Canadians are becoming increasingly anxious about the unpredictability of the housing market, according to the latest State of the Housing Market report commissioned by Mortgage Professionals Canada (MPC) from Oxford Economics.

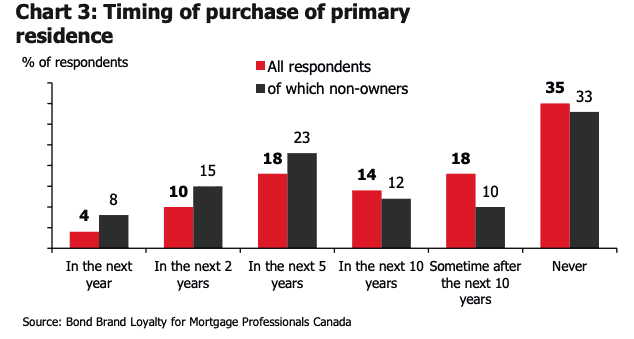

The report surveyed over 2,000 Canadians across the country and found that a record-high number of non-homeowners, 33 per cent, believe they will never be able to afford a family home. This is an increase of 8 points in just six months and a substantial 15 points year-over-year.

Fewer non-homeowners plan to purchase a home within the next five years, at only 18 per cent, down six percentage points from the year before.

The rapid decline in affordability due to high home prices and now high-interest rates have contributed to Canadians’ concerns about home buying. The report showed that nearly 60 per cent of respondents were anxious about inflation and their family’s finances, up 20 per cent from six months earlier.

However, despite these concerns, the demand for homeownership remains strong, with close to 80 per cent of respondents seeing real estate as a good long-term investment.

Mortgage and housing outlook

Despite falling home prices and rising interest rates, the mortgage market in Canada remained resilient in 2022, according to data from Oxford Economics.

The housing market is projected to face intense downward pressure until mid-2024, though a housing shortage is expected to extend over the near term due to strong population growth.

However, as mortgage rates peak later this year, falling house prices and a gradual income growth recovery will improve affordability and support mortgage growth in the medium to long term.

Homebuyer trends

While 26 per cent of survey respondents think it is a good time to buy a home in their community, this figure is declining, down three points compared to the end of 2021 and one point lower relative to mid-2022.

The decline in affordability is also apparent when looking at the increase in respondents thinking that they will never buy a primary residence. This share reached 35 per cent compared to 30 per cent six months ago and 27 per cent at the end of 2021.

Rising mortgage costs and inflationary pressures have significantly impacted Canadians’ confidence in their ability to invest in real estate.

The proportion of non-owners no longer considering buying is also notably high at 33 per cent, only marginally below the corresponding share of owners (36 per cent).

Motivations

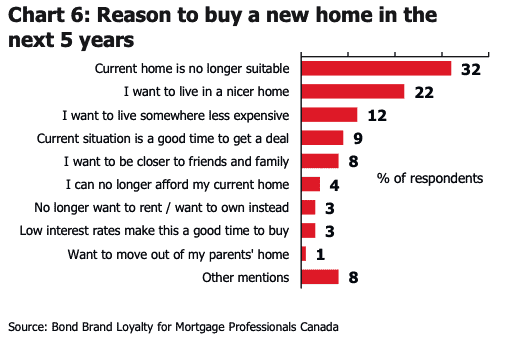

Moreover, Canadians’ preferences for buying new homes have been changing over time.

Around 32 per cent of those who plan to buy in the next five years feel their home isn’t suitable anymore in terms of size or location, which is an increase compared to mid-year 2022 and the end of 2021, suggesting that Canadians continue to want larger homes even as the pandemic era comes to an end.

About 22 per cent of respondents are specifically looking to upgrade to a nicer home, while the share of respondents considering moving to a more affordable home has increased but remains below four per cent.

Many workers are being called back to the office, so the share of those wanting to relocate to reduce their commute is increasing, up two points to 12 per cent, while 15 per cent wish to downsize (three points lower than a year ago).

When asked how much respondents view their home as an investment versus a place to live, on average, they rated their home as 80 per cent place to live versus 20 per cent as an investment.

Mortgage affordability

Rising interest rates have caused many respondents to reconsider their ability to meet any future increases in mortgage payments. Currently, 62 per cent of respondents report needing outside help, like family, to make a down payment and say they would not have been able to afford a home without it, up five points from mid-year 2022 and six points year-over-year.

On top of this, rising interest rates caused many respondents to reconsider their ability to meet any future increases in mortgage payments.

Overall, close to six per cent of respondents are already struggling to make their payments, while 20 per cent of respondents would struggle to make their payments even if they went up by 10 per cent or less. Another 37 per cent would have a hard time if their mortgage payment went up by 20 per cent.

First-time recent homebuyers are significantly more likely to be struggling to pay their mortgage. Over 14 per cent of them are currently facing payment difficulties (11 points more than non-first-time recent buyers).

Interest rates

The Bank of Canada has paused further hikes and Oxford Economics expects it will maintain the overnight rate at 4.5 per cent through 2023 and then begin easing in early 2024.

This may result in stable mortgage rates, supporting mortgage demand and improving housing affordability across Canada.

Affordability

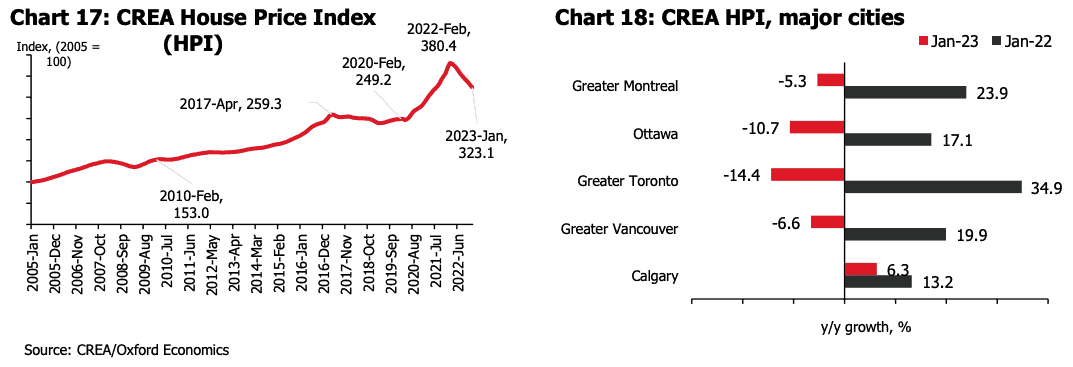

The housing correction is expected to continue into 2023, with a 30 per cen peak-to-trough drop in house prices by year-end 2023.

Oxford Economics expects new national policies targeting affordability will support this decline, such as prohibiting foreigners from buying Canadian real estate.

Over the medium term, more robust growth in housing supply should help restore affordability and support mortgage growth.

Affordability by region

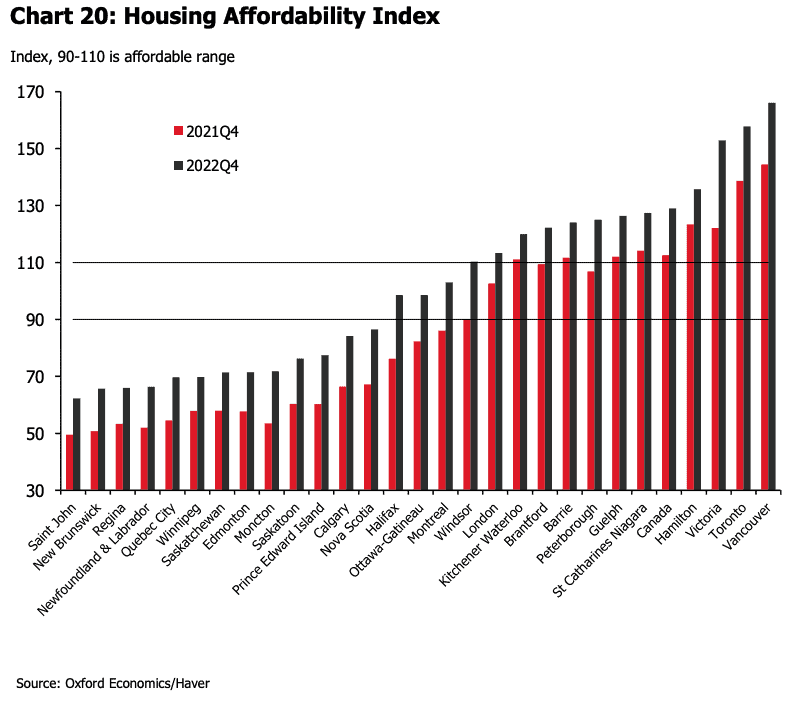

Despite the recent fall in home prices, higher mortgage costs have resulted in a broad deterioration of affordability across the country.

Urban centers in Ontario and British Columbia, where average house prices are 23x the average disposable income, remain the least affordable; this ratio is much lower in Quebec (13.3 times).

The Atlantic provinces remain relatively affordable: N.B. (8.0 times), N.S. (11.6 times), P.E.I. (10.4), and N.L. (7.5 times). Alberta (10.5 times), Saskatchewan (8.5 times), and Manitoba (10.4 times) also fare better.

Affordability is expected to improve by the end of 2023 as mortgage rates begin to ease and the house price correction continues.

Immigration patterns

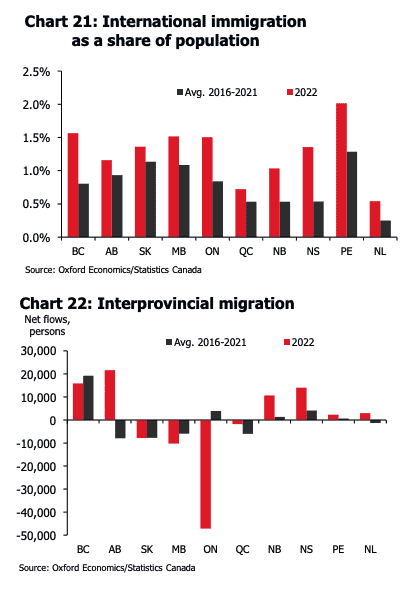

One of the key drivers of mortgage growth across Canada is migration, both between provinces and from abroad. Strong immigration flows are expected to support positive population growth and create increased housing demand.

Based on the federal government’s immigration plan and continued demand, robust immigration trends are expected to persist in the near to medium term.

Relative to population, Ontario, British Columbia, and the Prairies have seen the most significant international immigration flows in the past six years.

While Ontario was a major destination between 2010 and 2019, interprovincial migration has been net negative in 2021 and 2022; outflows are expected to moderate as housing affordability improves.

Quebec is expected to continue receiving relatively few immigrants over the next few years due to its independent immigration legislation. The province is also recording negative net interprovincial migration, which will weigh heavily on housing demand in the coming years.

Read the full report from Mortgage Professionals Canada and Oxford Economics here.

Not a shock. Everything is beyond unaffordable. One shouldn’t have to work 2/3/4 jobs to survive and have a place to live. It’s utter nonsense. Too many immigrants, not enough homes for those already here. But it’s too late. This government will continue to destroy the country.

Rescind Emergency WW2 Order in Council PC 1940-1121 it merged the PMO and PCO and should have sunsetted at end of war. Makes a 50%+1 PM an autocrat. Emasculates the s.12 office of GovGen and subsumes the GG’s s.11 Privy Council. Wholly anti-BNA/Constitution Act 1867 – and it persists because no one objects/challenges this travesty. Imagine if the debanking/account freezing 2022 Emergencies Actions were still in effect!! It’s your move!

I am sick of hearing about affordability. There are amny places around the world less affordable than here. We need a more natural economy without government interference. They just make a mess and are usually too late or not enough. Government money is our money and guess what? There is no money! Such is life if you can’t afford a home or buy a mini home. Landlords need to recover their extra costs as well as make a profit. They take on the risk for goodness sakes. We are way too socialist for my likes. We can not afford it not can we make miracles happen.

agreed

where people in centers other than Toronto, Calgary Van, Ottawa and Montreal asked to take part?

If not than this info is meaningless to those people outside the centers of the universe.