Ever since Toronto’s real estate boom began, pre-construction has been one of the most popular forms of investment. This is because investors assume that the value of a future project will continue to increase. Pre-construction is also an attractive investment because it isn’t as risky or costly as buying a “run down” home (requiring a huge deposit) and renovating it (more money spent than expected!) and then hoping to sell it for a profit.

Pre-construction, in contrast, divvies up the deposit and the developer takes care of the construction. Having said that, while pre-construction flipping appears simpler than flipping a home, it’s simply not the case. There are numerous complications regarding developer charges, carrying costs and charges for upgrades that are added to the initial purchase price.

What’s more, certain pre-construction projects in Toronto can cost more than a resale condominium. Here are just three of the many financial impediments that may make your flip a flop.

Loss of incentives:

Agreements of Purchase and Sale are typically drafted by the developer and are very developer friendly with respect to assigning your agreement. Apart from the general fees and legal fees that the original purchaser (“assignor”) will likely have to pay to the developer for the ability to assign the agreement, the assignor may also lose certain financial incentives. For example, the caps on development charge levies or credits for future common expenses may be lost in the event of an assignment. The loss of these incentives makes the assignment much less attractive for the second buyer (“assignee”).

It’s obvious that failure to address such loss of incentives before anyone enters into any agreement will lead to a dead deal or a lawsuit. It’s imperative to take the following steps to prevent a dispute and failed flip because of a loss in incentives:

- The assignor should negotiate better assignment terms before signing the original agreement with the developer;

- Both the assignor and assignee should review the agreement with a lawyer prior to entering into an assignment agreement; and

- Depending on what the lawyer finds in the agreement, include a clause to address the potential for a loss of incentives. For example, if you’re representing the assignor, draft a clause for the assignment agreement that states that the assignee recognizes that incentives may be removed and if such incentives are removed then the assignee agrees to continue with the completion of the assignment at no cost to the assignor. If you’re representing the assignee, however, modify it to state that any reduction in incentives will be deducted from the purchase price.

Fees, fees and more fees:

Apart from paying the developer’s costs for the assignment (yes, this includes legal fees!), there are several other costs that the assignor and assignee need to consider.

For example, who gets the benefit of the interest on the deposit? The assignor must also consider how HST will be treated on the profit of the sale as it may be considered a “flip” and therefore a taxable gain at different rates. Assignees, on the other hand, will want to ensure that they have the capital to not only pay for the deposit to the assignor for the assignment when it becomes firm, but also the deposit that the assignor already paid to the developer. This is particularly crucial as lenders will not provide financing for an assignment prior to the completion date.

Assignees should also get their financing in order prior to accepting an assignment because some lenders refuse to provide a loan based on the assignment purchase price. Finally, assignors and assignees must be clear as to whether or not the price paid by the assignee includes the fees that the developer charged for the assignment; who will be responsible for adjustments that are paid to the developer before the project closes; and who pays for any upcoming fees for upgrades.

The best way to mitigate for these financial surprises is to ensure a lawyer carefully combs through the original agreement and sets out all past, current and future fees in the assignment agreement, as well as who pays for what and when.

When can you assign?

Many developers now prohibit purchasers from assigning their unit until the developer has sold a certain percentage of the total development. The threshold in Toronto can be between 85 per cent and 90 per cent of the development. This means that, if the market slows and the developer can’t meet the threshold or if the developer goes bankrupt in its effort to meet the threshold, then the assignor may be stuck with a project that she cannot sell or with no project at all.

As such, it’s critical for investors to carefully review any restrictions on when the assignor may assign the agreement, as well as the integrity and financial strength of the developer.

Central Toronto’s condominium prices continue to accelerate, making it no surprise that, despite these potential problems, investors continue to buy pre-construction and make a profit. Having said that, it’s imperative to understand fluctuations in the market and the legal terms and financial terms of an agreement.

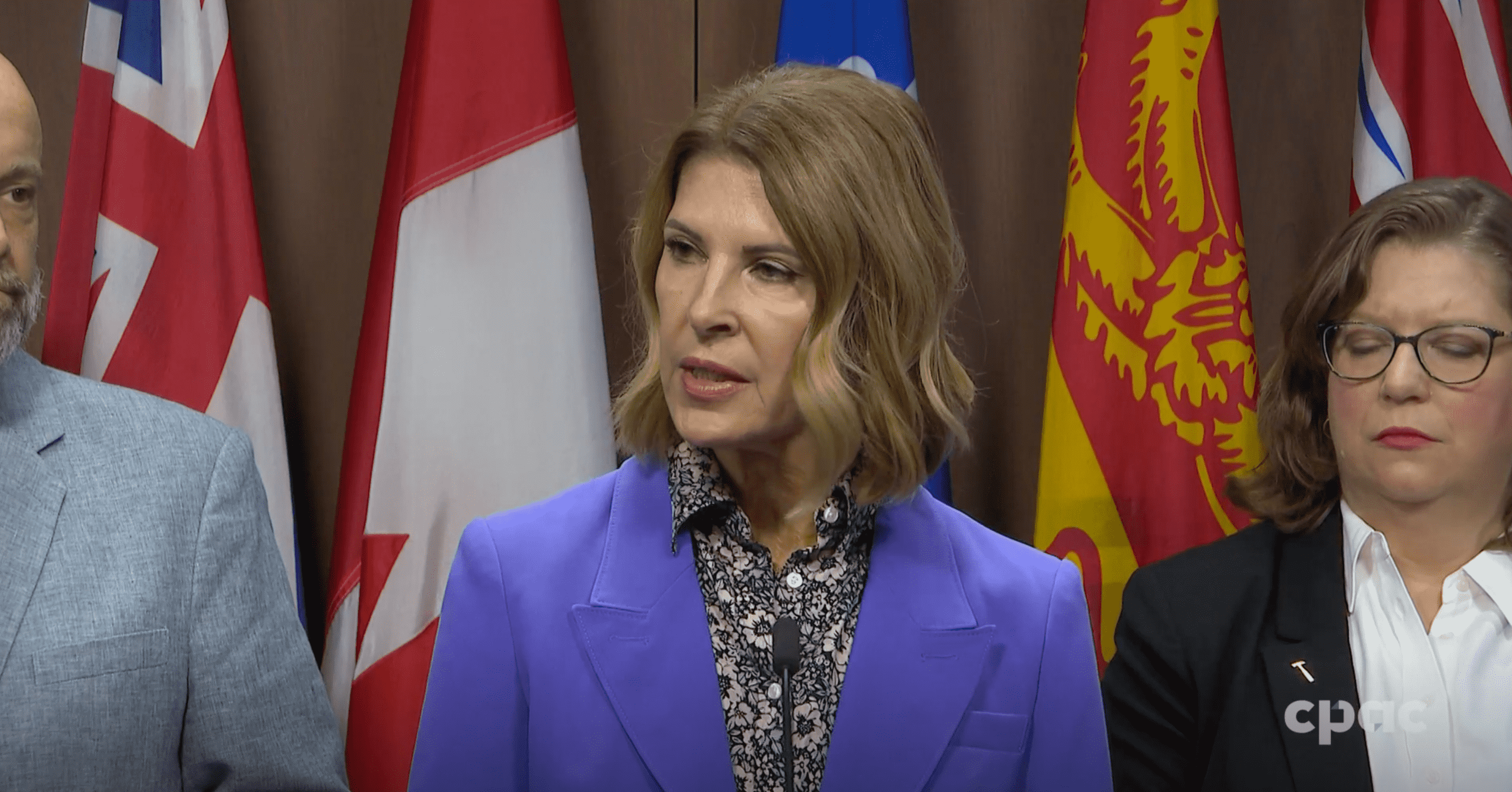

Natalka Falcomer is a lawyer, real estate broker and Certified Leasing Officer who started her real estate career in private equity. She created, hosted and co-produced a popular legal call-in show on Rogers TV and founded and recently sold Groundworks, a firm specializing in commercial leasing law. She is currently the Chief Real Estate Officer of Houseful.ca, leading the development and expansion of the company’s personalized home buying and selling experience for the Canadian market. She sits as an advisor on NAR REACH Canada and is the former multi-year board member of the Ontario Trillium Foundation.