The Quebec Professional Association of Real Estate Brokers (QPAREB) recently released its latest market statistics, highlighting key trends shaping the housing landscape in the Montreal and the Quebec City census metropolitan areas (CMAs).

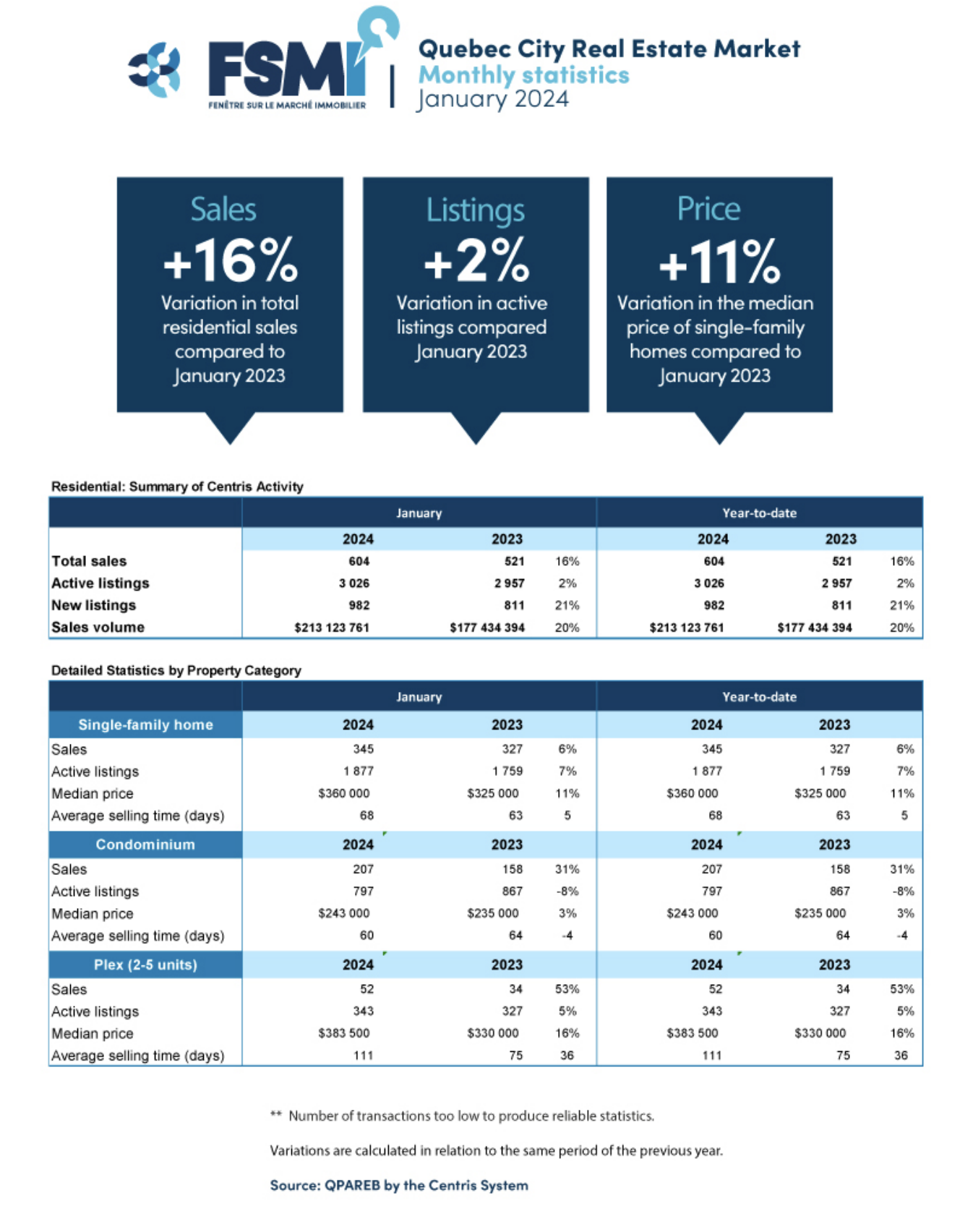

Quebec City

In January, Quebec City witnessed a significant uptick in residential sales, particularly in the condominium sector which had its third-best performance in 25 years.

High condominium sales and single-family home inventory

With 604 sales — a 16 per cent increase compared to January 2023 — the market surpassed historical averages recorded since 2000. This surge was primarily driven by heightened demand in the condominium segment.

While condominium sales increased significantly, the inventory of single-family homes for sale went up, contrasting with a decline in condominium listings to levels unseen since 2010. This imbalance between supply and demand continued to exert pressure on prices, maintaining a seller-friendly market environment across all property categories.

Plexes are an interesting alternative ‘as prices remain affordable’

“At first glance, the 16 per cent jump in sales in the Quebec City region is comparable to the provincial average for January. However, it masks a strong performance in the condominium sector, thus continuing the trend that began at the end of 2023,” notes Charles Brant, QPAREB market analysis director.

“The more marked price growth in single-family homes and the lack of properties in this category continued to drive first-time homebuyers and possibly investors towards the condominium and plex markets. Moreover, plexes are proving to be an interesting alternative as prices remain affordable for buying as a group and as rents in the region continue to rise.”

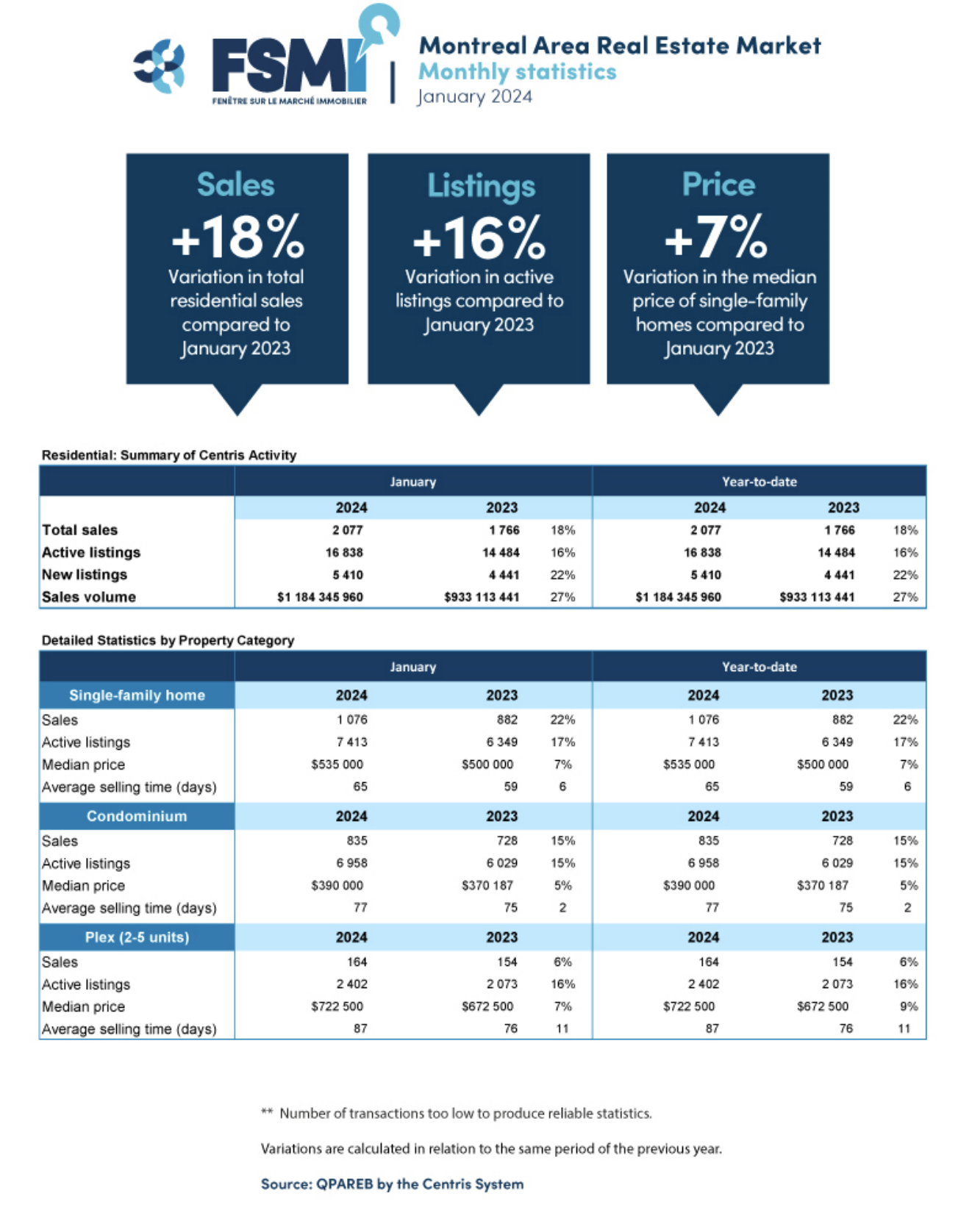

Montreal

The residential resale market in Montreal kicked off the year on a strong note, witnessing a notable surge in sales compared to January 2023, particularly in the suburbs. This signalled a promising recovery in activity that’s anticipated to persist.

Higher sales thanks to better interest rate expectations

Last month, residential sales in the Montreal CMA totaled 2,077 transactions, an 18 per cent increase equivalent to 311 more sales, compared to the same period last year. Although this level of activity remains slightly below historical averages recorded since 2000, the surge in sales is attributed to more favorable interest rate prospects.

Brant weighs in: “The solid performance of sales for the start of the year is essentially attributable to more encouraging prospects regarding interest rates. Since late 2023, economists agree that the upcycle in interest rates is behind us and that a reverse process should begin in 2024. This widely shared analysis has been reflected in the bond markets and, for all practical purposes, in a significant decline in fixed mortgage rates. This has been beneficial for the real estate market.”

“Sharp slowdown in economic activity and the resulting uncertainties influence the propensity of households to purchase a home”

However, he continues to say there are “several headwinds to a more decisive resumption of transactional activity. We are referring to the sharp slowdown in economic activity and the resulting uncertainties that influence the propensity of households to purchase a home.”

Despite this, “A change of course by the Bank of Canada suggests a first cut in interest rates later this year. This change in the Bank of Canada’s approach, while not necessarily impacting January’s statistics, is seen as a particularly positive signal in advance of the busy spring season, both on the part of buyers and sellers.”

See more detailed statistics for the province and regions.