Big changes could be coming for many Canadians

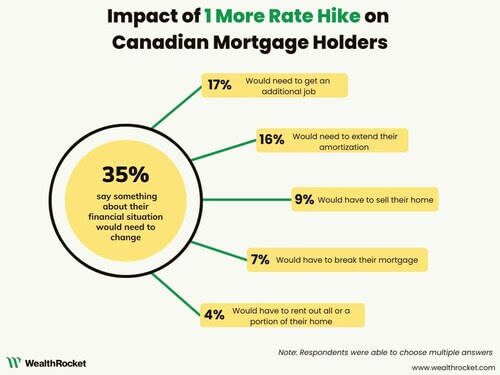

About 65 per cent of respondents don’t feel their situation would have to change. That said, the survey found that as little as one more interest rate increase could mean mortgage holders taking an additional job (17 per cent), extending their amortization period (16 per cent) or selling their home (9 per cent). An additional 11 per cent reported anticipating other changes.*

David O’Leary, WealthRocket’s personal finance expert, explains, “Most of us will know somebody who had to sell their home and downsize, or start renting because they couldn’t afford it any longer. But many people facing this situation will be reluctant to admit it until they have no choice.”

A main driver: Many spend more than recommended on housing

Source: WealthRocket

Although the Canadian Mortgage and Housing Corporation (CMHC) doesn’t recommend that homeowners spend over 39 per cent of their monthly gross income on housing, over 30 per cent of Canadian homeowners with a mortgage ignore this advice.

How Canadians afford housing today

To contend with ever-rising housing costs, Canadians rely on different arrangements. For example, 36 per cent say one partner’s income covers mortgage costs, and any remaining costs are covered by the other’s income. 27 per cent say all housing costs, mortgage included, are covered by one partner’s income.

Read the WealthRocket survey here.

* some respondents chose multiple answers