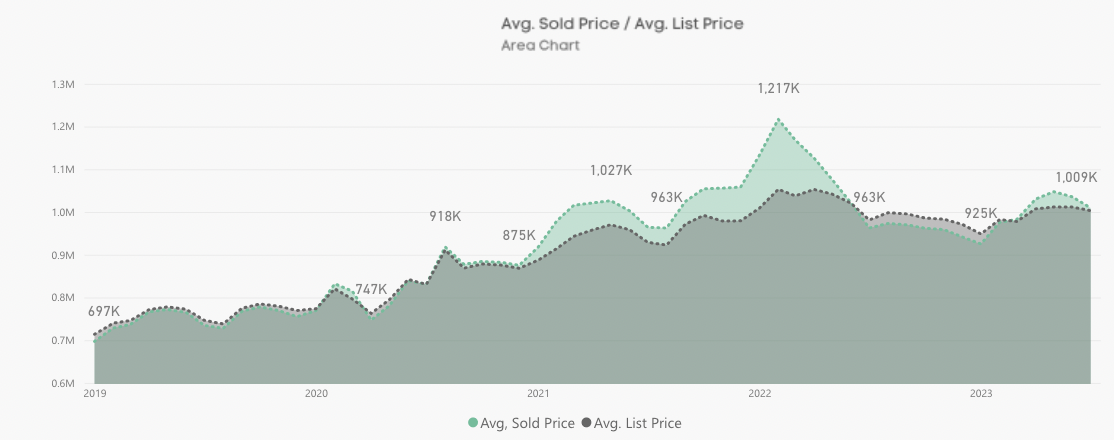

In its Market Watch for July, the Toronto Regional Real Estate Board (TRREB) states that the real estate market was more balanced, and I’d generally agree with that. The market is behaving in a fashion that doesn’t favour buyers or sellers. This is especially visible when looking at the average sale price compared with the average list price, evidence that buyers and sellers are adapting to meet their counterparty’s expectations.

Source: Daniel Foch, Chartography.ca, TRREB Market Watch

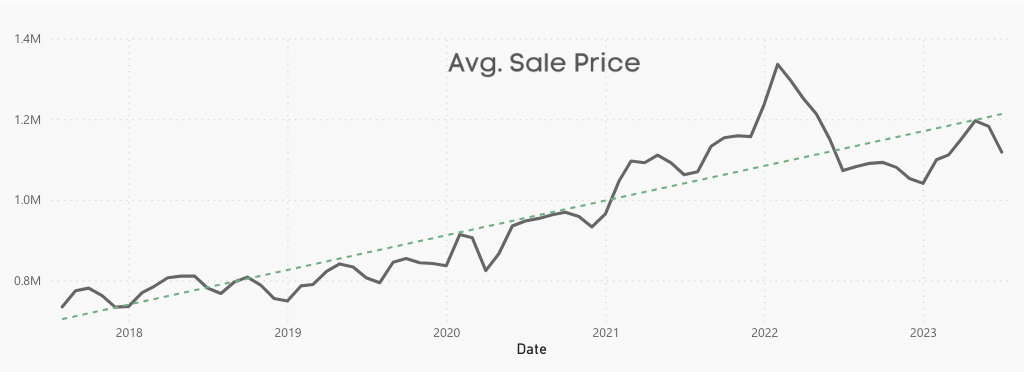

According to TRREB’s data, home prices increased by 4.2 per cent on a year-over-year basis from July 2022. My challenge with this comparison is that July 2022 was the epicentre of one of the toughest markets we’ve seen in Canadian history when prices fell at a record-breaking pace last year. At the same time, sales volume grew by 7.8 per cent, which indicates that reduced volatility has given buyers a sense of safety in the current market.

The new trend

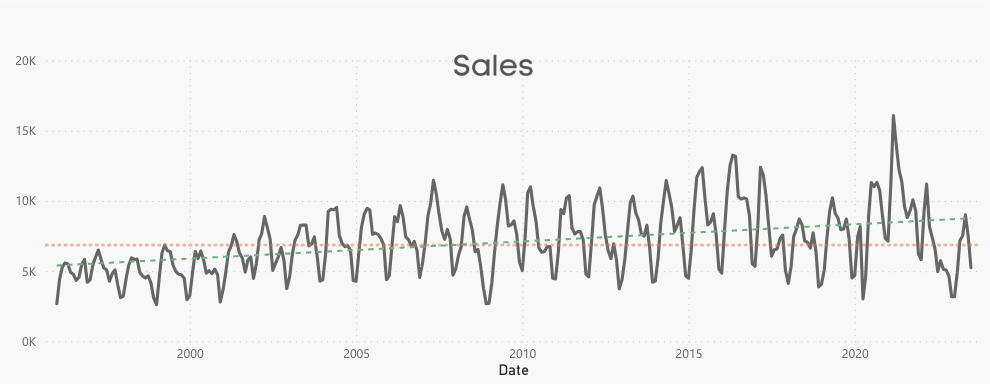

Because 2022 was an exceptionally volatile year, it’s tough to use for the sake of comparison on any metric. Instead, it makes more sense to look at the market based on long-term trendlines and historical averages. This will tell us where we should be based on many years of historical data rather than just compared to one outlier.

House price growth has fallen below the trendline of its most recent bull market, which began slowly after prices dropped severely in 2017 and ramped up during the pandemic era. Most of the gains from this year’s spring market have been erased now.

Source: Daniel Foch, Chartography.ca, TRREB Market Watch

Sales have fallen just below the long-term average and are well below their growth trendline.

Source: Daniel Foch, Chartography.ca, TRREB Market Watch

Short supply

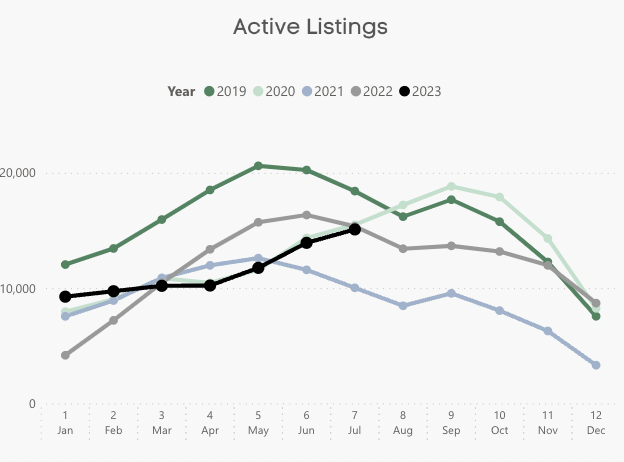

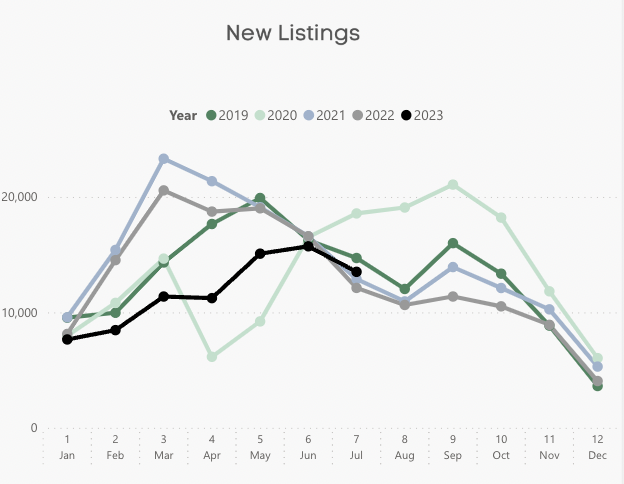

For much of the past two years, a large part of the conversation has focused on the market’s lack of supply. Lack of supply can lead to excess demand, even in a market suppressed by the Bank of Canada’s return to interest rate hikes. Setting that supply scarcity against the backdrop of record population growth in Canada, it becomes clear why we have yet to see meaningful decreases in house prices since the drop-off from last year.

Now, it seems that story is changing a bit, with listings on TRREB falling in line with typical figures for the past two months.

Source: Daniel Foch, Chartography.ca, TRREB Market Watch

Source: Daniel Foch, Chartography.ca, TRREB Market Watc

What happens next

Generally, I’d say that the declines in price we’ve seen in Toronto’s real estate market this summer are in line with seasonality, just as price growth earlier this year appeared seasonal. September data will decide if this downtrend is a seasonal phenomenon or a return to the bear market that started in 2022. My guess would be the latter, but I think it’s too early to call.

The market seems disheartened by the Bank of Canada’s unpausing of rate hikes, and financial stress appears to be mounting on sellers, which could increase supply. At the same time, a sense of economic uncertainty could cause buyers to delay homebuying plans. If we see the market turn in favour of buyers, further price declines could certainly be possible.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.