A lukewarm attempt at recovery seems to be appearing in Toronto’s real estate market. For the first time in a while, it seems that demand has been able to outgrow supply.

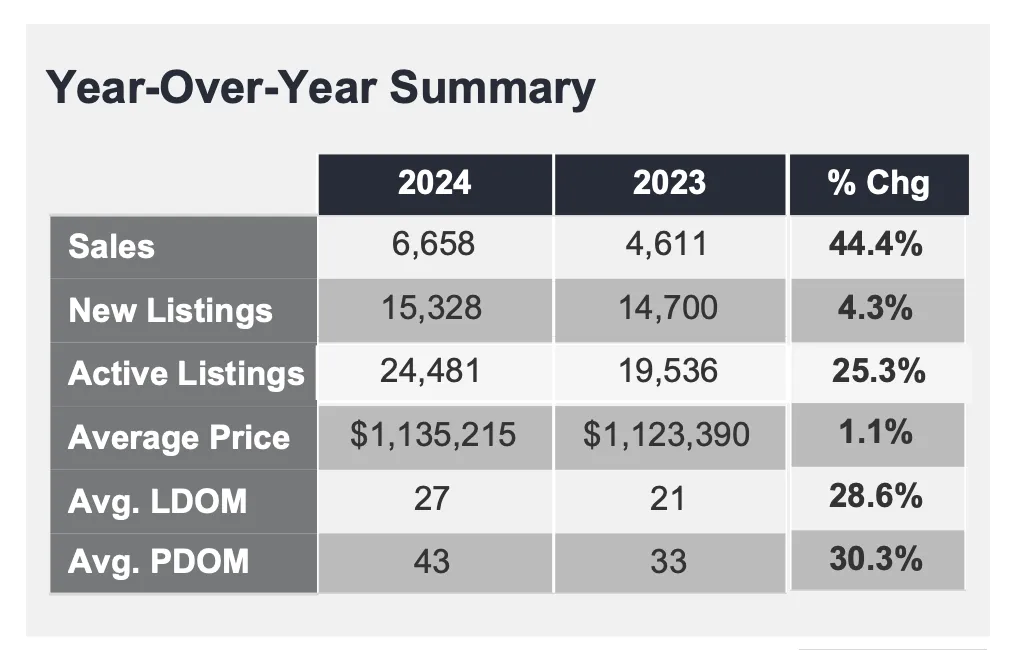

According to October data from the Toronto Regional Real Estate Board, active listings are still up significantly (25.3 per cent) but sales are up more (44.4 per cent).

Source: TRREB

I won’t dispute that the general sentiment in the real estate market in the Greater Toronto Area does seem to be warming up a little, with home sales up compared to October of last year. Frankly, I’d be very concerned if we didn’t see some warmth, given we’ve seen significant advantages given to buyers since then, including:

- Interest rates coming down 125 basis points

- Amortizations will be extended to 30 years, increasing buying power by 8 per cent

- Insured mortgage cutoff increasing from $1-million to $1.5-million

- Neighbourhoods have been upzoned to four units

- The government has created incentives for owners who want to add units

Warm, not hot

I deliberately chose the word “warm” because it has been pretty cold all year, and I’m not ready to describe it as “heating up.” In the past few months, new listings were up significantly, and the heightened pace of supply caused active listings to accumulate more quickly against suppressed demand.

This month, new listings are only up 4.3 per cent compared to last year, which could dramatically slow the pace at which active supply accumulates. If sales remain strong toward the end of the year we could see some supply get absorbed and momentum build for a more pronounced spring market. As mentioned in earlier notes, rate cuts seem to be more of a pent-up supply story than a pent-up demand story so far—with sellers timing the “heating” effect just as much as buyers.

Buyer’s vs seller’s market

Homes are still selling more slowly than they did last year, now spending 28 to 30 per cent more time on the market compared to last year. This means that supply takes longer to get absorbed, and the market will definitely need to speed up its absorption rate if it hopes to see a seller’s market in the next spring. To me, our current reading on “days on market” metrics indicates a market that is balanced, or even leaning in favour of buyers, rather than sellers.

Condos

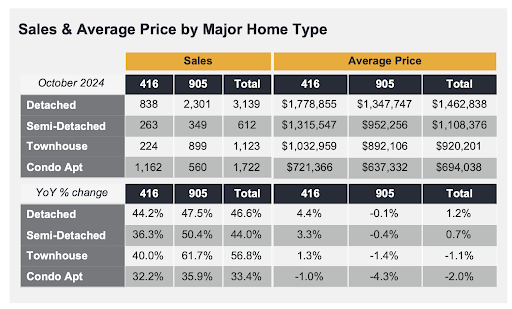

No supply/demand imbalance has been more pronounced than the 416 condo sector. As a result, looking at the 416 condo sector can often tell us a lot about the market. In the past few months, year-over-year growth in condo sales has been relatively low or negative, but in October, condo sales posted pretty significant gains. 32.2 per cent more 416 condos sold this October than last October, and similarly, 35.9 per cent more 905 condos sold.

It is reasonable to assume that the returning affordability brought on by falling interest rates and falling condo prices has helped make these units more attainable for entry-level buyers, downsizers, and investors. Toronto condo prices have fallen 1 per cent since last year (a drop of about $7,200), while 905 condos have fallen 4.3 per cent since last year (a drop of about $27,000).

Source: TRREB

Detached homes

Detached homes have been a different story altogether. In the 416 area, detached homes are up 4.4 per cent, likely supported by upzoning to 4 units, and anticipatory demand from increased insurable mortgages and longer amortizations ahead. The knock-on effect appears in increases we’re seeing in semi-detached and townhouse products, up 3.3 per cent and 1.3 per cent respectively.

905 versus 416

This month’s data really paints the picture that we’re seeing a re-urbanization of demand. With a re-opening workplace and Toronto’s traffic being ranked third worst in the world, it is not surprising that those who suburbanized into the 905 during the pandemic era may be reconsidering a 416 lifestyle.

This trend is most visible when looking at the sale-to-list-price ratio (SP/LP) in suburban areas, like Simcoe County and Peel Region, versus urban 416 areas:

- (905) Halton Region – 98 per cent

- (905) Peel Region – 98 per cent

- (416) City of Toronto – 100 per cent

- (905) York Region – 98 per cent

- (905) Durham Region – 100 per cent

- (705) Dufferin County – 98 per cent

- (705) Simcoe County – 97 per cent

From my view, the sale-to-list-price ratio acts like a bid/ask spread indicator—where a narrower spread indicates a more efficient and liquid market. In real estate terms, a sale-to-list price ratio closer to 100 per cent suggests a more balanced market where buyers and sellers are in closer agreement on property values. When this ratio is significantly below 100 per cent, it often indicates a buyer’s market where properties are selling for less than their list price. Conversely, when it’s above 100 per cent, it typically signals a seller’s market where properties are selling for more than their asking price due to high demand.

Looking at the data, we can see that the City of Toronto and Durham Region are showing the most balanced markets with ratios at 100 per cent, while other regions are slightly favouring buyers with ratios between 97 and 98 per cent.

Points of concern

There are a few main vulnerabilities that do exist in Toronto’s market at this point that are worth noting heading into the spring market:

- The stock market is at all-time highs, and a negative wealth effect caused by declines in that area could create issues.

- The federal government has committed to reducing population growth and potentially reducing the population by 0.2 per cent, which certainly mutes the impact of the evergreen bull case for Toronto real estate, which is that demand will always outpace supply.

- Unemployment is rising in Canada, as are mortgage delinquencies. These are typically leading indicators of further distressed supply and can become a headwind against house price growth.

Overall, my outlook is that we’ll see a reasonably strong spring market with policy introductions and momentum from the fall market. Barring any major changes to the economic picture, spring 2025 should look more like a typical spring market we’ve seen in years like 2018 and 2019.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.

SNLR in TRREB reporting area is obfuscated by the Double-Counting permitted by the Terminate-ReList rules at TRREB. 30.3% of New Listings are “do-over duplicates”.

Similarly SalePrice to ListPrice ratios are mis/dis-informative without examining the pervasiveness of purposeful UnderListing-with-a-hold-Offer-Date.

Another aspect that all daily and monthly Real Estate pundits/forecasters in 416 and 905 will have to account for – THE DIFFERENCE between the nominal prices of the two zones and the Price variations of each zone from their respective 2022 Peaks.

October 416 is only 6.23% below it’s April/22 Peak of $1,243,070 while 905 is 20.40% below it’s (2 month earlier) Peak of $1,402,948