The Teranet-National Bank Composite House Price Index (HPI) saw another sharp increase in July, with a month-over-month jump of 2.4 per cent after seasonal adjustments. This marks the fourth consecutive monthly rise and the second-highest monthly growth ever recorded, second only to the increase observed in July 2006.

It’s important to note the Teranet-National Bank Composite HPI is based on closed transactions — so it typically lags behind the market.

Among the 11 major Census Metropolitan Areas (CMAs) covered by the index, eight experienced price hikes during the month. Leading the pack was Halifax with a 4.9 per cent surge, followed closely by Hamilton at 4.4 per cent, Vancouver (3.9 per cent), Toronto (3.5 per cent), and Victoria (1.6 per cent).

Moderate growth was observed in Winnipeg (1.3 per cent), Ottawa-Gatineau (0.6 per cent), and Edmonton (0.3 per cent). In contrast, three cities reported price contractions, with Quebec City leading the way with a decline of 1.2 per cent, Montreal with a 0.9 per cent decrease, and Calgary with a more modest 0.3 per cent dip.

Commenting on the growth in house prices, National Bank Economist Daren King emphasized the recovery of the residential real estate market in recent months. The composite index’s 2.4 per cent — increase in July, coupled with the cumulative decline of only 3.8 per cent since its peak in April 2022, suggests a partial correction of the market.

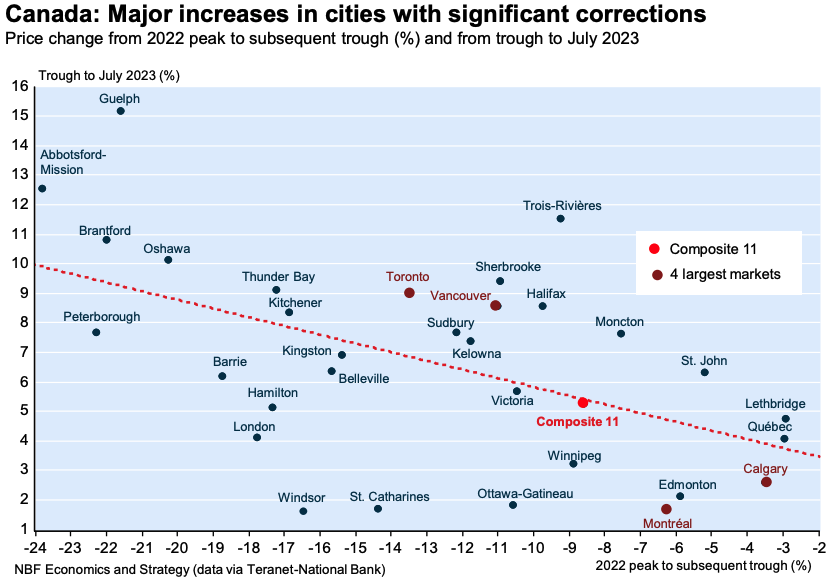

King noted, “Interestingly, the recent upturn in prices has been greatest in the cities that have seen the biggest corrections.”

Notably, four of the covered CMAs—Saint John, Lethbridge, Quebec City, and Trois-Rivieres—have managed to fully recover their price declines.

Looking ahead: Projecting growth and assessing affordability

“Prices could continue to rise in the third quarter, supported by strong demographic growth and the lack of supply of properties on the market,” King writes.

“That said, the deterioration in affordability with recent interest rate hikes in a less buoyant economic context should represent a headwind for house prices thereafter.”

The Teranet-National Bank HPI is estimated by tracking observed or registered home prices using data collected from public land registries. All dwellings that have been sold at least twice are considered in the calculation of the index.

I think the methodology of this Cdn version of the Case-Schiller identical-home sold comparison is intense.

But the takes time and the time to compile (it’s based on registered sales NOT arranged ones) makes the omission of a reference to the “3-4 month time-lag” a real bone-headed error.

Hi Anon,

We always appreciate your feedback. We note early in the article the data lags behind the market. We have also added further clarification on Teranet’s methodology.

Thanks for reading,

Jordana

jordana@realestatemagazine.ca