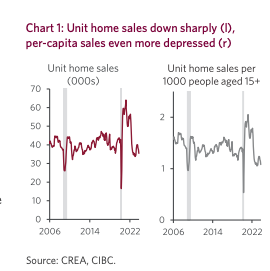

Canadian housing is in recessionary territory, CIBC reports, as it’s facing the biggest challenges since the country’s recession in 1991. In early 2021, unit sales hit a peak of 64,000 and are currently down by 45 per cent – 12 per cent below the pre-pandemic decade-average level. Things are even worse per capita, with (apart from early pandemic lockdowns) sales levels below 2008 recession levels.

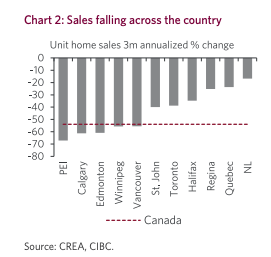

While larger, overvalued centres, like Toronto and Vancouver, are seeing this most, markets with population booms are experiencing it, too. For example, the Prairie and Atlantic regions’ three-month annualized sales remain down. Apart from St. John and Halifax, unit sales there are higher than they were pre-pandemic.

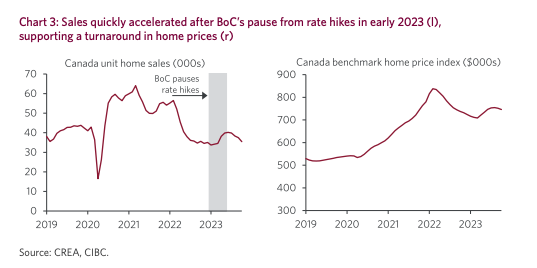

CIBC still expects the downward trend to get worse, though. Even though the Bank of Canada won’t likely raise rates again, its experts don’t foresee another quick recovery as we saw right after the rate hike pause in January.

Low supply no longer protecting average price

The benchmark home price is down by 11 per cent since its early 2022 peak and 38 per cent above its level pre-pandemic, despite the unit sales correction.

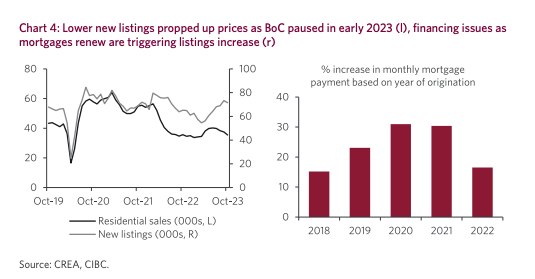

Single-family home prices surpassed condominium prices during the pandemic’s low interest rate period, being 42 per cent higher than their levels pre-pandemic, while condominium prices were 30 per cent higher. The high prices were sustained by few new listings from early 2022 to early this year (a decline of 31 per cent or more).

That said, things are now different. New listings have increased recently, going up by 31 per cent from their 19-year low in March of this year (excluding the pandemic lockdown period). Part of the boost is a reflection of more owners listing properties for sale due to higher mortgage payments and other increasing financial issues.

A buyers’ market with no buyers

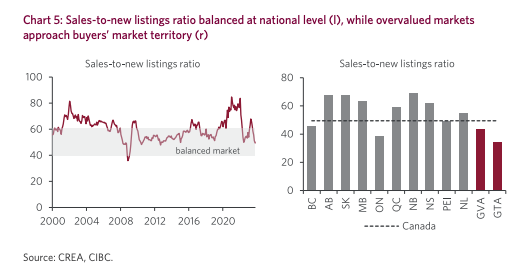

The impact of this is a national market moving from seller territory to balanced conditions headed into buyer territory. Toronto is already seeing this and Vancouver is coming up behind it. The Prairie and Atlantic regions remain closer to seller conditions but are softening. That said, with affordability issues persisting, we may not see much of a demand increase, despite buyer-favourable conditions.

Read CIBC’s full report here.

I’m not sure how it is like 1991. What was the average wage in 1991? And what was the average home price? There’s an entire generation since the 90s that thinks 3-4% is a normal mortgage rate. I’ve even become accustomed to that. But that doesn’t benefit everyone. And it doesn’t promote steady long term growth. It promotes people treating housing like a commodity. If it’s a commodity, then prices will fluctuate – it should be expected that prices may drop (it’s not just an fluctuation that goes up all the time)