What does housing demand rely on? Is it the need to buy something or having more-than-enough disposable income?

The answer can reveal what lies ahead for Realtors in Canada, or for that matter, in the U.S., the U.K., New Zealand and Australia – all with hot housing markets and record-breaking prices.

In November, CIBC came out with a report suggesting Canadians have accumulated the largest cash hoard ever. The report was a little perplexing. Statistics Canada data says real GDP declined 5.4 per cent in 2020, the steepest fall since at least 1961. However, disposable income rose by 10 per cent compared to last year, the biggest increase in approximately four decades.

Why did disposable income rise? The government handed out cash support as the economy suffered, and it flushed the bank accounts of Canadians. This single factor, highlighted by the CIBC, played a crucial role in driving the housing market. Add to this another record-setting development – In December 2020, HSBC offered variable-rate mortgages at sub-one per cent, marking lowest mortgage rates dip in Canada.

Let’s recall the developments in the housing market. In May 2021, the average house price was up nearly 40 per cent compared to the corresponding period last year. The housing sector has seen an unprecedented buying frenzy that began in the second half of 2020.

If Realtors believe it was just the need for a house that drove demand, they may have misread the signs. In its detailed report on the Canadian economy in 2020, Statistics Canada noted that housing investment rose by 3.9 per cent in 2020 compared with 2019. It led to a “significant rise” in the mortgage debt of Canadian households. The above findings clearly show that demand was driven by excessive cash pile-up, thanks to the government’s stimulus program and ultra-low mortgage rates due to near-zero policy rates of the Bank of Canada.

Reports on the housing market suggest growth was evenly distributed, and even luxury real estate witnessed comparable interest. Across Toronto, Vancouver, Montreal and other markets, the sale of luxury real estate, including condominiums, attached and single-family homes, posted healthy growth numbers in the first half of 2021. Other reports reveal people flocked to rural and small communities in record numbers to drive growth in these oft-neglected areas. Urbanites pushed house prices in such regions by nearly 75 per cent in a matter of one year. A never-before kind of interest has added pressure on municipalities.

Behind this is the near-equal distribution of government stimulus among Canadian households. Low debt and high disposable income meant people were bidding for houses in whichever market they could. But this momentum might not last long.

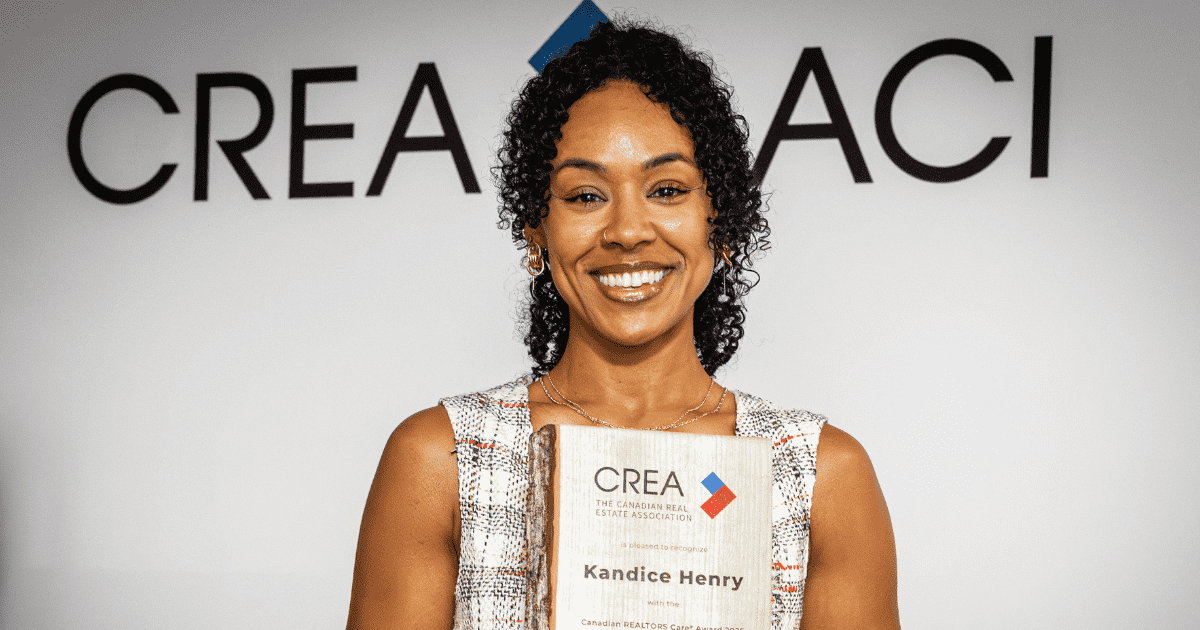

For three straight months now, the number of houses changing hands has declined. Per CREA, the activity posted an 8.4 per cent drop in June compared to May. The silver lining, however, is June sales were the highest ever recorded in this month. The chair of CREA specifically mentioned that in the last few months, activity in the sector has “noticeably calmed down.” Inventory is also higher now, with 2.3 months of stock, and no one can blame supply constraints for low sales or high prices.

The Bank of Canada has adjusted its quantitative easing (QE) program with a reduced purchase target of $2 billion every week. Though the bank acknowledged that inflation would remain above the two-per-cent target through the second half of 2021, policy rates have not been raised. In its press release, the bank noted that the housing market would ‘ease back from historical highs’.

Realtors need a timely adjustment in their business strategy. Now that sales numbers are declining, it is time to connect the dots. From here on, which sub-sector will pique buyers’ interest? Will it be the luxury real estate that will continue to post healthy growth? Given that the economy is yet to rebound from the pandemic shock and job levels have yet to reach pre-pandemic levels, it is unlikely that the luxury market will sustain the momentum once the government cuts stimulus and the Bank of Canada further tightens its QE.

It might be the small communities, which have outperformed big cities, that will continue to grow in the short-to-medium term. Canadians are still sitting on a record-high cash pile, and rising inflation will not significantly impact house sales in non-urban areas, given the selling price will still remain affordable.

The demand in the housing market from here on will be shaped not by more-than-enough disposable income but by a real need to buy a housing asset. Urbanites may not be seeking any wealth creation from a purchase in cheaper small-town real estate. They may be looking for refuge from their present fast-paced setup. Statistics Canada data reveals a migration from big cities to the countryside is currently underway at a record-high pace.

Kunal Sawhney is the founder and CEO of Kalkine. An accomplished financial professional, he has extensive expertise in equity markets and adopts quantitative and qualitative stock selection practices.