Canada’s luxury real estate market burst out of the gate in 2025, but momentum quickly cooled as macroeconomic and geopolitical concerns boiled to the surface.

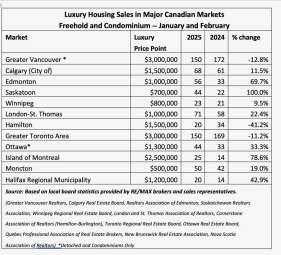

The latest Re/Max Canada Spotlight on Luxury Report tracks luxury real estate activity across 12 major markets in January and February, comparing it with the same period in 2024. While 75 per cent of those markets posted year-over-year sales increases—many of them in the double digits—the latter part of the winter season brought growing uncertainty tied to tariffs, stock market volatility, and political unease.

“Canadian homebuyers expressed solid enthusiasm for luxury real estate out of the gate in 2025, with growing consumer confidence, robust stock market performance and a more favourable lending environment stimulating activity at all price points,” says Kingsley Ma, area vice president at Re/Max Canada. “Unfortunately, the climate changed quickly amid increased political tensions between Canada and the U.S. as a trade war ensued…”

Mid-sized markets lead the way

Smaller, more affordable urban centres saw the biggest gains in the first two months of the year. Sales doubled in Saskatoon, while Montreal saw a 78.6 per cent increase. Edmonton surged nearly 70 per cent, and Ottawa climbed over 50 per cent. Halifax, London-St. Thomas and Calgary also posted notable gains.

In contrast, several high-price-point markets saw sales contract. Hamilton dropped 41.2 per cent year-over-year, followed by Greater Vancouver (-12.8 per cent) and the GTA (-11.2 per cent).

In these more volatile regions, buyers at the top end of the market are ”exercising more caution than sellers,” the report notes. “For some would-be high-end buyers, the deterioration of stock portfolios, even on paper, have given reason to pause. U.S. holdings in the Nasdaq, S&P 500, and the Dow are down from the start of the year, with some markets nearing correction territory before rebounding.” The report also highlights the upcoming federal election as another reason luxury markets have stalled.

High-end homes show resilience

That said, not all areas of the market are pulling back. The GTA’s ultra-luxury market has been active compared to last year. Seven homes over $7.5-million sold early this year—including four above $10-million.

Condominiums over $3-million are also showing signs of strength in Toronto and Vancouver. Fifteen luxury condo units were sold in Greater Vancouver between January and February (up from zero in 2024), while 12 were sold in the GTA, compared to 11 during the same period last year.

Federal housing policy has provided some support, especially in Western markets. A December 2024 change to mortgage insurance rules—raising the CMHC insurance cap to $1.5-million and allowing 30-year amortizations—has opened doors for more buyers.

“…the move has provided buyers with more leeway in terms of smaller downpayment,” the report explains, with positive effects already evident in Edmonton and Saskatoon.

Demographic shifts bolstering demand

“In-migration and immigration continue to play a significant role in supporting demand at luxury price points in markets including Calgary, Edmonton, Saskatoon, Halifax Regional Municipality and Moncton, albeit at a slower pace than in years past.” said Samantha Villiard, vice president of regional development at Re/Max Canada.

Several markets have also seen increased demand for multi-generational homes and downsized luxury properties, saying “Downsizing doesn’t look like it once did, as Boomers and Generation X redefine the trend by making lateral moves at similar price tags but with smaller, easier-to-maintain footprints.”

Long-term outlook remains positive

While some regions are currently in wait-and-see mode, Re/Max believes the underlying fundamentals remain strong. A rising number of high-net-worth individuals, ongoing population growth and an impending massive intergenerational wealth transfer will continue to support demand in the luxury segment.

According to the report, Canada added nearly $1.2-trillion in household wealth in 2024. Nearly two million Canadians are millionaires, with that number projected to grow to 2.4 million by 2028.

“The wealth transfer in Canada is unprecedented,” said Ma. “We are already seeing the impact of the download occurring in markets across the country.”

Ma adds, “While there may be some economic turbulence in the foreseeable future, Canadian luxury real estate tends to be quite resilient. Like the ocean, receding levels are often followed by a wave.”