The recent history of Canadian real estate has been full of surprises. In 2022, we saw the biggest price drop in Canadian history. In 2023, we followed that up with the strongest spring market in Canadian history when measured by price growth from January to May.

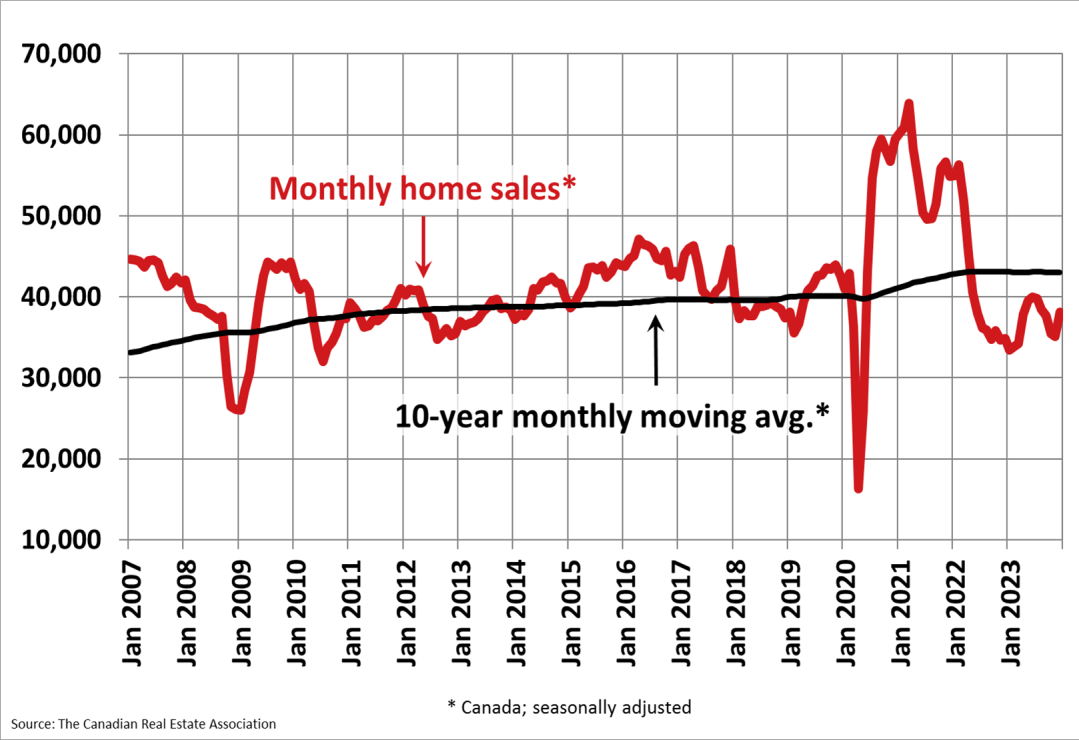

We also finished 2023 with the lowest number of home sales since 2008. That year was not a good year, given it was in the middle of the financial crisis.

So, what will 2024 bring us?

While many believe that the path of interest rates will be the core driving factor, I think the outcome really depends on the severity of recession and unemployment. We’re already seeing banks shore up loan loss provisions and a broad balance sheet contraction of financial institutions around the world.

So, if rates come down as a response to the recession rather than a “soft landing”, credit availability will be an important theme this year. The availability of capital matters just as much as the cost of capital.

With all that being said, the surprises continue into this year.

Higher than expected sales last month

According to recent statistics released by the Canadian Real Estate Association (CREA), Canadian home sales experienced a surprising surge in December 2023, which is very atypical of December. Sales are still well below the long-term average number:

The month saw a significant and cyclically anomalous month-over-month increase of 8.7 per cent in home sales, indicating there could be some opportunistic buyers in the market. However, there were some contrasting trends observed in the housing market during this period.

Re-entry of supply as rents lower

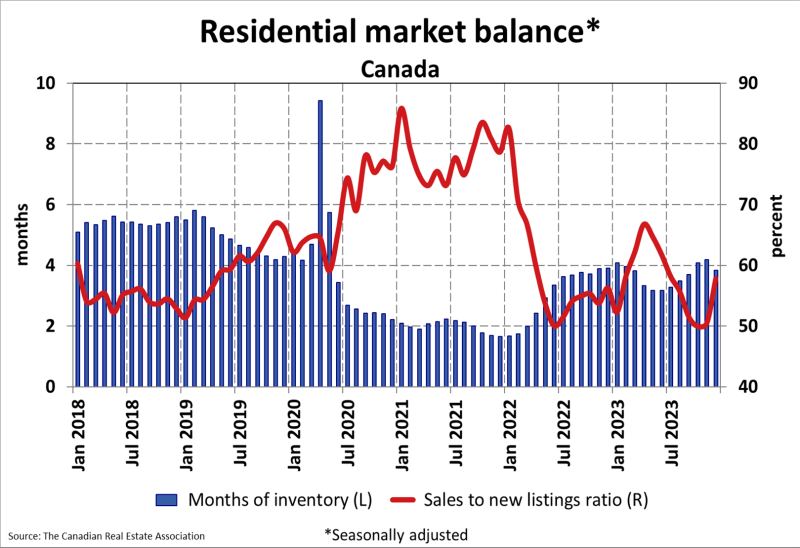

While home sales rose, the number of newly listed properties actually decreased by 5.1 per cent compared to the previous month, which is more along the supply scarcity theme that dominated the last few years. This decline in new listings drove a tightening of inventory in the market.

A couple of things might help with this, though. Given that many listings were set to expire on December 31, January will be defining as we see whether or not a lot of that new supply re-enters the market. As well, in 2023, many owners tried their hand in the rental market if they couldn’t sell — but with rents falling for three consecutive months now, that option is gradually becoming less compelling. Could this rent reversal materialize in more inventory in 2024?

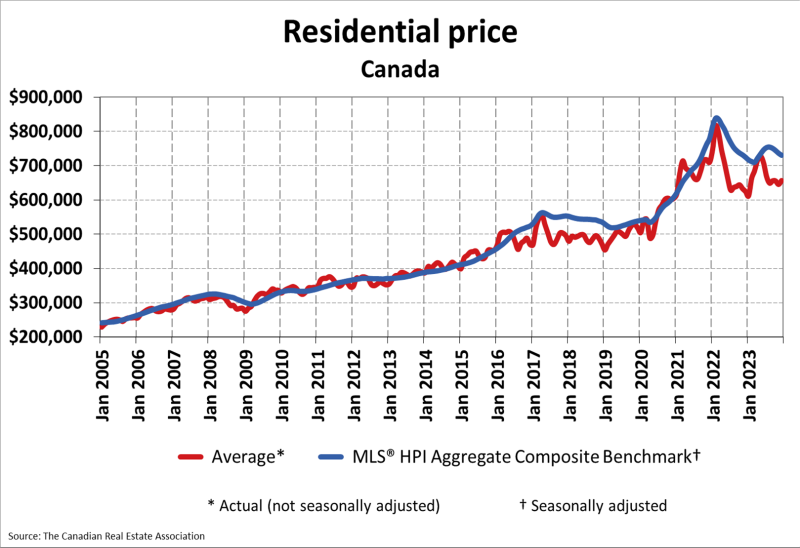

Average sale price rose YoY

The MLS Home Price Index (HPI) fell by 0.8 per cent month-over-month, indicating a relatively significant decrease in home prices each month. Despite this decline, the national average sale price still managed to show a year-over-year increase of 5.1 per cent. Time will reveal whether or not the shift in prices was a function of seasonality or a more important trend to watch.

Spring will be telling

It’s worth noting that the recovery of the housing market in 2024 is anticipated to be the true test of its resilience. While December showed positive sales numbers, the spring season is expected to provide a more accurate picture of the market’s overall performance and demand. Experts are forecasting a recovery in housing demand in the coming year, and it remains to be seen how this will ultimately play out.

High demand relative to new listings

In terms of market conditions, the sales-to-new listings ratio tightened in December, reaching 57.8 per cent compared to 50.5 per cent in November. This indicates a higher level of demand relative to new listings, given December is characteristically a low-listing month.

The months of inventory at the end of December decreased to 3.8 months on a national basis, down from 4.2 months in November. This number would typically signify a potential scarcity of available homes in the market, but I do believe January will be more important to watch, given that it takes far longer to sell a home than before, and that we’re seeing more re-listing of properties than we have in the past few years.

Keep an eye on B.C. and Ontario

The decline in the Aggregate Composite MLS HPI was mainly observed in Ontario markets, particularly the Greater Golden Horseshoe, and to a lesser extent in British Columbia. Keep in mind, since these markets make up something like 40-60 per cent of national averages, it’s easy for them to skew the national average. But, I do think it’s important to look at these markets regardless of where you’re located in Canada because they seem to be forward-looking.

We saw the GTA peak in February 2022 as soon as the Bank of Canada fired its first warning shot of the rate-hiking cycle. The Ontario market seems to be a good leading indicator for the remainder of Canada in this sense, as most smaller Canadian markets didn’t see that peak until March or April. So, while Ontario is driving prices up in the current environment, it could just as easily create a headwind against recession in 2024. Closely watching the Toronto Regional Real Estate Board’s spring market and January stats would be a great exercise for many professionals.

Varied price trends across the country thanks to interprovincial migration

Other regions in Canada have seen stable or even rising prices, such as Alberta, New Brunswick and Newfoundland and Labrador. This suggests that price trends are becoming more varied and regional differences are less pronounced. A lot of this is driven by record interprovincial migration in Canada, and the exodus of Ontarians who are searching for affordable housing outside of their province.

Overall, the Canadian housing market has experienced positive sales growth in December 2023, but it remains to be seen how the market will evolve in the coming months. The recovery in housing demand this year will be a key factor in determining the market’s resilience and performance.

2023 was the worst year in Canadian real estate since the last time we saw a major recession in Canada. While some feel the worst could be behind us heading into 2024, I’m expecting a bit of turbulence.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

Crea national stats do indeed say something – but it’s not local.

Nonetheless, while we are addressing pan-Canadian issues , let’s get the REM Realtor attention directed at the B20 Stress Test – its “+2%” component is too high for a time of peak rates and must be reduced.

Dropping the B20’s “+2%” mortgage-qualifying criterion in 2024 by a matching 1/4%-1/2% every time the Bank of Canada reduces its Bank Rate would do wonders for a) the Real Estate business, b) Lenders’ volumes, c) the overall GDP economy, d) the OSFI and e) any tiny changes R. Tiffany Macklem decides to make.

Let’s incrementally drop the “+2%” until a mortgage Face rate + the added Stress test qualifying percentage EQUALS the Federal 5yr base comparator rate. ie until the stress test becomes a neutral adjustment for the shorter-term/lower rate mortgage term and variable types – Let everyone qualify at the 5yr Federal Rate.

Then let the Stress +% STAY at that +%= 5yr until national policy switches to be more/less stimulative.

The “+2%” policy was initiated to attempt to “neutralize” low-low rates, so that buyers would not “count on” low low rates to qualify for the payments (that could not stay low forever).

Now the “+2%” is making qualifying “more difficult” – it’s become a restrictive, anti-stimulative policy … which is counter-productive for all participants

NB the OSFI is tasked to protect the shareholders of mortgage lending institutions – the introduction of the stress test demonstrates this AND the Superintendent’s inaction (after months of consultation with all participants) appears to confirm this limited-focus mandate and shows that THAT this officeholder appears to have no regard for consumer affordability or the contribution of real estate market activity.

But in reality, the Superintendent is not isolated from the economy, the Office’s mandate CRIES OUT FOR more consumer responsibility to be built-into it and I suggest that neutralizing the Stress test via this “Scaling” modification will achieve this and will begin the integration the OSFI into the real-world economy.