Randall Bartlett, senior director of Canadian Economics, and Helene Begin, principal economist, attribute the resurgence to various factors.

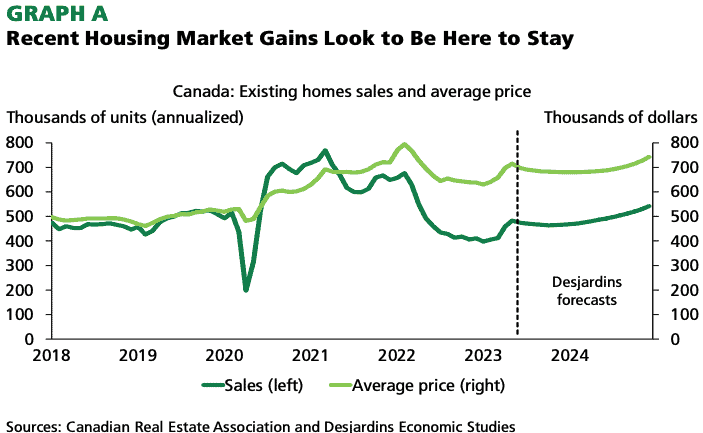

Traditionally, rising interest rates have been associated with a slowdown in the housing market. However, the market stabilized in early 2023 as the Bank of Canada paused rate hikes. In April, existing home sales experienced a sharp increase, suggesting a change in direction that continued through May.

This surge in sales, combined with a decline in listings, has shifted the Canadian housing market back into seller’s territory, driving up home prices, particularly in major cities.

The Desjardins report suggests that the recent spike in home sales and prices will likely have some staying power. One of the key drivers is population growth, fueled by a significant influx of immigrants and non-permanent residents. Research by Statistics Canada found immigrants play an outsized role in Canada’s housing market, often more likely to own properties such as condominium apartments, row houses and semi-detached houses than Canadian-born homeowners.

The Canadian job market is also contributing to increased home sales, as sustained employment and income gains have put households in a better financial position. Although there was a slight decline in employment among Canadians aged 15 to 24 in May, it is not expected to have a significant impact on the overall labour market or monetary policy.

Additionally, Canadians have accumulated substantial savings during the pandemic, further contributing to the rebound in the housing market.

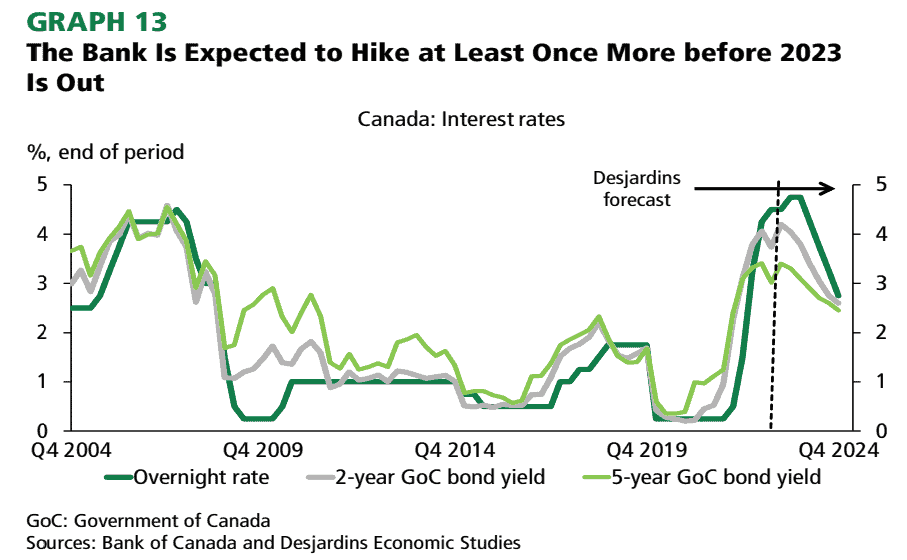

However, the Desjardins report cautions that the recent interest rate hikes by the Bank of Canada and the persistence of inflation may discourage some potential homebuyers due to higher borrowing costs. Economists expect one more 25 basis point rate hike to be delivered in July, which may give prospective homeowners pause before entering the housing market due to the likelihood of further rate hikes.

The report also warns that the full impact of last year’s rate hikes, including the most recent hike in June, has yet to be fully felt. Not all Canadians, especially homeowners, are experiencing the same level of impact from higher interest rates. Desjardins’ research reveals that a significant number of homeowners have fixed-payment variable-rate mortgages, and they have not yet seen the full effect of the additional interest costs.

Lack of housing supply

While housing demand remains strong, there are concerns about the availability of housing supply. Despite the rise in interest rates, home construction has held up well, but elevated housing starts are not expected to last as resale activity is still below its peak. Furthermore, the majority of housing starts are condos, reflecting the limited supply in the “missing middle” housing segment, such as townhomes, duplexes, and low- to medium-rise apartments. This shortage of new housing options exacerbates upward pressure on home prices, and there is currently no meaningful relief in sight from government policies.

Province by province

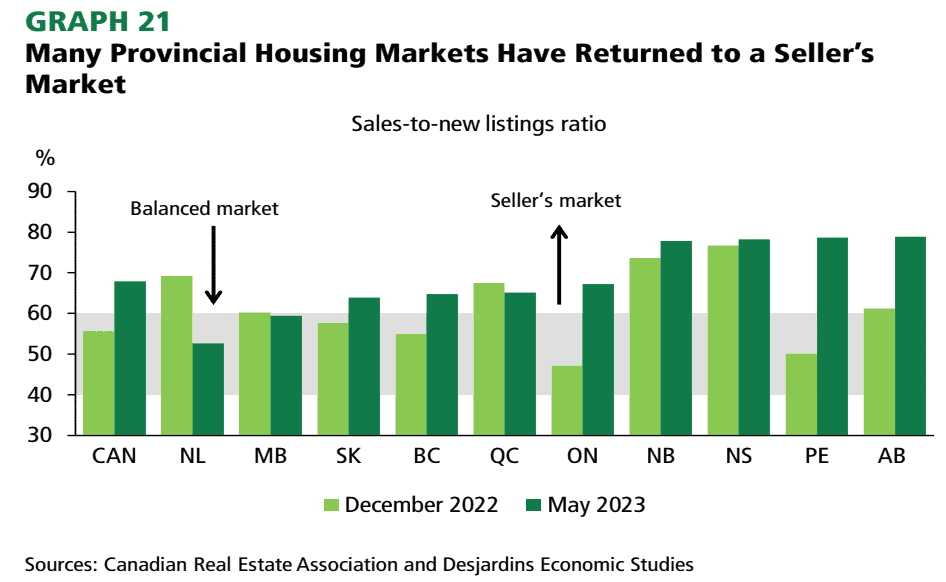

The housing market varies across provinces and cities. In British Columbia, resale activity, primarily in the Greater Vancouver Area, has driven up home prices in the province. Ontario has also experienced an increase in sales and prices, particularly in the Greater Toronto Area, driven by international migration.

Due to affordability and a booming economy, Alberta, Saskatchewan, and Manitoba have become popular destinations for young Canadians. Despite being the most affordable regions, the Atlantic provinces have seen significant price increases, making homeownership increasingly difficult for locals. In Quebec, there has been a slight increase in housing inventory, but overall, it remains a seller’s market.

Gains expected to continue

Desjardins predicts that the recent gains in the Canadian housing market will continue, further eroding affordability. Strong housing demand driven by population growth, a tight labour market, and accumulated savings will support market activity. However, higher interest rates and limited housing supply are expected to temper further increases.

Read Desjardins’ Canadian Residential Real Estate Outlook here.