Major Canadian markets and migration across the country has changed, thanks to growing affordability issues — which land transfer taxes and new property assessments are contributing to, according to Re/Max Canada’s 2024 Tax Report.

The report emphasizes the need for interventions to make homeownership more accessible, address housing supply issues, and prevent continued out-migration, particularly among the youth.

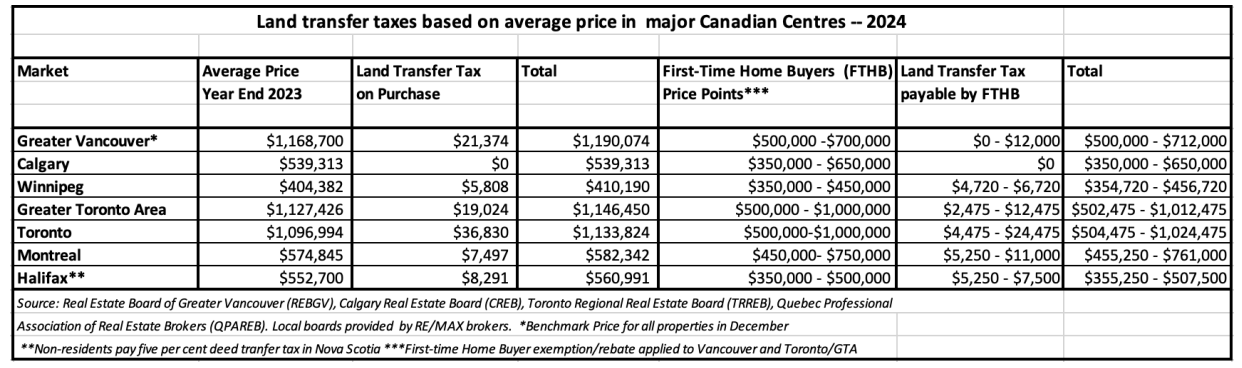

It assessed key markets in six Canadian provinces, including Vancouver, Calgary, Winnipeg, Toronto, Montreal and Halifax. It highlights that governments at all levels are collecting billions through levies, development fees and land transfer and property taxes.

Large migration to Alberta and Atlantic provinces

Tax rate increases, along with high housing values and mortgage rates, contribute to a post-pandemic exodus from expensive markets. Last year, this led to increased interprovincial migration numbers in Alberta and Atlantic Canada (namely Nova Scotia, New Brunswick and Prince Edward Island) — nearly 60,000 homebuyers moved to these areas.

According to Statistics Canada, in the first three quarters of 2023, Alberta experienced more than double the interprovincial migration from the year prior. The province welcomed 45,194 people, with the highest influx from Ontario, British Columbia, Saskatchewan and Manitoba.

During the same period, Nova Scotia saw more than 5,000 new residents after nearly 10,000 interprovincial migrants during the same period in 2022. New Brunswick saw almost 4,500 new arrivals in the 2023’s first three quarters, while Prince Edward Island had just over 1,000.

“Given today’s housing market realities, it comes as no surprise that buyers are willing to travel across the country to achieve home ownership,” says Re/Max Canada president Christopher Alexander. “In addition to affordable housing values and extensive job opportunities, Alberta is well known for its position on taxation, with no provincial sales tax and zero land transfer tax on residential real estate.

Cash-rich buyers from provinces such as Ontario and British Columbia are aware that the sale of their property in Toronto or Vancouver will stretch that much further in Alberta or Atlantic Canada’s major centres. And for first-time buyers, it’s an opportunity to get into the market at an affordable price point and gain equity, as opposed to paying down someone else’s mortgage by renting.”

“The first order of business should be revisiting the first-time buyer rebate/exemption in Toronto and Vancouver”

The Fraser Institute’s 24 Facts for 2024 Report indicates that the average Canadian family pays 45.3 per cent of its income in taxes, with land transfer taxes and regressive tax policies affecting migration patterns.

Toronto’s introduction of a luxury tax on home sales over $3 million on January 1, 2024, adds to the burden. This has prompted calls to revisit first-time buyer rebates or exemptions in major cities like Toronto and Vancouver.

“When you think about what a $40,000 tax bill payable upon closing could do if it was applied to a down payment, it’s clearly time to incentivize the first domino,” says Alexander. “The first order of business should be revisiting the first-time buyer rebate/exemption in Toronto and Vancouver, because at $400,000 and $500,000-$525,000, respectively, they’re woefully inadequate given the average or benchmark price of properties in those cities.”

Sources of rising housing costs

A survey by Leger found that 28 per cent of Canadians believe land transfer tax has impacted their housing decisions, with younger generations, particularly Gen Z and Millennials, feeling the impact more significantly. A growing number of this demographic are therefore leaving major centres for affordable home ownership.

There’s also confusion from new and proposed property tax reassessments nationwide (including Toronto, Montreal and Halifax), as some properties were assessed above recent sale prices.

New home construction, in Toronto for example, is another source of affordability challenge. Taxes, development fees and levies imposed on new condominiums — a common entry-level purchase — are estimated to be about 25-30 per cent of the total purchase price. The Building Industry and Land Development Association found there was an additional $222,000 cost for an average new single-family home in the GTA in 2019 — three times more than major U.S. markets including San Francisco and New York City.

“If we don’t heed the call, we risk continued out-migration of our youth”

“The goal should be to make homeownership more accessible, not less,” says Alexander. “Taxation is contributing to the demise of the Canadian dream, with home ownership across the country falling from peak levels reported in 2011, and it will continue to decline unless there is some intervention. A greater supply of affordable housing in major centres will have a sizeable impact on keeping the dream alive. However, if we don’t heed the call, we risk continued out-migration of our youth.”

Similar challenges in North American cities, such as over 600,000 people leaving New York State for low-tax states like Florida, underscore the broader impact of public policy on housing and economic dynamics.

“Clearly, public policy is contributing to a myriad of issues – with affordability front and centre – and there’s no relief in sight,” says Alexander. “Shelter is a basic human need, yet accessibility is becoming increasingly problematic as government reliance on the housing sector as a means of funding creates a greater divide.

Affordability and opportunity are key to healthy and sustainable real estate market activity and a vibrant economy. As such, the potential economic impact of ongoing out-migration on the future of individual provinces should raise alarm bells.”

Read the full report here.

Excellent insights from Christopher. Tax of $40,000! That can hardly be considered a tax in that range. More like extortion of a basic need and the simple goal of home ownership.