Amid the many interest rate hikes and ever-changing conditions we’ve seen in markets across the country, there are other stories interwoven. A big one is about the affordability of townhomes.

Some markets are still hot and relatively affordable (such as Calgary), whereas others, like Toronto, may be heading toward a 20-year record low.

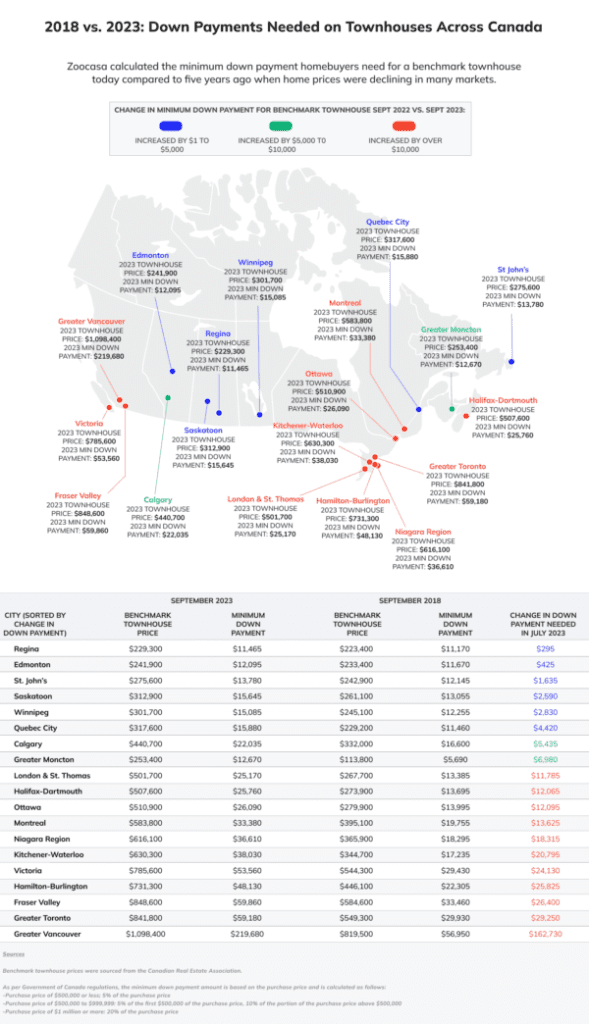

A report* by Zoocasa dives into the affordability of townhouses across the country and what a down payment today looks like vs five years back.

Home price drop may open up townhome market

To paint an overall picture, home prices dipped by 1.2 per cent monthly last month to just over $740,000, though this doesn’t reflect prices as low as we saw in 2018. Many Canadian cities saw huge price increases and affordability issues over the past few years, so, this drop will hopefully open up markets to interested buyers waiting in the sidelines.

Wide range of prices and increases

The country’s price growth proved to be quite varied. While most of the analyzed markets saw required townhome down payment increases of under-$20,000 and six saw less than $5,000, one stood out with an increase of over $160,000.

Source: Zoocasa

Six-digit spike in major market, some saw little change

Edmonton and Regina were the only cities with required down payment boosts of under $1,000 (at $425 and $295, respectively).

As for the other end of the spectrum, Greater Vancouver was the only location with a large jump – now, the required townhome down payment there is $219,680, representing a $162,730 increase. Keep in mind, this steep climb has much to do with the province’s 20 per cent down payment requirement on homes over $1 million.

Which cities landed in the middle? Down payments for townhomes of at least $50,000 are required in Toronto ($59,180, a five-year-jump of 29,250), the Fraser Valley ($59,860, $26,400 more than September 2018) and Victoria ($53,560, an increase of $24,130 from five years ago).

Hamilton-Burlington and Kitchener-Waterloo were the remaining cities that experienced increases of over $20,000, with changes coming in at $25,825 and $20,795, respectively.

* Minimum down payment amounts were calculated based on 5 per cent of the purchase price for homes priced at $500,000 or less, 10 per cent for homes priced between $500,001 and $999,999 and 20 per cent for homes priced at $1 million and over.

AFFORDABILITY (ratio of monthly payments to Family Income) can only be improved by:

1) a decrease in the Price of Property;

2) a decrease in the Rate of interest that finances these properties;

or

3) an Increase in Family Incomes.

Which one are you recommending?