National home sales in Canada edged down 0.6 per cent month-over-month last month, with actual monthly activity coming in 5.9 per cent below May 2023 levels.

On the other hand, sales activity remained below the 10-year average, as the number of newly listed properties increased by 0.5 per cent month-over-month in May.

More homes for sale across Canada thanks to new listings and slow sales

More new listings amid slower sales have led to an increasing number of homes for sale across most Canadian markets. About 175,000 properties were listed for sale nationally at the end of May 2024, representing a 28.4 per cent increase from a year earlier, but remaining below historical averages. There were 4.4 months of inventory nationally, up from 4.2 months in April, the highest level for this measure since the fall of 2019.

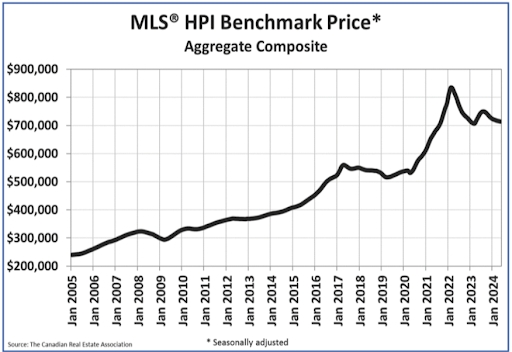

The MLS Home Price Index dipped 0.2 per cent month-over-month in May. The non-seasonally adjusted national average sale price was down 4.0 per cent year-over-year at $699,117.

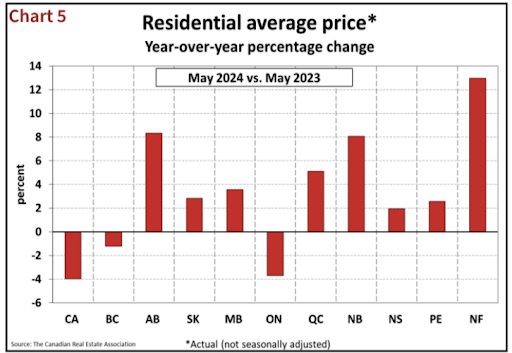

Largely flat prices with a few anomalies

Home prices are largely flat across most markets, except for steady increases in Calgary, Edmonton and Saskatoon.

The national sales-to-new listings ratio eased to 52.8 per cent, still within the 45-65 per cent range for balanced market conditions. The non-seasonally adjusted national average sale price was down 4.0 per cent year-over-year.

Lower interest rates & the psychological effect on homebuyers

The Bank of Canada’s recent 25 basis point rate cut is expected to have a significant psychological effect on potential homebuyers who have been sitting on the sidelines, bringing pent-up demand back into the market.

However, the pace and extent of further rate cuts will determine the impact on the housing market.

Canadian housing activity saw another quiet month in May, with sales edging slightly lower and new listings moving only a little higher. We’ll see what happens in the coming months, when the Bank of Canada’s rate cut is expected to create a revival.

Daniel Foch and Nick Hill are co-hosts of The Canadian Real Estate Investor Podcast. Daniel Foch, a real estate broker and analyst, is frequently featured in major media and has advised on over $1BN in real estate transactions, focusing on affordable housing. Nick Hill, a real estate investor and mortgage agent, has a background in business, commercial real estate and startups, working with investors and developers across Canada.

Sales will continue to struggle as the Feds attempt to maintain high real estate values and avoid a market crash. The Feds will further reduce interest rates to avoid a snap depression when one trillion plus in mortgage renewals come up in the next 16 months. Unemployment is on the rise and very few have any confidence in Trudeau as he sinks the Country further in debt. Things are not rosy in Canada.

Who wrote the headline?