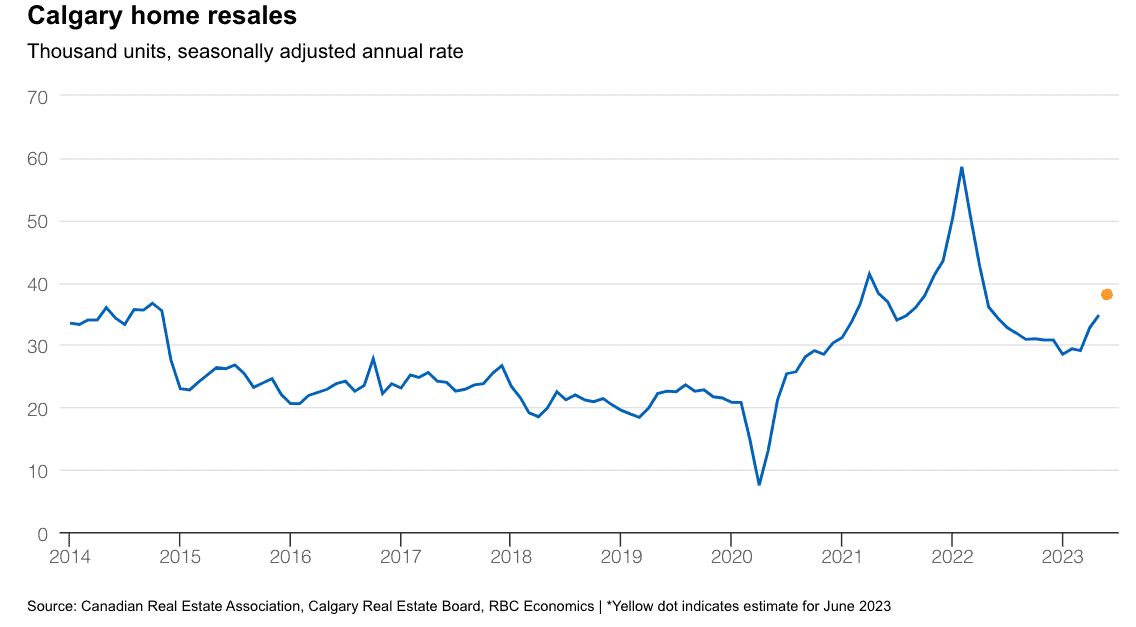

Buyers “quickly absorb” growing supply in Calgary

The Calgary area has experienced a significant increase in the number of homes available for sale in the past two months. This surge in supply has helped unlock some of the pent-up demand and drive up market activity. Home resales in June are estimated to have jumped nine per cent month-over-month, following a solid six per cent increase in May.

Hogue writes, “Still, the increase in supply has come well short of demand, leaving the market heavily tilted in favour of sellers.” As a result, prices continue to rise at an accelerating rate, with a year-over-year increase of 4.4 per cent.

“Calgary’s impressive population growth and relatively affordable position (compared to other major Canadian cities) will likely keep this trend going over the back half of the year.”