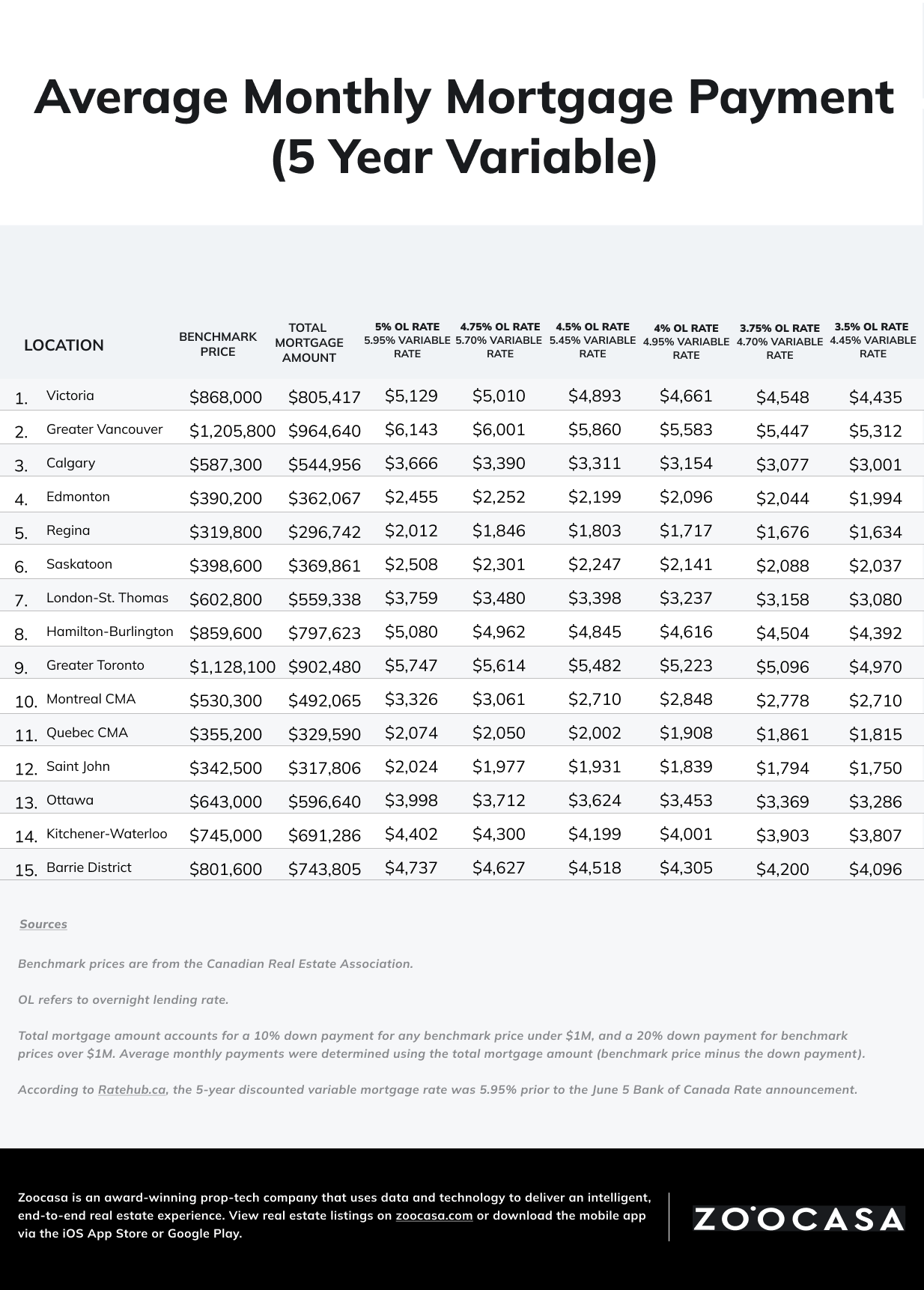

The Bank of Canada (BoC)’s recent 25 basis point drop that lowered its key overnight lending rate to 4.75 per cent sparks the questions of if and when other rate drops will follow, and what the financial impact will be on the average five-year variable mortgage holder. Zoocasa looked into this in a recent report.

Rate fluctuations and 5-year variable mortgage savings in major Canadian cities

The report focuses on major Canadian cities. For example, in Toronto, payments can be expected to decrease by about $155 per month. This creates savings for homeowners of about $1,860 per year. In Vancouver, the average monthly change between different interest rates is $166.20, creating an average annual savings of over $1,994.

On the other side of the spectrum, Regina, the most affordable city, showed an average monthly change of $75.60 between different interest rates, resulting in an annual savings of $907.

There will be even more savings if we see further rate cuts going forward. The BoC’s next announcement will be on July 24, 2024.

‘With lower lending rates, prospective buyers will be motivated to get off the sidelines’

Unsurprisingly, high borrowing costs can be a major challenge for current and prospective homeowners. A 2024 Zoocasa survey of 1,577 people across Canada and the United States found that over half of non-homeowners noted high prices as the main reason for not purchasing a home, despite their desire to do so.

“With lower lending rates, prospective buyers will be motivated to get off the sidelines, ultimately leading to more sales activity and the potential for an increase in prices,” says Carrie Lysenko, Zoocasa CEO.

Read the full report here.