Once again, sales volume has continued to fall in Canadian real estate — although this time, it was probably to be expected.

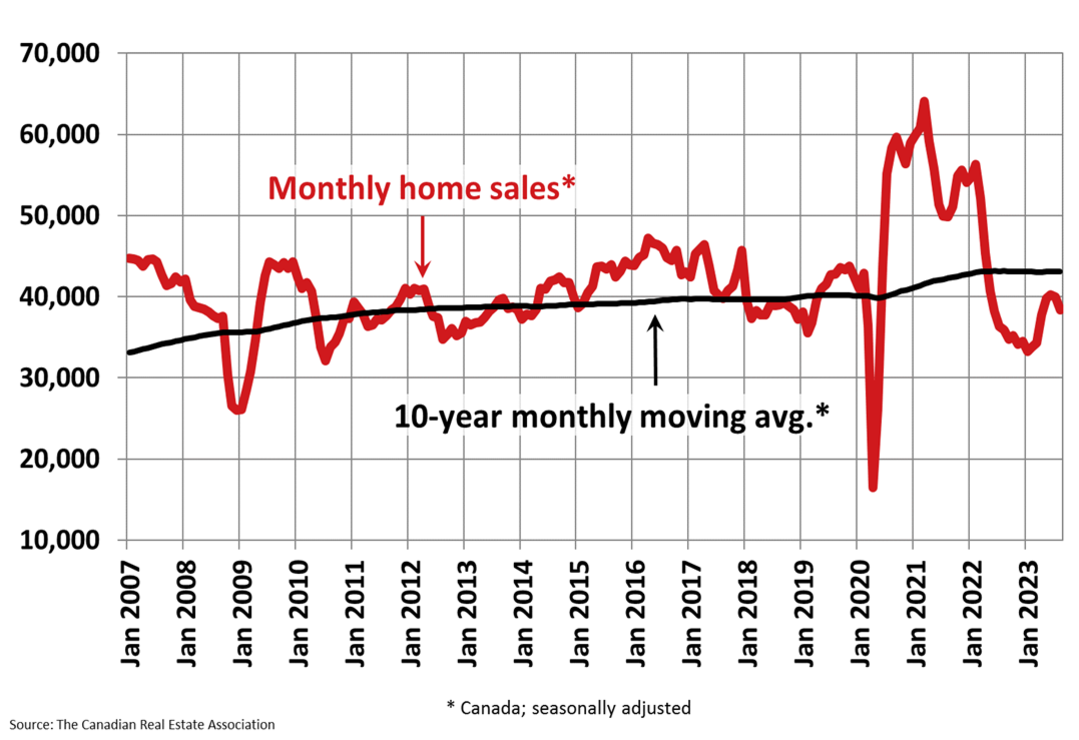

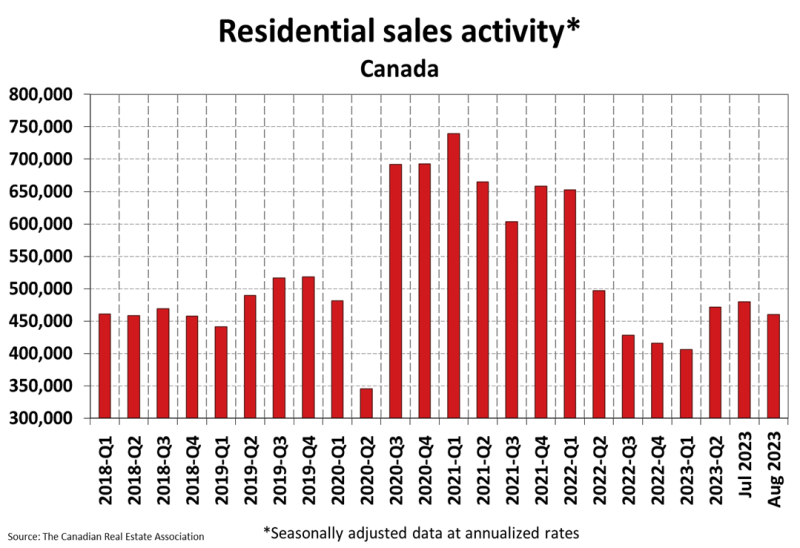

According to monthly statistics from CREA, national home sales declined 4.1 per cent month-over-month in August, which is honestly a pretty typical move into the trough of the summer market.

With that being said, actual (not seasonally adjusted) monthly activity came in 5.3 per cent above August 2022, which is a bit of an improvement from an exceptionally rough summer market last year –— where most markets saw house prices reach their annual low point around August.

While we’re nowhere near the lows of Q4 of last year, we’re also not even close to the highs we saw during the pandemic. As a result, the real estate industry is clearly in a recessionary hangover period after a long hard run during the pandemic’s emergency monetary policy rates — with home sales now staying well below the 10-year average. Sales numbers look far more consistent with sustainable markets seen in 2018 and 2019.

Supply

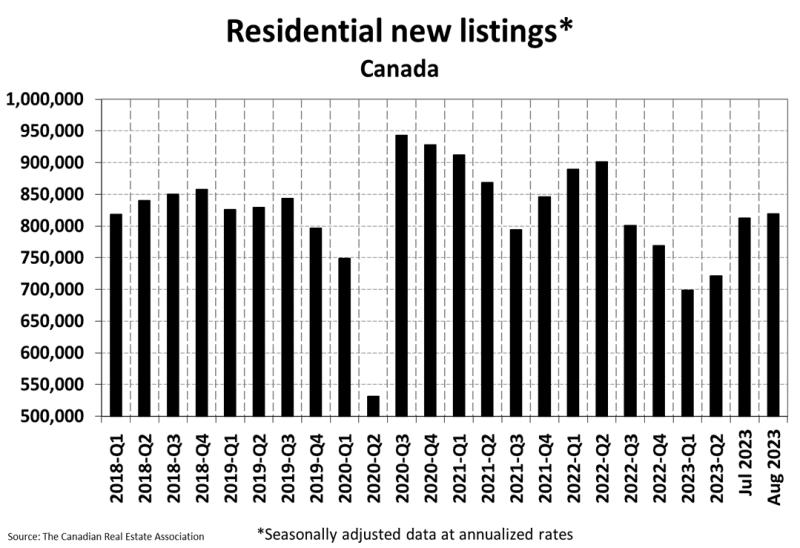

At the same time, we’re seeing demand slip while supply continues to ramp up — albeit at a slower rate. The number of newly listed properties edged up 0.8 per cent month-over-month — a 9.6 per cent annualized growth rate.

This type of supply, coupled with decreasing demand, has Canada’s real estate market on the path toward a buyer’s market by the end of the year unless something changes.

Price

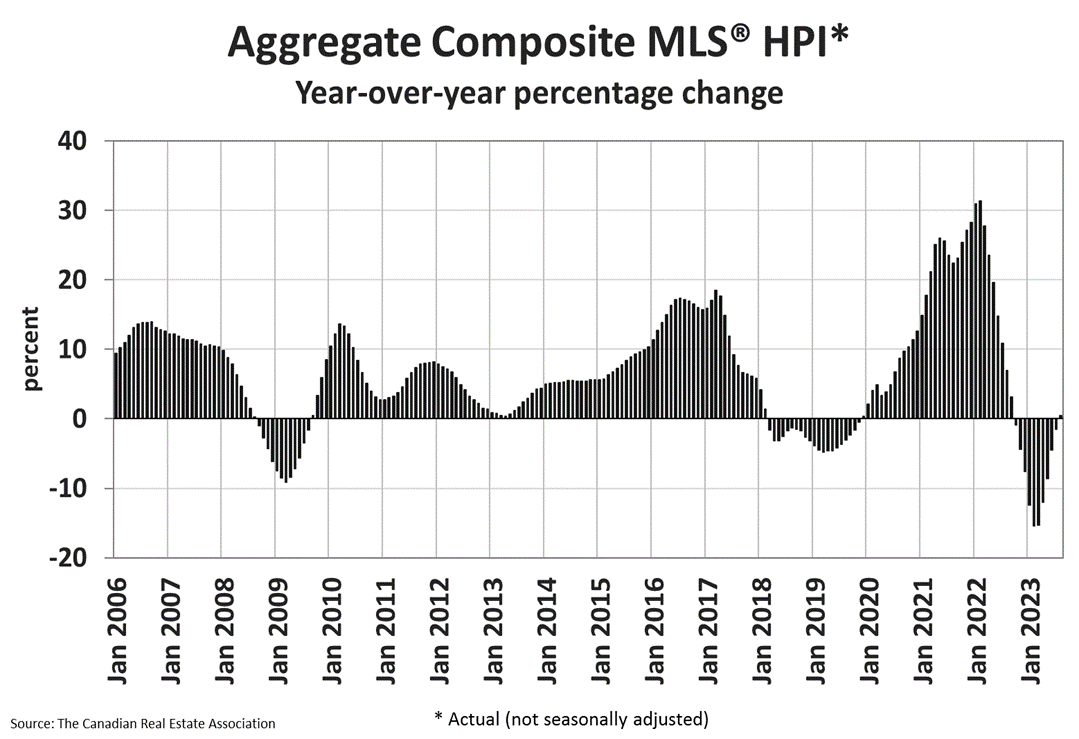

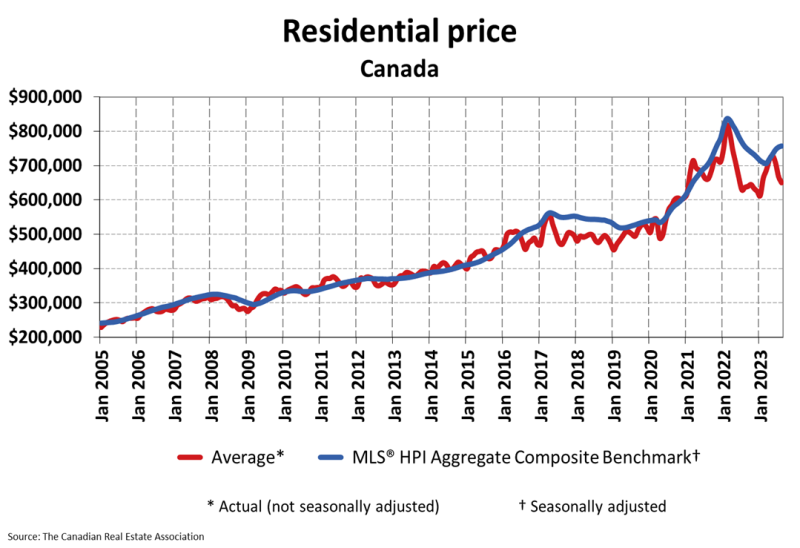

As a result of all of these factors, price has managed to stay relatively unchanged on a year-over-year basis — moving up just 0.4 per cent since this month last year. This is the first year-over-year increase in the House Price Index (HPI) since it began falling in Q1 of 2022. If you look really closely, you can almost see it on the chart below.

While some in the industry state that HPI is a bit of a lagging indicator, we can see its continued divergence on the chart below from the average house price, which is continuing its downtrend.

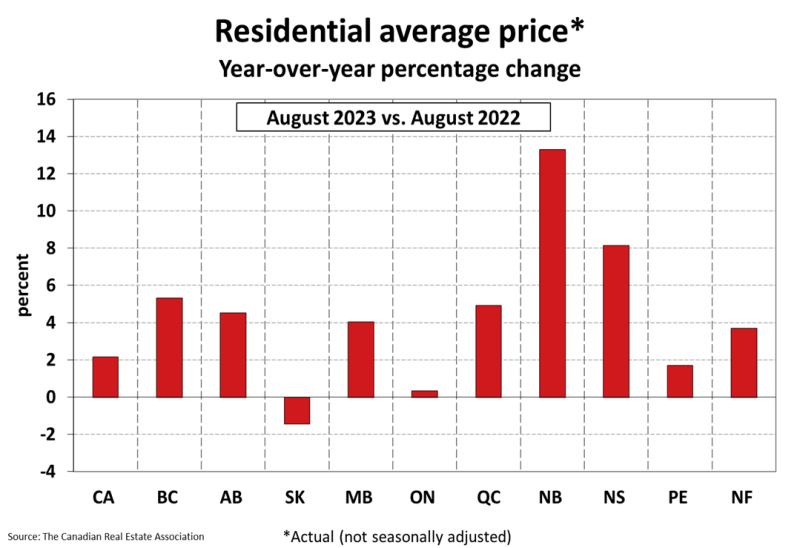

Price growth seems to be really geographically dependent — with almost all provinces growing within close proximity to the rate of inflation, including:

- British Columbia

- Alberta

- Manitoba

- Quebec

- Newfoundland

Little change, or a real (adjusted for inflation) decline, was noted in:

- Saskatchewan

- Ontario

- Prince Edward Island

However, outsized growth was seen in New Brunswick and Nova Scotia.

It is most likely that this outsized growth in these Atlantic provinces is a result of massive interprovincial migration from Ontario into those provinces, as recently acknowledged by RBC’s report: “Canadians on the move: will a pandemic shakeup in migration trends hold?”

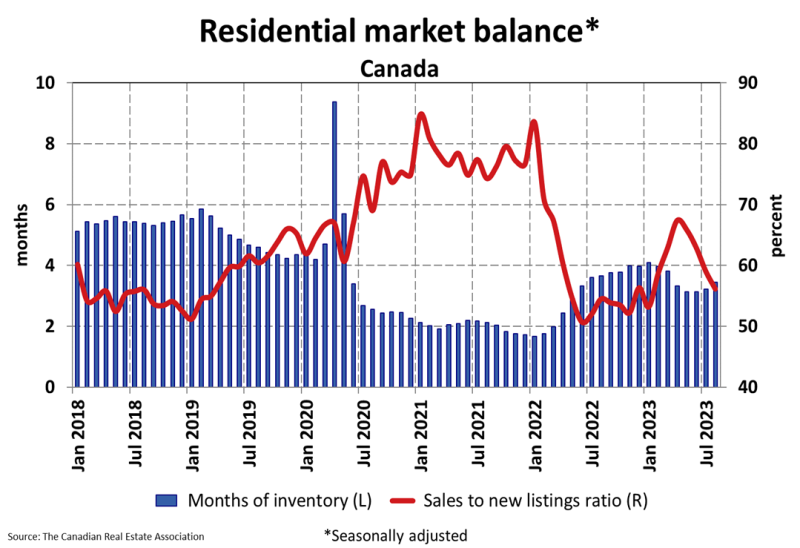

Market balance

While the market is currently looking balanced, both metrics are trending in a negative direction. The sales-to-new listings ratio continues its downtrend, meaning that listings continue to outpace sales. This causes continued growth in months of inventory. If this trend continues, I expect Canada’s real estate market will be in a buyer’s market by the end of the year.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.